Break-Even Analysis: Formula & Examples

Table of Contents

How to Calculate the Break-Even Point?

To calculate the Break-Even Point in Units, you have to use the following formula.

Break-Even Point (Units) =

Fixed Costs / (Selling Price per Unit − Variable Cost per Unit)

If you need to calculate the Break-Even Point in Sales, you need to use the following formula:

Break-Even Point (Sales) =

Fixed Costs / Contribution Margin Profit

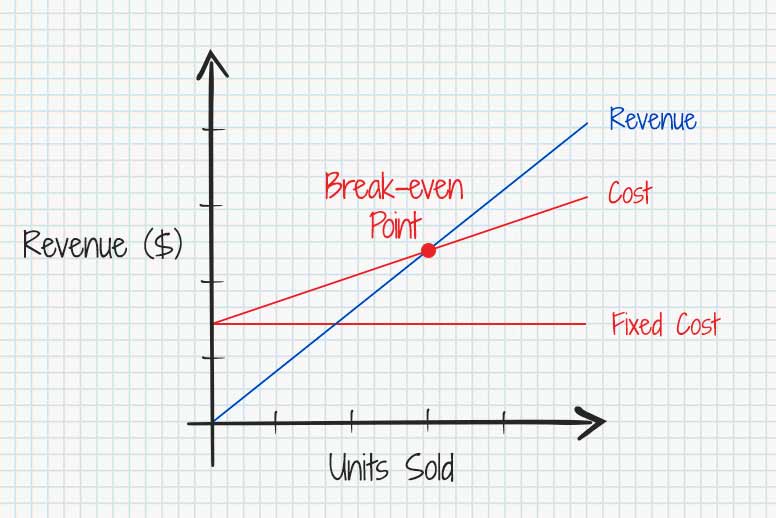

What is the Break-Even Point?

The Break-Even Point is a formula that allows companies and accounting departments to know when they will start becoming profitable.

Break-Even Point definition

To be more precise, the Break-Even Point is that moment when the company’s income equals the expenses, so there is neither benefit nor loss.

There are several ways to calculate the Break-Even Point: by units, by sales, by target, by tax consideration, etc.

In this article, we will analyze and share some examples of the best way to calculate it.

How to Calculate it in Units?

Break-Even Point (Units) = Fixed Costs / (Sales Price per Unit – Variable Costs per Unit)

At the Break-Even Point (BEP), your business isn’t losing money, but it’s not making a profit either.

Once you pass this point, every sale starts to add to your profit.

For business owners, especially when starting their business, one of the most important questions is: “When will my business reach the break-even point?”

All businesses aim to become profitable to keep running long-term.

Here’s a simple formula to help contractors figure out their break-even point:

Let’s break it down:

- Fixed Costs: These are expenses that stay pretty much the same each month, like rent or utility bills. Whether you’re doing a lot of jobs or just a few, these costs don’t change much.

- Sales Price per Unit: This is the price you charge for one job or service. For example, if you charge $500 for a carpentry job, that’s your sales price per unit.

- Variable Costs per Unit: These are the costs that go up or down depending on how much work you’re doing. Think of things like materials and labor costs. These expenses change with each job and usually make up the biggest part of your budget.

Here’s how to calculate your variable cost per unit:

Cost per Unit = Total Variable Costs / Total Units Produced

This formula will give you a clear idea of how much you need to charge or sell to cover your costs and start making a profit.

Break-Even Point Example in Units

Imagine your business has $10,000 fixed costs per month (like rent and utilities). You sell a product or service for $100 each, and it costs you $20 to produce each unit (materials, labor, etc.).

This means you’re left with a $80 contribution margin per unit (the amount that goes toward covering your fixed costs).

- Fixed Costs per Month = $20,000

- Selling Price (ASP) = $200

- Variable Cost per Unit = $40

- Contribution Margin = $160

Now, divide your $20,000 in fixed costs by the $160 contribution margin, and you get a break-even point of 125 units. So, if you sell 125 units, you’ll break even—meaning no profit, but no loss either.

- Break-Even Point (BEP) = 125 units

You can also use Excel’s Goal Seek function to make this calculation easier.

Just set the target (net profit of $0), and Excel will tell you how many units you need to sell to hit that break-even point.

RELATED ARTICLE: Gross Profit vs. Net Profit: Formula, Analysis & Examples

Try our free Break-Even Point calculator

Do you need help calculating your Break-Even Point? Try our BEP Calculator for free. Add your monthly fixed costs, your selling price per unit, and your production cost per unit to figure out when you will start making a profit.

How to Conduct Break-Even Point Analysis

When a company hits its break-even point, it’s not losing money, but it’s not making a profit yet either—it has “broken even”. From this point forward, any extra revenue goes straight toward increasing profit.

Doing a break-even analysis is key to setting the right prices, creating realistic sales goals, and spotting areas where the business could improve—like tweaking sales tactics or marketing strategies.

For established companies with multiple services or products, you can also calculate the break-even point for each offering. This helps decide whether adding a new service or product makes financial sense.

Overall, break-even analysis gives you valuable insights to make good business decisions, set your pricing and clear sales goals with an actual number to aim for, making it easier to plan for growth and profitability.

RELATED ARTICLE: What Is A Ledger Balance? Definition, Formula & Examples

Other Break-Even Point Calculation Examples:

1. Sales Revenue

If you need to calculate the break-even point in terms of sales revenue (dollars), rather than units, you should use the following formula:

BEP in Sales = Fixed Costs / Contribution Margin Ratio

Where:

CMR = (Selling Price per Unit – Variable Cost per Unit) / Selling Price per Unit

Let’s break it down with an example:

Imagine you run a business with $2,000 in fixed costs per month (for rent, utilities, etc.). You sell a product for $50 each, and it costs you $20 to make one product (for materials and production).

Step 1: Calculate the Contribution Margin

- Contribution Margin = Selling Price per Product – Variable Cost per Product

- Contribution Margin = 50$ – 20$ = 30$

So, every time you sell one product, you make $30 to help cover your fixed costs.

Step 2: Calculate the Contribution Margin Ratio

- Contribution Margin Ratio = Contribution Margin / Selling Price per Product = 30 / 50 = 0.6 or 60%.

Step 3: Calculate the Break-Even Point in Sales Revenue

To figure out how much total revenue you need to cover your costs, divide your fixed costs by the Contribution Margin Ratio:

Break-Even Point (Sales Revenue) = Fixed Costs ÷ Contribution Margin Ratio = 2000 ÷ 0.6 = 3,333.33

Conclusion:

You need to sell $3,333.33 worth of products each month to break even.

This means selling enough units of your product to cover both fixed and variable costs before making any profit.

RELATED ARTICLE: What Is A Pay Stub? Definition & Best Practices

2. Desired Profit (Target Profit)

You can also calculate the break-even point in terms of target profit, rather than units or sales, if you have a profit target in mind for your business.

You should use the following formula:

- Target Profit (Units):

Target Profit =

(Fixed Costs + Target Profit) / (Selling Price per Unit – Variable Cost per Unit)

- Target Profit (Sales):

Target Profit = (Fixed Costs + Target Profit) / Contribution Margin Ratio

3. Multiple Products (Weighted Average)

For businesses that sell multiple products, the break-even point must account for the different profit margins across products. In those situations, a weighted average contribution margin is used.

Let’s break it down in the following example:

BEP (Sales) = Fixed Costs / Weighted Average Contribution Margin Ratio

Where Weighted Average Contribution Margin Ratio:

∑ (Sales Mix Percentage x Contribution Margin Ratio for each product) / 100

4. Variable and Fixed Costs Mixed

If costs are mixed (both variable and fixed), you can calculate the break-even point by identifying the total contribution margin, with the following formula:

BEP (Units) = Fixed Costs / (Average Selling Price – Average Variable Cost per Unit)

5. Cash Break-Even Point (Units)

This version of the break-even point considers only cash-related expenses, ignoring non-cash expenses like depreciation. It helps in understanding how much cash sales are needed to cover cash outflows.

You should use the following formula:

CBEP = Fixed Cash Costs / (Selling Price per Unit – Variable Cost per Unit)

Fixed Cash Costs: Excludes non-cash expenses like depreciation or amortization.

6. Tax Consideration

If your business wants to include the effect of taxes in its break-even calculation (for after-tax profit), it adjusts for taxes.

Formula for Target Profit After Tax (Units):

BEP with Tax = (Fixed Costs + (Target Profit / (1 – Tax Rate)) / (Selling Price per Unit – Variable Cost per Unit)

Key Considerations:

- Fixed Costs remain the same regardless of the production or sales volume.

- Variable Costs change directly in proportion to the number of units produced or sold.

- Contribution Margin helps understand how much of each sale contributes toward covering fixed costs and generating profit.

Final Thoughts

Understanding and calculating your business’s break-even point is more than just a mathematical exercise—it’s a strategic move that empowers you to make informed financial decisions.

Mastering the BEP formula gives you a clear roadmap to profitability. From pricing strategies to cost management, break-even analysis illuminates areas where you can optimize for growth, ensuring your hard work translates into tangible financial results.

Ready to take control of your business finances?

Download Invoice Fly today!