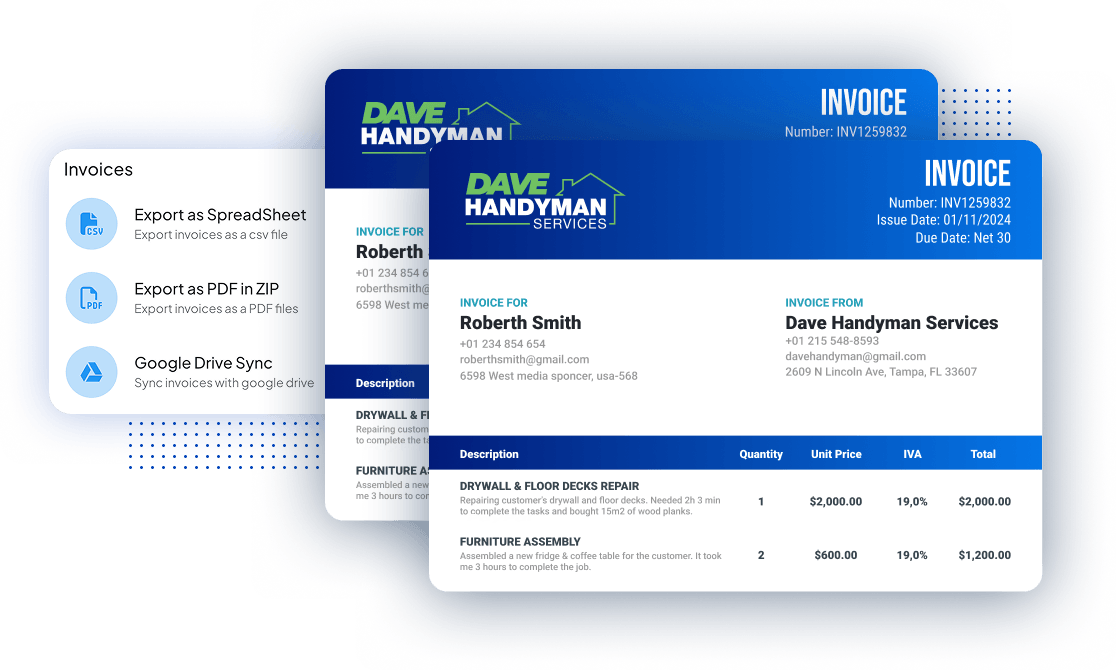

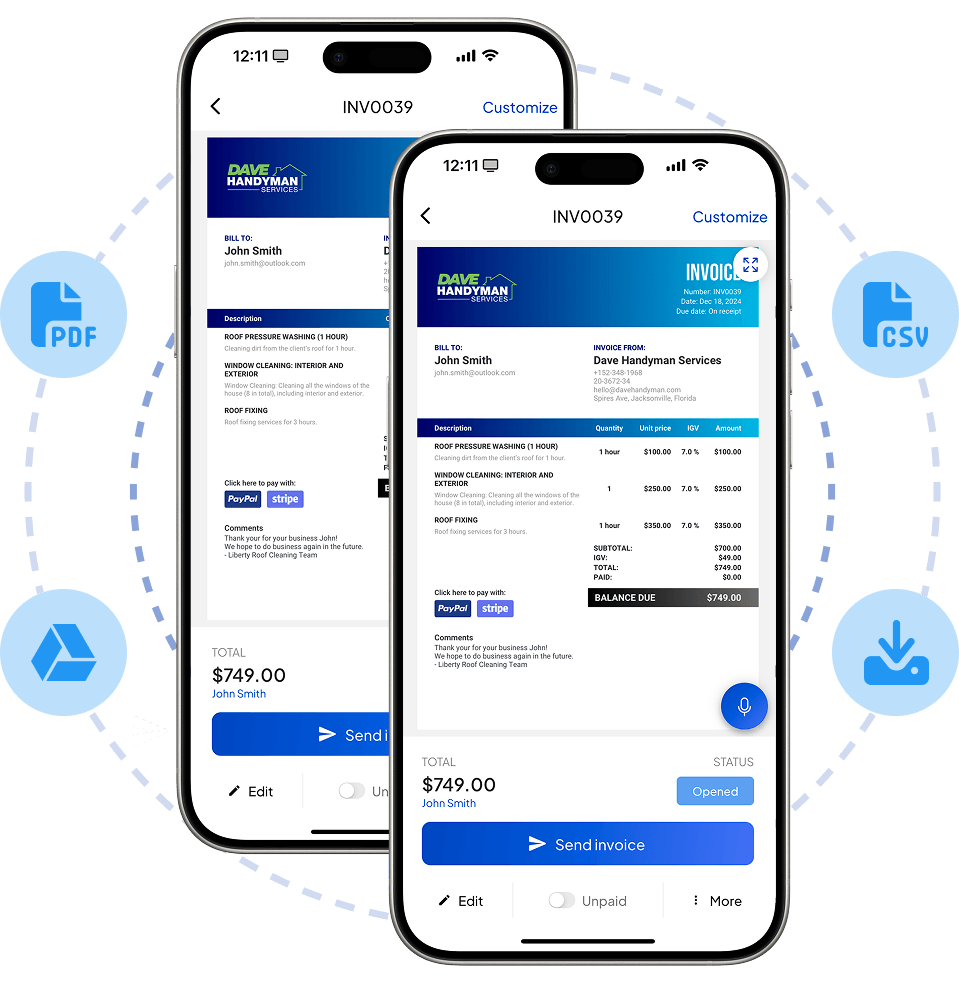

Download & export all your invocies in 2 clicks

Quickly download & export all of your invoices to your phone or computer for deeper analysis, revenue check, and tax purposes.

125,000+ american pros trust Invoice Fly

Keep every invoice on track: control payments, taxes, planning, compliance & more!

Download & export your invoices for smarter & deeper analysis

Invoice Fly allows blue collar pros, contractors & SME’s to get the big picture of their invoices over a specific period of time. It helps keep track of late payments, stay tax compliant, forecast future income, and export in bulk for administrative & record keeping purposes.

Why do small businesses & contractors love downloading & exporting invocies with Invoice Fly?

How does downloading & exporting invoices

with Invoice Fly work?

Financial & Tax Purposes

- Bookkeeping & accounting: Exported invoices help track income, expenses, and outstanding payments.

- Tax filing: At year-end, invoices serve as official proof of earnings and deductible expenses.

- Audits: Authorities may request invoice records during audits — having them exported and organized makes compliance faster.

Client & Payment Management

- Client requests: Some clients ask for invoice copies in PDF, Excel, or other formats for their internal accounting systems.

- Proof of work: Exported invoices provide evidence of completed tasks, useful if a client disputes payment.

- Recurring payments: Businesses often export invoices to verify billing cycles for subscriptions or maintenance contracts.

Business Operations & Planning

- Cash flow tracking: Reviewing exported invoices helps identify late payments and forecast income.

- Performance analysis: Comparing invoices month-to-month shows which services or clients bring the most revenue.

- Record backups: Keeping offline copies protects against data loss if an invoicing system crashes.

Legal & Compliance Reasons

- Dispute resolution: If payment issues arise, invoices serve as formal documentation in negotiations or legal cases.

- Contract proof: Exported invoices linked to service agreements validate the terms fulfilled.

- Transparency: Having downloadable records helps demonstrate honest, consistent billing practices.

Practical & Administrative Uses

- Sharing with accountants / bookkeepers: Many professionals prefer bulk exports (CSV, Excel) to reconcile accounts quickly.

- System migration: If switching from one invoicing tool to another, exports ensure a smooth transfer of financial history.

- Offline access: Workers without constant internet (e.g., contractors on job sites) may need invoices stored on devices.

How do freelancers & contractors

benefit from downloading & exporting invoices?

For freelancers and contractors, downloading and exporting invoices provides better financial control, easier tax compliance, and stronger client transparency. It allows them to track income, monitor unpaid balances, and back up records, while also ensuring they have clear proof of work to resolve disputes.

Exported invoices are simple to share with clients or accountants, making business operations more professional, efficient, and legally compliant.

35%

faster tax preparation

by exporting invoices yearly or quarterly

4x

less payments disputes

due to proof of service & transparency

6h

saved every week

with more efficient bookkeeping

Customized solutions for 50+ industries

Do more with the right set of tools

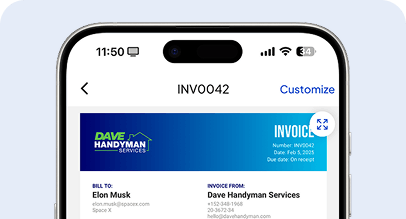

Send professional, polished invoices that make a great impression. Easily customize each one with your branding, payment terms, and itemized details. With built-in online payments and clear layouts, you’ll get paid faster—no chasing, no confusion.

Invoicing Software

Win more jobs by sending professional-looking estimates. Get them approved and kickstart new projects.

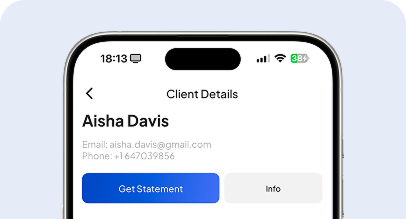

Client Portal

Manage all your client’s details, invoices, estimates and statements from a secure and cloud-based online platform.

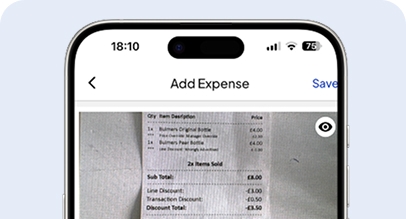

Receipt Scanner

Collect online payments with Credit Card or PayPal, Stripe, Apple Pay, American Express, Visa, MasterCard, and more.

Pick the best plan for you.

Get the tools you need to work smarter, stay in control, and grow with confidence.

What do you mean by

downloading & exporting invoices?

Downloading and exporting invoices means creating a copy of your invoices from an invoicing system or accounting software and saving them in a file format you can use outside the platform — such as PDF, Excel, or CSV.

- Downloading usually refers to saving individual invoices (often as PDFs) to your computer or device so you can share them with clients, accountants, or keep them as backups.

- Exporting typically means pulling a batch of invoices or invoice data into a file (like Excel or CSV) so you can analyze income, prepare taxes, reconcile payments, or migrate records into another system.

In short, downloading is about having single copies for sharing or proof, while exporting is about bulk data management and reporting.

FAQs about downloading & exporting invoices

An export invoice is a special type of invoice used in international trade. To generate one, include all standard invoice details (seller and buyer information, description of goods or services, quantities, prices, and payment terms) along with export-specific information such as HS codes, country of origin, currency, Incoterms, and shipping details. Many invoicing and accounting tools provide export invoice templates, or you can create one in Word/Excel as long as it contains all legally required fields for customs clearance.

Most modern invoicing and accounting platforms allow you to download multiple invoices at once in PDF, Excel, or CSV formats. This is typically done through a bulk actions menu, “Download All” option, or by exporting invoices for a selected time range. If using spreadsheets, you can export the entire invoice history as a CSV/Excel file, which can be sorted or filtered for easier bookkeeping.

No, exporting does not mean printing. Exporting an invoice means saving or transferring it into a digital file format (like PDF, Excel, or CSV) for storage, sharing, or analysis. Printing, on the other hand, produces a physical paper copy. You can export an invoice first and then print it if needed, but the two actions are different.

To extract data from invoices, you can:

- Use invoicing software that allows exporting invoice details directly into Excel/CSV files.

- Apply optical character recognition (OCR) tools that scan and convert invoice text into digital data.

- Hire accounting services that manually input invoice details into bookkeeping systems.

This process helps you analyze payments, track expenses, and automate reconciliation.

You can store invoices electronically by saving them in cloud accounting platforms like Invoice Fly, secure cloud storage (Google Drive, Dropbox, OneDrive), or by keeping encrypted local backups. Best practices include:

- Using PDF format for universal readability.

- Keeping organized folders by year and client.

- Backing up files regularly.

- Following local regulations on data retention (keeping invoices for 5–7 years for tax compliance).

Free Resources

Resources to run your business smoothly and efficiently.

Free Templates

Explore free templates and create estimates, quotes, invoices, bills and receipts.

Free Generators

Generate Estimates, Quotes, Invoices, Bills, Receipts, and Proformas online.

Free Calculators

Use our free calculators: Service Price, Profit Margin, Net Salary, VAT, Break-Even…

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs