#1 App for Flooring Businesses

Flooring Business Software

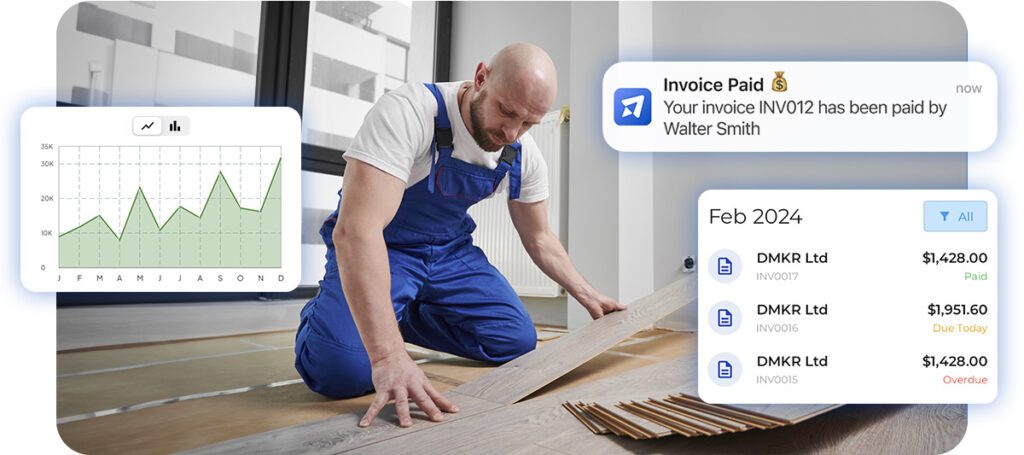

Run a smoother flooring business with Invoice Fly. Send estimates and invoices, and save hours of work by automating your workflows.

- Home

- »

- Industries

- »

- Flooring Business Software

Get your Flooring Business working smoothly

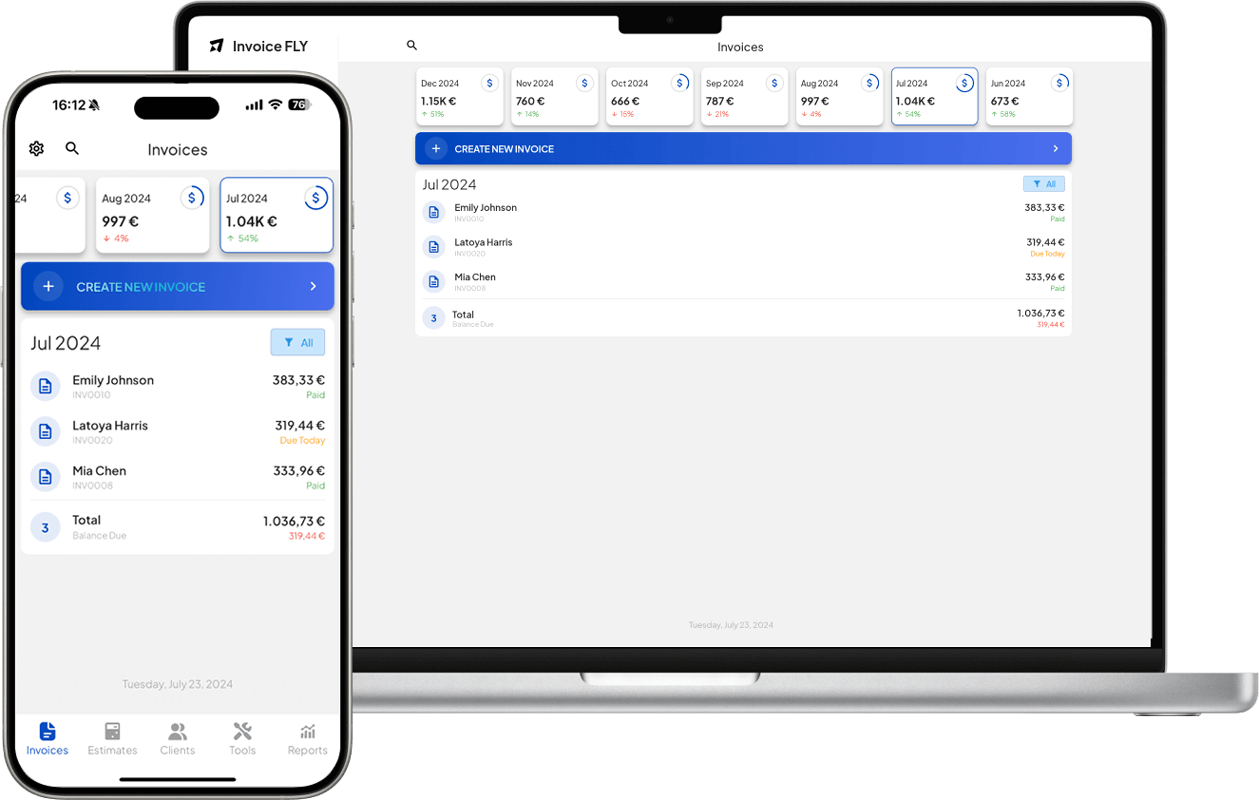

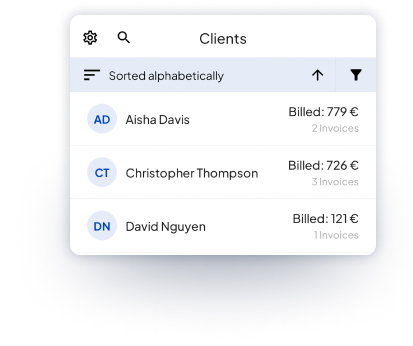

With Invoice Fly you will have precise control of your clients either from your office or on site. Send quotes or estimates, invoices and download quick statements about your customers.

What is a Flooring Business Software?

A Flooring Business Software is a specialized tool designed to help flooring contractors manage their invoicing, job scheduling, and overall business performance. In the flooring industry, contractors face unique challenges, such as coordinating multiple projects and ensuring accurate billing for labor and materials.

Invoice Fly streamlines essential administrative tasks, allowing contractors to quickly generate invoices, track payments, and manage project details all in one place. By automating these processes, flooring contractors can stay organized, minimize errors, and focus more on delivering high-quality workmanship to their clients.

Flooring contractors encounter both the rewards and difficulties of their trade. While installing beautiful floors is fulfilling, the daily challenges of managing project timelines, client communication, and maintaining steady cash flow can be overwhelming.

Flooring Business Software, such as Invoice Fly, alleviates these burdens by providing tools that boost efficiency and ensure accurate financial management, allowing flooring contractors to concentrate on their craft and grow their businesses with confidence.

Why do Flooring Contractors prefer using Invoice Fly over other software?

Flooring contractors face unique challenges, such as managing multiple projects, tracking material costs, and ensuring accurate billing for each job. Invoice Fly offers a specialized solution that simplifies these tasks, making it a top choice for flooring professionals looking to boost efficiency and stay organized.

Here’s why Invoice Fly stands out for Flooring Contractors:

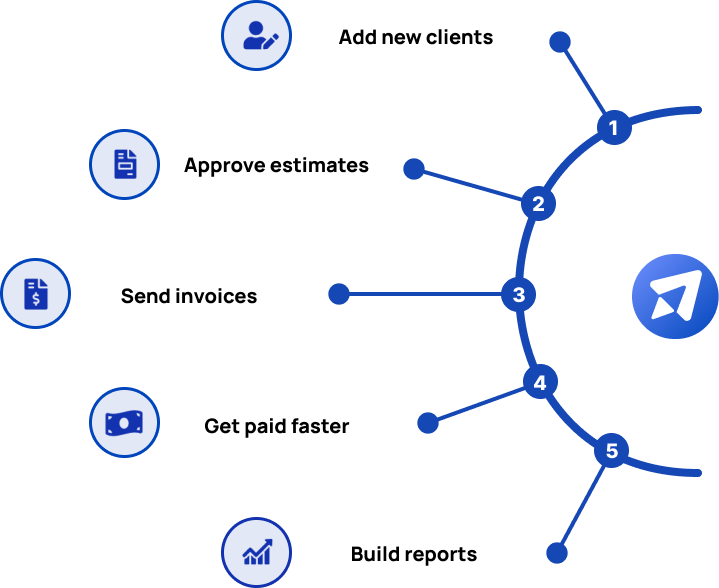

1. Simplified Workflow for Flooring Professionals

Flooring contractors value Invoice Fly for its clean, intuitive interface, which allows them to focus on their craft rather than complex software. With minimal training, contractors can quickly create invoices, track payments, and manage project details. This simplicity reduces administrative stress and frees up more time for flooring projects.

2. Customized for Flooring Businesses

Unlike generic invoicing platforms, Invoice Fly is specifically tailored to the flooring industry. It enables contractors to itemize labor, materials, and services, ensuring accurate and professional billing. With job tracking and client management features, flooring professionals can easily manage multiple projects, ensuring every detail is accounted for and each invoice is precise.

3. Mobile Access for On-the-Go Contractors

As flooring contractors frequently work on-site, Invoice Fly’s mobile access is a game-changer. Contractors can generate invoices, update project details, or check payment statuses directly from their smartphone or tablet. This mobile functionality ensures business management is accessible anywhere, even while working between job sites.

4. Easy Invoicing for Better Cash Flow

Chasing late payments can disrupt a flooring contractor’s workflow. Invoice Fly simplifies invoicing with features like payment reminders. This ensures steady cash flow, reducing the time spent on follow-ups and allowing contractors to focus on completing projects and growing their business.

How much does a Flooring Contractor make in 2024? Taxes & Wages

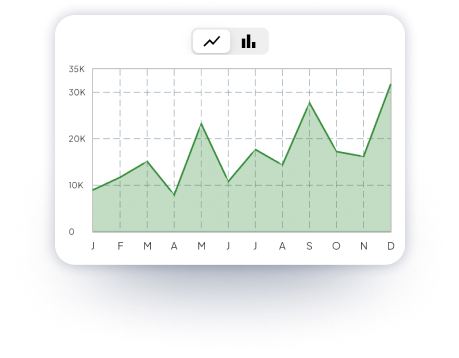

In 2024, flooring contractors in the U.S. can expect to earn an average annual salary of around $40,000 to $75,000, depending on factors such as experience, location, and the size of their business.

Entry-level flooring professionals may earn closer to the lower end of this range, while experienced contractors and those operating larger flooring companies can see wages well above $75,000 annually. In high-demand or high-cost areas like New York or San Francisco, earnings could exceed this average due to increased demand for skilled flooring work.

As independent contractors or small business owners, flooring professionals are responsible for paying Self-Employment Tax (15.3%), which covers Social Security and Medicare contributions, along with Federal Income Tax (ranging from 10% to 37%), and State and Local Taxes, which can vary from 0% to 13.3%.

By taking advantage of tax deductions for business expenses such as tools, materials, and travel, flooring contractors can significantly reduce their tax liability, ensuring they retain more of their hard-earned income.

Try our Salary Calculator

FAQs

Tracking the costs of materials (e.g., flooring, adhesives) and equipment (e.g., saws, nailers) helps you keep accurate records. To track expenses:

Go to the "Tools" section in the bottom menu and select "Expenses."

Click on "Add Expense" to input the cost of flooring materials and tools purchased for installations.

You can categorize expenses by material type (e.g., hardwood, tile) or equipment, and even attach receipts by scanning them into the app.

This allows you to monitor expenses, manage your budget, and use this information for future projects or tax reporting.

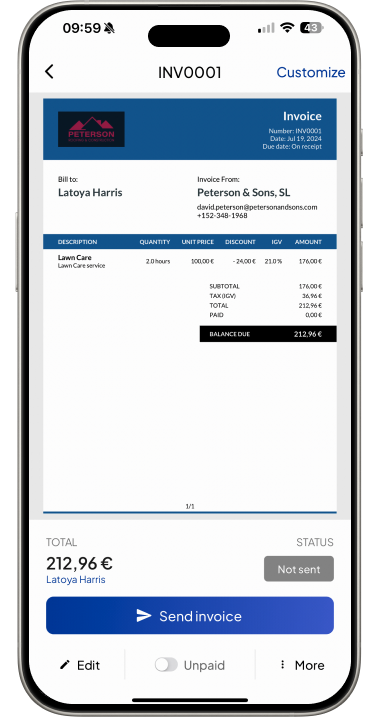

Getting client approval on the scope of work and materials before starting a flooring installation or repair is crucial. To request a client signature:

Open the estimate or invoice for the project.

Click on "More" and select "Collect Client Signature."

Send the estimate or invoice to the client, allowing them to review the materials, labor, and costs, and digitally sign it.

Once signed, you will be notified, ensuring that the client has approved the details of the project before you begin the work.

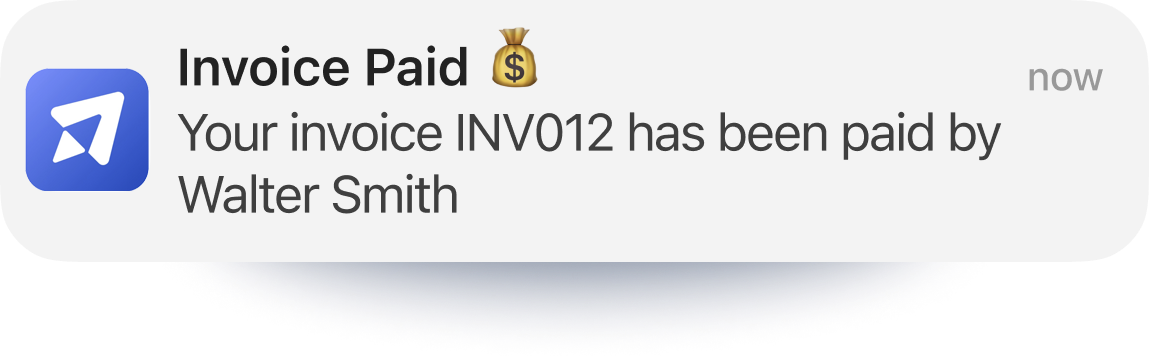

Keeping track of payments for flooring installations is essential for managing cash flow. To receive notifications when clients make payments:

Go to the "Settings" menu in the top left corner of the app.

Click on "More Options".

Scroll down to "Notifications".

You will receive real-time notifications when a client makes a payment, whether via Stripe, PayPal, or opens the email.

This allows you to stay on top of your incoming payments and follow up with clients who have outstanding balances.

In many regions, materials (e.g., flooring, underlayment) and labor (installation) may be taxed at different rates. To handle this:

Go to "Settings" and select "Tax and Currency."

Choose "Type of Tax per Item," which allows you to apply different tax rates for materials (e.g., wood, tiles) and labor.

This ensures accurate tax calculation and compliance with local regulations on your invoices.

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs