What Percentage of Income Should Small Businesses Set Aside for Taxes?

Table of Contents

- How much do you need to set aside for taxes?

- Step 1: Get clear on tax obligations

- Step 2: Use the 30% rule to save for taxes

- Step 3: Choose a saving method

- What factors impact how much you owe in taxes?

- How do small business owners file taxes?

- What types of taxes do small businesses pay?

- When do you need to pay taxes?

- What happens if you underestimate your taxes owed?

- What happens if you pay too much?

- How to manage your savings for taxes

- Tips on lightening the load at tax time

- Stay ahead of taxes and keep more of your earnings in the long run

One of the biggest financial challenges for small business owners in the United States is ensuring they set aside enough for taxes.

Unlike W-2 employees who have Social Security and Medicare taxes withheld from their paychecks, self-employed individuals and business owners must calculate and pay their own taxes. Failing to set aside enough can lead to penalties and interest or an unexpectedly high bill at tax time.

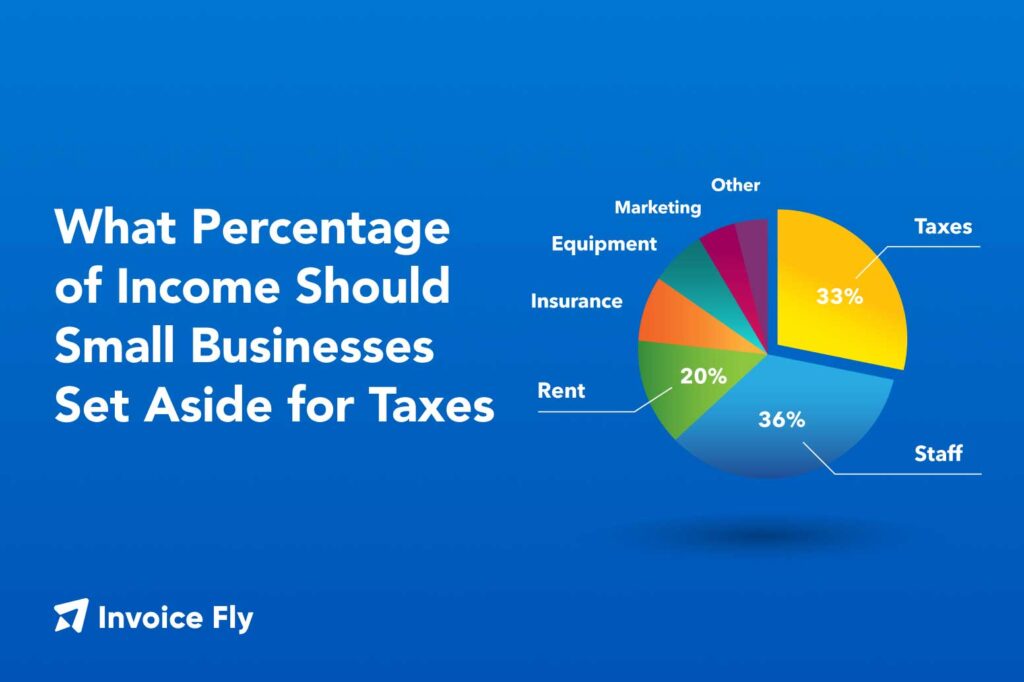

So, how much should you set aside? A common rule of thumb is to save 25-30% of net income to cover federal income tax, self-employment tax, and state and local taxes. However, the exact percentage depends on multiple factors, including business structure, location, deductions, and total income.

This guide covers:

- How to calculate and save for tax dues

- The types of taxes businesses must pay

- How to avoid penalties and interest

- What happens if you overpay or underpay your estimated taxes

By planning ahead, business owners can reduce financial stress and maximize tax-saving opportunities.

How much do you need to set aside for taxes?

The total amount you need to set aside depends on:

- Business structure: Sole proprietors, LLCs, and corporations have different tax obligations.

- Income level: Higher earnings result in higher tax brackets.

- State and local taxes: Some states have no income tax, while others have high rates.

- Tax deductions and credits: Write-offs like the earned income tax credit and business expenses can reduce your tax liability.

For most small business owners, the recommended savings percentage is between 25-30% of net income. If your state and local tax rates are higher, you may need to adjust your savings accordingly.

Step 1: Get clear on tax obligations

Understanding how tax is calculated for your business is crucial for financial planning. Here’s a breakdown of the main taxes small businesses must pay:

Federal income taxes

- All businesses must file federal taxes with the IRS. The tax rate depends on business structure and net income.

- Some corporations are taxed separately from their owners, while sole proprietors report income on their personal tax returns.

Self-employment tax

- Self-employed individuals must pay 15.3% in Social Security and Medicare taxes.

- This includes 12.4% for Social Security and 2.9% for Medicare, which is typically split between employers and employees but must be paid in full by self-employed individuals.

State and local taxes

- State and local tax rates vary depending on where your business operates. Some states have no income tax, while others charge business and sales taxes.

- Certain local governments also impose taxes on business property, gross receipts, or industry-specific activities.

Payroll and employment taxes

- If you have employees, you must withhold federal income tax, Social Security and Medicare taxes, and state payroll taxes.

- Employers must also pay unemployment taxes to fund unemployment benefits.

Step 2: Use the 30% rule to save for taxes

Many small business owners follow the 30% rule to ensure they can cover their tax liabilities without financial stress.

- Set aside 30% of your net income in a dedicated tax savings account.

- Transfer a portion of every payment received into this account.

- Adjust the percentage if needed based on federal estimated payments and business expenses.

Keeping taxes separate prevents spending tax dues and ensures you’re prepared for quarterly tax deadlines.

Step 3: Choose a saving method

There are multiple ways to set aside tax savings effectively:

- Open a separate tax savings account: Prevents mixing tax funds with business expenses.

- Automate savings transfers: Helps stay consistent without forgetting.

- Use accounting software: Tools like Invoice Fly’s reporting software can track 2024 taxes and estimate payments.

- Work with a tax professional: Ensures compliance with service terms and conditions when handling business taxes.

Some financial institutions may charge file fees or have specific eligibility criteria and underwriting rules for business tax savings accounts. Always check what terms and conditions apply when opening a dedicated account.

What factors impact how much you owe in taxes?

Several key factors determine how much you need to set aside for taxes. Understanding these variables can help you plan ahead and minimize surprises at tax time.

1. Business structure

Your tax liability depends on whether you operate as a sole proprietor, LLC, partnership, S-corp, or C-corp.

- Sole proprietors and single-member LLCs report business income on their personal tax returns and pay self-employment taxes.

- Partnerships and S-corps pass income through to owners, who pay taxes on their personal returns.

- C-corporations are taxed separately from their owners and must file corporate income tax returns.

2. Income level

- The more you earn, the more you pay in taxes due to progressive federal income tax brackets.

- Higher-income earners may also be subject to additional taxes, like the Net Investment Income Tax (NIIT).

3. Self-employment tax

- Self-employed individuals must pay 15.3 percent in Social Security and Medicare taxes.

- This includes 12.4 percent for Social Security and 2.9 percent for Medicare, which is typically split between employers and employees but must be paid in full by self-employed individuals.

4. State and local taxes

- State and local tax rates vary depending on where your business operates. Some states have no income tax, while others charge business and sales taxes.

- Certain local governments also impose additional business taxes.

5. Tax deductions and credits

Eligible tax deductions and credits can significantly reduce the amount you owe.

- Common deductions include:

- Home office expenses

- Business-related travel and vehicle expenses

- Health insurance premiums for self-employed individuals

- Retirement contributions such as SEP IRA or Solo 401(k)

- Student loan interest for qualifying business owners

- Tax credits, like the earned income tax credit, can also lower your tax bill if you qualify.

6. Payroll taxes

If you have employees, you are responsible for payroll tax obligations, including:

- Withholding federal and state income taxes from employee wages

- Paying Social Security and Medicare taxes as an employer

- Filing employment tax returns and making timely deposits

Proper payroll management ensures compliance with IRS regulations and avoids potential penalties.

How do small business owners file taxes?

Small business owners file taxes based on their business structure. Sole proprietors and single-member LLCs report business income and expenses on Schedule C (Form 1040) as part of their personal tax return.

Partnerships and multi-member LLCs file Form 1065 and issue Schedule K-1s to partners. S corporations report income on Form 1120-S, while C corporations file Form 1120 and pay corporate taxes separately.

Business owners must also ensure they meet quarterly estimated tax payment requirements and comply with state and local tax filing deadlines. Using tax software or working with a professional can help streamline the process and reduce errors.

What types of taxes do small businesses pay?

Federal and state income taxes

- All businesses must pay federal income tax. State and local taxes vary based on location.

Self-employment tax

- If you’re self-employed, you must pay 15.3% in Social Security and Medicare taxes.

Employment and payroll taxes

If you have employees, you must withhold and pay payroll taxes, including:

- Social Security and Medicare contributions

- Federal and state income tax withholding

- Unemployment tax (FUTA and SUTA)

Other taxes

- Sales tax: Required if you sell taxable goods or services.

- Excise tax: Applies to specific industries, such as fuel, alcohol, and tobacco.

When do you need to pay taxes?

Other taxes

If you expect to owe at least $1,000, the IRS requires quarterly estimated tax payments:

- April 15, 2025 – First quarter

- June 16, 2025 – Second quarter

- September 15, 2025 – Third quarter

- January 15, 2026 – Fourth quarter

Annual tax filing deadlines

- April 15 – Federal tax return due date for most small businesses.

- State deadlines vary – Check with your state tax agency.

What happens if you underestimate your taxes owed?

Failing to set aside enough for taxes can result in:

- IRS penalties and interest – The IRS charges fees for underpayment.

- Higher tax dues at year-end – A large bill instead of manageable installments.

- Cash flow issues – Not having enough set aside can disrupt business operations.

To avoid underpayment penalties, the IRS recommends:

- Paying at least 90% of your total tax bill throughout the year

- Using the safe harbor rule: Paying 100% of last year’s tax liability if income fluctuates

What happens if you pay too much?

If you overestimate your taxes, you can:

- Receive your refund from the IRS after filing your return.

- Apply the excess toward next year’s estimated tax payments.

Overpaying may also delay access to business funds, so it’s best to accurately estimate tax payments rather than significantly over-save.

How to manage your savings for taxes

A structured approach to tax savings helps small businesses avoid financial stress when tax deadlines approach.

1. Set up a dedicated tax savings account

- Keep tax funds separate from operational business accounts to avoid accidental spending.

- Many business bank accounts offer sub-accounts for tax savings.

2. Automate tax savings

- Transfer a fixed percentage of every payment received into your tax savings account.

- Use automated bank transfers or accounting software like Invoice Fly’s reporting software to track and schedule tax payments.

3. Calculate estimated tax payments

- The IRS requires quarterly tax payments for self-employed individuals and business owners.

- Use Form 1040-ES or a tax calculator to estimate what you owe.

4. Keep track of tax deductions

- Use receipt scanning tools and expense trackers to log deductible expenses throughout the year.

- Maintain organized records to support deductions in case of an IRS audit.

5. Work with a tax professional

- A CPA or tax advisor can help reduce your tax liability through tax-saving strategies.

- Ensure compliance with eligibility criteria and underwriting rules for business tax deductions.

Proper tax management ensures you meet deadlines, avoid penalties, and optimize your tax strategy.

Tips on lightening the load at tax time

Managing taxes effectively throughout the year can help reduce financial stress and tax liabilities.

- Maximize deductions – Track and claim all eligible business expenses, such as office supplies, travel, and home office costs, to lower taxable income.

- Contribute to retirement plans – Investing in a SEP IRA or Solo 401(k) can reduce your taxable income while securing your financial future.

- Make quarterly tax payments – Paying estimated taxes on time helps avoid IRS penalties and interest for underpayment.

- Claim available tax credits – Tax credits like the earned income tax credit and energy efficiency incentives can significantly reduce the total amount you owe.

- File early and stay organized – Submitting tax returns early prevents last-minute errors, avoids late fees, and may allow you to receive your refund sooner.

- Stay updated on tax laws – Changes to 2024 taxes and deductions may impact your liability; consulting a tax professional can ensure compliance and maximize tax savings.

By planning ahead and using smart tax strategies, small business owners can reduce their tax burden and improve cash flow throughout the year.

Stay ahead of taxes and keep more of your earnings in the long run

Setting aside 25-30% of your income for taxes is a smart way to avoid financial surprises at tax time. By keeping tax savings separate, using tracking tools, and staying ahead of deadlines, small business owners can avoid penalties and keep operations running smoothly.

For easier financial management, Invoice Fly’s invoice maker and reporting software can help track income, estimate taxes, and manage quarterly payments efficiently.

Start organizing your business taxes today with Invoice Fly.