Sales Tax Nexus Across the US: Explained for Remote Sellers

Table of Contents

Sales tax nexus is the connection between a business and a state that requires the business to collect and remit sales tax. This connection can be created by having a physical presence, reaching certain sales thresholds, or selling through online marketplaces. Because sales tax rules vary by state, understanding when nexus applies is essential to staying compliant and avoiding penalties. In this guide, we’ll explain what sales tax nexus means, how it works, and how to manage it across the US.

What Is Sales Tax Nexus?

So what is sales tax nexus exactly? Sales tax nexus is the connection between your business and a state that requires you to charge sales tax to customers in that state. Once you have nexus, you’re legally obligated to register for a sales tax permit, collect sales tax from customers in that state, and remit those taxes to the state government.

In practical terms, think of what is a sales tax nexus as the state’s way of saying, “Your business is active enough here that you need to follow our sales tax rules.” Before you establish nexus, you can usually sell to customers in a state without collecting sales tax. After nexus is triggered, tax filing and collection becomes mandatory.

How Sales Tax Nexus Works Today

Sales tax nexus didn’t always work this way. In the past, states could only require sales tax collection if a business had a physical presence, like an office, warehouse, storefront, or employees in the state. That changed in 2018, when the Supreme Court’s South Dakota v. Wayfair decision allowed states to enforce nexus rules based on economic activity, even if the seller has no physical footprint there.

Today, many states create nexus when your sales or number of transactions cross certain sales tax nexus thresholds. This means remote sellers, ecommerce businesses, and online service providers can trigger nexus without ever setting foot in the state.

Why Sales Tax Nexus Matters

Understanding sales tax nexus is critical because the consequences of getting it wrong can be expensive. Failing to charge sales tax where required can lead to penalties, interest, and back taxes. You need to know where you have nexus to price products correctly and protect your gross profit vs net profit. Each state has its own nexus rules, thresholds, and filing schedules. Noncompliance increases the risk of audits and unexpected tax bills.

States are paying closer attention than ever to sales tax enforcement because this revenue funds public services and government programs. For business owners and remote sellers, knowing when nexus applies isn’t just good bookkeeping—it’s essential tax planning and compliance.

Types of sales tax nexus

Several types of nexus can trigger sales tax obligations, with physical and economic nexus being the most common.

Physical Nexus is the traditional standard, established when a business has a tangible presence in a state. This can include having an office, store, or warehouse, employing workers in the state (including remote employees), storing inventory in third-party fulfillment centers like Amazon FBA, owning or leasing property or equipment, or attending trade shows and sales events.

Economic Nexus is the newer standard that applies even if you never set foot in a state. It’s triggered purely by how much you sell into that state. Most states now enforce economic nexus sales tax laws using thresholds based on total annual sales revenue (commonly $100,000), number of transactions (commonly 200), or a combination of both.

For example, California sales tax nexus uses a $500,000 sales threshold for remote sellers, while New York requires both $500,000 in sales and 100 transactions. Florida sales tax nexus applies at $100,000 in remote sales with no transaction requirement. Once you cross a state’s threshold, you must register, collect, and remit sales tax just like a local business.

Other Nexus Types include affiliate nexus (when in-state affiliates help drive your sales), click-through nexus (when you pay commissions to in-state partners for online referrals), and marketplace nexus (which affects sellers using platforms like Amazon, Etsy, or eBay where the marketplace facilitator may collect tax on your behalf).

Physical vs. economic nexus

Physical nexus is created when your business has a real, physical presence in a state. Common triggers include having an office or retail location, employing workers who live or work in the state, using independent contractors or sales reps, storing inventory anywhere in the state, owning or leasing property or equipment, or attending trade shows and in-person sales events. If your business has any of these connections, you almost certainly have physical nexus and must charge sales tax on taxable sales in that state.

Economic nexus applies even without physical presence. Most states measure economic nexus thresholds on a calendar year basis, though some use rolling 12-month periods. You need to monitor your sales continuously to identify when you cross thresholds. Texas sales tax nexus, for instance, sets a higher threshold at $500,000 in annual sales, while Illinois sales tax nexus uses the more common $100,000 in sales or 200 transactions standard.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

Sales tax nexus by state

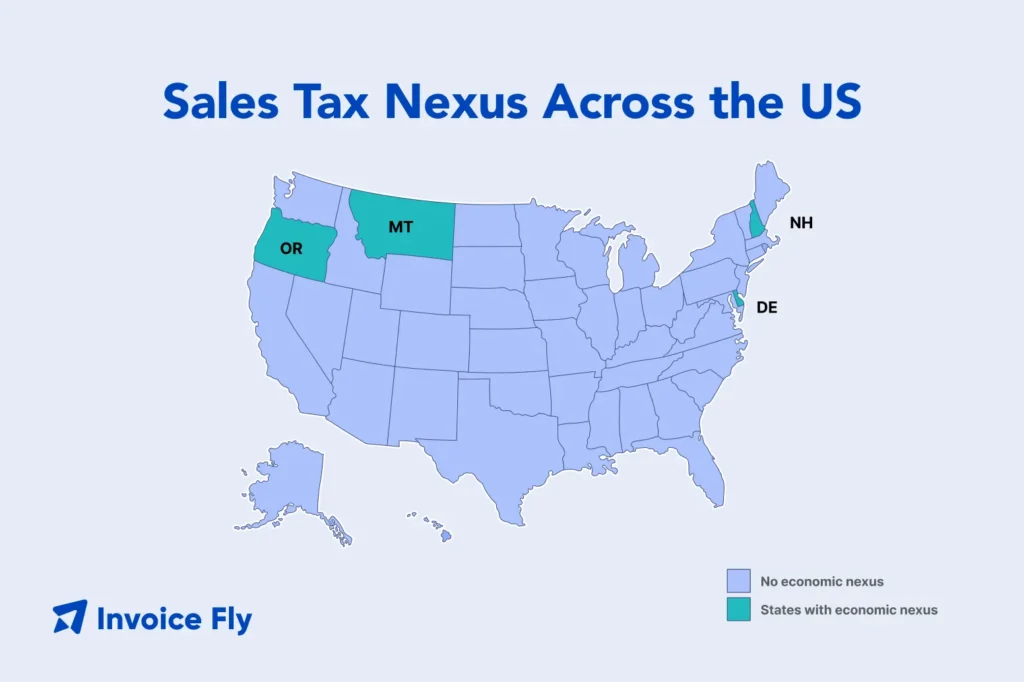

Sales tax nexus thresholds and tax rates vary widely by state. While most states follow similar economic nexus standards, some have higher thresholds, unique requirements, or no statewide sales tax at all. This state tax matrix helps you understand where your obligations begin.

States With No Statewide Sales Tax

Five states impose no statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. Alaska has no statewide sales tax, though local jurisdictions may impose their own taxes. Delaware, Montana, New Hampshire, and Oregon have no sales tax at any level, eliminating sales tax nexus concerns for most sellers.

States With Unique Thresholds

High-Threshold States:

- Alabama requires remote sellers to register once they exceed $250,000 in annual sales with no transaction count threshold

- California sets the bar at $500,000 in annual sales for remote sellers, with complex district taxes that vary by location

- Mississippi uses a $250,000 sales-only threshold with no transaction requirement

- New York requires both $500,000 in sales and more than 100 transactions in the prior four quarters—you must meet both thresholds

- Texas sets one of the highest thresholds at $500,000 in annual sales with complex local jurisdiction rules

States With Special Tax Structures:

- New Mexico uses a gross receipts tax rather than traditional sales tax, with economic nexus applying at $100,000 in sales

- Hawaii uses a general excise tax instead of traditional sales tax, with economic nexus at $100,000 in sales or 200 transactions

Standard Threshold States

The majority of states use the common $100,000 in sales OR 200 transactions threshold (either one triggers nexus). These include Arizona, Arkansas, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Vermont, Virginia, Washington, West Virginia, and Wisconsin.

Several states use $100,000 in sales with no transaction threshold: Pennsylvania, South Carolina, and Tennessee.

Criteria for establishing sales tax nexus

Understanding the specific activities that create nexus helps you monitor your exposure and take appropriate action.

Physical presence triggers include opening an office (even a home office where employees work), hiring employees who reside in the state, storing inventory anywhere in the state including at third-party logistics providers, owning or leasing vehicles or equipment, having salespeople or independent contractors conducting activities in the state, and attending conferences or trade shows.

Economic activity triggers involve exceeding the state’s annual sales threshold (typically $100,000-$500,000), exceeding the state’s transaction threshold (typically 200 transactions) where applicable, or meeting both thresholds in states that use “and” rather than “or” language.

Relationship-based triggers include having affiliate relationships with in-state businesses, using in-state referrals or click-through arrangements, and utilizing marketplace facilitators with nexus in the state.

Impact of sales tax nexus on businesses

Establishing nexus creates immediate tax compliance obligations and operational impacts.

What happens if I have economic nexus?

When you establish economic nexus in a state, you must take several steps to remain compliant.

1. Register for a sales tax permit

Apply for a sales tax license or permit from the state’s tax authority. According to the IRS, this process typically requires your business information, tax ID numbers, estimated sales volume, and details about your business structure.

2. Calculate and collect sales tax

Determine the correct sales tax rate for each transaction using a sales tax calculator. Some states are origin-based (you charge tax based on your location) while most are destination-based (you charge sales tax based on the customer’s location).

3. Update your systems

Modify your invoicing software to include appropriate sales tax line items and your invoice management processes to handle multi-state tax requirements.

4. File returns and remit taxes

Submit sales tax returns on the state’s required schedule and remit the taxes you’ve collected. Late tax filing or payment results in penalties and interest. States like Iowa and Ohio provide detailed guidance on filing requirements and deadlines.

5. Maintain detailed records

Keep documentation of all sales, exemption certificates, and taxes collected. Maintain proper receipts and records, as states can audit you for several years back.

Steps businesses can take to comply with sales tax nexus laws

- Monitor your sales activity: Track sales into each state monthly to identify when you’re approaching nexus thresholds.

- Understand marketplace facilitator laws: If you sell through Amazon, Etsy, or eBay, know whether the marketplace facilitator collects sales tax on your behalf. You’re still responsible for sales made through your own website and may need a merchant account to process payments.

- Consider automation software: Multi-state tax compliance is complex. Tools like TaxJar can calculate correct tax rates, track exposure, and prepare returns automatically.

- Leverage resale exemptions properly: Obtain valid resale certificates to document tax-exempt B2B transactions.

- Plan for cash flow impact: Collecting sales tax increases invoice amounts but doesn’t increase your revenue. Proper cash flow projection accounts for sales tax pass-through.

- Get professional help: Corporate income tax and sales tax compliance are areas where professional assistance often pays for itself.

- Review product taxability: Not all products and services are taxable in all states. Understanding what you sell and how it’s taxed prevents over-collection or under-collection.

- Monitor regulatory changes: Nexus laws change frequently. States adjust thresholds, add new nexus categories, or modify filing requirements regularly.

Conclusion

Sales tax nexus determines where your business is required to collect and remit sales tax, and those nexus rules have become more complex with the rise of economic nexus. Whether nexus is triggered by physical presence or sales thresholds, understanding your obligations helps you avoid penalties and stay compliant.

The best way to manage multi-state sales tax is to be proactive. Track your sales by state, know the thresholds that apply to your business, and register as soon as nexus is triggered—before problems arise. Waiting until a state reaches out can lead to back taxes, interest, and fines.

For growing small businesses and ecommerce sellers, tax compliance can feel overwhelming. Using automation tools, keeping clean records, and getting professional guidance when needed can make a big difference. As you expand into new states, treating sales tax compliance as part of your growth plan—not an afterthought—will save you time, money, and stress.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

FAQs

You likely have nexus if you have physical presence (office, employees, inventory) or you cross a state's economic threshold (sales/transactions). Track both by state.

Economic thresholds often reset each year (or roll over 12 months, depending on the state). But if you register, you usually must keep collecting until you close the account with that state.

There's no universal exemption, but nonprofits, government entities, and resellers may be exempt in certain states with valid exemption certificates.

It varies by state. Common exemptions may include groceries, prescription drugs, some clothing, and certain manufacturing/agricultural supplies. Always check rules where you have nexus.

Delaware, Montana, New Hampshire, and Oregon have no statewide sales tax. Alaska has no statewide tax, but some local areas do.