What is a Pay Stub? Meaning, Definition & Best Practices

Table of Contents

In this comprehensive guide, we’ll explore what is a pay stub and the best practices to follow.

Everything you need to know, including the information they contain, their significance, and best practices for managing them.

Understanding financial documents like pay stubs is essential for both employers and employees.

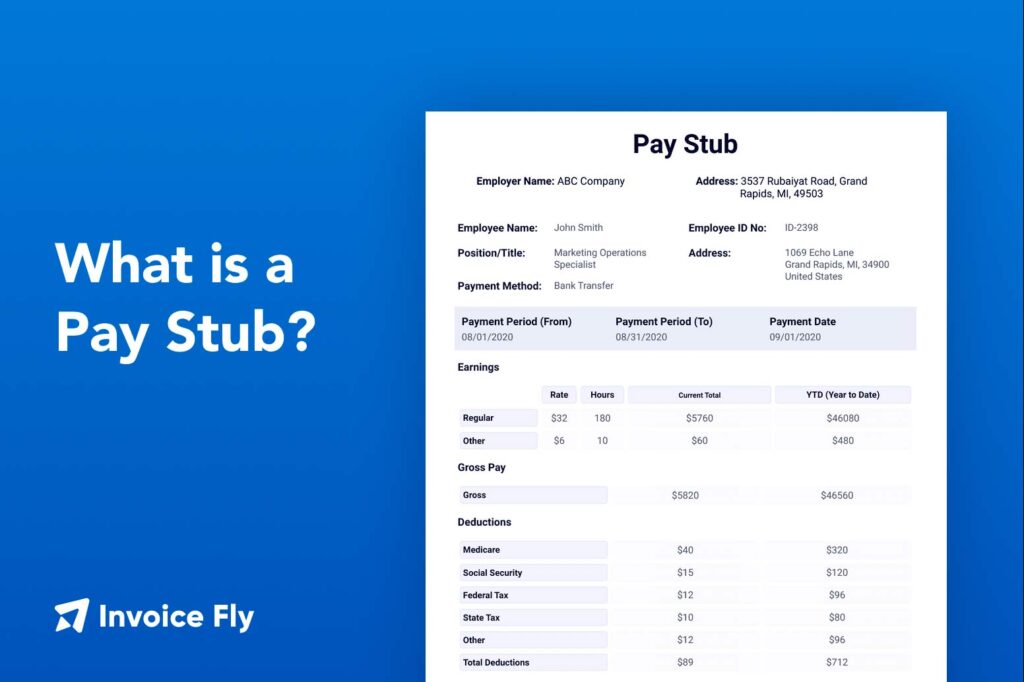

A pay stub, also known as a pay slip or paycheck stub, provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period.

Beyond its immediate utility, it’s a critical document for record-keeping, tax purposes, and financial planning.

What Information is on a Pay Stub?

A pay stub is more than just a summary of earnings. It provides a detailed breakdown of various components of an employee’s compensation. Here are the key elements typically found on one:

1. Gross Pay

- Definition: The total amount of employee’s gross earnings before any deductions.

- Components:

- Regular wages or salary

- Overtime pay

- Bonuses or commissions

2. Deductions

- Definition: Amounts subtracted from gross wages for taxes, benefits, and other obligations.

- Common Deductions:

- Federal, state, and local taxes

- Social Security and Medicare (FICA taxes)

- Health insurance premiums

- Retirement contributions (e.g., 401(k) plans)

3. Contributions

- Definition: Employer contributions to benefits or savings plans.

- Examples:

- Employer’s share of health insurance

- Matching contributions to retirement plans

4. Net Pay

- Definition: The amount an employee takes home after deductions.

- Calculation: Gross wages – Deductions = Net Pay

5. Garnishments

- Definition: Court-ordered deductions for debts such as child support, loans, or unpaid taxes.

6. Paid Time Off (PTO)

- Details Provided:

- Vacation days earned and used

- Sick leave balance

- Personal days

7. Pay Period and Pay Date

- Pay Period: The range of dates for which the employee is being paid (e.g., bi-weekly or monthly).

- Pay Date: The specific date when the payment is issued.

8. Rates of Pay (hourly rate or salary)

- For hourly workers, the total hours worked during the pay period are also included. Additionally, the pay stub often details the breakdown of regular and overtime hours worked, showcasing transparency in how earnings are calculated.

- For salaried employees, it may highlight the prorated amount if they worked less than the standard period because of leaves or other reasons. This section ensures employees clearly understand their earnings in relation to the time and effort they’ve invested during the pay cycle.

Why Are Pay Stubs Important?

For Employees:

- Verification of Income: They provide essential proof of income for critical financial processes like securing loans, renting property, or applying for credit cards. They offer lenders and landlords confidence in an applicant’s financial stability.

- Tax Filing: During tax season, they act as a reliable record to ensure that income and tax deductions are reported accurately. They help prevent errors and support claims for refunds or deductions.

- Budgeting: By breaking down gross income, deductions, and net pay, they empower employees to better understand their financial situation. They are useful tools for managing personal budgets, saving goals, and expense planning.

For Employers:

- Compliance: Helps employers comply with federal laws and state wage laws, ensuring transparency in employee compensation. Adhering to these requirements reduces the risk of legal disputes or penalties.

- Dispute Resolution: If there are discrepancies or disputes over wages, they serve as documented evidence to clarify misunderstandings and resolve conflicts amicably.

- Record-Keeping: They contribute to accurate payroll records, which are essential for audits, financial reporting, and maintaining organized business operations.

Pay Stub Best Practices

1. Accuracy is Key

- Ensure all details, including gross wages, deductions, and net pay, are accurate.

2. Use Digital Solutions

- Leverage tools like Invoice Fly’s Invoice Maker to automate payroll and generate accurate pay stubs efficiently.

3. Provide Clear Explanations

- Include a brief description or legend to explain common deductions and contributions.

4. Maintain Confidentiality

- Protect sensitive information by using secure systems to generate and distribute pay stubs.

5. Retain Records

- Both employees and employers should retain pay slips for at least three years for tax and legal purposes.

The Role of Technology in Pay Stub Management

Modern software has revolutionized payroll management, making it easier to generate and distribute pay stubs accurately. Tools like Invoice Fly’s Reporting Software and Client Portal offer features that streamline this process.

Benefits of Using Payroll Software:

- Efficiency: Automates calculations and minimizes errors.

- Customisation: Allows for tailored pay stub formats to suit business needs.

- Accessibility: Employees receive and can access their pay stubs anytime through secure portals.

How to Read a Pay Stub

Understanding a pay stub is crucial for financial literacy. Here’s a step-by-step guide:

- Start with Gross Wages: Check the total earnings before deductions.

- Review Deductions: Ensure all taxes and benefits align with expectations.

- Examine Contributions: Verify employer contributions to benefits.

- Calculate Net Pay: Confirm the take-home amount matches your records.

- Look at PTO Balances: Keep track of remaining vacation or sick days.

Simplify Payroll with Invoice Fly

Managing payroll and pay stubs doesn’t need to be complex. Tools like Invoice Fly’s Invoice Maker make it easy to create professional, accurate pay stubs that comply with all legal requirements.

Whether you’re a small business owner or an employee looking to streamline financial records, Invoice Fly has the solutions you need.

Explore Invoice Fly’s features today to take control of your payroll process. From invoice generation to detailed reporting, Invoice Fly helps you stay organised and efficient.

Pay Stub - Frequently Asked Questions

The requirement varies by state. Some states require employers to provide pay stubs, while others do not. Check your state’s labor laws for specifics.

Yes, many employers use digital platforms to distribute pay stubs securely. Ensure employees consent to receiving electronic copies.

Notify your employer or HR department immediately. Keep records of all communications and request a corrected stub.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime employee pay, record-keeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.