- Home

- »

- Industries

- »

- Handyman Software

Handyman Software

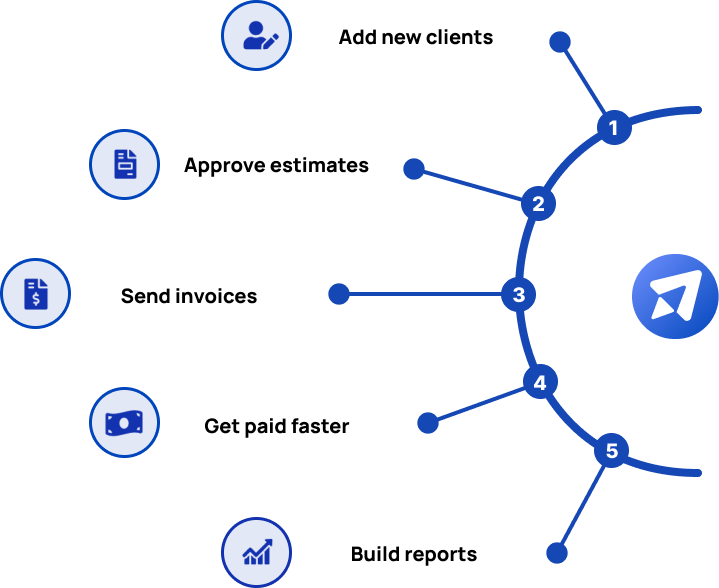

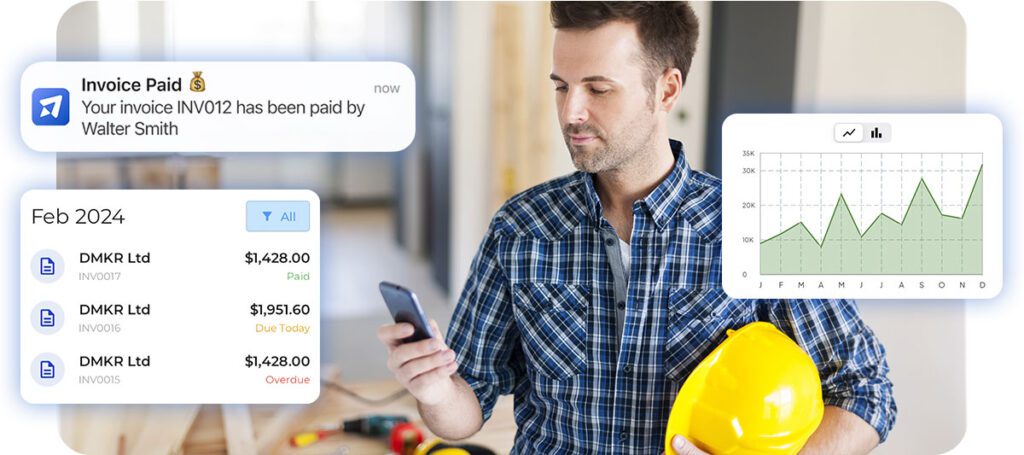

Run a smoother handyman service business with Invoice Fly. Send estimates and invoices, and save hours of work by automating your workflows.

What is a Handyman Software?

Running a Handyman Business comes with its own set of rewards and challenges. As a handyman, you take pride in solving problems and delivering high-quality work to your clients. But with the daily demands of the job—managing schedules, handling customer requests, purchasing materials, and keeping track of payments—staying organized can be tough. That’s where handyman business software comes in.

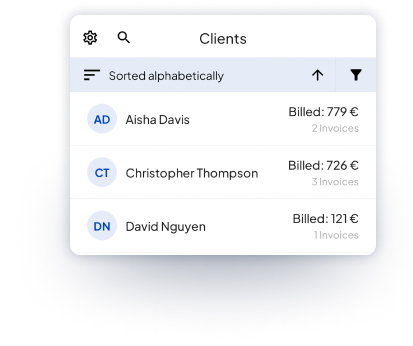

A Handyman Software like Invoice Fly is a digital tool designed to simplify the operational side of your business. It helps you create and send professional invoices, track payments, manage expenses, and keep your job schedules in check—all in one place.

Get your Handyman Business working smoothly

With Invoice Fly you will have precise control of your clients either from your office or on site. Send quotes or estimates, invoices and download quick statements about your customers.

Why do Handymen prefer using Invoice Fly over other software?

Handyman contractors prefer using Invoice Fly over other software due to features that align with the unique needs of the home service industry.

Here’s how Invoice Fly stands out:

1. Project Based Invoicing and Tracking

- Complex Billing Structures: Construction projects often involve various phases, subcontractors, materials, and labor costs. Invoice Fly offers customizable invoicing tailored to the needs of each project, making it easier to track expenses and bill clients accordingly.

- Progress Billing: Construction companies frequently bill clients based on project milestones (e.g., 30% upon completion of foundation work, 50% for framing). Invoice Fly might provide features that simplify progress billing and manage partial payments.

2. Material and Labor Cost Tracking

- Detailed Cost Breakdown: Construction businesses often have to invoice for different types of materials, equipment, and labor. Invoice Fly enables itemized billing, ensuring that every expense is clearly documented and tracked, reducing the risk of missed charges.

- Integration with Purchase Orders: For large construction projects, it’s important to tie invoices to purchase orders. Invoice Fly likely integrates purchase orders directly into invoices, making cost management and documentation seamless.

3. Time Tracking and Payroll Integration

- Labor Tracking: Construction work is often paid hourly, and Invoice Fly could offer integrated time tracking that simplifies billing for labor. This ensures accurate payments and simplifies reporting for payroll.

- Subcontractor Management: Managing subcontractor payments can be complex. Invoice Fly’s functionality may include easy ways to manage subcontractor invoices, ensuring that payments align with contractual terms.

4. Mobile & Desktop App

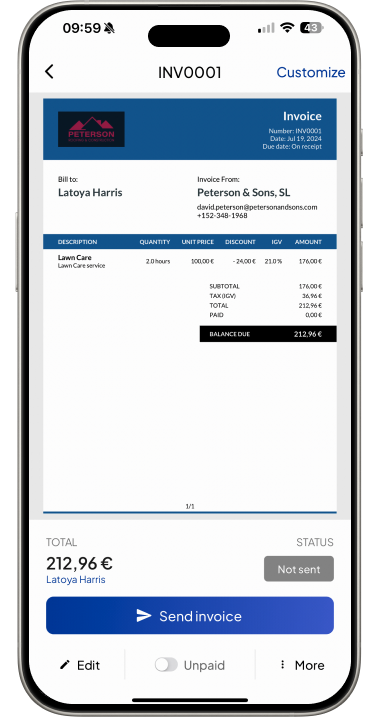

- Ease of Use in the Field: Handyman professionals frequently work on-site and need immediate access to invoicing tools. Invoice Fly’s mobile features allow for quick invoicing and expense tracking directly from the job location.

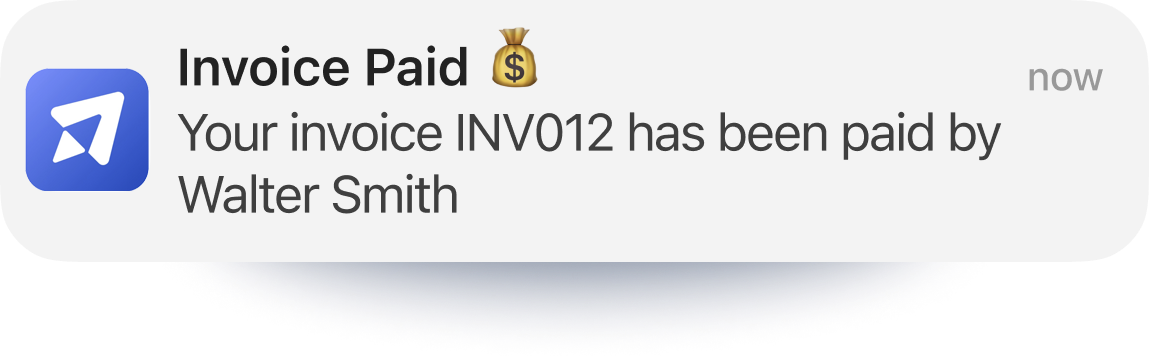

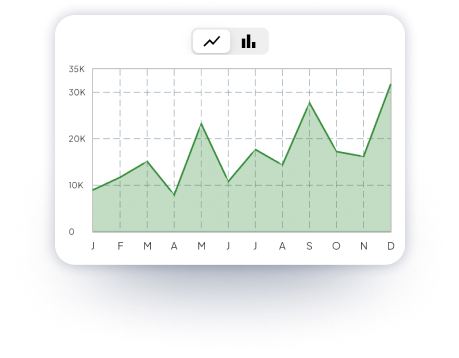

- Real-Time Updates: In a fast-paced field like handyman services, real-time updates on invoicing, payment status, and project expenses are crucial. Invoice Fly’s cloud-based system can provide instant access to key financial information.

How much does a Handyman make in 2024? Taxes & Wages

In 2024, Handymen in the United States earn an average salary of around $47,891 per year.

However, salaries can vary significantly depending on location and experience.

For example, in San Jose, California, construction workers can earn as much as $94,555, which is about 97% higher than the national average.

The actual take-home pay will depend on federal and state taxes, with federal tax rates ranging from 10% to 37% based on income brackets.

State taxes also vary, with states like California having higher income tax rates compared to others like Texas, which has no state income tax.

After deductions for taxes, social security, and Medicare, a handyman making $47,891 could expect to take home around $38,000 to $40,000 annually, depending on their state of residence

Try our Salary Calculator

Handyman Software

FAQs

Handyman jobs often involve multiple small tasks within a single visit, such as fixing a leaky faucet, hanging shelves, or repairing drywall. To manage and track these tasks on a single invoice:

Open the invoice you want to create or edit.

Add each task as a separate line item, specifying the details of each job performed.

This allows you to provide a clear breakdown of services, ensuring your clients understand exactly what they are paying for.

Accurately tracking the time spent on each task is crucial for ensuring fair billing and efficient time management. To track time spent on handyman jobs:

Go to the Tools section in the menu at the bottom of the screen.

Click on "Client Time Tracking."

Log the hours spent on each specific task, whether it’s a small repair or a larger project, ensuring that all time worked is accounted for and billed accurately.

For larger handyman projects, requesting a deposit can help cover upfront costs and secure the job. To request a deposit:

Open the estimate that you want to create or edit.

Scroll down to find the "Deposit Request" option.

Enable this option to specify the deposit amount required before starting the job.

Ensure that you have Stripe or PayPal enabled to process the deposit payment securely, making it easier for your clients to pay and for you to manage the project.

When performing handyman services, it’s common to bill separately for materials and labor. To manage this in your invoices:

Open the invoice you want to create or edit.

Add each material (e.g., paint, screws, lumber) and labor entry as separate line items.

Specify the costs for materials and labor individually, so your clients can see a transparent breakdown of the total charges.

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs