- Home

- »

- Industries

- »

- Roofing Software

Roofing Software

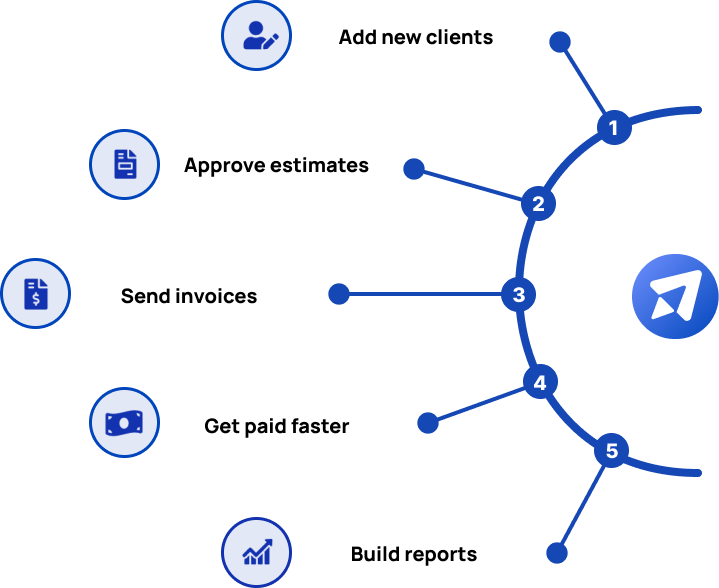

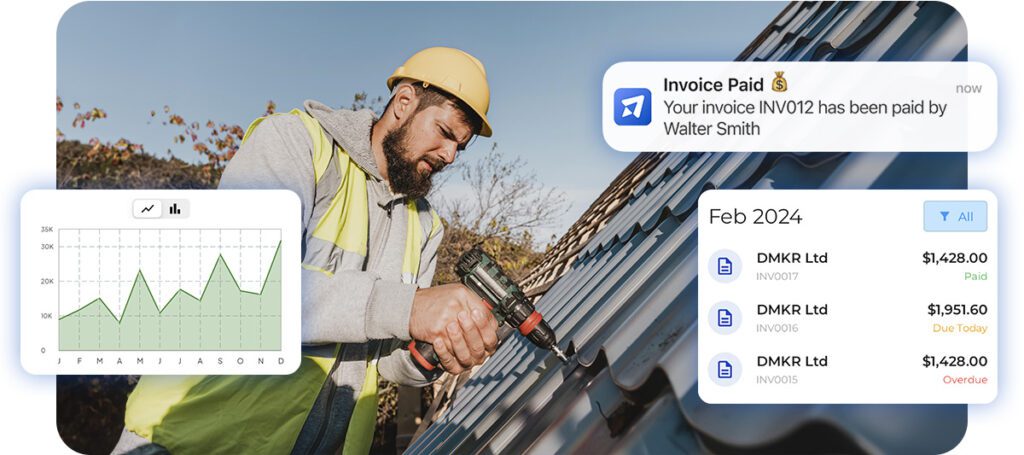

Run a smoother roofing business with Invoice Fly. Send estimates and invoices, and save hours of work by automating your workflows.

Get your Roofing Business working smoothly

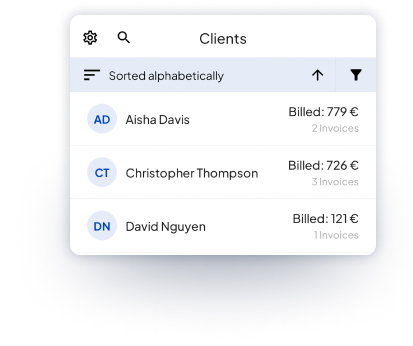

With Invoice Fly you will have precise control of your clients either from your office or on site. Send quotes or estimates, invoices and download quick statements about your customers.

What is a Roofing Software?

Owning a Roofing Business is both rewarding and demanding. As a roofing contractor, you take great satisfaction in providing essential services that protect homes and businesses, but the daily grind can be overwhelming.

Coordinating multiple projects, handling customer expectations, tracking material costs, and staying on top of invoices and payments can quickly become a challenge. That’s where a Roofing Business Software steps in to simplify your workload.

Roofing contractors can benefit from specialized software, such as Invoice Fly, which is created to streamline their operations and improve business performance.

With Invoice Fly, you can easily create invoices, track payments, manage job schedules, and monitor overall costs with ease, helping you stay organized, get paid faster, and focus more on delivering high-quality roofing services.

Why do Roofers prefer using Invoice Fly over other software?

Roofing contractors prefer using Invoice Fly over other software due to features that cater to the specific requirements of the roofing industry.

Here is why it stands out:

1. Project-Based Invoicing and Tracking

- Detailed Billing Structures: Roofing jobs often involve different steps, from preparation to installation, along with subcontractors, materials, and varying labor expenses. Invoice Fly offers customizable invoicing tailored to the needs of each project, making it easier to track expenses and bill clients accordingly.

- Progress Billing: Roofing companies frequently bill clients on project milestones (e.g., 30% upon completion of tear-off, 50% after installation of the underlayment). Invoice Fly might offer features that simplify progress billing and manage partial payments.

2. Material and Labor Cost Tracking

- Detailed Cost Breakdown: Roofing businesses often need to invoice for various materials, tools, and labor. Invoice Fly enables itemized billing, ensuring that every expense – whether for shingles, underlayment, or equipment – is clearly documented and tracked, reducing the risk of missed charges.

- Integration with Purchase Orders: For large roofing projects, it’s crucial to link invoices to purchase orders. Invoice Fly likely integrates purchase orders directly into invoices, making cost management and documentation effortless.

3. Time Tracking and Payroll Integration

- Labor Tracking: Roofing jobs are frequently billed by the hour, and Invoice Fly may provide built-in time tracking to make labor billing easier. This ensures precise payments and simplifies payroll reporting.

- Subcontractor Management: Handling subcontractor payments can be complicated. Invoice Fly’s features may offer streamlined methods to manage subcontractor invoices, ensuring payments are made according to contractual agreements.

4. Mobile & Desktop App

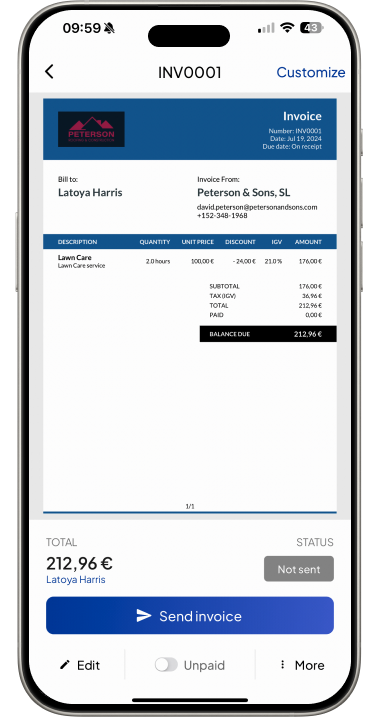

- Ease of Use in the Field: Roofing supervisors and contractors frequently operate on-site and require immediate access to invoicing tools. Invoice Fly’s mobile features enable real-time invoicing and expense tracking directly from the job site.

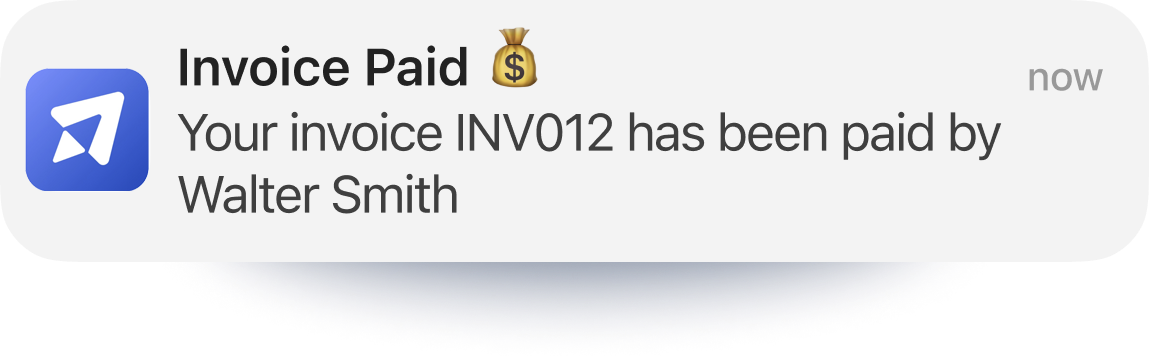

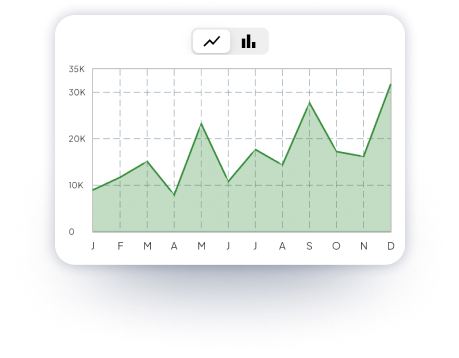

- Real-Time Updates: In a dynamic industry like roofing, real-time insights into invoicing, payment status, and project costs are critical. Invoice Fly’s cloud-based platform could provide immediate access to key financial information.

How much does a Roofer make in 2024? Taxes & Wages

In 2024, roofers in the U.S. can expect to earn a median annual wage of approximately $50,030, according to the U.S. Bureau of Labor Statistics.

Entry-level roofers may start at around $36,240 annually, while the top 10% of earners can make over $79,850.

Factors such as demand in different regions and the type of roofing work—such as new installations or repairs—affect wages.

Roofers working in cities with high construction activity, like Dallas and Charlotte, often see better job opportunities and potentially higher pay due to the demand for roof repair and maintenance, especially following storm seasons.

Roofers’ federal tax rate will depend on their taxable income. In 2024, the IRS has established tax brackets ranging from 10% to 37%.

Self-employed roofers are required to pay both the employer and employee portion of Social Security (12,4%) and Medicare (2,9%) taxes, covering totaling 15.3%.

Try our Salary Calculator

Roofing Software

FAQs

Roofing projects often involve various tasks, such as installation, repairs, and inspections. To track the time spent on each task:

Use the "Client Time Tracking" feature located in the "Tools" section.

Log the hours spent on specific tasks, such as shingle installation, roof inspections, or leak repairs.

Convert the logged time into an invoice to ensure accurate billing for the hours worked.

Roofing jobs usually involve both labor and materials (e.g., shingles, flashing, nails). To create an invoice that includes these costs:

Open the app and select "Create New Invoice."

Add client details and specify the services provided, such as roof installation, repairs, or inspections. Include separate line items for labor and materials, clearly breaking down the cost for each component of the job.

Save and send the invoice directly to the client.

Yes, before-and-after photos can be especially useful in roofing to show clients the completed work and the improvements made. To add photos:

Open the invoice related to the roofing job.

Scroll down to the section below the payment info and add photos showing the roof before the work began and after it was completed.

This visual evidence helps justify the charges and adds professionalism to your invoices.

In some regions, labor and materials for roofing jobs may have different tax rates. To handle this:

Go to "Settings" and select "Tax and Currency."

Choose "Type of Tax per Item," which allows you to apply different tax rates for labor and materials.

This ensures that your invoice is accurate and complies with tax regulations in your region.

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs