- Home

- »

- Free Resources for Small Businesses

- »

- Free Business Calculators

- »

- Salary Calculator

Salary Paycheck Calculator

Quickly estimate your yearly gross salary based on your taxes. Simply input your yearly gross income and a breakdown of taxes.

Perfect for budgeting and financial planning, giving you a clear picture of what you’ll take home after taxes. Save this page to your bookmarks for fast access.

Gross To Net Calculator

Salary Calculator

Yearly Gross Income

Income before Taxes

Federal Tax

Brackets: 10%, 12%, 22%, 24%, 32%, 35%, & 37%

State Tax

Brackets: 0% - 11.45%

Social Security

Brackets: 0% - 12.4%

Medicare

The most common Medicare Tax in USA is 1.45%

Total Summary

Salary paycheck calculator: step-by-step guide

Our Salary Paycheck Calculator is a powerful online tool designed to help you understand exactly how much of your earnings you’ll take home after taxes and deductions. Whether you’re a freelancer, contractor, employee, or employer, this calculator provides a quick and reliable way to estimate your net income based on your gross wages.

- Step 1: enter your yearly gross income.

- Step 2: enter your federal taxes.

- Step 3: enter the state taxes.

- Step 4: enter your social security.

- Step 5: enter your medicare.

Next, our online salary paycheck calculator will instantly calculate your paycheck.

Table of Contents

How to calculate net income

Net income is the amount of money you actually receive in your bank account after all mandatory and voluntary deductions have been subtracted from your gross income. It is commonly referred to as “take-home pay.”

To calculate your net income manually, you start with your total gross income for the pay period — this includes hourly wages or salary, plus any overtime, bonuses, or commissions.

Then, you subtract federal income tax, Social Security tax, Medicare tax, state income tax (if applicable), and any voluntary deductions like insurance premiums or 401(k) contributions. What’s left is your net pay.

This process can be time-consuming and prone to error, which is why using Invoice Fly’s salary paycheck calculator is so beneficial. It handles all the math and tax rules for you, so you can feel confident in the accuracy of your net income estimation.

Net Income = Gross Income – (Federal Taxes + State Taxes + Local Taxes + FICA Taxes + Benefits Deductions + Wage Garnishments)

How to calculate annual income

Understanding your annual income is essential when budgeting, planning for taxes, or applying for credit or loans.

To calculate annual income, you take your regular gross pay and multiply it by the number of pay periods in a year. If you’re paid weekly, you multiply your weekly gross pay by 52; if you’re paid biweekly, multiply by 26; and if you’re paid monthly, multiply by 12.

For salaried employees, this is usually straightforward. However, for hourly workers or freelancers with variable income, you’ll need to average your earnings over a few pay periods to get a reliable annual estimate. Invoice Fly helps you perform this calculation effortlessly by offering both per-paycheck and annual views, giving you a complete picture of your financial situation.

Annual Income = Earnings per Pay Period × Number of Pay Periods per Year

To calculate your gross annual income, multiply the amount you earn each pay period by the number of times you’re paid in a year. The number of pay periods depends on your payment frequency:

- Weekly: 52 pay periods per year

- Biweekly (every two weeks): 26 pay periods per year

- Semimonthly (twice a month)

How to calculate taxes taken out of a paycheck

Calculating the taxes deducted from a paycheck involves understanding multiple layers of tax responsibilities. These include federal income tax, Social Security tax, Medicare tax, and potentially state and local taxes, depending on where you live. The federal income tax is calculated based on IRS tax brackets, which vary by income level and filing status. Social Security and Medicare taxes, collectively known as FICA, are calculated as a fixed percentage of your income. In addition, many states impose their own income taxes, which can be either flat-rate or progressive. On top of that, deductions for things like health insurance, retirement plans, and union dues may reduce your taxable income. InvoiceFly’s calculator integrates all these variables to provide a comprehensive estimate of how much tax is withheld from each paycheck, eliminating guesswork and ensuring transparency.

Total Taxes = Federal Income Tax + State Income Tax + Local Tax (if applicable) + Social Security Tax + Medicare Tax

Federal Income Tax: This is based on your taxable income and IRS tax brackets. It varies depending on your filing status (single, married, etc.) and the number of allowances or dependents you claim on your W-4.

State Income Tax: Varies by state. Some states have no income tax, others use flat rates, and some use progressive brackets like the federal system.

Local Tax (if applicable): Certain cities or counties charge additional local income tax. These are usually small percentages.

Social Security Tax: Fixed rate of 6.2% of your gross wages, up to the annual wage cap ($168,600 in 2024).

Medicare Tax: Fixed rate of 1.45% of your gross wages.

If you earn more than $200,000/year (single), an additional 0.9% is withheld for Medicare.

2024 Income Tax Brackets (due April 2025)

Tax Rate Single Married Filing Jointly Married Filing Separately Head of Household 10% $0 – $11,600 $0 – $23,200 $0 – $11,600 $0 – $16,550 12% $11,600 – $47,150 $23,200 – $94,300 $11,600 – $47,150 $16,550 – $63,100 22% $47,150 – $100,525 $94,300 – $201,050 $47,150 – $100,525 $63,100 – $100,500 24% $100,525 – $191,950 $201,050 – $383,900 $100,525 – $191,950 $100,500 – $191,950 32% $191,950 – $243,725 $383,900 – $487,450 $191,950 – $243,725 $191,950 – $243,700 35% $243,725 – $609,350 $487,450 – $731,200 $243,725 – $365,600 $243,700 – $609,350 37% $609,350+ $731,200+ $365,600+ $609,350+ 2025 Income Tax Brackets (due April 2026)

Tax Rate Single Married Filing Jointly Married Filing Separately Head of Household 10% $0 – $11,925 $0 – $23,850 $0 – $11,925 $0 – $17,000 12% $11,925 – $48,475 $23,850 – $96,950 $11,925 – $48,475 $17,000 – $64,850 22% $48,475 – $103,350 $96,950 – $206,700 $48,475 – $103,350 $64,850 – $103,350 24% $103,350 – $197,300 $206,700 – $394,600 $103,350 – $197,300 $103,350 – $197,300 32% $197,300 – $250,525 $394,600 – $501,050 $197,300 – $250,525 $197,300 – $250,500 35% $250,525 – $626,350 $501,050 – $751,600 $250,525 – $375,800 $250,500 – $626,350 37% $626,350+ $751,600+ $375,800+ $626,350+ What is a paycheck?

A paycheck is the payment you receive from your employer for the work you’ve performed during a specific pay period.

It represents the culmination of your labor, hours worked, or services rendered, and includes both your gross earnings and the deductions taken out before the final amount, your net pay, is deposited into your bank account.

Paychecks can be issued on a weekly, biweekly, semimonthly, or monthly basis, depending on the employer’s pay schedule. In today’s digital landscape, paychecks are often processed through direct deposit, though some employees may still receive physical checks.

Types of paychecks

Paychecks can be issued in different formats depending on the employer’s preference and the employee’s chosen payment method.

- Traditional paper checks are still used in some businesses, though they are becoming less common due to the convenience of direct deposit.

- Direct deposit electronically transfers your wages into your bank account, often faster and more securely than a paper check.

- Another option is payroll cards, which are prepaid debit cards loaded with your earnings.

Each type of paycheck serves the same purpose: delivering your compensation. But the method can affect how quickly you receive your money and how you access it.

How to read a paycheck

Reading your paycheck properly is important to understanding how your earnings are calculated and whether any errors or discrepancies exist. Each paycheck provides a snapshot of your income for the pay period, as well as cumulative information that tracks your total earnings and deductions for the year. Learning how to read this information can help you spot potential mistakes and ensure your tax withholdings are correct.

Information found on a paycheck

A standard paycheck includes your name, the employer’s name, the pay date, and the pay period covered.

It also shows your gross income, which is the total amount earned before any deductions. Your net income, the actual amount you take home, is also clearly displayed.

The paycheck may also indicate the number of hours worked if you are paid hourly, along with any overtime or bonuses earned during the pay period. Having a clear understanding of this data ensures transparency and allows you to confirm that you’re being paid correctly.

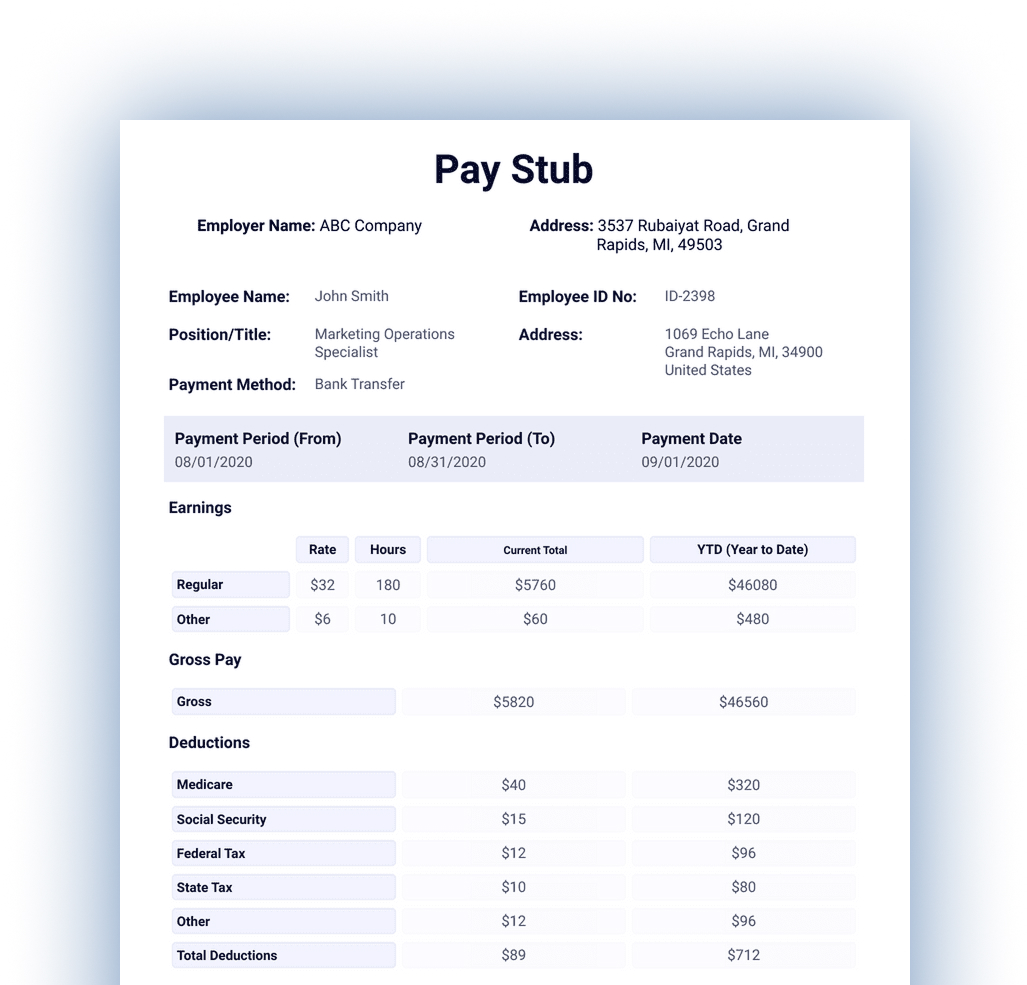

Information found on a pay stub

A pay stub provides a much more detailed look at your earnings and deductions than the paycheck itself.

It shows a line-by-line breakdown of all income sources, including regular wages, overtime, bonuses, and commissions.

It also lists all deductions, such as taxes withheld (federal, state, and local), insurance premiums, retirement contributions, and any wage garnishments.

Pay stubs typically include year-to-date totals for both income and deductions, which is helpful for budgeting and preparing for tax season.

Understanding paychecks: Withholdings and deductions

Every paycheck includes a variety of withholdings and deductions that reduce your gross income to arrive at your net pay.

These deductions fall into two main categories: mandatory withholdings and voluntary deductions.

- Mandatory withholdings include federal income tax, Social Security, and Medicare taxes.

- Voluntary deductions might include retirement savings, health insurance, and other benefits.

These deductions ensure you’re contributing to social safety nets, staying compliant with tax laws, and potentially benefiting from tax-advantaged accounts.

Federal income tax withholding

Federal income tax withholding is the portion of your income that your employer is required to deduct and send to the IRS on your behalf. The amount withheld depends on your income level, tax filing status, and the number of dependents or allowances you claim on your W-4 form.

This system is designed to ensure that you’re paying your federal tax gradually throughout the year rather than in one lump sum at tax time.

FICA withholding

FICA, or the Federal Insurance Contributions Act, refers to two critical payroll taxes: Social Security and Medicare.- Social Security tax is withheld at 6.2% of your gross wages, up to an annual limit.

- Medicare tax is withheld at 1.45%, with an additional 0.9% tax applied to high earners.

State and local tax withholding

In addition to federal taxes, many employees must pay state and local income taxes, which vary significantly by location.

Some states have a flat income tax rate, while others use a progressive scale similar to federal tax brackets.

A few states, like Texas and Florida, do not impose any state income tax at all. Local taxes, such as city or county taxes, may also apply depending on where you live and work.

The rates below represent the top marginal state income tax rates—key for accurate paycheck withholding:

State Top Rate California 13.30% Hawaii 11.00% New York 10.90% Oregon 9.90% Minnesota 9.85% Massachusetts 9.00% Maryland 5.75% Colorado 4.40% Illinois 4.95% Louisiana* 3.00% States with no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

*Louisiana switched to a flat 3% rate in 2025 (Louisiana Department of Revenue).

Local (Municipal or County) Tax Withholding:In addition to state taxes, many workers face local income taxes ranging from 1% to 3%, depending on the city or county. Few illustrative examples:

-

Maryland (Anne Arundel Co.):

- 2.70% on the first $50,000 of taxable income

- 2.94% on $50,001–$400,000

- 3.20% above $400,000

-

Frederick Co, MD:

- Single/head: 2.25% up to $25,000 → 2.75% to $50,000 → 2.96% to $150,000 → 3.20%

Benefit deductions

Benefit deductions are amounts voluntarily withheld from your paycheck to cover the cost of employer-sponsored benefits.

These often include health, dental, and vision insurance, as well as contributions to retirement plans like a 401(k) or health savings accounts (HSAs).

Some benefit deductions are taken out pre-tax, which can reduce your taxable income and increase your take-home pay.

Wage garnishments

A wage garnishment is a court-ordered deduction that requires your employer to withhold a portion of your wages to repay debts.

Common types of garnishments include child support, student loan debt, unpaid taxes, or civil judgments.

These amounts are deducted after taxes and must continue until the debt is fully paid.

Wage garnishments can significantly reduce your take-home pay, and failing to account for them can lead to financial surprises.

FAQs about our Free Paycheck Calculator

Salary paychecks are calculated by dividing an employee’s annual salary by the number of pay periods in a year, then subtracting applicable taxes and deductions.

For example, if someone earns $60,000 per year and is paid biweekly, their gross pay per paycheck would be $60,000 ÷ 26 = $2,307.69.

From this amount, federal income tax, Social Security, Medicare, state and local taxes, and any benefit deductions (like health insurance or retirement contributions) are withheld.

The remaining amount is the employee’s net pay or take-home pay.

To figure out salary pay, you start with the employee’s agreed-upon annual salary, then divide it based on the company’s pay schedule: weekly, biweekly, semimonthly, or monthly.

For instance, if someone earns $48,000 annually and is paid monthly, the gross salary per paycheck would be $4,000.

This amount does not change from month to month unless the salary or deductions change. It's important to also factor in applicable taxes and withholdings to determine the net salary.

Living paycheck to paycheck means a person relies entirely on each paycheck to cover their basic expenses, with little or no savings left after bills are paid.

There is no specific salary threshold that defines this; it varies depending on cost of living, debt, and spending habits. For example, someone earning $90,000 in a high-cost city like San Francisco may still live paycheck to paycheck, while someone earning $45,000 in a more affordable area may have extra financial breathing room.

The key factor is whether the salary supports regular expenses without requiring credit cards or dipping into savings between pay periods.

To calculate pay for a salaried employee, take their annual salary and divide it by the number of pay periods in the year.

For example, an employee earning $72,000 annually with a semimonthly pay schedule (24 pay periods per year) would receive $72,000 ÷ 24 = $3,000 in gross pay per paycheck.

Then, subtract applicable taxes (federal, state, local), FICA contributions (Social Security and Medicare), and any pre-tax or post-tax deductions. The result is the employee’s net salary.

The 50/30/20 rule is a popular budgeting method that helps individuals manage their after-tax income effectively. Under this rule:

- 50% of your net income should go toward needs, such as housing, food, transportation, insurance, and utilities.

- 30% is allocated to wants, such as entertainment, dining out, hobbies, and non-essential shopping.

- 20% should be used for savings and debt repayment, including emergency savings, retirement contributions, credit card debt, or student loans.

This rule provides a flexible framework for building financial stability while still enjoying discretionary spending.

Other Free Calculators

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs