- Home

- »

- Glossary Of Terms

- »

- Billing Adress

Billing Address Definition

A 60‑Second Definition

Your billing address is the street address that your payment method—credit card, debit card or ACH account—is registered to. Card networks and banks use it for Address Verification Service (AVS) checks, flagging mismatched ZIP codes or street numbers as potential fraud.

Why Merchants Ask for It

- Fraud prevention: AVS compares the numeric parts of the address (street number + ZIP) with the issuing bank’s file.

- Tax compliance: Certain digital‑service sales taxes depend on the customer’s billing state.

- Accurate receipts: The address—and occasionally the billing contact’s email—prints on invoices and statements for audit trails.

What Goes in a Billing Address?

A classic template has two main sections stacked top‑to‑bottom:

| Field | Purpose | Example |

|---|---|---|

| Name | Cardholder or company | Acme LLC |

| Street & Number | Primary address line | 123 Market St. |

| Apartment/Suite | Secondary line (optional) | Suite 500 |

| City & State | Jurisdiction | San Francisco, CA |

| ZIP Code | AVS match & tax | 94105 |

| Country | ISO code preferred | US |

| Electronic receipts | example@invoicefly.com | |

| Phone | Customer service follow‑up | +1 123‑456‑7891 |

Pro tip: Use the same spelling the bank has on file—”St.” vs “Street” can fail AVS.

Billing vs. Shipping Address

Billing Address: Tied to payment authentication. May be a P.O. box.

Shipping Address: Where the goods go. Can differ for gifts or remote offices.

Service Address: Where services are consumed (common in utilities).

How to Find or Update Yours

Open your bank or card issuer’s app.

Navigate to Profile → Addresses.

Edit the entry; update the billing contact phone or email if requested.

Changes usually propagate in 24‑48 h.

What Happens if It’s Wrong?

Declined charge: AVS mismatch triggers a hard decline for some merchants.

Delayed payouts: Subscription platforms may suspend service until details match.

Chargeback risk: Fraudulent orders processed with bad address data face higher dispute odds.

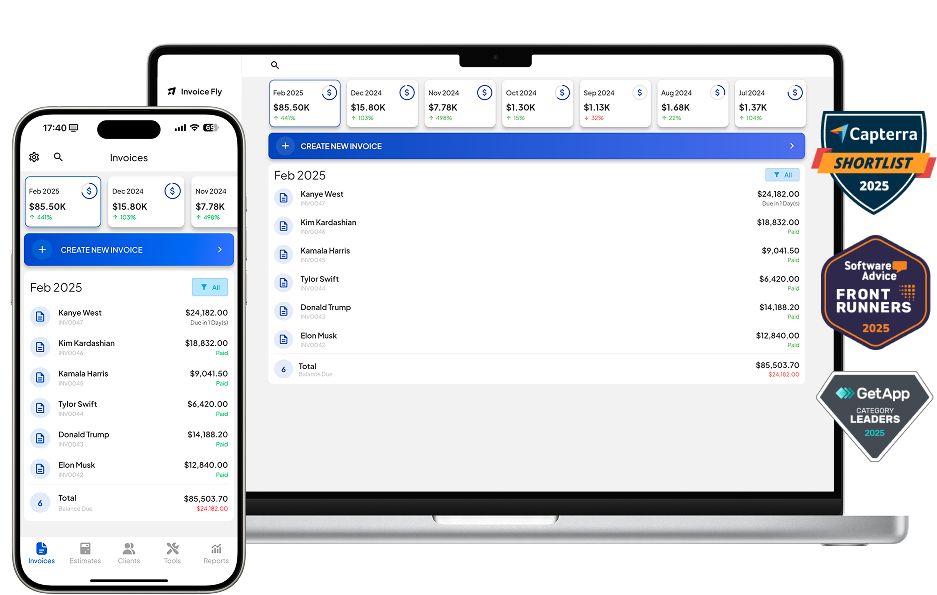

How InvoiceFly Helps

Prefills the customer’s billing address from prior invoices, saving manual entry.

Validates ZIP code format in‑form to reduce AVS failures.

Stores a dedicated billing contact (name, phone, email) per client profile for clean, professional i

FAQs

It includes the cardholder’s name, full street address, city, state, ZIP code, country—and often an email or phone for the billing contact.

Check your last card statement or log into your banking app under Profile → Address.

Yes. Even a wrong digit in the ZIP can lead to declined payments or chargebacks.

It must match the address on file with your card issuer—usually your current residence or headquarters, but not always.

Use the exact formatting your bank recognizes, including apartment numbers and the five‑digit ZIP (plus 4 if requested).

It’s the first AVS gate against payment fraud—critical for merchants and card networks alike.

For personal cards, yes. For business cards, it’s the registered company address.

Complete street address, city, state, ZIP, country, plus contact email/phone if the form asks.

Other Free Resources

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs