- Home

- »

- Industries

- »

- Concrete Estimating Software

Concrete Estimating Software

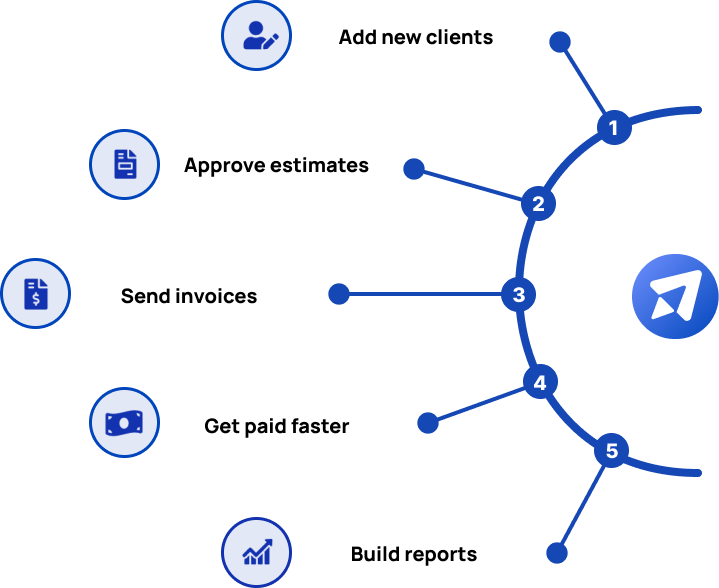

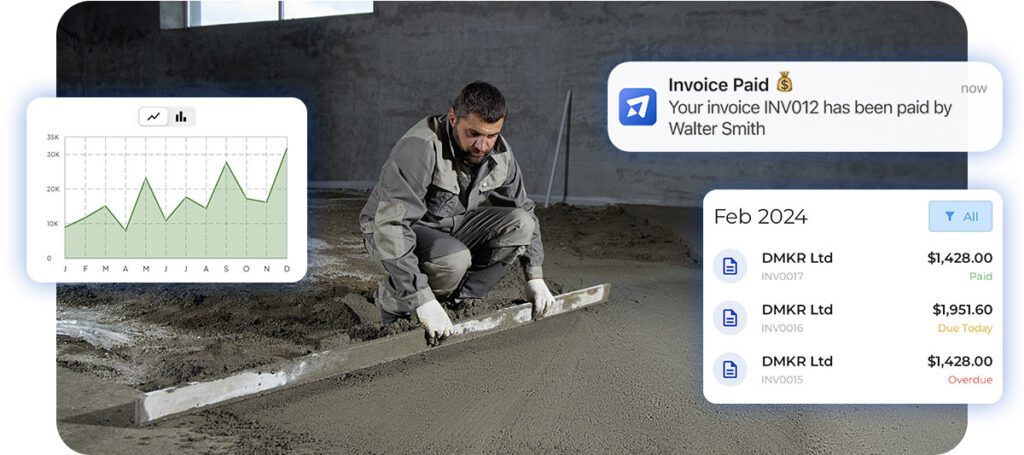

Run a smoother concrete business with Invoice Fly. Send estimates and invoices, and save hours of work by automating your workflows.

Get your Concrete Business working smoothly

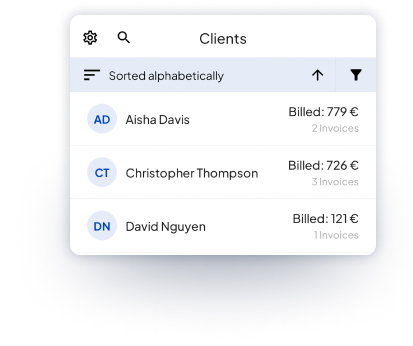

With Invoice Fly, you will have precise control of your clients either from your office or on-site. Send quotes or estimates, invoices, and download quick statements about your customers.

What is a Concrete Estimating Software?

Concrete Contractors face a range of unique challenges in managing their businesses, from handling heavy workloads and coordinating job schedules to keeping track of invoices and payments.

Concrete Estimating Software like Invoice Fly serves as an all-in-one solution that helps contractors streamline their operations. Designed specifically to meet the needs of concrete professionals, this type of software simplifies invoice management, expense tracking, and business reports—all essential for maintaining profitability in a competitive industry.

Invoice Fly addresses these pain points by automating invoicing, improving accuracy, and generating detailed financial reports. This allows concrete contractors to stay on top of their financial performance and focus on delivering high-quality work while keeping their business organized and profitable.

Why do Concrete Pros prefer using Invoice Fly over other software?

Concrete Contractors face a variety of challenges when managing their business, from handling complex job schedules to tracking expenses and invoices across multiple projects.

Concrete Estimating Software like Invoice Fly stands out as the preferred software due to its ease of use, powerful automation tools, and tailored features that meet the specific needs of construction professionals.

Here is why it stands out:

1. Built for Efficiency

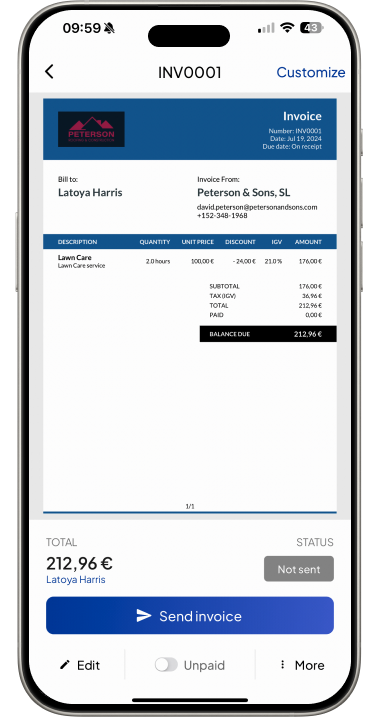

Concrete Contractors often juggle several projects simultaneously, making efficiency essential. Invoice Fly simplifies the invoicing process with automated billing and payment tracking, enabling contractors to generate and send invoices in minutes. Its intuitive interface ensures that even those with limited tech experience can quickly adopt the software without wasting time on the job site.

2. Tailored for the Construction Industry

Unlike generic invoicing tools, Invoice Fly is designed with construction businesses in mind. It includes features such as itemized billing for labor, materials, and job-specific costs, allowing concrete contractors to create accurate, detailed invoices. This level of customization helps contractors account for every aspect of the job, reducing the chances of under-billing and increasing profitability.

3. Mobile & Desktop App

Concrete contractors are frequently on the move, working at multiple job sites throughout the day. Invoice Fly’s mobile-friendly platform allows them to send invoices, track payments, and update project details from their smartphones or tablets. This mobile access ensures that invoicing stays on track, even while contractors are out in the field, helping to maintain cash flow without delays.

4. Seamless Payment Processing

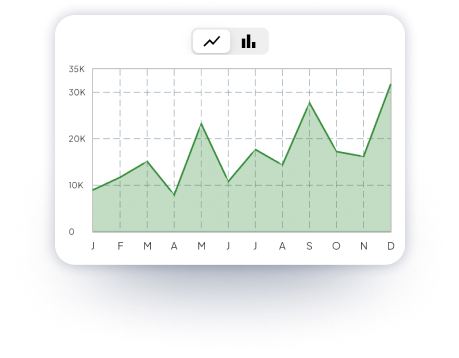

One of the most significant benefits of Invoice Fly is its robust financial reporting features. Concrete contractors can access reports on income, expenses, and project profitability, enabling them to make informed business decisions. This helps contractors track their financial health and plan for future growth by identifying profitable projects and areas for improvement.

How much does a Concrete Contractor make in 2024? Taxes & Wages

In 2024, concrete contractors in the U.S. can expect to earn an average annual salary ranging from $55,000 to $85,000, depending on factors such as experience, location, and the size of the business.

Entry-level concrete workers may earn closer to the lower end of the spectrum, while seasoned contractors, especially those running their own operations, could see earnings surpassing $100,000 annually.

In metropolitan areas with high demand for construction, such as Los Angeles or New York City, earnings for concrete contractors may significantly exceed national averages.

As self-employed professionals or business owners, concrete contractors are responsible for Self-Employment Tax (15.3%), which covers Social Security and Medicare.

They are also liable for Federal Income Tax (10% to 37%, depending on their income bracket) and State and Local Taxes (ranging from 0% to 13.3%, based on location).

Try our Salary Calculator

Concrete Estimating

Software FAQs

Accurately tracking time for boiler installations, repairs, and routine maintenance is essential. To track time spent on each job:

Use the "Client Time Tracking" feature in the "Tools" section.

Log hours spent on specific tasks, such as boiler installation, repairs, or system diagnostics.

Once logged, you can convert the tracked time into an invoice to ensure accurate billing for time-based services.

Yes, you can send estimates for boiler installations and repairs and then convert them into invoices once approved by the client:

Create an estimate detailing the labor, parts, and service costs for the boiler work.

Once the client approves the estimate, open the estimate, click "More" in the bottom-right corner, and select "Convert to Invoice."

This streamlines the process from estimate to invoice without re-entering data.

Yes, you can include warranty or guarantee information in your invoices to reassure clients. Here’s how:

Open the invoice related to the job.

Scroll down to the "Notes" section and add the details of any warranties or guarantees offered, such as parts or labor coverage for a set period after installation or repair.

Including this information helps build trust with clients and provides them with peace of mind about your services.

Boiler businesses often need to respond to emergency repair calls, which may require separate billing. To handle this:

Create or edit an invoice and add a line item labeled "Emergency Repair."

Specify the labor and parts costs for the emergency work, ensuring it is clear to the client that this is an urgent service.

This allows you to charge a premium for emergency services and clearly outline the charges.

Try Invoice Fly Today

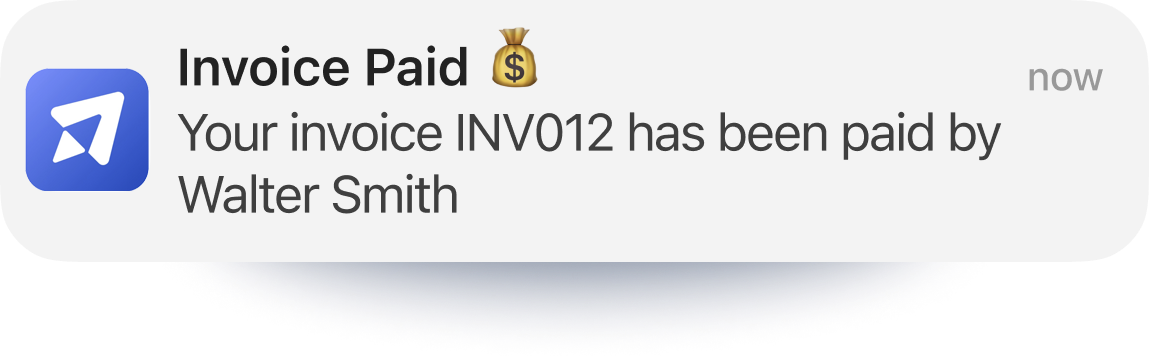

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs