Invoice vs. Bill: What is the difference?

We hear it asked all the time — “What is an invoice?” and “What is a bill?” and “Are they even that different at all?”. Although we use invoices and bills quite often in our daily lives in America, it’s common for people to get confused between the two, especially when it comes to managing their own business.

While they may seem similar, there are distinct differences between the two. But don’t worry about figuring it out; we’re here to help. In this article, we dive into what an invoice is and what a bill is, explaining the fundamentals and how each should be used.

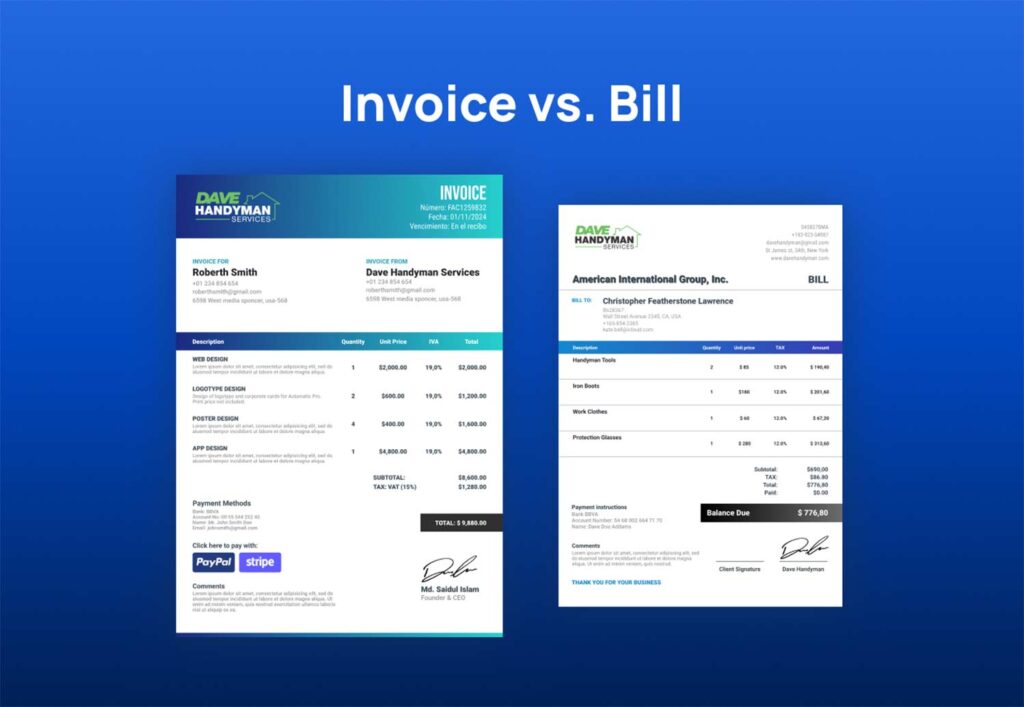

Invoice vs. Bill:

What is an Invoice?

For starters, an invoice is a document requesting payment, issued by a seller to a buyer that provides a detailed account of the goods or services provided, along with the price, payment terms, and deadlines (make payment in 15 days, 30 days or 60 days).

It’s typically issued after the product or service has been provided, serving as a formal request for payment.

Unlike bills, invoices are commonly used in business-to-business (B2B) transactions, where payment is expected at a later date. Therefore you can anticipate a fair amount of detail to be required on these documents, ensuring both parties have a clear understanding of the terms and expectations.

RELATED ARTICLE: What is an Invoice? Everything You Need To Know

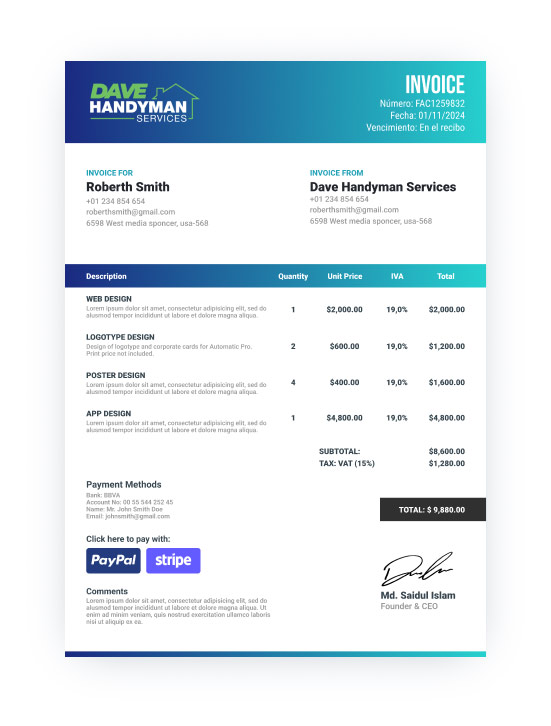

Key Components of an Invoice

If you want to make an invoice, it’s much easier to make them using tools like our invoice maker, our free invoice generator or using our free invoice templates.

Otherwise, if you want to make an invoice manually, here are the key components an invoice includes:

Header information 🏢

Highlighting the seller’s business name, address, and contact details, often alongside a company logo.

Customer details 👤

Addressing the customer’s name and company (if applicable).

Invoice number 🔢

A unique identifier for each invoice.

Date of issue 📅

The date when the invoice is issued.

List of products/services 📋

A breakdown of what’s being charged, including quantities and unit prices.

Payment terms ⏰

Outlining payment conditions, including how to pay, the due date, and late fees.

Total amount due 💵

The final amount, including taxes and any other charges.

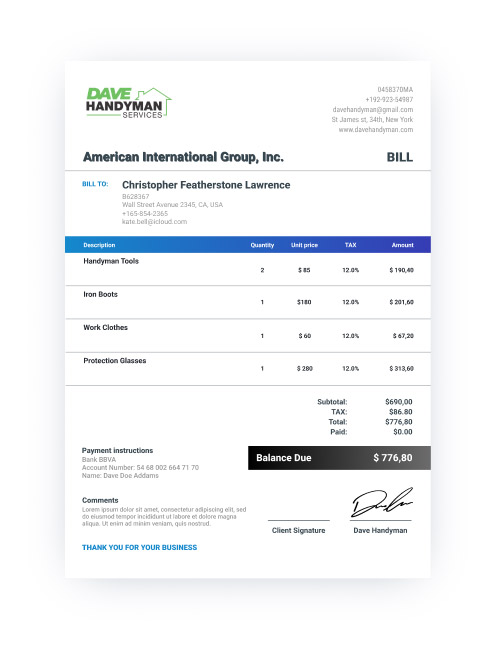

What is a Bill?

Bills, on the other hand, are more straightforward and are often used for one-time or immediate payments. For example, when you head out to a restaurant for dinner or buy that latest iPhone, you’re likely to receive a bill for the total amount owed, and you’re expected to pay right away.

Because of their immediacy, bills don’t tend to require the extended payment terms or detailed breakdowns that invoices do. There’s no need for fine print (well, not usually), and they’re often much smaller, with minimal room for comprehensive information.

RELATED ARTICLE: What Is A PO Number On An Invoice?

Key Components of a Bill

These days, bills are generally created by point-of-sale (POS) registers, which automatically generate a document detailing the goods or services purchased and the total amount due. It’s quick, easy, and efficient.

And when it comes to the details, here’s what you can expect.

Seller information 🏢

Highlighting the seller’s business name.

Customer information 👤

While not always required, some bills include details such as the customer’s table number.

Description of goods/services 📋

A concise list of the products or services provided.

Total amount due 💵

The total amount the customer needs to pay, including any taxes or tips requested.

Payment methods accepted 💳

Indicating what’s available, whether it’s a cash, card, or mobile payment.

Thank You or Additional Notes 💬

Bills often include a polite note, such as, “Thank you for your purchase!”.

Invoice vs. Bill: The Key Differences

As you can see, the terms invoices and bills refer to documents requesting payment for goods or services, but each has its own place in different scenarios. While an invoice is used in formal transactions, the bill is used for more casual sales.

How can you tell them apart?

Here are the three key differences:

1. Level of Detail

Invoices provide a more comprehensive overview than bills, typically formatted as A4 documents, providing enough room for heavy details. However, not all invoices are printed. In fact, most are issued online these days, using accounting tools like Invoice Fly to manage transactions.

Bills, by contrast, are much simpler and smaller documents, and are usually printed at the till by the service provider/retailer. Details are kept concise, focusing on the total amount the customer owes, and there’s sometimes a lovely “thank you” note at the end.

2. Payment Expectations

Invoices typically include detailed payment terms that specify when and how payment is due. These terms might include the specific due date, accepted payment methods, and any late fees for overdue payments. Robust? Yes, undoubtedly, and for good reason (someone’s got to get paid).

Meanwhile, bills don’t require so much information about when or how to pay, as the payment is typically expected immediately via a traditional method, such as cash or card.

3. The Customer

Another way to distinguish an invoice from a bill is by looking at the customer. Invoices are primarily used in business-to-business (B2B) transactions, where goods or services are provided with the expectation of delayed payment or credit terms.

As for bills, these are more common in business-to-consumer (B2C) transactions, such as retail stores, gas stations, and salons, where payments are expected immediately.

RELATED ARTICLE: What Is A Proforma Invoice?

When to Use an Invoice or a Bill

The choice between using an invoice or a bill largely depends on the nature of the transaction and the expected timing of payment. Bills are more straightforward requests for immediate payment in consumer settings, while invoices serve as detailed financial documents that facilitate future payments in business contexts.

By establishing a strong understanding of when to use an invoice or a bill, you’ll find business transactions much more straightforward, removing any unnecessary stress and ensuring processes are kept professional. So, to clarify, here’s a quick breakdown of why you might use each document.

Use an invoice when:

- The transaction involves another business or professional service.

- Payment is not expected immediately and will be settled at a later date.

- The transaction involves a recurring payment or ongoing service agreement.

- Detailed information is required regarding the goods or services sold.

Use a bill when:

- The transaction occurs in settings where immediate payment is required.

- The customer is expected to pay at the point of service without any delayed terms.

- The goods or services provided are for personal use and not business-related.

- The transaction is straightforward with little need for details.

What is a Customer Statement?

A customer statement is a document that summarizes a customer’s outstanding balances and transactions over a specific period (often monthly).

Unlike an invoice or bill, which is issued for individual transactions, a customer statement is more comprehensive, providing an overview of multiple invoices or bills issued to a customer.

This statement is particularly useful for businesses that offer credit terms to their customers, as it helps them manage their accounts receivable effectively.

PRO TIP: If you need support with tracking payments, using an accounting tool like Online Payments will make a massive difference in your day-to-day life.

With features like a Client Portal, it’s easier than ever to stay updated on client payments, allowing you to focus on what you do best.

RELATED ARTICLE: What Is A Pay Stub? Definition & Best Practices

How Can Invoicing Software Ease Your Work?

Managing business payments can be highly time-consuming, especially for small businesses handling multiple transactions with multiple clients.

Most people don’t have the time for these administrative burdens and would rather focus on their actual work — and that’s fair enough. You didn’t start your job to run your books.

By implementing efficient payment systems, businesses can significantly reduce these repetitive duties, ensuring timely transactions without wasting any time.

Moreover, these tools not only facilitate easier invoicing but also enable better cash flow management through features like client notifications and invoice reporting, handling all of the mundane tasks so that you don’t have to.

Top 8 benefits of using an Invoicing App on the Go:

- Generate invoices in seconds

- Use professional invoice templates

- View detailed reports

- Accept online payments

- Manage multiple clients with ease

- Track your time spent on jobs

- Log your work expenses

- Keep updated with phone widgets

Save time with Invoice Fly

With over 125k monthly users, Invoice Fly has quickly become one of the most popular invoicing tools in the United States.

With user-friendly features and end-to-end support, we empower business owners, individual contractors and freelancers to create a professional invoices, send them, track them, and get paid fast.

It sounds easy, and it really is that easy.

Ready to Get Started?

Download Invoice Fly today!

Courteney Searle is a Senior Content Strategist and SEO Writer with a strong experience in SaaS and mobile app products.

Although was born in Australia, she possesses extensive experience in music, fashion, technology, architecture, banking, invoicing, accounting, and the home service industry in the United States.

Courteney's passion is creating engaging content that simplifies complex software solutions for diverse audiences.

Her deep understanding of industry-specific knowledge enables her to produce useful content, helping those who seek to learn new concepts or become more informed about specific topics.