- Home

- »

- Industries

- »

- Cleaning Business Software

Cleaning Business Software

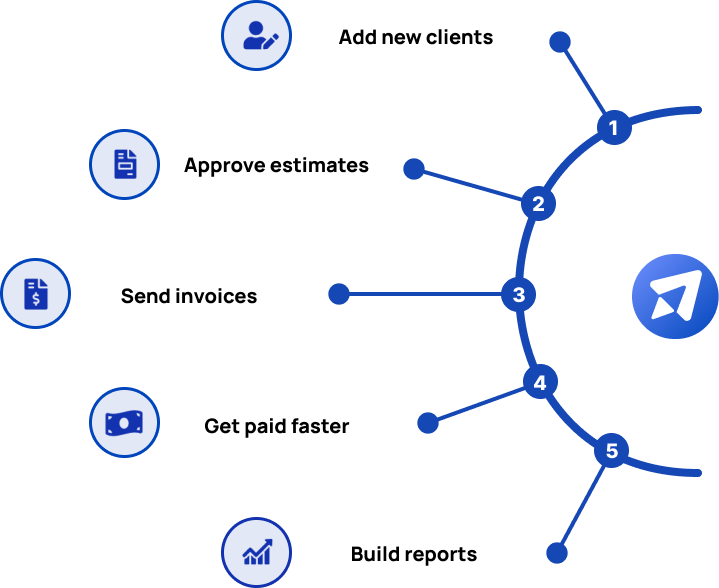

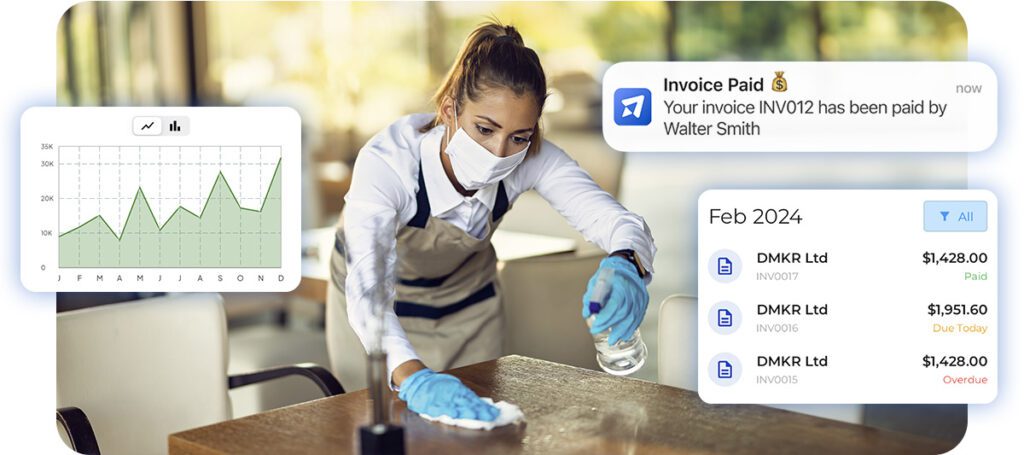

Run a smoother cleaning business with Invoice Fly. Send estimates and invoices, and save hours of work by automating your workflows.

Get your Cleaning Business working smoothly

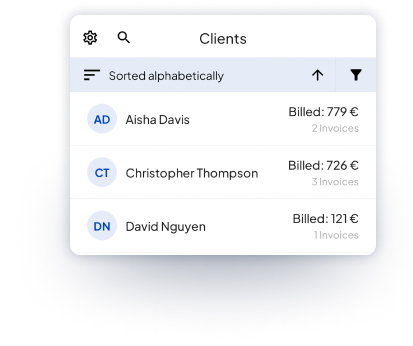

With Invoice Fly you will have precise control of your clients either from the your office or on site. Send quotes or estimates, invoices and download quick statements about your customers.

What is a Cleaning Business Software?

A Cleaning Business Software is a digital solution designed to help cleaning contractors efficiently manage invoicing, job scheduling, and overall business operations.

Running a cleaning business presents its own set of challenges, from coordinating multiple client appointments to ensuring accurate billing across a variety of cleaning services.

A cleaning business solution like Invoice Fly simplifies these tasks with easy invoicing, estimating, tracking payments, and maintaining detailed records of completed jobs.

Why do Cleaning Contractors prefer using Invoice Fly over other software?

Cleaning Contractors prefer using Invoice Fly over other software because it offers a comprehensive, user-friendly solution specifically designed for contractors and small business owners.

Here’s why Invoice Fly stands out:

1. Built for Simplicity

Cleaning Contractors want to focus on servicing clients, not navigating complex software. Invoice Fly provides a clean, easy-to-use interface that requires minimal training, allowing contractors to quickly generate and send invoices, track payments, and manage customer information—all without the steep learning curve of other tools. This simplicity helps cleaning professionals stay focused on growing their business rather than getting bogged down by technical issues.

2. Tailored for Cleaning Businesses

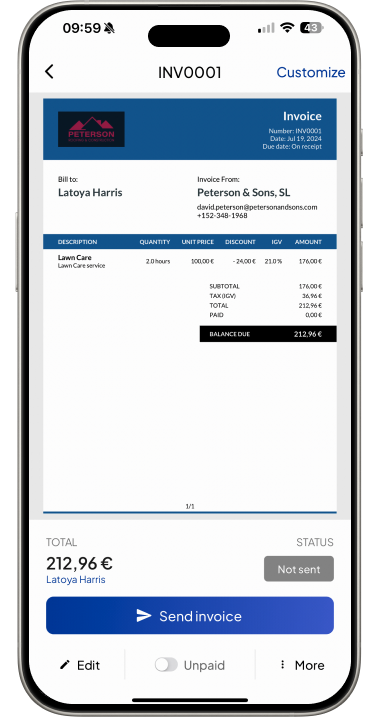

Unlike generic invoicing software, Invoice Fly is designed for service-based businesses like cleaning contractors. It includes features such as customizable billing for different cleaning services, supply tracking, and client management, ensuring contractors can easily generate accurate invoices and track their work history. This industry-specific focus helps cleaning contractors keep operations smooth while ensuring every client is billed correctly.

3. Mobile & Desktop App

Cleaning Contractors are often on the go, whether they’re traveling to a new client or managing a team across different locations. With Invoice Fly’s mobile functionality, contractors can create invoices, update job details, and monitor payment statuses directly from their smartphones or tablets. This flexibility ensures contractors can efficiently manage their business no matter where the job takes them.

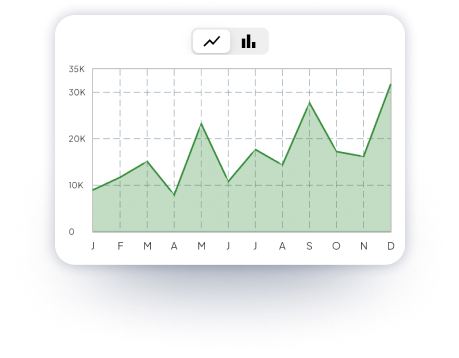

4. Time-Saving Simplicity

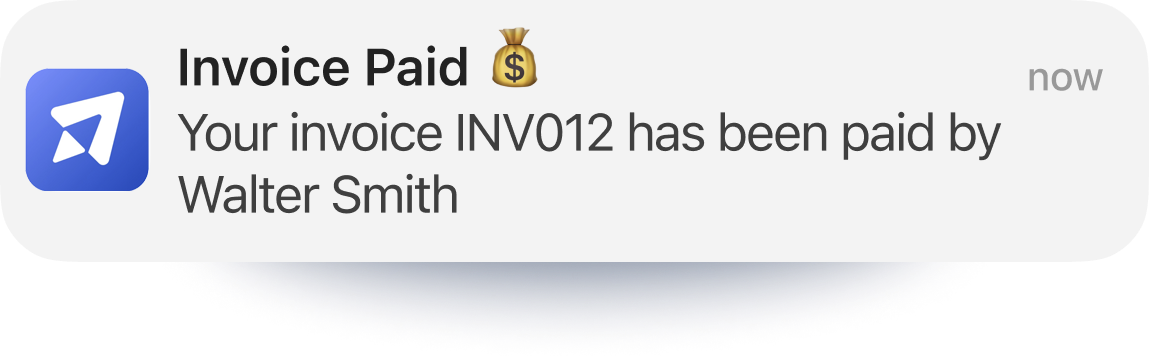

Administrative tasks like chasing late payments or sending recurring invoices can take up valuable time. Invoice Fly automates these processes, allowing cleaning contractors to set up reminders, invoices, and track overdue payments. By reducing manual work, contractors can focus more on delivering high-quality service and less on administrative follow-ups, ultimately increasing productivity.

How much do Cleaning Contractors make in 2024? Taxes & Wages

In 2024, Cleaning Contractors in the U.S. can expect to earn an average annual salary of around $30,000 to $60,000, depending on factors such as experience, location, and the size of their business.

Entry-level cleaning professionals may start on the lower end of this range, while experienced contractors and those running larger cleaning operations can see wages well above $60,000 annually.

In high-demand or high-cost-of-living cities, such as New York or San Francisco, earnings may exceed these averages. As independent contractors, cleaning professionals are responsible for paying Self-Employment Tax (15.3%) for Social Security and Medicare, Federal Income Tax (ranging from 10% to 37%), and State and Local Taxes, which can vary between 0% to 13.3%.

By leveraging deductions for business expenses such as supplies, travel, and equipment, cleaning contractors can significantly reduce their tax liability and maximize their take-home income.

Try our Salary Calculator

Cleaning Business

Software FAQs

To bill clients for both labor and cleaning supplies or equipment costs, follow these steps:

Open the invoice you want to create or edit.

Add separate line items for labor and each cleaning supply or equipment used during the job.

Specify the costs for each item and service, so your clients have a clear breakdown of what they are being charged for.

Accurate time tracking is essential for billing clients correctly and managing your cleaning team’s productivity. You can track the time spent on a cleaning job using the Client Time Tracking feature. This can be found under the Tools section and allows you to log hours for each cleaning task, ensuring you charge appropriately for your services.

Yes, collecting client signatures is a great way to formalize your cleaning service agreements and ensure that both parties are on the same page. To collect client signatures:

Choose the invoice or estimate related to the cleaning service you need a signature for.

Click on the More button and select "Collect Client Signature."

This ensures that your client has agreed to the terms of service, including the scope of work and payment terms.

Adding before-and-after photos to your cleaning service invoices can help demonstrate the value of your work and justify your charges. To do this:

Open the invoice related to the cleaning job you want to create or edit.

You can add photos directly under the payment info section and before the notes section.

This is especially useful for showing the condition of a property before and after your cleaning service, providing clear evidence of your work’s effectiveness.

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs