How to Get Your Pest Control Insurance: Need-to-Know Guide

In this guide we will cover how to get your pest control insurance, why is important to get one, and how much it costs across different States in the U.S., in 2025.

Protection against legal and financial risks is important for any business. Pest control services are no exception.

The pest control services market expects to reach $42.5 billion by 2032. This makes it a good career choice. However, your business is vulnerable without the correct insurance coverage.

Let’s understand why:

Steps to get your Pest Control Insurance

What Is Pest Control Business Insurance?

Pest control company insurance includes several policies. These policies protect your business from financial problems caused by different risks. This includes accidents, damages, and legal actions. Key coverages include:

- General Pest Control Liability Insurance: Protects against bodily injury, property damage, and advertising injury claims.

- Professional Liability Insurance (Errors and Omissions): Covers claims of inadequate work or negligent services.

- Workers’ Compensation Insurance: Provides benefits to employees suffering from work-related injuries or illnesses.

- Commercial Auto Insurance: Covers damages and liability from vehicle accidents.

- Pollution Liability Insurance: Addresses claims of environmental damage due to your pest control activities.

- Property Insurance: Property coverage for your business. Protects your premises and it’s contents

- Inland Marine Insurance: Safeguards tools and equipment when transported between job sites.

Knowing these policies and how they relate to your business can help protect you from day-to-day common risks.

Why Do Pest Control Contractors Need Insurance?

Pest control contractors often work with dangerous chemicals. They also work in places where property damage or injuries can happen. Here are some reasons why the right insurance is essential:

- Legal Requirement: Most states require certain types of insurance, such as general liability and workers’ compensation.

- Contractual Obligations: Some clients might require specific liability coverage before awarding contracts.

- Financial Protection: Insurance protects your business assets from claims and lawsuits, which could otherwise be financially devastating.

- Pest Management: Pest Control Insurance will safeguard you from working with any kind of pests: you’re covered for everything from rodents to insects, arachnids, and other wildlife animals.

- Commercial Properties: Pest control insurance protects business owners from financial losses due to property damage, liability claims, or accidents, ensuring their commercial properties and operations remain secure.

- Medical expenses: Pest control insurance covers medical costs for injuries or exposure to harmful chemicals, safeguarding business owners and employees from unexpected healthcare costs.

State-Specific Insurance Requirements

Insurance requirements can vary significantly by state. Here’s a look at what contractors might expect in ten different states:

State | Required Insurance |

Texas | General liability, Commercial auto |

Florida | Pollution liability, General liability |

California | Pollution liability, Professional liability |

New York | High levels of coverage required |

Illinois | General liability, Workers’ compensation |

Georgia | Workers’ compensation, Commercial auto |

Ohio | General liability, Inland marine (suggested) |

Michigan | Strong recommendation for pollution liability |

Virginia | Workers’ compensation, General liability |

Pennsylvania | Professional liability insurance |

Top Tip: Always confirm the specific insurance requirements with your local and state authorities. This ensures your business is fully compliant and protected.

How Much Does It Cost?

The cost of pest control insurance coverage varies based on a number of factors such as:

- The size of your business

- The number of employees

- The types of services you offer

- Location

Example: Florida’s humid climate increases the demand for pest control services. This makes pest control insurance in Florida a necessary safeguard for businesses and could raise coverage costs.

Generally, premiums can range from $500 to $3,000 annually, with basic coverage costing as little as $350 per year.

Top Tip: shop around and compare quotes from multiple insurance brokers to ensure you’re getting the best deal for your peace of mind.

Save Time and Money With Pest Control Software

Beyond traditional insurance, pest control operators can leverage software solutions to mitigate risks and enhance operational efficiencies.

Platforms like Invoice Fly offer comprehensive tools designed for the pest control industry, including:

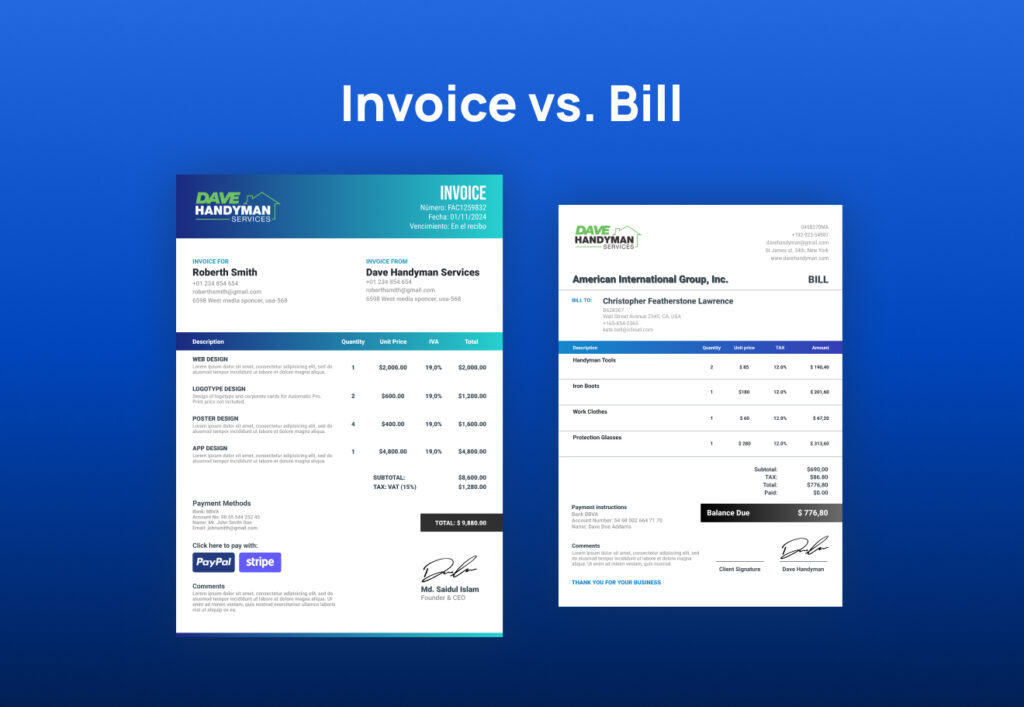

- Invoice and Estimate Generators: Streamline billing and service quotes.

- Client Portals and Time Tracking: Enhance customer service and operational transparency.

- Reporting Software: Provides insights into business performance and financial health.

Using these tools can help manage your business more efficiently. They may also lower insurance costs by reducing the chances of claims.

How Do I Choose the Best Insurance Provider?

With many types of insurance to choose from, the process can be overwhelming. Follow these steps to ensure you are fully covered and get the best value for your money:

- Evaluate Coverage Options: Ensure the provider offers insurance that covers costs and meets all your specific needs.

- Compare Costs: Research different quotes to find the best rate for your business.

- Check Customer Reviews: See what others say about their reliability and service.

- Industry Expertise: Prefer providers with experience in the pest control industry.

- Understand the Fine Print: Read the terms and conditions carefully to know exactly what is covered and what’s not.

Can I Use my License in Other States?

When you run a pest control business in different states, keep in mind licenses typically do not transfer. Each state has its own licensing requirements and regulations.

To work in another state, you will need to meet that state’s licensing rules. This may include extra training, tests, or fees.

For example, pest control insurance in Texas might differ significantly from the requirements for pest control insurance in California.

Always check with the local regulatory body. This will help you understand the specific requirements for running your pest control business legally in each state.

Securing Your Future with Pest Control Insurance

Pest control insurance is an important investment for your company’s future. To safeguard your operations and ensure long-term success with your business, follow these steps:

- Choose the Right Coverage: Tailor your insurance to meet the specific needs of your pest control business.

- Work with a Trusted Provider: Select an insurance provider known for reliability and industry expertise.

- Utilize Industry-Specific Software: Implement specialized software to manage risks and streamline operations effectively.

Ready to fortify your pest control business with the best insurance options?

Download Invoice Fly and start running a smooth and secure pest control business today!

Ellie McKenna is a creative copywriter born in United Kingdom.

Although was born in Northern Ireland, she possesses extensive knowledge about SaaS and Mobile Apps products in the United States, as she has been in-house writer, agency writer and freelance for American companies.

Working at Vista has allowed her to create content that focus on the user search intent, creating great informative articles for contractors and small businesses in the U.S.