- Home

- »

- Glossary Of Terms

- »

- Payment terms

Payment Terms: Definition, Types, and Examples

Payment terms are the agreed conditions that define how and when a customer must pay for goods or services. They are an essential part of any invoice or contract, as they establish expectations for both the seller and the buyer. Clear terms protect a business’s cash flow, minimize disputes, and build trust with clients.

Why Payment Terms Matter

Without defined payment terms, businesses risk late payments, disputes, and even bad debt. A well-structured payment term outlines the due date, possible discounts, penalties for late payment, and acceptable payment methods such as credit card, bank transfer, check, or digital wallets.

Common Payment Terms

- Net 30: Payment is due 30 days after the invoice date.

- Net 60: Payment is due 60 days after the invoice date.

- Net 90: Payment is due 90 days after the invoice date.

- Due on Receipt: The customer must pay as soon as the invoice is received.

- Advance Payment: The customer pays before delivery or service begins.

- Milestone Payments: Payments are tied to project stages or deliverables.

Payment Terms in Action

For example, a freelance designer might use Net 30 terms to give clients enough time to process payments, while a construction company could prefer milestone billing to match project progress. E-commerce sellers often use payment on purchase to ensure immediate cash flow.

Best Practices for Setting Payment Terms

- Always include terms clearly in invoices and contracts.

- Adapt terms based on client type (corporate vs. individual).

- Offer incentives (e.g., 2% discount if paid within 10 days).

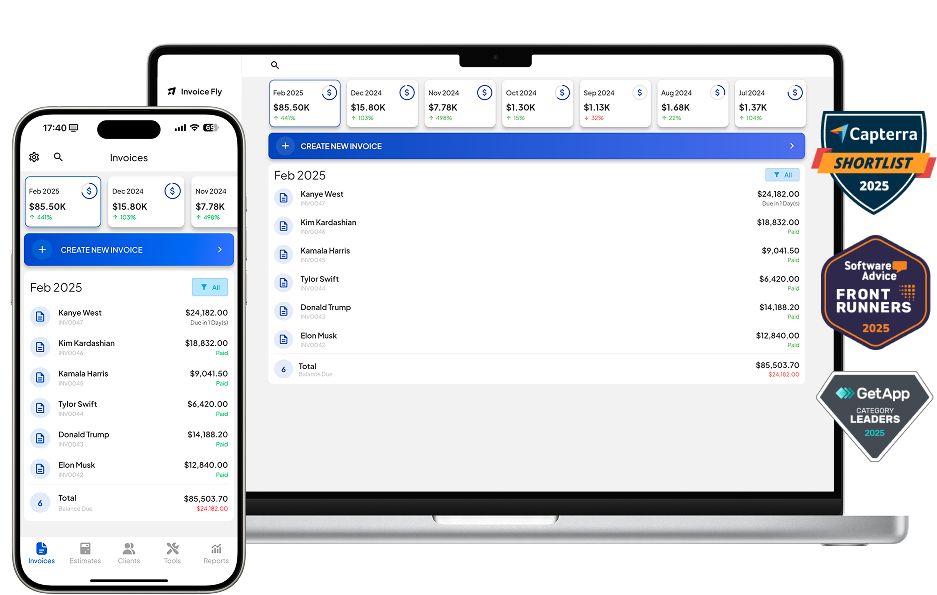

- Automate invoicing and reminders with invoicing software.

Mini Comparison: Net 30 vs Net 60 vs Net 90

- Net 30: Standard for small businesses; balances flexibility with healthy cash flow.

- Net 60: Often used in B2B contracts; may strain smaller suppliers.

- Net 90: Common in large corporations; risky for vendors without strong cash reserves.

Conclusion

Choosing the right payment terms is crucial for maintaining healthy accounts receivable and predictable cash flow. Whether using Net 30, milestone billing, or upfront payments, businesses should tailor terms to their industry and client relationships. Leveraging an invoice template or a free invoice generator can help ensure terms are applied consistently and professionally.

FAQs Net 90

Payment terms are the conditions that define when and how a customer must pay for goods or services.

These terms mean payment is due 30, 60, or 90 days after the invoice date, depending on what is agreed.

A common example is "Net 30," which means the payment must be completed within 30 days from the invoice date.

It requires the customer to pay within 30 days of the invoice issuance.

Advance payment, progress/milestone payment, and deferred (post-delivery) payment.

In many industries, the standard is Net 30, but this can vary by sector and client relationship.

A simple phrase: "Payment due within 30 days of invoice date (Net 30)."

It means the payment is due within 7 days of the invoice date, common for fast-turnover industries.

Other Free Resources

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs