+65% of small businesses have digitalized their invoicing process in the United States in 2025.

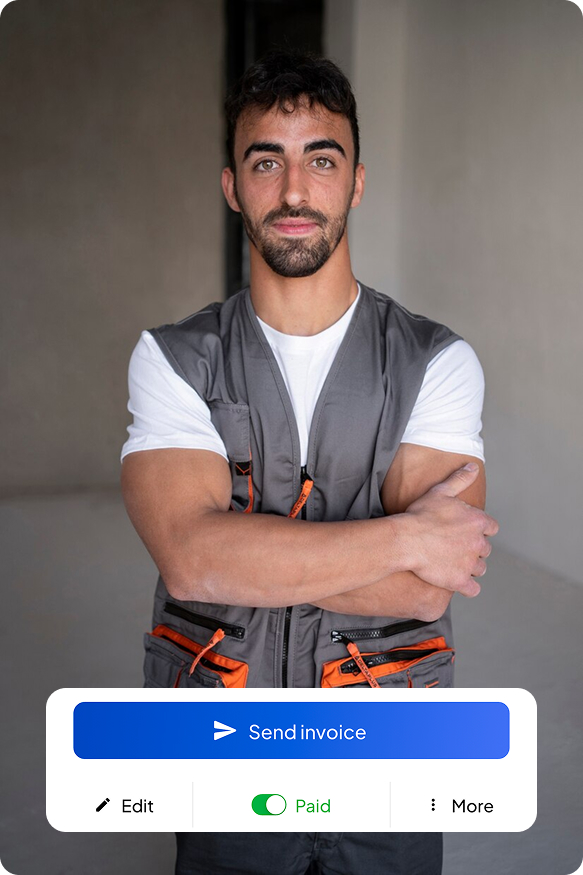

Invoice Management Made Simple with Invoice Fly

Managing invoices can be a daunting task, but with Invoice Fly, it becomes streamlined and efficient.

Our desktop software and mobile app is designed to help you keep your financial records organized, ensuring you never miss a payment or lose track of important documents.

Improved Cash-Flow

Timely and accurate invoicing facilitates faster payments, enhancing your company’s cash flow.

Reduced Disputes

Clear and detailed invoices minimize misunderstandings and payment disputes.

Better Financial Planning

Accurate invoicing data enables more precise budgeting and forecasting.

How Invoice Fly Helps You Stay Organized:

- 1. Invoice Numbers

Automatically generate unique invoice numbers to keep track of all your invoices and transactions.

Avoid unnecessary duplicated invoices and register every completed job to keep proof of work and legal compliance.

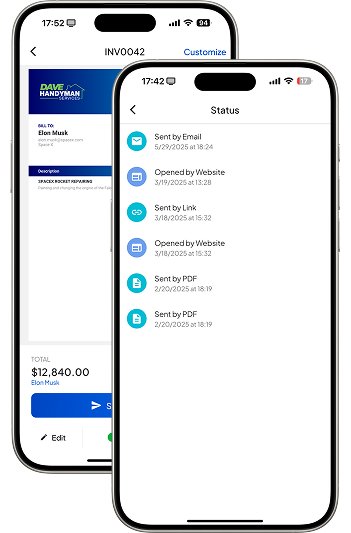

- 2. Invoice Statuses

Easily track timelines about when was the invoice sent, received by client, opened and paid.

Get notified every time there is a status update.

- 3. Monthly Tracking

Create monthly and yearly reports and track the performance of your business.

Control the amount of invoices paid and over due, business expenses, and the final balance to make data driven decisions.

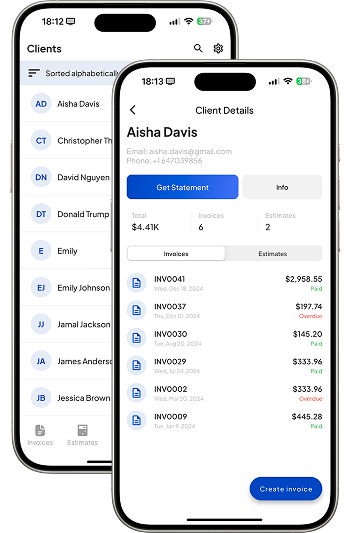

- 4. Client Management

Centralize all your client’s details in one place.

Easily track the number of invoices and estimates by client, paid and over due invoices, and download monthly and yearly statements.

All this information is stored in our servers, so you can access it at any time, and from anywhere.

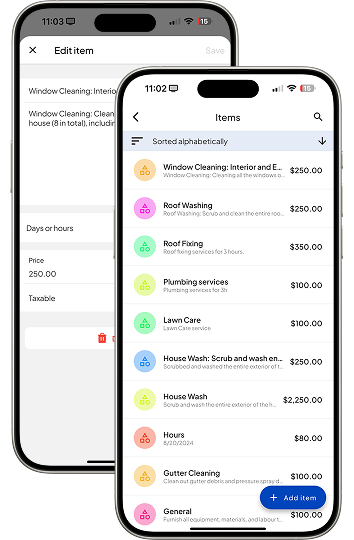

- 5. Item Creation (your services)

Create a list of the services your business is offering to your customers.

Add the name of the service, the final price, the number of days and hours to complete the job, and the amount of taxes the client will pay.

- 6. Expense Tracking

Easily scan your receipts or add them manually to keep track of all your business expenses.

Get a report and analyze what are the biggest expenses in your business and optimize them to increase total revenue.

FAQs about Invoice Management

An invoice management system is a powerful software solution that enables businesses to efficiently track, manage, and process invoices from receipt to final payment.

When automating the entire invoice processing workflow—including invoice capture, approval routing, payment processing, and performance tracking—this system helps eliminate human mistakes, reduce processing time, and enhance overall financial efficiency.

It also ensures compliance with internal policies and regulatory standards, making it an essential tool for modern businesses seeking to optimize their accounts payable operations.

To effectively manage invoices, your business should implement a structured and automated invoice management process, following these key steps:

Digitalize Invoice Capture: Use software to automatically scan, upload, or import invoices to reduce manual data entry.

Set Clear Payment Terms: Define consistent terms to avoid late fees and improve relationships with your customers.

Use an Invoice Management Software: Use tools that track invoice status, flag discrepancies, and integrate with accounting systems.

Maintain Accurate Records: Store all invoice data securely for audits and financial reporting.

Monitor and Analyze Performance: Use reporting tools to track metrics like payment cycle times and outstanding liabilities.

To organize invoices effectively, use a blend of digital tools and structured processes.

Start by centralizing all incoming invoices in one location—preferably a cloud-based system like Invoice Fly.

Digitize paper invoices using scanning apps or document management software, and apply consistent naming conventions for easy retrieval.

Use Invoice Fly as your invoice management software to automate sorting, categorization, and storage. Regularly review, archive, and back up invoices to maintain accuracy and compliance.

For added control, use invoice tracking spreadsheets to monitor payment status, due dates, and vendor details.

To invoice professionally, follow a clear, consistent, and business-ready format that ensures your clients understand the charges and pay on time. Here are key steps:

Use a Professional Invoice Template: Choose a clean, branded template that includes your logo, business details, and contact information.

Include Essential Information: List the invoice number, issue date, due date, client details, and a clear breakdown of products or services provided.

Add Payment Terms: Specify payment methods, due dates, late fees, and any applicable taxes or discounts.

Maintain a Polite Tone: Use courteous language such as “Thank you for your business” or “Please contact us with any questions.”

Send Timely and Track Delivery: Deliver invoices promptly after services are rendered and track their status using invoice management software.

Follow Up Professionally: Send polite reminders before and after the due date if payment hasn’t been received.

For more information, read our article: How Do You Write An Invoice? Sample & Template

Free Resources

Resources to run your business smoothly and efficiently.

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs