What Is a Pro Forma Invoice: Meaning, Purpose and Examples

Table of Contents

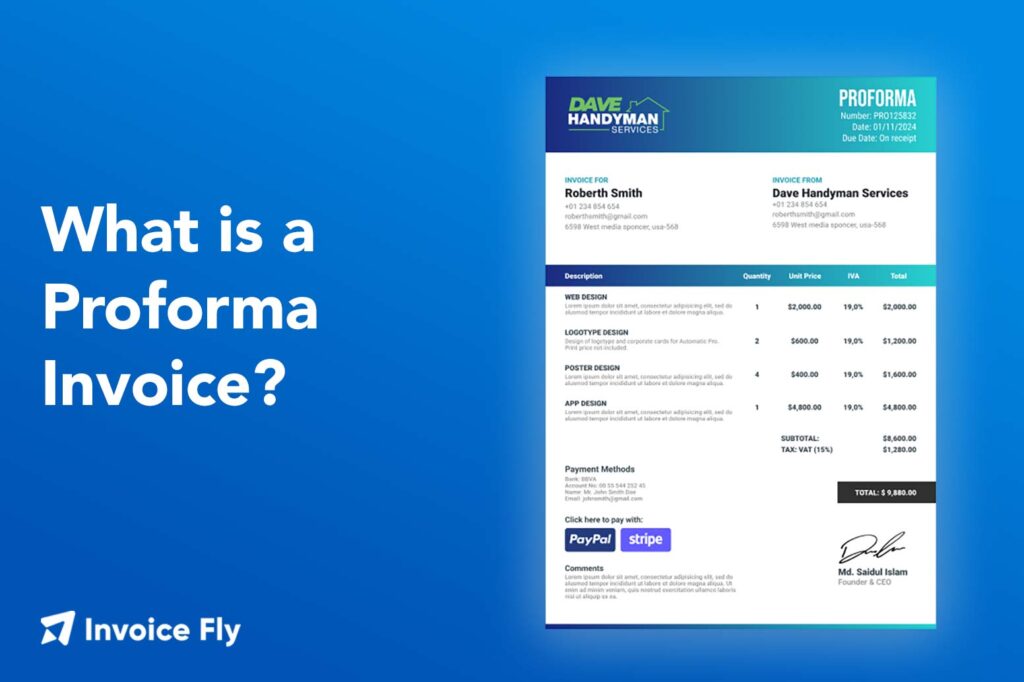

In the world of business, invoices play a crucial role in creating smooth transactions between buyers and sellers. But among the different types, the proforma stands out as a unique (and often confusing) document, used to outline important financial expectations.

So, what exactly is a proforma invoice, and how does it differ from a regular invoice?

We cover these questions and more in this comprehensive guide, diving into all of the essentials, including step-by-step instructions on how to create a proforma invoice and the best time for sending one.

What is a Proforma Invoice?

A proforma invoice or pro forma invoice, is a preliminary bill of sale provided by a seller to a buyer before the actual sale occurs. Think of it as a pre-sale handshake, ensuring everyone is on the same page before moving forward.

Proforma invoices are official invoices commonly used in international trade to navigate the complexities of cross-border transactions. However, they’re equally useful in domestic dealings, especially for high-value services or products, where clear terms and mutual agreement are needed before taking the next step.

With that said, a proforma invoice is not a demand for payment. It’s more of an estimate (or a quote) that helps the buyer understand the potential cost of the goods or services before making a final decision.

What is it's Purpose?

The purpose of a proforma invoice is to give both the seller and the buyer a clear preview of the transaction. Simplifying the sales process, not only helps the seller clarify the terms of the sale but also ensures the buyer fully understands what they’re purchasing before the deal is finalized.

For businesses managing multiple transactions, tools like reporting software can help track proforma invoices and other financial documents.

Moreover, many contractors find it beneficial to use time-tracking tools, helping them understand the actual time involved in their service to ensure they’re providing accurate estimates in future jobs.

The Differences Between Similar Documents

Proforma invoices, quotes, and other types of invoices may appear alike, but they serve distinct purposes in business transactions. Here’s an overview of what makes them different.

Proforma vs Quote

Yes, these documents are similar — but there’s a slight difference. A proforma invoice is more formal, providing detailed information like prices, quantities, and terms, whereas a quote is more casual, offering an initial estimate without all the fine print.

Why do we need both? You don’t. Some businesses will use both, while others will choose one. It all depends on what you’re selling, the level of detail required, and whether a formal or informal agreement is needed before proceeding with the transaction.

Proforma vs Regular Invoice

While both documents relate to a transaction, they serve completely different stages.

A proforma invoice is a preliminary document. It’s typically shared before a transaction is completed, outlining the details of the potential sale. As such, it is not legally binding and doesn’t demand payment.

A regular invoice, on the other hand, is a formal request for payment, typically shared following the supply of goods or services. It includes the amount due and serves as a legal document that can be used for accounting purposes.

PRO TIP:

Using online accounting tools like InvoiceFly makes it easier than ever to create invoices, track payments, and get paid. What are you waiting for? Try it for free today!

Why Do Businesses Use Proforma Invoices?

There are many reasons why a business will use a proforma invoice, although it’s often one of a few cases: for clarity, financing, or international trade. Let’s dive into them.

1. Clarity for Buyers

Many businesses this invoice format to ensure transparency and alignment, giving buyers a clear overview of expected costs, timelines, and product specifications. This proactive approach helps prevent misunderstandings, keeping transactions smooth.

2. Budgeting & Financing

By outlining expected costs, a proforma invoice is particularly useful in assisting clients with their budgeting, helping them allocate resources for upcoming transactions. Moreover, in certain instances, a proforma invoice can also help buyers obtain necessary financing.

3. Facilitating International Trade

When goods are being shipped across borders, a proforma invoice often serves as a document for customs clearance, providing essential information like the value of goods, where they’re coming from, and where they’re headed.

How to Create a Proforma Invoice

Creating a proforma invoice is simple, but getting the details right is key. Here’s a step-by-step guide to help you put together a clear and professional document.

1. Use a Clear Template

Start with a professional template, like our free Proforma Generator, that includes all necessary sections, ensuring your document is easy to read and well-organized.

2. Fill in the Details

If you have all the necessary information, this step should only take about 10 minutes.

However, if it’s your first time creating a proforma invoice, it may take longer — and that’s completely normal. Regardless of your experience, it’s always better to take your time and ensure the details are correct rather than rushing the process.

Typically includes:

- Seller information

- Customer contact details

- Invoice number

- Delivery date

- List of products/services

- Applicable taxes

- Payment terms

- Total amount due

- Notes (if needed)

3. Double-Check Payments Terms

Once you’ve filled in the template, it’s time to double-check the payment terms. This includes the total cost, your accepted payment methods, the due date, and any late fees.

By clarifying these details (and getting them right), you can avoid any confusion or potentially costly errors, ensuring a smoother experience for both parties.

4. Add Notes or Additional Information

If necessary, include any additional details in a notes section. This could be special shipping instructions, disclaimers, or policies related to the transaction.

A thank-you message or a personalized note can also leave a positive impression, especially if you’re building a long-term business relationship.

5. Review and Share

Ready to send? Before sharing the proforma invoice, give it one more final review and then download the document — ideally exported as a PDF for professional presentation.

If you’re using InvoiceFly’s Invoice Maker, you can also send the invoice directly to your customer through the app. This not only speeds up the process but also eliminates any potential errors made by sending via email.

When Should Proforma Invoices Be Sent?

A proforma invoice is usually sent before the sale is finalized, often when the buyer is still deciding or when the seller needs to provide an estimated cost for the goods or services.

Examples of when a proforma invoice might be sent:

- Before confirming a sale

- During the quoting process

- When shipping international goods

- For custom-made or out-of-stock items

Proforma Invoices in the United States

In the US, a proforma invoice is typically used for the same reasons as in other countries. It serves as a non-legally binding estimate and is often used for customs purposes or when a business is providing an estimate to a potential customer.

While it’s common in international trade, businesses in the US might also use proforma invoices when engaging in complex or large transactions that require upfront clarity.

Is a Proforma Invoice Legally Binding?

No, a proforma invoice is not legally binding. It’s simply an estimate provided before a sale.

The document does not demand the prospective buyer to purchase the services/goods but rather provides clarity of what’s available to them. Should a buyer agree to the terms outlined, the seller can then issue a formal invoice, which becomes legally binding.

Can it be canceled?

Yes, a proforma invoice can be canceled. Since it’s not a final agreement or legal document, there’s no obligation to honor it once it’s been issued.

If either party decides not to proceed with the transaction, they can simply disregard the proforma invoice or issue a new one. However, if the transaction moves forward, the proforma invoice will need to eventually be replaced by a final invoice.

Simplify Your Invoicing with Invoice Fly

A proforma invoice plays an important role in business transactions, especially when clarity and transparency are needed before finalizing a sale.

Whether you’re estimating costs for a customer, providing a shipping document for international transactions, or protecting your business with clear terms, a proforma can definitely help to keep things smooth.

Ready to simplify your invoicing process?

Try our free Proforma Invoice Templates and our Invoice Maker tool . Our Invoicing Software not only allows you to create and send proforma invoices but also helps you keep track of them, making it easier than ever to manage your finances.

Every month, InvoiceFly helps over 125k people take control of their businesses, from handyman contractors to designer landscapers. So no matter what you’re working on, you can count on us as your partner in accounting.