Invoice vs. Quote: What’s the Difference?

Running a business typically involves managing various financial documents, but two of the most common ones often cause confusion: quotes and invoices. Confused as well? Don’t worry. Many business owners and clients alike find themselves googling, “What is a quote vs an invoice?”

While both are crucial for managing business transactions, they serve distinct purposes, supporting different stages of the sales process. In this article, we’ll clear up any confusion and explain when and how to use each document in your business transactions.

Read on to learn the essentials, or visit Invoice Fly to access useful tools like our invoice maker and quote generator.

What is a Quote vs What is an Invoice?

A quote and an invoice are both essential documents, but they have different uses. In short, a quote is typically provided at the beginning of a potential sale, offering an estimate of the cost. Meanwhile, invoices are often issued after the goods or services have been delivered.

But let’s break it down further.

Quotes are helpful for clarifying the scope and total cost of a service/product before the transaction takes place. Think of it as an overview, allowing potential customers to review your offering, its price, and any additional terms or conditions involved.

Invoices, on the other hand, are usually created and shared after the service/product has been provided. It’s a formal request for payment, outlining what exactly was provided, a detailed breakdown of the cost, how to pay, and any payment terms.

So, while the two are very different, they still complement each other, helping businesses maintain clarity and professionalism throughout the entire transaction process.

Key Differences: Invoice vs Quote

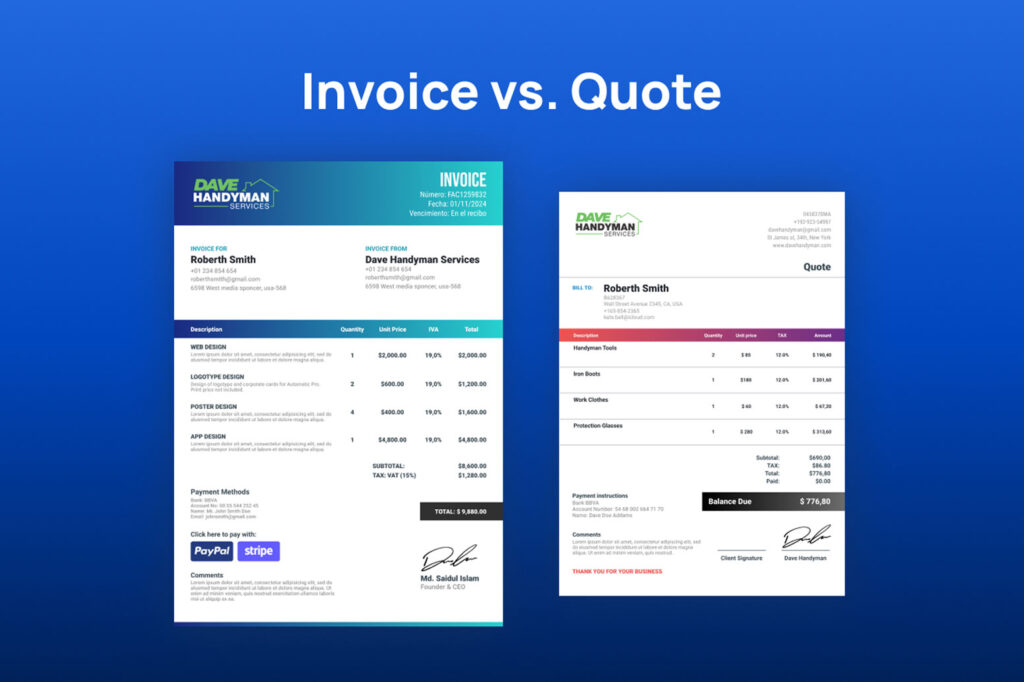

Let’s dive into the details and take a closer look at the key differences between quotes and invoices. Although they serve distinct purposes, the documents are relatively similar in appearance — hence why they’re easy to confuse!

Purpose:

- A quote provides an estimate of costs before a sale

- An invoice is a formal request for payment issued after the sale

Legality:

- A quote is non-binding and can be adjusted before the final agreement.

- An invoice is legally binding and requires payment as per the agreed terms.

Content:

- A quote is typically less detailed, providing an overview of the products or services being offered, an estimated price, and any relevant terms or conditions.

- An invoice, in contrast, is more formal and comprehensive, including a detailed breakdown of the actual products or services delivered, the total amount due, payment instructions, the due date, and any additional terms related to the payment.

When to Use a Quote

Before a sale:

Providing a quote to customers who inquire about specific services or products is an effective way to clearly outline important details, ensuring the customer is aware of the scope, pricing, and any key terms or conditions.

During negotiations:

Quotes are excellent for facilitating discussions and adjustments. For example, if the initial price or scope isn’t quite right, the quote can act as a shared document that both parties can use to refine before any commitment is made.

For custom or variable pricing:

If the services or products you offer vary in price based on the customer’s specific needs, quotes are incredibly helpful, providing an opportunity to outline custom details to ensure both parties are on the same page.

To outline terms and conditions:

Terms and conditions are crucial for most businesses, as they help prevent misunderstandings and provide protection against potential disputes. By issuing a quote, you can clearly define these details upfront, ensuring both parties are aligned from the start.

When to Use an Invoice

After delivering the service/product:

Once you’ve fulfilled the order, an invoice can be issued to formally request payment for the goods or services provided. This step signifies the completion of the transaction and the start of the payment process.

For financial record-keeping:

Invoices are legally binding documents that serve as an official record of the transaction, making them essential for tracking sales, managing accounts, and maintaining accurate financial documentation for tax purposes.

To facilitate on-time payments:

In some cases, businesses may direct customers to make payments directly, bypassing the need to send invoices. While this approach can save time upfront, it can also lead to payment delays and complications, as there may be no clear due date or payment terms outlined. To avoid these issues, it’s best to clarify all payment details in a formal invoice.

What is a Quote? Exploring Key Components

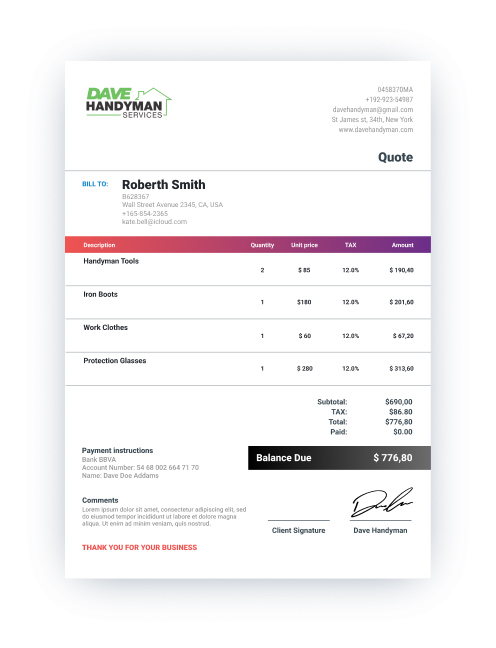

A quote is a financial document issued by a business to a prospective customer, offering an estimated price for goods or services before the sale is made.

It outlines the scope, expected cost, and any terms or conditions, helping customers make informed decisions.

Looking for an easy way to make quotes? Try Invoice Fly’s free quote generator.

Key Components of a Quote

Header information 🏢

This section includes the seller’s business name, address, contact details, and often a company logo, which makes it easy for the customer to identify the seller.

Customer details 👤

For record-keeping purposes, it also helps to include the customer’s name, company (if applicable), and their contact details.

Quote number 🔢

The quote number acts as a unique identifier for each quote, allowing both the business and the customer to easily reference the quote in future communications.

Date of issue 📅

Along with the quote number, it’s important to highlight when the quote is issued, helping businesses to keep track of quotes, especially when adjustments are required.

List of products/services 📋

Within a quote, you have the opportunity to provide a detailed breakdown of what’s being quoted, clarifying quantities, unit prices, and any unique details.

Estimated price 💵

Most importantly, a quote should have a total estimated cost for the products/services listed. This should also include taxes and other charges if applicable.

Terms and conditions ⏰

If you have any special terms, such as delivery timelines or payment conditions, a quote provides an opportunity to outline these details ahead of the transaction.

Validity Period ⏳

Since prices often change from year to year, it’s essential to specify how long the quote remains valid. After this period, the terms or pricing may be subject to revision.

What is an Invoice? Exploring Key Components

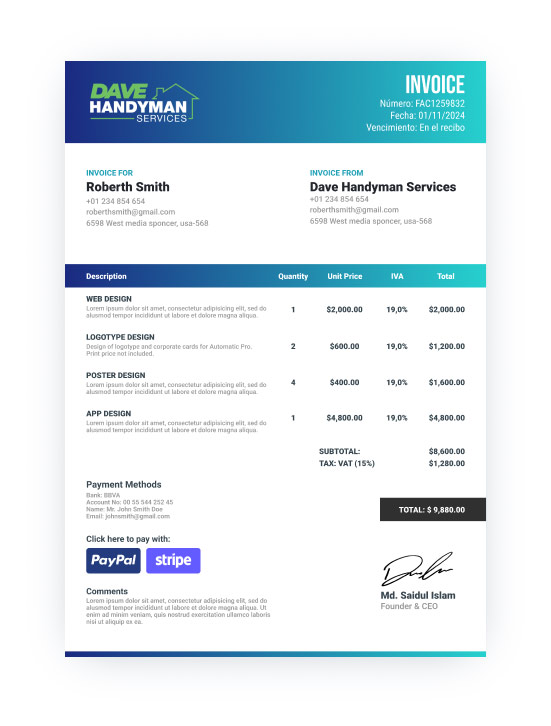

An invoice is a formal document issued by a business to request payment for goods or services provided. It serves as a record of the transaction, detailing the amount due and payment terms. Here are the key components of an invoice:

Need help generating invoices? Try Invoice Fly’s invoice maker, the easiest way to create professional invoices and share them in seconds.

Key Components of an Invoice

Header information 🏢

This section includes the seller’s business name, address, contact details, and often a company logo, which makes it easy for the customer to identify the seller.

Customer details 👤

As a legally binding document, it’s important to address the customer in your invoices, including their name, company (if applicable), and any key contact details.

Invoice number 🔢

Each invoice is typically assigned a unique, sequential identifier for easy tracking and referencing, ensuring it stands out in accounting records.

Date of issue 📅

Not to be forgotten, the date of issue is an essential detail on invoices, providing a clear indication of when the payment timeline begins.

List of products/services 📋

When requesting payment from customers, it’s important to detail the products/services provided, giving them a point of reference for all costs and any applicable discounts.

Payment terms ⏰

Payment terms are one of the most critical details, clarifying which forms of payment are accepted, when payment is due, and any penalties for late payments, such as late fees.

Total amount due 💵

Lastly, you will need to state the final amount due, including taxes and any other charges.

Learn more about invoices in our Ultimate Guide to Invoices.

How to Create Quotes and Invoices

Back in the day, creating quotes and invoices often meant manually writing or typing them out, then mailing or faxing them to customers.

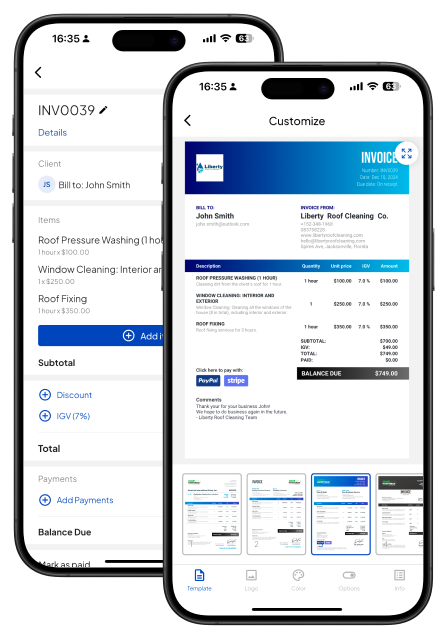

While that process may still be used in some industries, advanced technology (like Invoice Fly’s software) has made it easier than ever to create and send quotes and invoices.

Businesses can now produce professional financial documents with great efficiency, sharing them with clients in a matter of seconds. And moreover, these tools are often able to track payments in real-time, providing immediate updates and ensuring better cash flow management.

Tools for Creating Invoices and Quotes

Today, there are endless tools available for making invoices and quotes. Some are simple and straightforward, while others offer advanced features and customization options. Which is best depends entirely on what your business is looking for.

Do you want the ability to fully customize your invoices and quotes? Or are you looking for something quick and easy to set up? And what about integration with payment systems or accounting tools? Once you know the answers to these questions, it will be much easier to choose the right tool for your business.

As for those looking for advanced support, Invoice Fly was built for businesses like yours. With customizable templates, online payment support, and income tracking, it’s the perfect solution for small to medium businesses that need more than just a basic invoicing tool.

Invoice vs Quote: How Can Invoice Fly Help With Both

Ready to simplify your quoting and invoicing? That’s why we built Invoice Fly, to help you create, send, and track large amounts of financial documents — all in one place.

It’s never been easier to create professional invoices and quotes. And once you have, you can share them in seconds, helping your business save time and get paid faster.

What are you waiting for?

Try it today and see how easy it is to streamline your billing process. With customizable templates, automated features, and real-time payment tracking, Invoice Fly really is an all-in-one solution for financial task management.

Invoice vs Quote FAQs

A business invoice is a document that asks customers for payment after they receive a product or service. Invoices are bills that help you track accounts receivable so you know how much money customers owe your business. Unlike an estimate, an invoice is final. The amount it asks customers for will not change.

The invoice should match the final quote exactly in terms of services or products provided, pricing and final cost, and terms. It is crucial that there are no discrepancies between the quote and the invoice to avoid confusion or disputes.

As a contractor, you juggle every aspect of your business every day. Something that you never want to drop is invoicing. A strong invoicing process is important to ensure you get paid on time and maintain cash flow.

Courteney Searle is a Senior Content Strategist and SEO Writer with a strong experience in SaaS and mobile app products.

Although was born in Australia, she possesses extensive experience in music, fashion, technology, architecture, banking, invoicing, accounting, and the home service industry in the United States.

Courteney's passion is creating engaging content that simplifies complex software solutions for diverse audiences.

Her deep understanding of industry-specific knowledge enables her to produce useful content, helping those who seek to learn new concepts or become more informed about specific topics.