Essential Elements of a Professional Invoice

Table of Contents

Ever sent an invoice only to wait weeks (or months!) for payment? Your invoice might be the culprit. The difference between amateur billing and professional invoicing isn’t just appearance. It’s the difference between “payment pending” and “payment received.”

Creating professional invoices is super important when you run your own business. A good invoice helps you get paid faster and makes your business look more professional. But what exactly should you include on an invoice to make it effective?

This guide will walk you through all the essential elements of a professional invoice in simple, easy-to-understand language. By the end, you’ll know exactly what to include to create invoices that look great and help you get paid on time!

What to Include on an Invoice?

An invoice is basically a bill you send to your customers asking for payment for your products or services. But it’s more than just asking for money. It’s a legal document that proves the transaction happened.

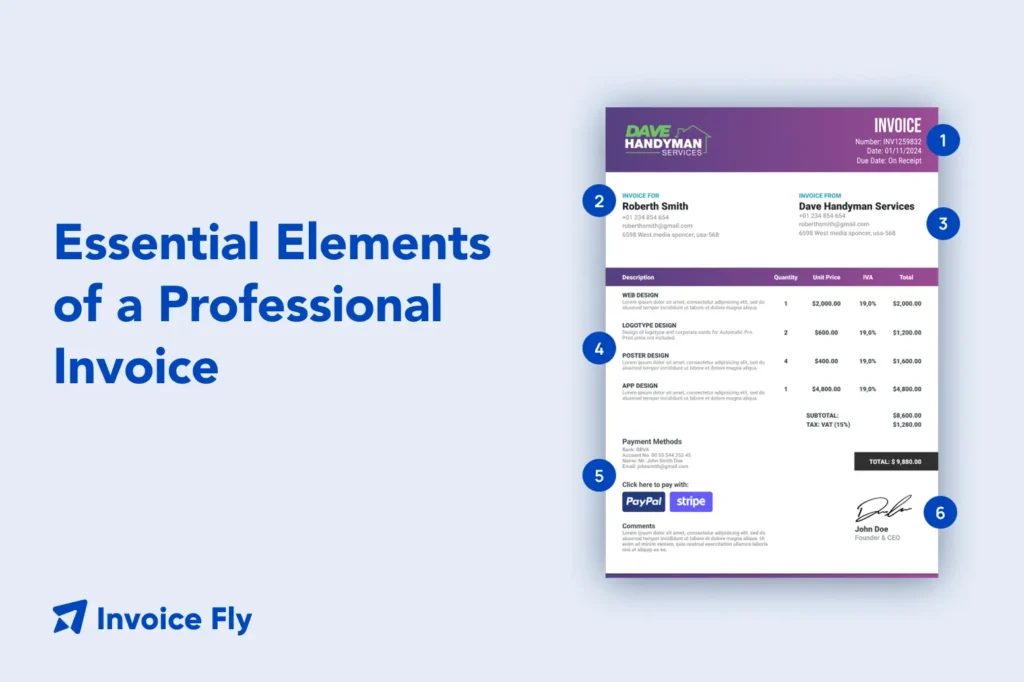

To make your invoice effective, you need to include certain key information. Let’s break down the 10 most important elements every professional invoice should have.

For a more comprehensive understanding of invoices, check out our complete guide: What is an Invoice? Everything you need to know.

10 Key Invoice Items

1. A Standout Header

Every invoice should have the word “INVOICE” clearly visible at the top. This might seem obvious, but it’s important! The header immediately tells your customer what the document is.

Make your header stand out by:

- Using a larger font size

- Making it bold

- Positioning it prominently at the top of the page

This simple step helps your invoice get noticed and processed faster, especially if your client receives lots of different documents.

2. Invoice Number or a Unique Identifier

Each invoice needs its own unique number or identifier. This helps both you and your customer keep track of payments and organize records.

Your invoice numbering system can be simple or detailed:

- Simple: Invoice #001, #002, #003, etc.

- Detailed: INV-2023-001 (year + sequential number)

- Customer-specific: ABC-001 (customer code + sequential number)

Whatever system you choose, be consistent. This makes it easier to find specific invoices later and helps with bookkeeping.

3. Your Company’s Details

Your invoice must include your business information:

- Business name

- Address

- Phone number

- Email address

- Website (if you have one)

- Tax ID number or business registration number (if applicable)

If you have a logo, add it to make your invoice look more professional and build brand recognition.

For sole traders or freelancers, you might need to include your personal name along with your business name. This is especially important if your business isn’t registered as a separate entity.

4. Client’s Details

Just as important as your details are your client’s details:

- Client’s name (individual or company)

- Contact person’s name (if sending to a company)

- Complete address

- Phone number

- Email address

Making sure these details are correct is crucial. Invoices with incorrect information often get delayed or lost, which means you have to wait longer to get paid.

5. Due Date on the Invoice

Always include a clear payment due date on your invoice. This tells your client exactly when you expect to be paid.

Common payment terms include:

- Due upon receipt (payment expected immediately)

- Net 7 (payment due within 7 days)

- Net 15 (payment due within 15 days)

- Net 30 (payment due within 30 days)

Choose payment terms that work for your business and cash flow needs. Whatever terms you choose, make the due date crystal clear to avoid confusion.

6. Goods or Services Sold

The heart of your invoice is the detailed list of what you’re charging for. For each item, include:

- Clear description of the product or service

- Quantity or hours

- Rate per unit or hour

- Subtotal for each line item

Be specific in your descriptions. Instead of “Consulting Services,” try “Website SEO Consulting – 10 hours at $75/hour.”

If you’re providing ongoing services, include the date range: “Social Media Management, May 1-31, 2023.”

Detailed descriptions prevent confusion and reduce the chances of payment disputes.

7. Fees or Taxes as an Invoice Component

If you charge additional fees or need to collect taxes, list these separately:

- Sales tax

- VAT (Value Added Tax)

- Service fees

- Shipping or delivery charges

- Late fees from previous invoices

Make sure each fee or tax is clearly labeled and calculated correctly. This transparency helps build trust with your clients and ensures you’re collecting the right amount of tax.

For international clients, you might need special tax considerations. Our article on What is a Proforma Invoice? can help with international transactions.

8. Total Amount Due

After listing all items, fees, and taxes, clearly state the total amount due. This should be easy to find and read. Consider making it bold or placing it in a box.

If you offer discounts, show:

- Original subtotal

- Discount amount

- New subtotal after discount

- Taxes/fees

- Final total

For example:

Subtotal: $500.00

Discount (10%): -$50.00

New Subtotal: $450.00

Sales Tax (8%): $36.00

TOTAL DUE: $486.00

9. Payment Methods

Tell your client exactly how they can pay you:

- Credit/debit card

- Bank transfer/ACH

- Check

- PayPal, Venmo, or other payment apps

- Cash

Include all relevant details for each payment method, such as:

- Your bank account details for transfers

- Links to online payment options

- Who to make checks payable to

- Physical address for mailing checks

The easier you make it to pay, the faster you’ll receive your money.

10. The Terms of the Transaction

Finally, include any important terms and conditions:

- Payment due date (as mentioned earlier)

- Late payment penalties

- Early payment discounts

- Refund policy

- Warranty information

- Any other relevant terms

Keep these terms simple and straightforward. Avoid legal jargon when possible, but make sure your bases are covered. If you need help with specific wording for your invoices, our guide on How to Write an Invoice?: Includes Template and Examples offers great templates and examples.

For example, Mike runs a small landscaping business and struggled with getting paid on time until he redesigned his invoices.

His new invoices include a bold “INVOICE” header at the top, consistent numbering (LAND-2023-001), his company logo and complete contact details, itemized services with specific descriptions (“Lawn Mowing – 0.5 acres” instead of just “Lawn Services”), clear payment terms (Net 15), and multiple payment options including a QR code for instant electronic payments.

The result? His average payment time dropped from 45 days to just 12 days, and clients stopped calling with questions about what they were being charged for, saving Mike hours of administrative work each month.

…Plus Anything “Extra”

While the 10 elements above are essential, there are additional items that can make your invoice even more effective:

Thank You Note: A simple “Thank you for your business!” can go a long way in building client relationships.

Special Instructions: Any specific notes about the products or services provided.

Future Appointments: If you’re a service provider, note the next scheduled appointment.

Reference Numbers: Include any client PO (Purchase Order) numbers or project codes. For more information, see What is a PO Number? The Ultimate Guide.

Summary of Hours: For service-based businesses, a summary of total hours worked over a time period.

Discount Information: Explain any discounts applied and why (loyalty discount, volume discount, etc.).

Bonus Tips – Make Your Invoice Look Professional!

The appearance of your invoice matters almost as much as the content. Here are some tips to make your invoices look more professional:

Use a Consistent Design: Maintain the same layout, colors, and fonts across all your invoices.

Add Your Logo: Include your business logo to strengthen your brand identity.

Use Color Strategically: A splash of color can make important information stand out, but don’t overdo it.

White Space Is Your Friend: Don’t cram too much information together. Use spacing to make your invoice easy to read.

Choose Professional Fonts: Stick to clean, professional fonts like Arial, Calibri, or Helvetica.

Quality Paper for Print Invoices: If you mail physical invoices, use good quality paper.

Mobile-Friendly Digital Invoices: If you send digital invoices, make sure they look good on mobile devices too.

Our Invoice Templates make it easy to create professional-looking invoices without having to design them from scratch.

What are Invoices for Sole Traders?

If you’re a sole trader (also called a sole proprietor), your invoices work the same way as any other business, with a few small differences:

- You’ll include your personal name along with your business name

- You’ll use your personal tax ID or Social Security Number (unless you have a separate EIN)

- You might need to specify that you’re a sole trader on the invoice

Even as a one-person business, professional invoices are crucial for getting paid properly and on time.

Why Do You Need an Invoice?

Invoices do much more than simply request payment from clients. They serve as legal documents that verify transactions, provide essential records for tax filing, and project a professional image that establishes your business’s credibility.

Plus, a sharp-looking invoice tells clients you’re the real deal. It helps you keep tabs on who’s paid (and who’s dragging their feet), lets you plan your budget by seeing what money is coming in, and stops those awkward “but I thought it would cost…” conversations before they start. Setting up a solid invoice system now will save you time and money later as your client list grows.

There’s No Need to Ask, “What Is An Invoice?”

After reading this guide, you should have a clear understanding of what makes a professional invoice. Remember that invoices are more than just payment requests. They’re a reflection of your business and an important part of your client communication.

By including all the essential elements we’ve covered, you’ll create invoices that:

- Get you paid faster

- Reduce confusion and questions

- Look professional

- Provide proper documentation for taxes

- Help you track your business income

The time you invest in creating good invoice templates will pay off many times over in faster payments and fewer billing headaches.

Final Thoughts

Creating professional invoices with essential elements isn’t just busywork. It’s a direct pipeline to your bank account. While invoice design might not be the most exciting part of running your business, it’s often the difference between checking your account to find payment received or sending awkward “just checking on that payment” emails.

Clear invoices create a smooth path to payment. When clients can instantly see what they purchased, how much they owe, when it’s due, and exactly how to pay, you’ve removed every obstacle between them and that “send payment” button.

Implement these invoice elements starting with your very next bill, and watch how payment delays and confused client questions begin to disappear. Consider it an investment that pays dividends with every transaction.

FAQs about Professional Invoice Elements

Send invoices immediately after completing work—ideally within 24-48 hours. The faster you invoice, the faster you get paid.

For bank transfers, include necessary details. For new clients, consider sending banking information separately or using secure payment links instead.

Send a friendly reminder email after the due date, followed by a phone call if needed. Stay professional. Consider implementing late fees for repeat offenders (but state these clearly in your terms).

Software generally looks more professional and offers helpful features like automatic numbering, payment tracking, and reminders.

Never use duplicate invoice numbers. For revisions, add a modifier (like "INV-001-REV") instead of reusing numbers.