Track every business expense with our receipt scanner

Our receipt scanner tool allows you to scan old receipts and generate new ones to track every expense of your business.

125,000+ american pros trust Invoice Fly

Control your business spending with Invoice Fly

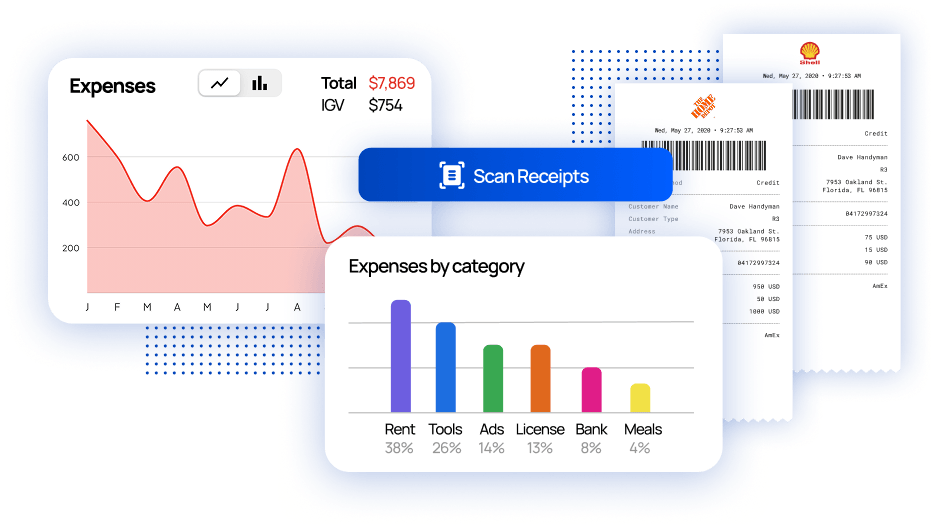

Smarter expense tracking starts with a simple scan

Our receipt scanner helps you uncover hidden expenses and take action.

Quickly identify which categories or merchants are costing you the most—so you can switch to more affordable suppliers, cut down on fuel costs for job site visits, and make smarter financial decisions with confidence.

Why do small business & contractors love using Invoice Fly’s receipt scanner?

How does Invoice Fly’s receipt scanner work?

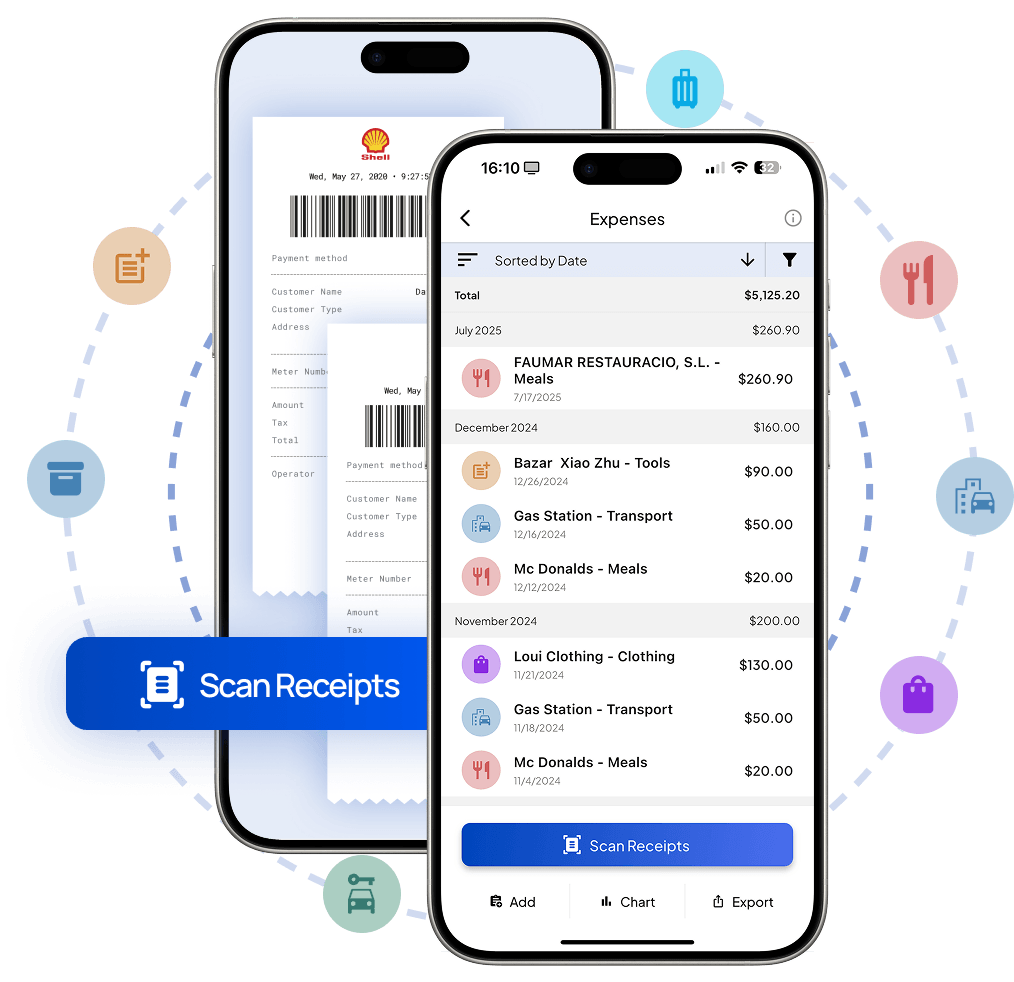

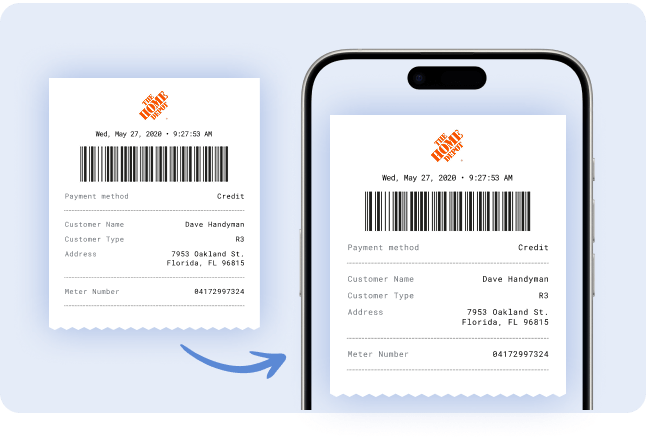

Scan all your old receipts effortlessly with our receipt scanner

By scanning all your old business receipts, not only you’re aware of your business expenses and financial health but also you can identify opportunities to optimize your spending and become more profitable by taking action on expensive vendors.

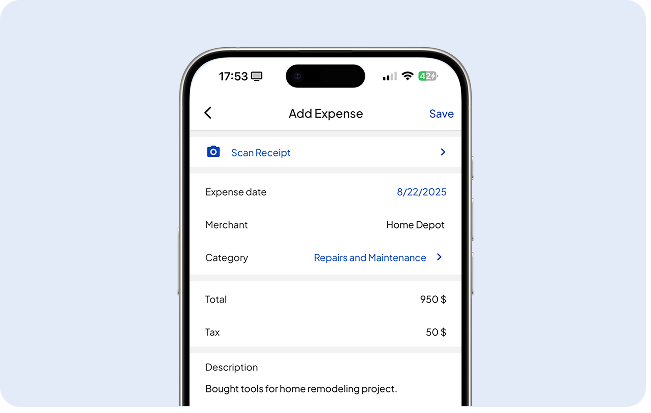

You don’t have the receipt? We got you! Add your new receipt manually

If you’ve lost a receipt or need to record an expense that doesn’t have one, you can easily add it manually in the app.

Just enter the expense date, merchant name, and select the appropriate category. Then, add the total amount—and include taxes if applicable—to keep your records accurate and complete.

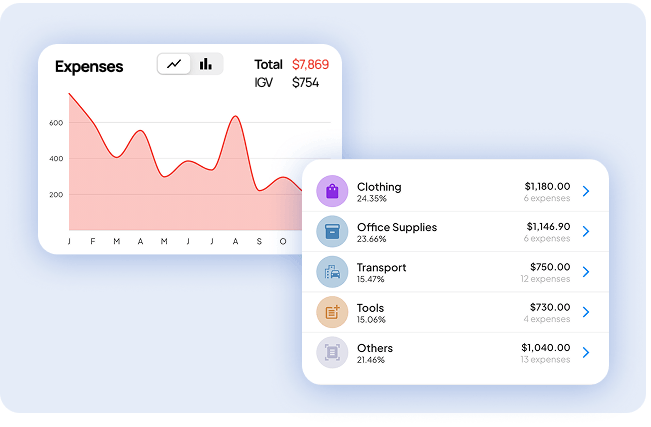

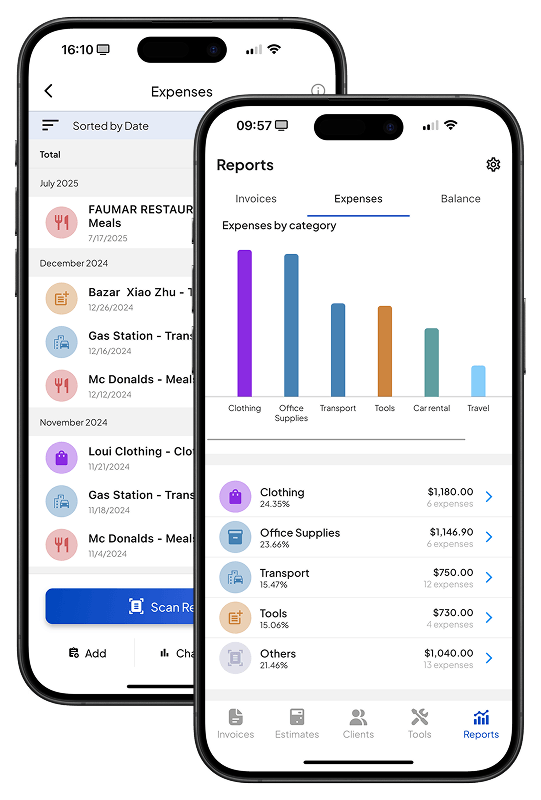

View & sort your expenses by category and by merchant in the expense chart

Invoice Fly will automatically create a chart with all the expenses organized by volume and category.

The most expensive categories will be displayed on top of the chart. If you click on a category (for example office supplies), you will see all the merchants were you bought office supplies recently.

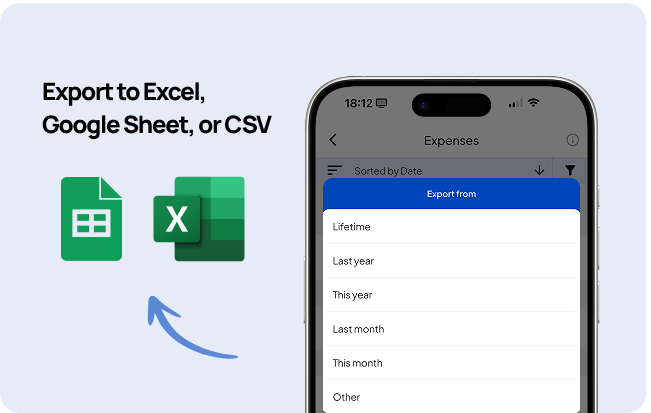

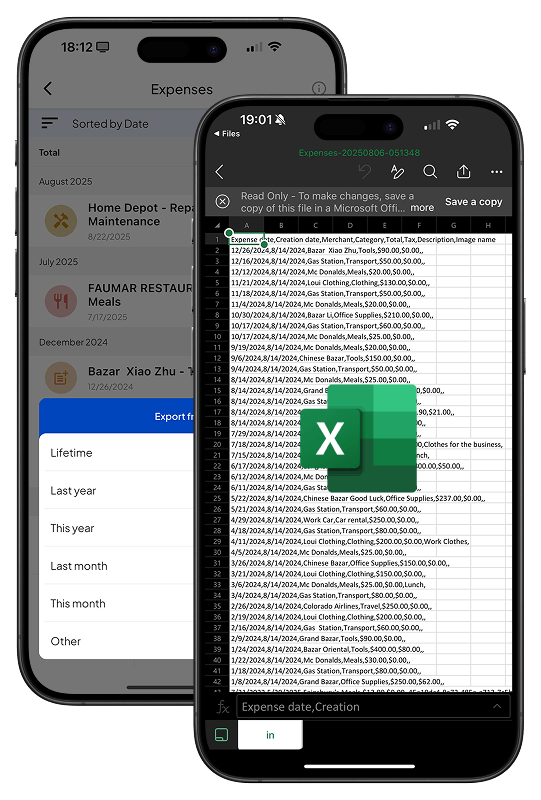

Export your business expenses & receipts for deeper analysis

Getting ready for tax season? Easily export all your business receipts for any custom date range with Invoice Fly.

Download them directly to your phone or computer to review expenses in detail and simplify your tax filing process—whether you’re analyzing deductions or submitting forms to your accountant.

How do small businesses & contractors benefit

from Invoice Fly’s receipt scanner?

Our business receipt scanner is built specifically for small business owners and blue-collar workers in the U.S. and around the world. Whether you’re tracking daily expenses or preparing for tax season, Invoice Fly helps you stay organized by making it easy to capture, manage, and export all your business receipts in one digital platform.

30h+

saved every quarter

thanks to hassle-free tax deductions.

25%

business expenses saved

by identifying expensive merchants.

24/7

always scan receipts

from the job site, merchant shop or your office.

Customized solutions for 50+ industries

Do more with the right set of tools

Send professional, polished invoices that make a great impression. Easily customize each one with your branding, payment terms, and itemized details. With built-in online payments and clear layouts, you’ll get paid faster—no chasing, no confusion.

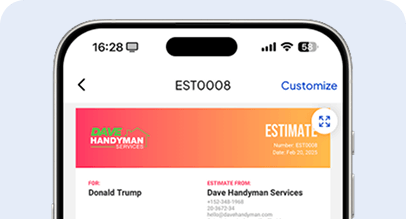

Estimates App

Win more jobs by sending professional-looking estimates. Get them approved and kickstart new projects.

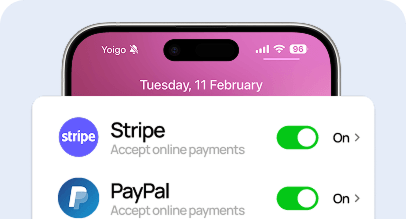

Online Payments

Collect online payments with Credit Card or PayPal, Stripe, Apple Pay, American Express, Visa, MasterCard, and more.

Business Reports

Manage all your client’s details, invoices, estimates and statements from a secure and cloud-based online platform.

Pick the best plan for you.

Get the tools you need to work smarter, stay in control, and grow with confidence.

What is a receipt scanner?

A receipt scanner is a desktop and mobile app tool that captures paper receipts and converts them into digital records. It’s especially useful for small business owners, freelancers, contractors, blue collar workers and anyone who wants to track expenses without dealing with piles of paper.

Most modern receipt scanners use OCR (Optical Character Recognition) technology to automatically extract key details like the merchant name, date, total amount, and payment method. Once scanned, receipts are stored securely and can be categorized, searched, or synced with accounting tools for bookkeeping, tax prep, or reimbursements.

Whether you’re scanning fuel receipts on the go or organizing monthly expenses, a receipt scanner helps you stay organized, avoid lost paperwork, and maintain accurate records—all from your phone or desktop.

How to use Invoice Fly’s receipt scanner?

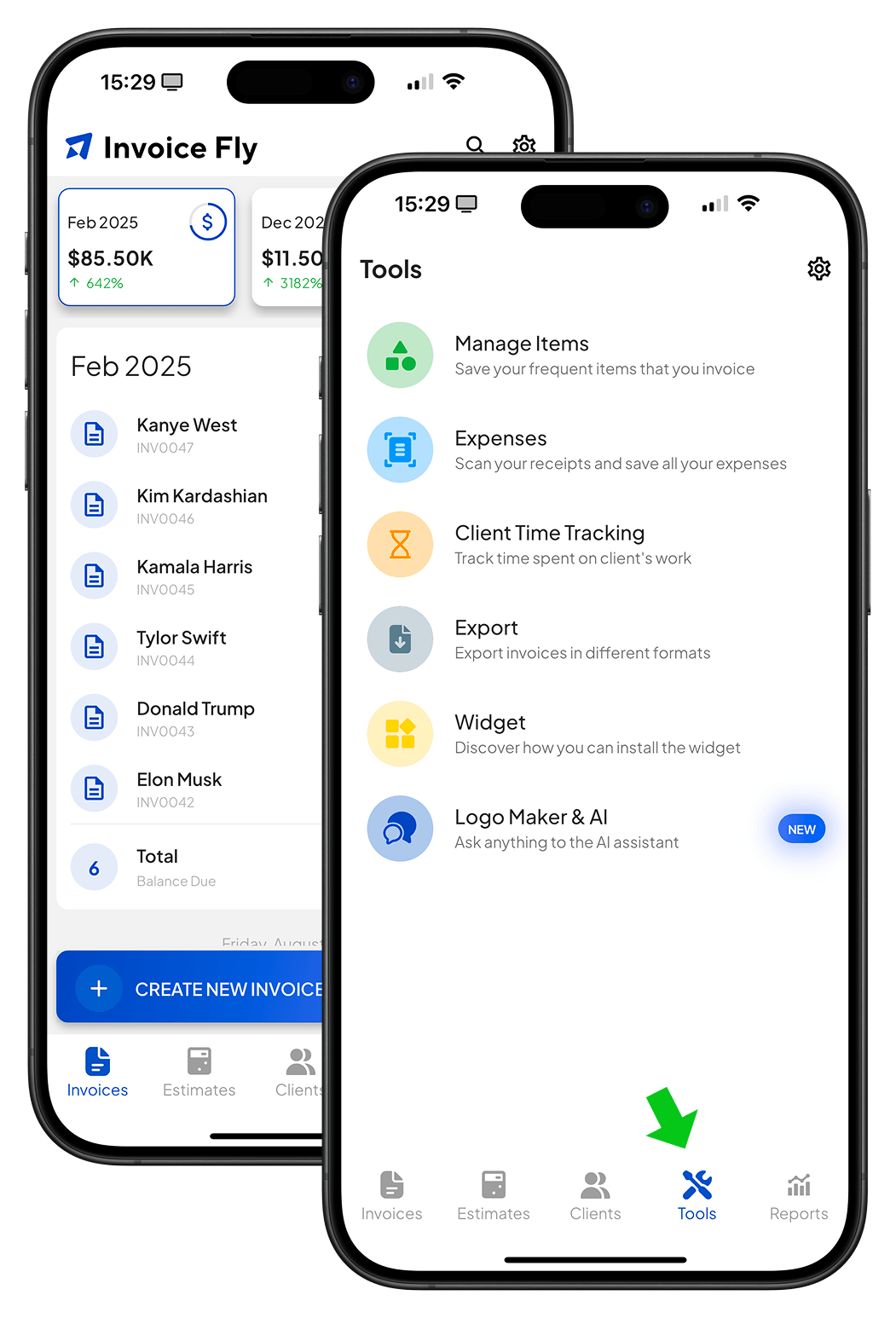

Step 1: Log in to Invoice Fly

- Open the app or desktop software

Open Invoice Fly mobile app on your phone, or log in from your computer browser.

- Click on "Tools"

Once inside, click on the “Tools” button on the bottom part of the app, on the navigation menu.

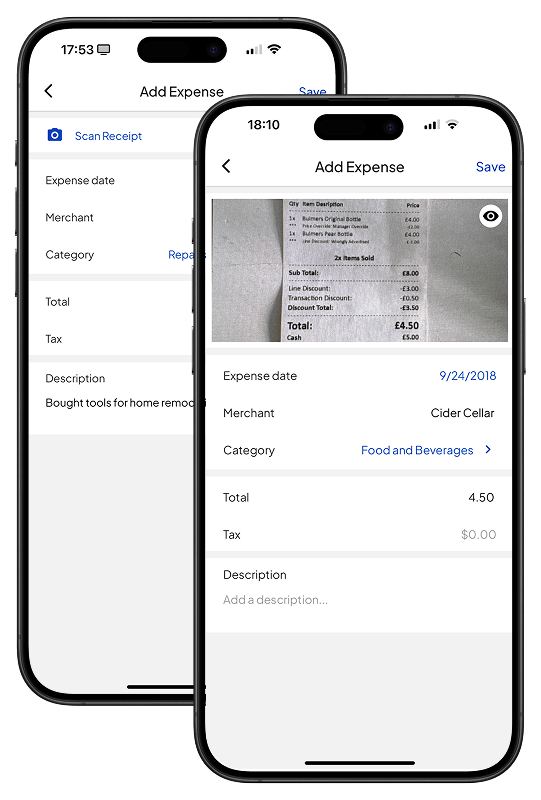

Step 2: Scan receipts

- Scan a receipt with your phone camera

Click on “Scan Receipts” and then click on “Take from camera”.

Once you’ve taken the picture, Invoice Fly will automatically generate a receipt in a few seconds and will add the expense to your business reports.

- Choose a receipt from your camera roll

Click on “Scan Receipts” and then click on “Take from camera”. Choose 1 receipt or multiple ones.

Our software will scan every uploaded image and add all the expenses to the expense chart, also displayed in the business reports section.

Step 3: Analyze your business expenses

- Track your expenses by category

Once you’ve uploaded all your receipts, click on “Chart” to view a clear breakdown of expenses by category. This helps you quickly see where most of your money is going, identify unnecessary costs, and make smarter decisions to improve cash flow.

Step 4: Export your expenses

- Analyse your expenses in depth

Export your expenses in multiple formats, such as Excel and CSV, to perform a deeper analysis of your spending. Easily spot costly suppliers, cut unnecessary expenses, and maximize your tax deductions.

FAQs about the receipt scanner

The best way to scan receipts is by using a receipt scanning app like Invoice Fly, with built-in scanning features. These apps use your phone’s camera to capture receipts, automatically crop them, and convert the data into a digital format for easy tracking and expense reporting. For bulk scanning, a dedicated desktop receipt scanner may be more efficient.

Yes. Most modern smartphones can scan receipts using their built-in camera and free scanning apps like Adobe Scan, Microsoft Lens, or specialized expense-tracking apps. These tools improve image quality, convert receipts into PDFs, and often extract key details (like date and amount) automatically.

A receipt scanner is worth it if you deal with large volumes of receipts or need to stay highly organized for taxes and accounting. Scanners (including mobile apps) save time, reduce paper clutter, and lower the risk of losing receipts, making them especially valuable for freelancers, contractors, and small businesses.

Yes. The IRS accepts scanned or digital copies of receipts as long as they are accurate, legible, and contain all the required information (vendor, date, amount, and business purpose). Digital storage must also be reliable and accessible in case of an audit. Keeping them organized in accounting software or secure cloud storage is recommended.

You can store receipts digitally by saving them as PDFs or images in cloud storage platforms (Google Drive, Dropbox, OneDrive) or by using expense management software like Invoice Fly that organizes them automatically. Best practices include keeping receipts sorted by year and category, creating backups, and ensuring files are secure and easy to retrieve for tax or audit purposes.

Free Resources

Resources to run your business smoothly and efficiently.

Free Templates

Explore free templates and create estimates, quotes, invoices, bills and receipts.

Free Generators

Generate Estimates, Quotes, Invoices, Bills, Receipts, and Proformas online.

Free Calculators

Use our free calculators: Service Price, Profit Margin, Net Salary, VAT, Break-Even…

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs