Online payments software that gets you paid fast

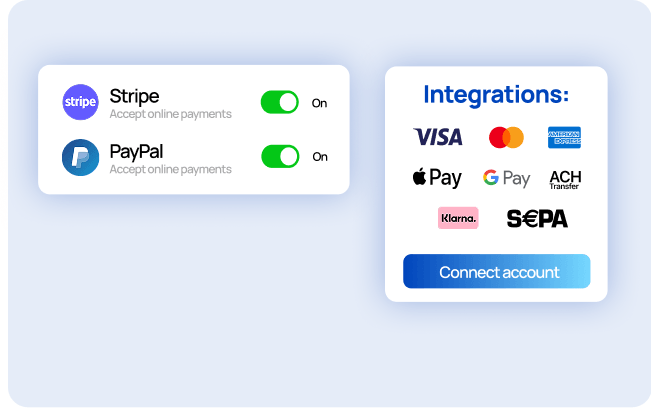

Our online payment processing feature helps small businesses, contractors and blue collar pros grow their cash-flow every month by ensuring safe, cloud-based payments options like PayPal and Stripe.

125,000+ american pros trust Invoice Fly

Grow your monthly revenue with

Invoice Fly’s online payments

Get paid 4x faster with PayPal & Stripe online payments

We make it easy for you. We have integrated PayPal and Stripe payments to your estimates and invoices, allowing you to collect payments at anytime, from anywhere.

Get paid fast with Visa, Master Card, American Express, Apple Pay, Google Pay, Klarna, ACH Transfers & SEPA.

Why do small businesses & contractors love to collect online payments with Invoice Fly?

How do Invoice Fly online payments work?

Accept more payments instantly

Thanks to our online payments processing integrations your business will be able to track all payments collected, and track your monthly income.

When your client receives the invoice, he can just click on the PayPal or Stripe button and make an instant payment.

Simplify your payments workflow

Track the payment status for any estimate or invoice that has been issued. Check when it was sent, when it was opened by the customer, and when it was paid.

Get notified every time there is an update on your payment workflow and don’t miss any detail.

Get paid securely with low-commission ACH transfers

ACH is a secure, affordable way to accept bank transfer payments, typically costing around 1%.

Payments are deposited within four business days, and Invoice Fly automatically adds the collected payment to your business reports for easy record-keeping.

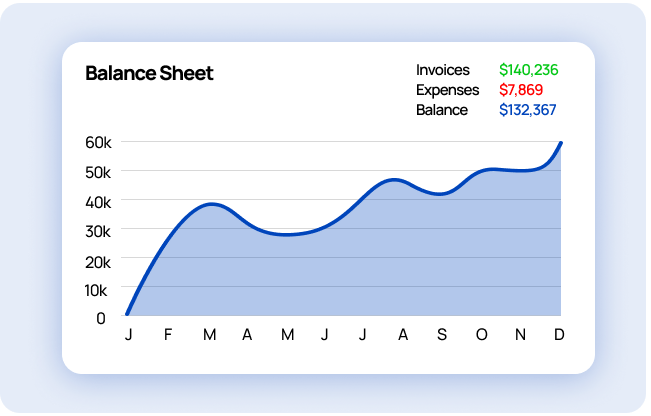

Control and track your cash-flow

Every payment you collect is automatically added to your business report. Here you can track payments by year, month, client, and get a great overview about your business health.

Also download your business reports in PDF, Excel or Sheets if you need to do extra calculations.

How do SMEs & blue collar workers

benefit from fast online payments?

Online payment processing solutions like Invoice Fly offer small businesses and contractors a faster, more organized way to manage their payments. Instead of chasing checks or handling cash, they can send professional invoices, accept digital payments, and track everything in real time.

3x

faster payments

by using PayPal & Stripe instead of cash

40%+

payment collection

increase thanks to professional invoices

5h+

saved every month

by not needing to follow up with unpaid invoices

Customized solutions for 50+ industries

Do more with the right set of tools

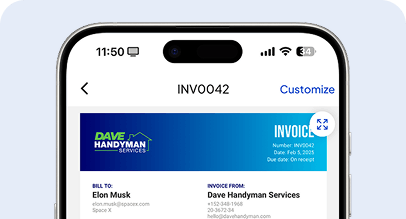

Send professional, polished invoices that make a great impression. Easily customize each one with your branding, payment terms, and itemized details. With built-in online payments and clear layouts, you’ll get paid faster—no chasing, no confusion.

Invoicing Software

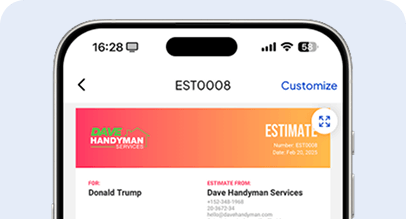

Win more jobs by sending professional-looking estimates. Get them approved and kickstart new projects.

Estimates App

Win more jobs by sending professional-looking estimates. Get them approved and kickstart new projects.

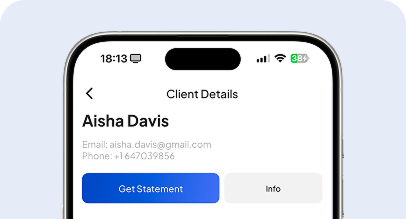

Client Portal

Manage all your client’s details, invoices, estimates and statements from a secure and cloud-based online platform.

Pick the best plan for you.

Get the tools you need to work smarter, stay in control, and grow with confidence.

What are online payments processing solutuions?

An online payment processing solution is a digital & cloud-based service that allows businesses to accept and manage electronic payments from customers. It handles the secure transfer of funds from a buyer’s payment method (like a credit card, debit card, or digital wallet) to the business’s account.

These systems often include features like invoicing, recurring billing, transaction tracking, and fraud protection — making it easier for small businesses and contractors to get paid quickly and efficiently.

Some examples include platforms like Stripe, PayPal, and Invoice Fly.

FAQs about online payments

Here are the main types of online payments commonly used by small businesses and contractors:

- Credit and debit card payments: Customers enter their card details to make secure, real-time payments through a payment gateway (e.g., Visa, Mastercard, Amex).

- Digital wallets: Platforms like PayPal, Apple Pay, Google Pay, and Venmo allow users to pay without entering card details each time.

- Bank transfers (ACH payments): Direct transfer of funds from a customer’s bank account to the business’s account. Often used for larger invoices or recurring payments.

- Buy now, pay later (BNPL): Services like Afterpay, Klarna, or Affirm let customers split payments over time while the business gets paid upfront.

- Cryptocurrency: Some modern platforms allow payments in Bitcoin or other cryptocurrencies, though it's less common and more volatile.

- Payment links or QR codes: Businesses can generate links or QR codes for invoices, letting customers pay quickly without logging into a platform.

Each method varies in speed, fees, and ease of use — but combining a few offers flexibility and convenience to customers.

1. ACH bank transfers (like Stripe or Square):

- Fees: Typically around 0.8% per transaction, often capped at around $5.

- Pros: Low cost; great for large payments.

- Best For: Invoices, subscriptions, and recurring payments.

2. Payment apps (Venmo, Cash App, Zelle, for peer-to-peer or small-scale use):

- Fees: Often free or very low if not using instant transfers.

- Pros: Instant payments, easy setup.

- Cons: Less professional, may not support invoicing or business-level reporting.

- Best For: Freelancers or very small operations.

3. PayPal Business (with friends & family workaround – not recommended for businesses):

- Fees: Standard fee is 2.9% + $0.30; lower with nonprofit rates or micropayments.

- Pros: Widely recognized, trusted by customers.

- Cons: Higher fees than ACH; risk of chargebacks.

- Best For: Broad customer base and international payments.

4. Stripe or Square for Invoicing:

- Fees: About 2.9% + $0.30 per card transaction; ACH is cheaper on both platforms.

- Pros: Includes invoicing tools, analytics, and integrates with your website or app.

- Best For: Growing businesses needing professionalism and automation.

Yes, both Stripe and PayPal are cloud-based platforms. They operate entirely online — no software installation is required. You access and manage your account, payments, invoicing, and reports through a web browser or app from anywhere with an internet connection.

Stripe and PayPal both let small businesses, freelancers, and contractors accept and manage payments online without needing to host any infrastructure themselves — a key benefit of being cloud-based.

Yes, PayPal and Stripe are both highly secure payment platforms. They are industry leaders in online payment processing and invest heavily in protecting both users and businesses.

Stripe Security Features:

- PCI-DSS Level 1 certified (the highest level of payment security compliance).

- Uses TLS encryption for all data in transit.

- Offers tokenization, so sensitive card data never touches your servers.

- Machine learning fraud detection (Radar) built into the system.

- Two-factor authentication (2FA) for account access.

PayPal Security Features:

- Also PCI-compliant and uses end-to-end encryption.

- Buyer and Seller Protection programs.

- Monitors transactions in real-time to detect fraud.

- Account activity alerts and 2FA.

- Doesn’t share financial details with merchants — adds a privacy layer for customers.

Free Resources

Resources to run your business smoothly and efficiently.

Free Templates

Explore free templates and create estimates, quotes, invoices, bills and receipts.

Free Generators

Generate free Estimates, Quotes, Invoices, Bills, Receipts, and Proformas online.

Free Calculators

Use our free calculators: Service Price, Profit Margin, Net Salary, VAT, Break-Even…

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs