- Home

- »

- Free Resources for Small Businesses

- »

- Free Templates

- »

- Free Invoice Templates

Invoice Templates

Explore our collection of free downloadable invoice templates in the format that best suits you.

Download a Free Invoice Template for

Google Sheets, Google Docs, Excel, Word & PDF

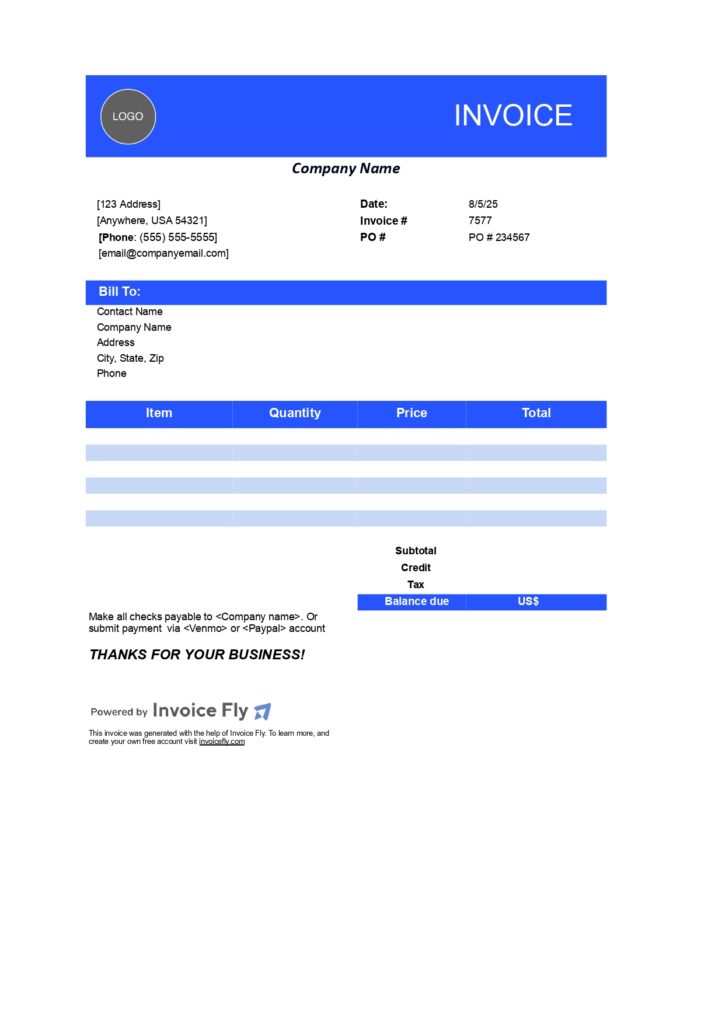

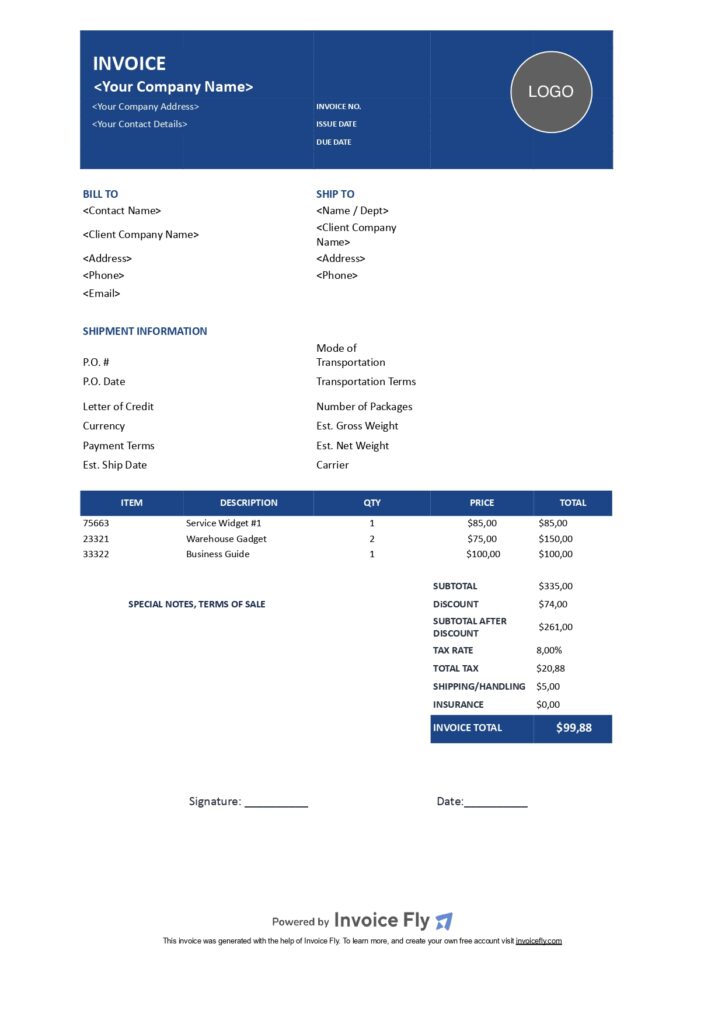

Contractor Free Invoice Template Dark Blue

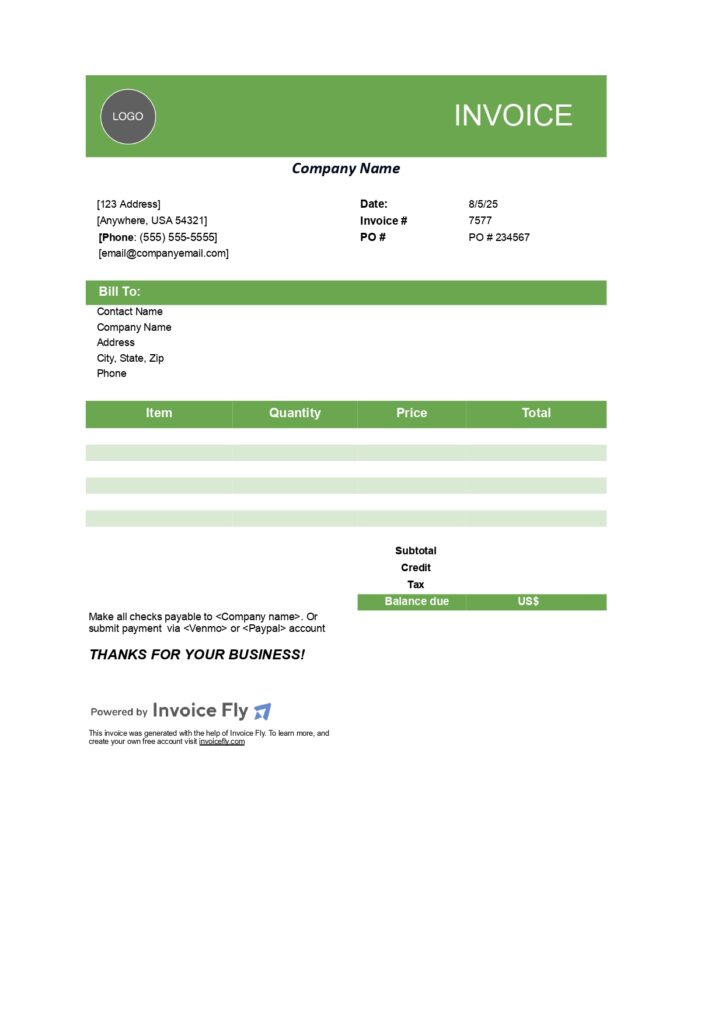

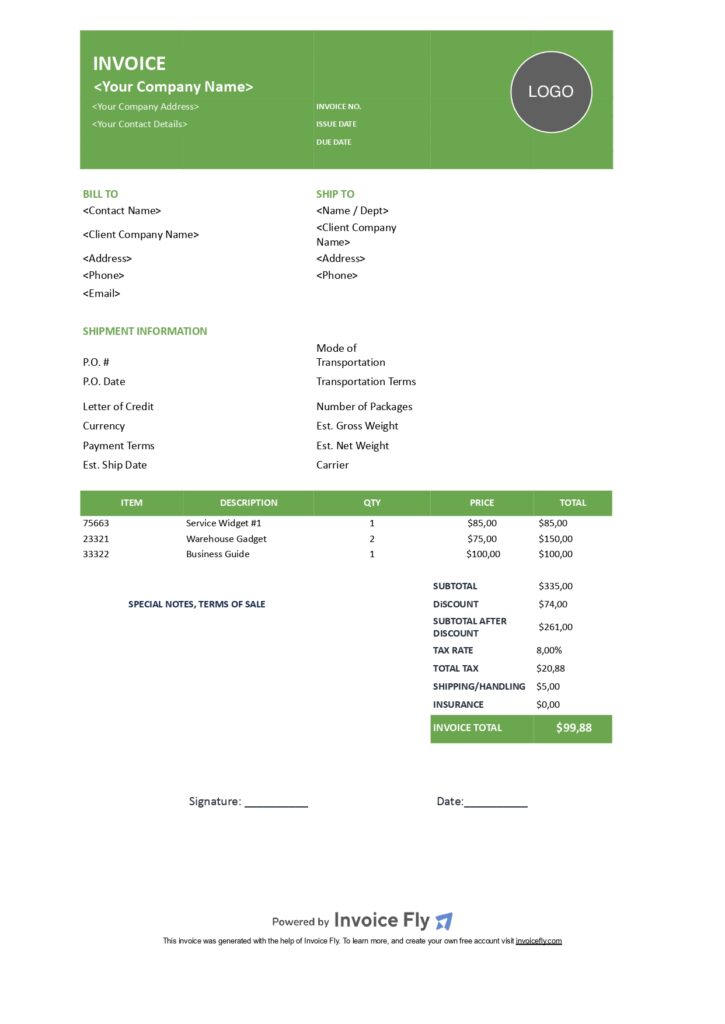

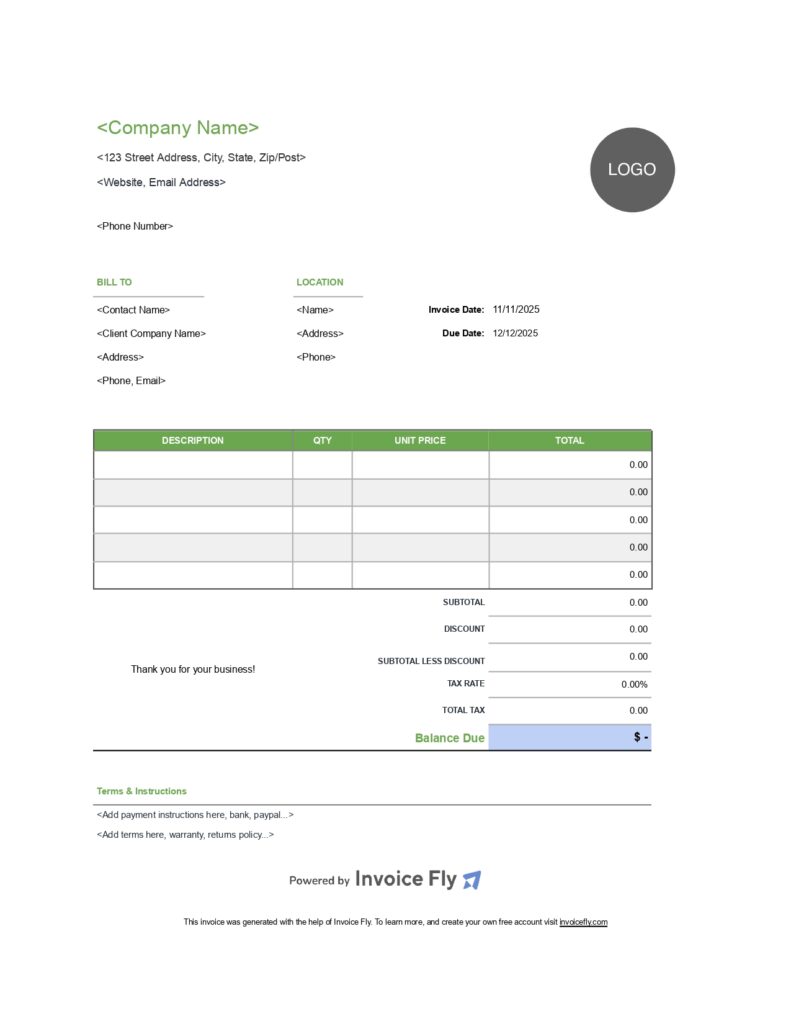

Contractor Free Invoice Template Green

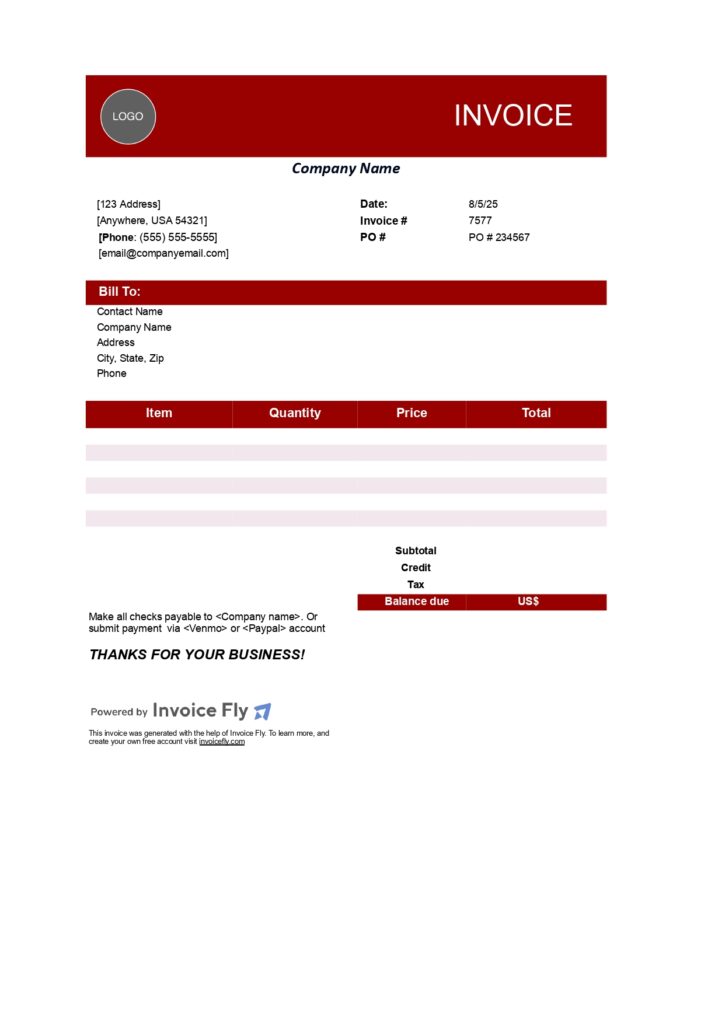

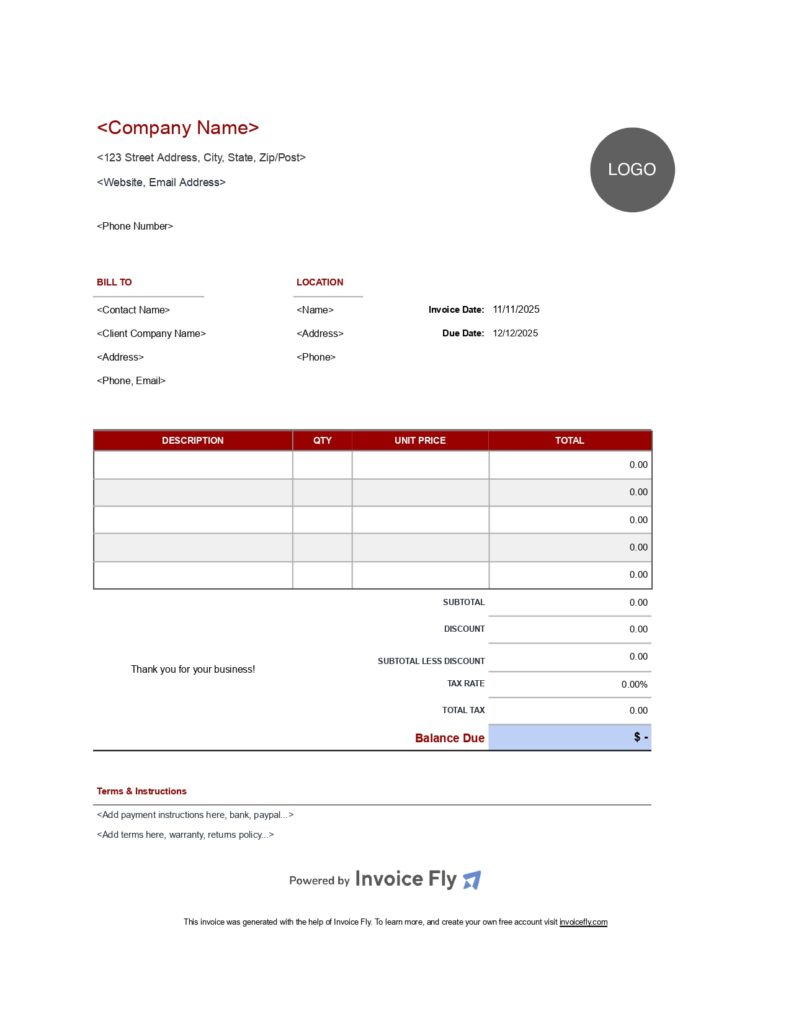

Contractor Free Invoice Template Red

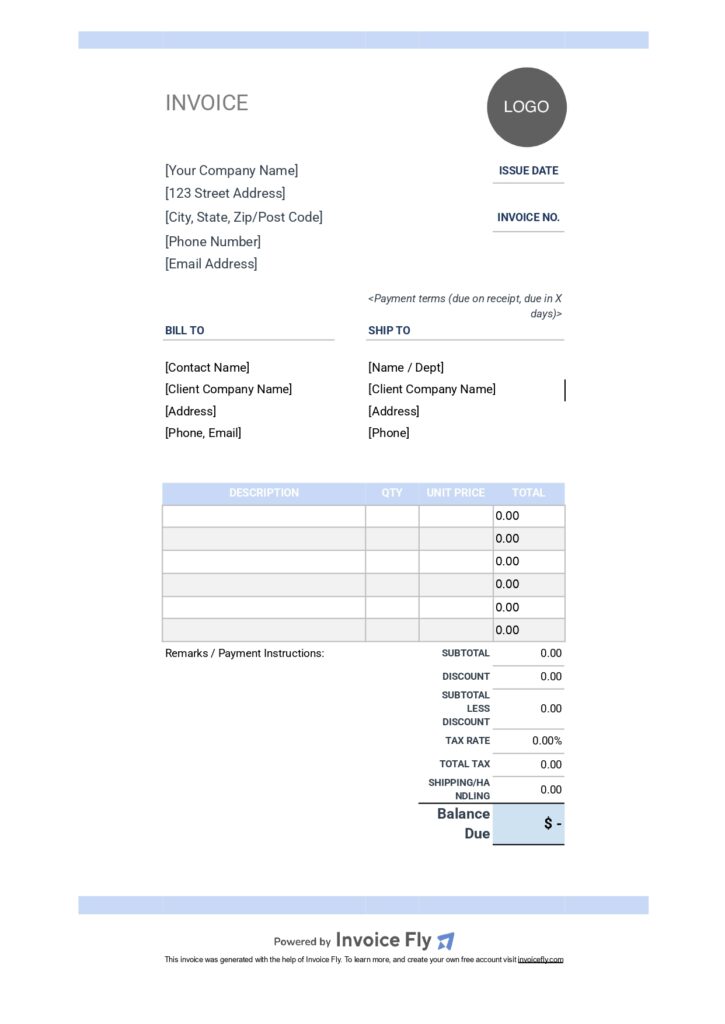

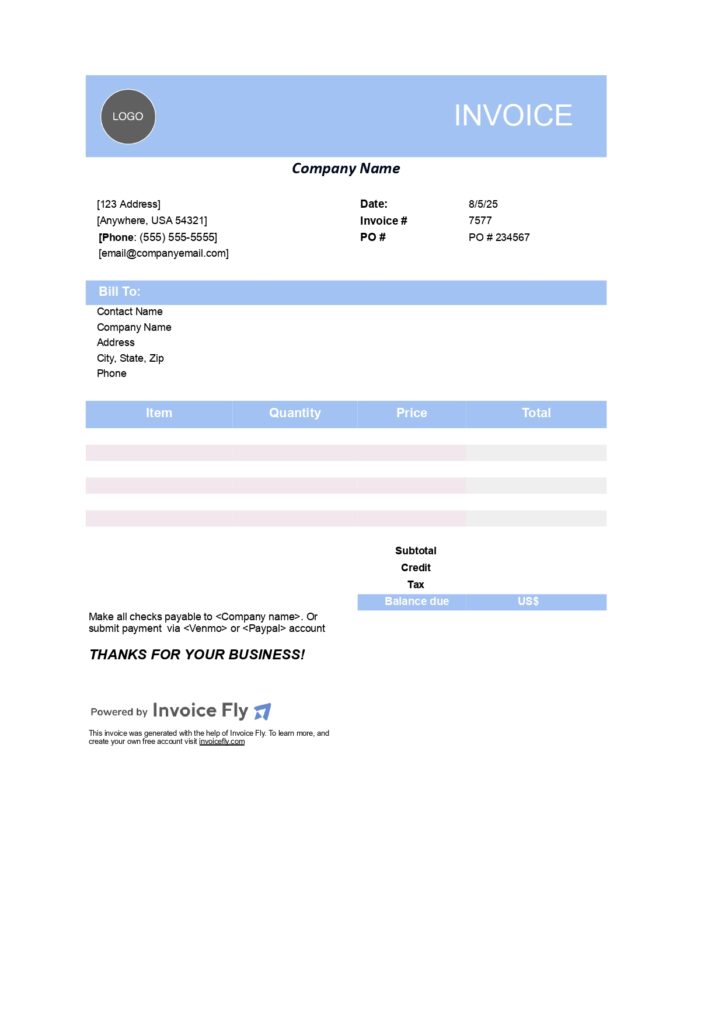

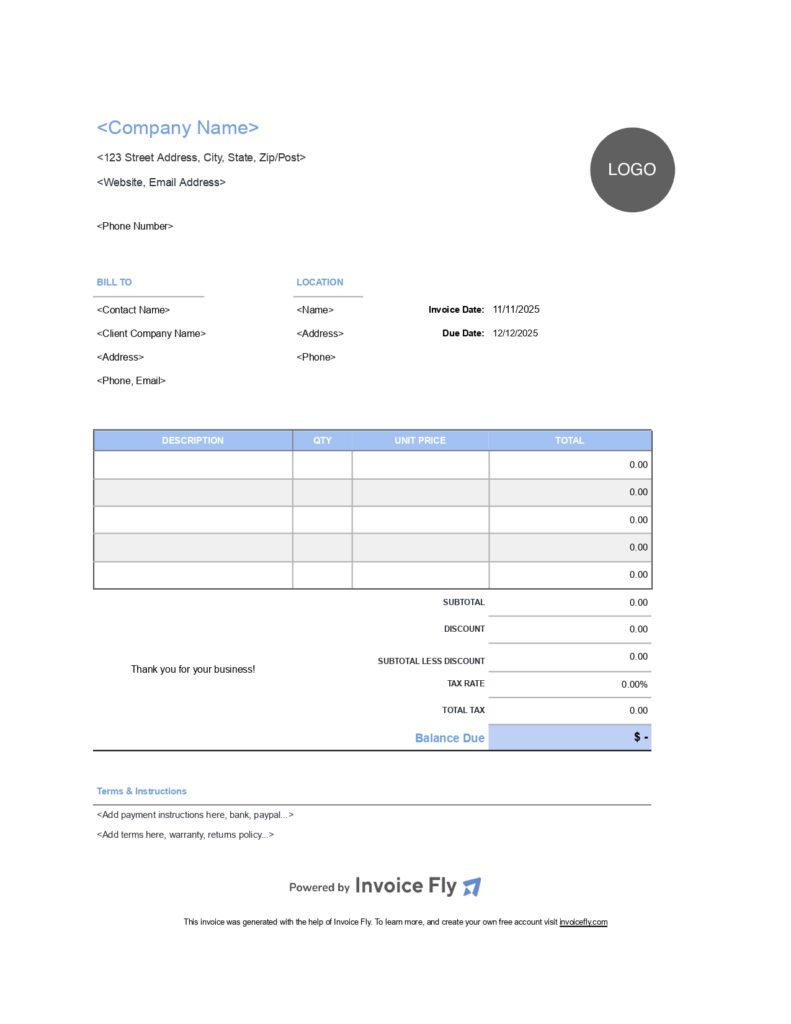

Contractor Invoice Free Template Light Blue

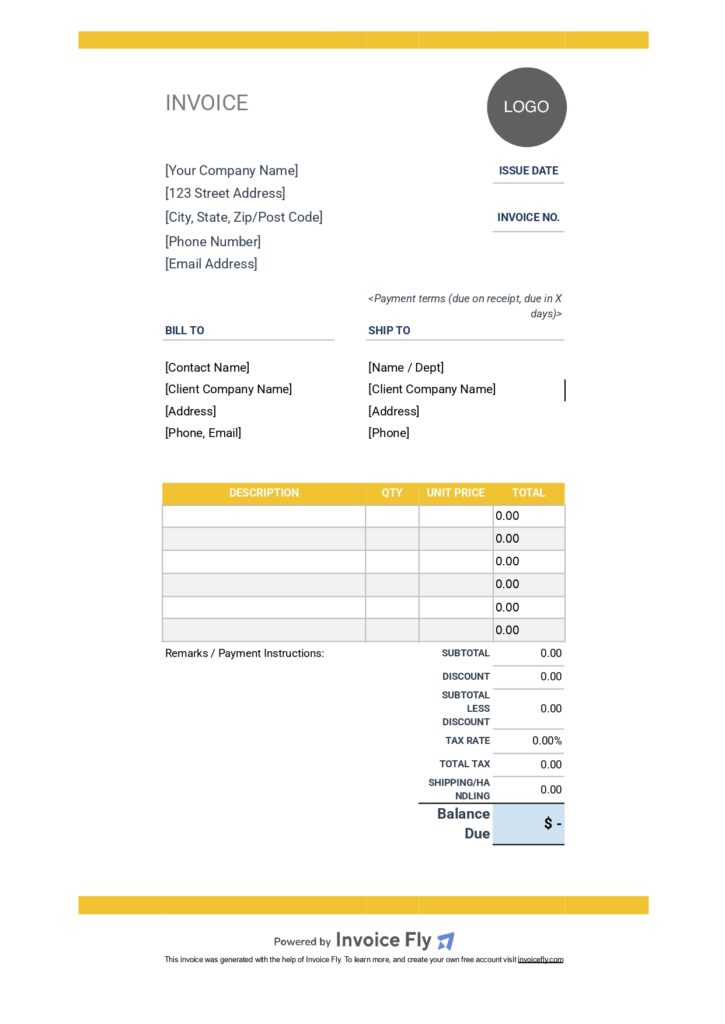

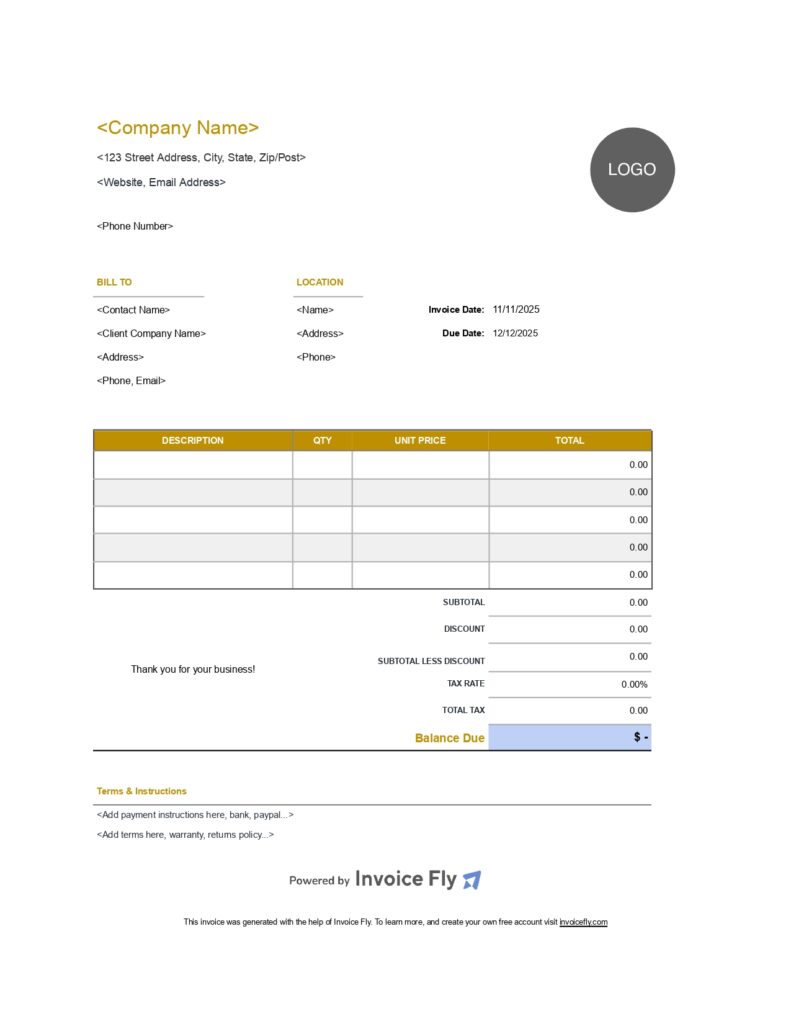

Contractor Free Invoice Template Yellow

Freelancer Free Invoice Template Dark Blue

Freelancer Free Invoice Template Green

Freelancer Free Invoice Template Red

Freelancer Free Invoice Template Light Blue

Freelancer Free Invoice Template Yellow

Small Business Free Invoice Template Dark Blue

Small Business Free Invoice Template Green

Small Business Free Invoice Template Red

Small Business Free Invoice Template Light Blue

Small Business Free Invoice Template Yellow

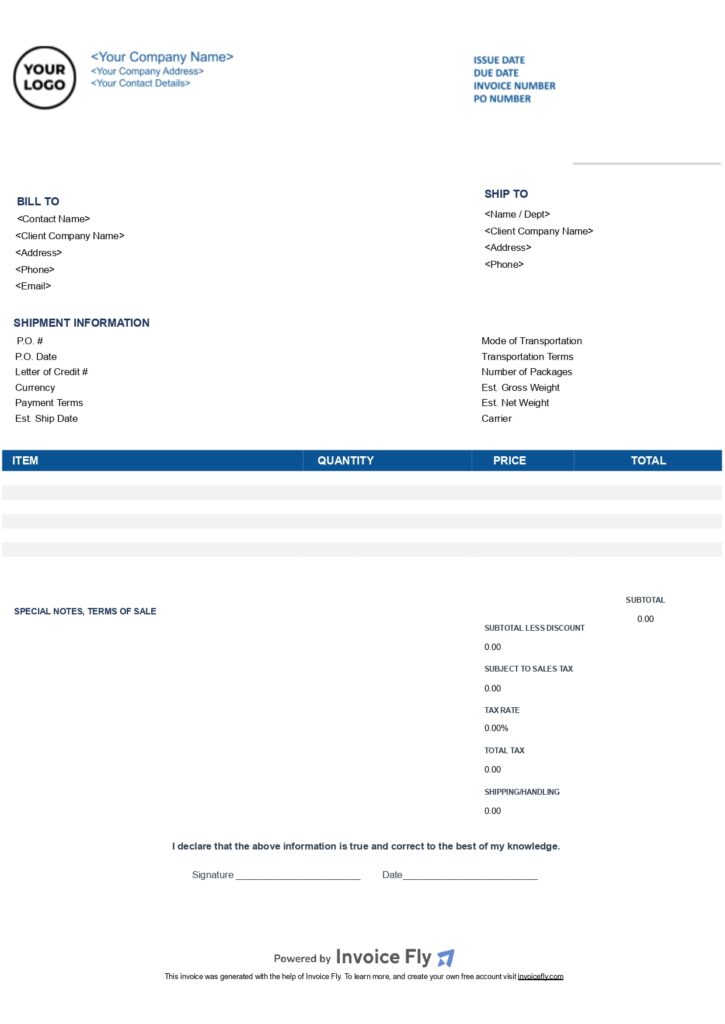

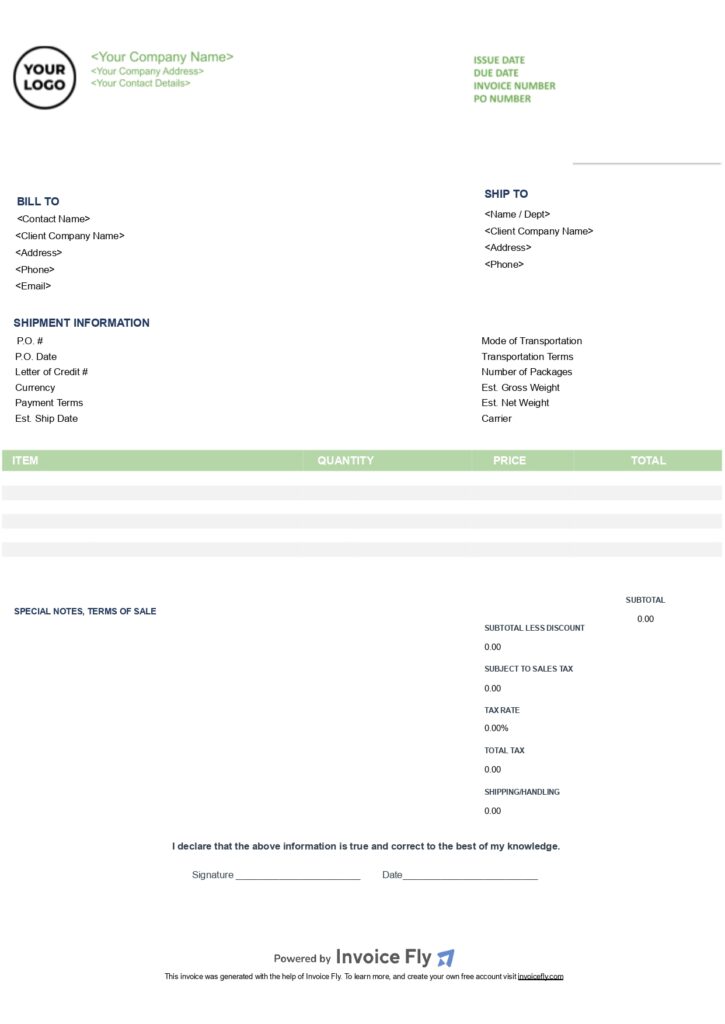

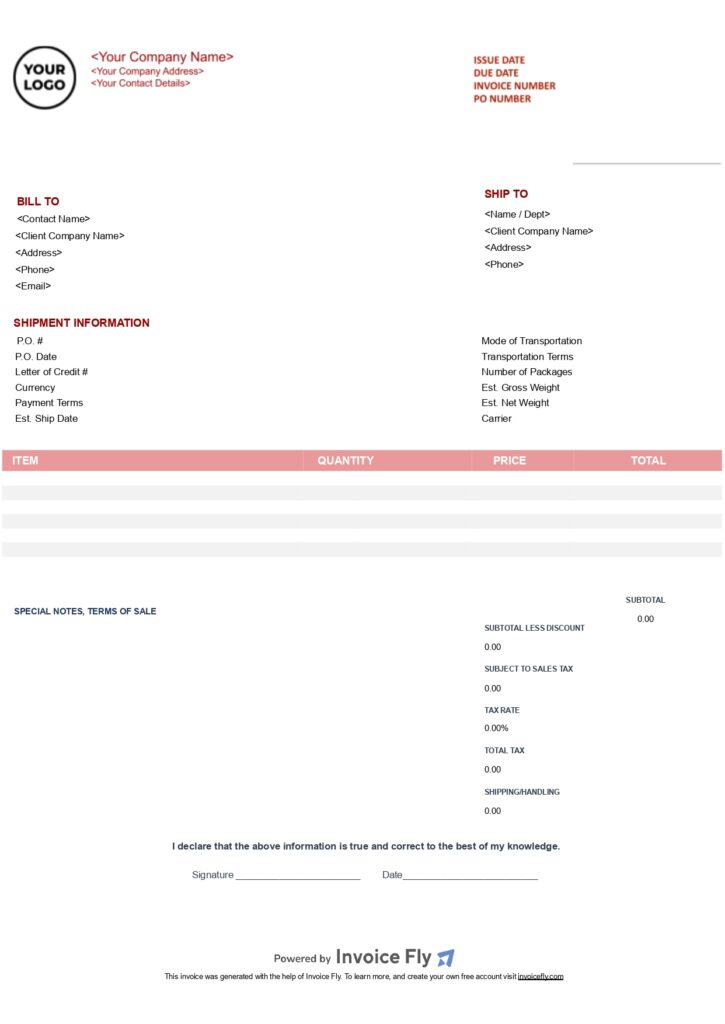

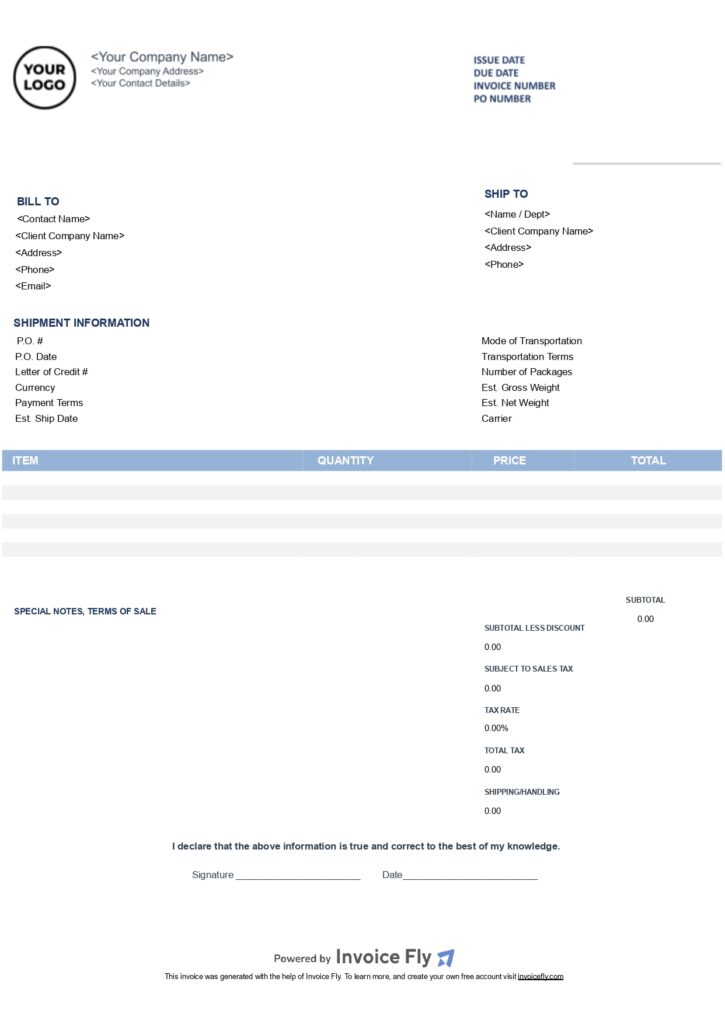

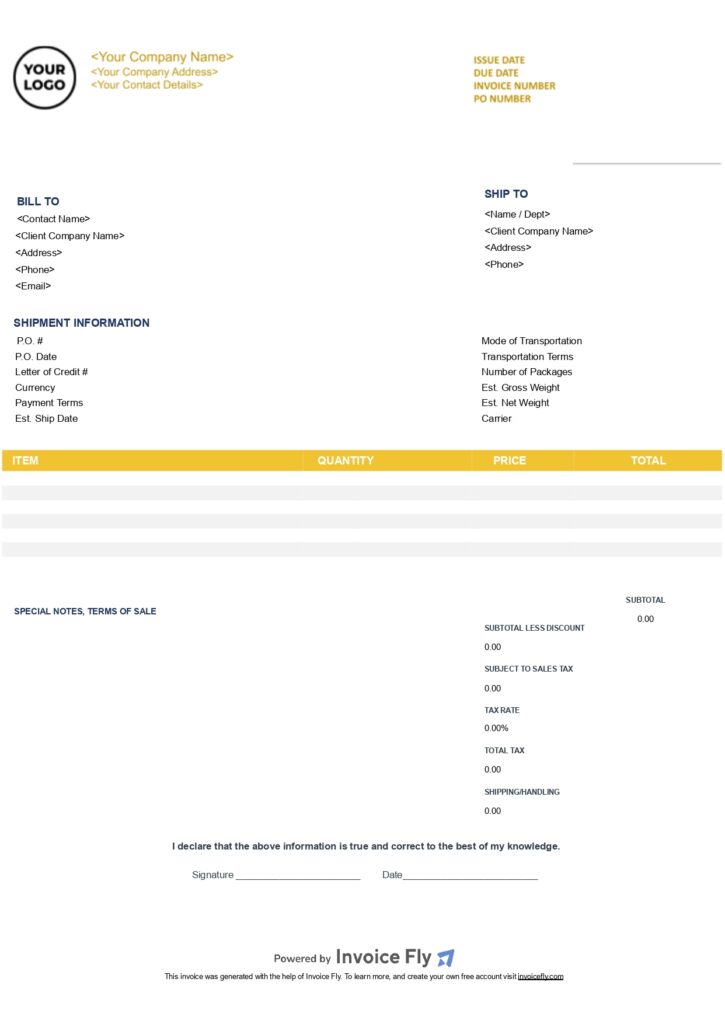

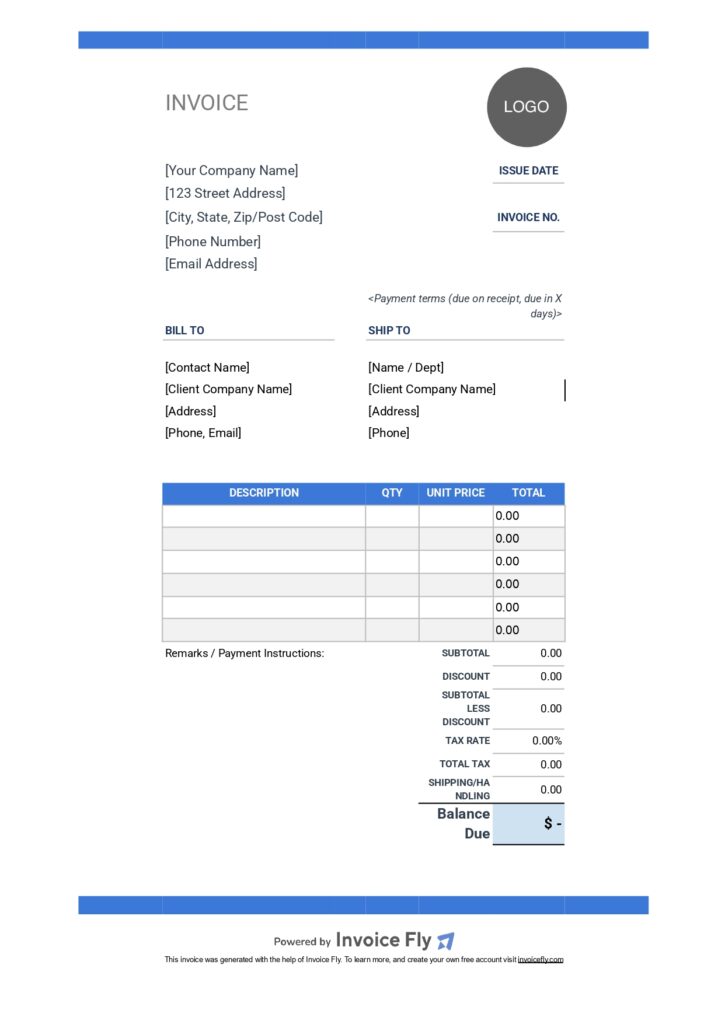

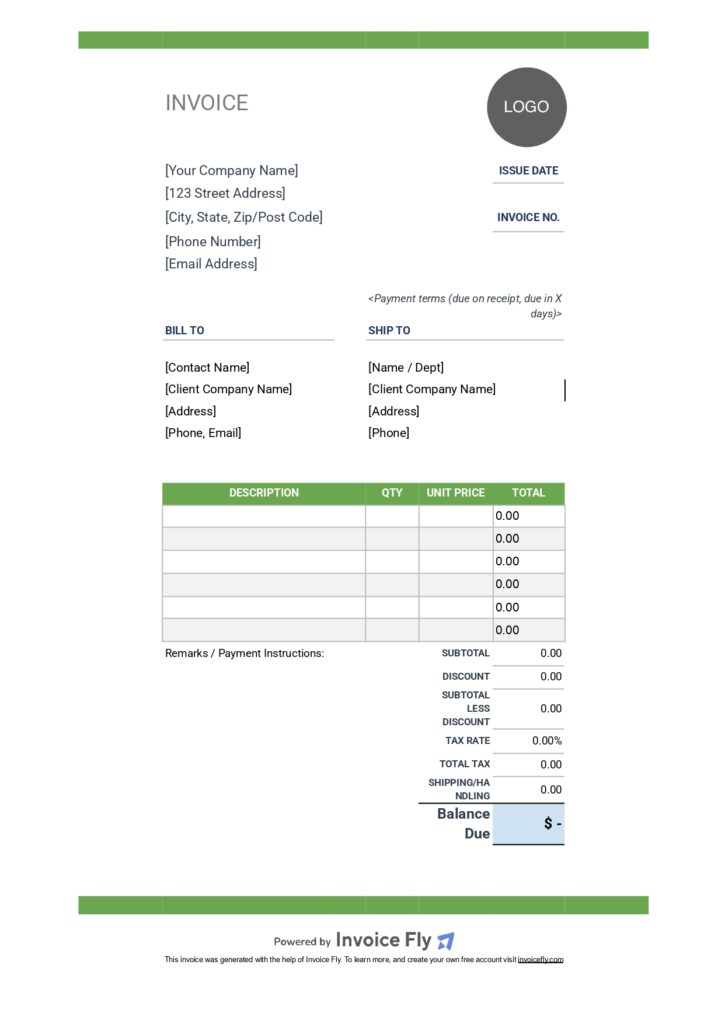

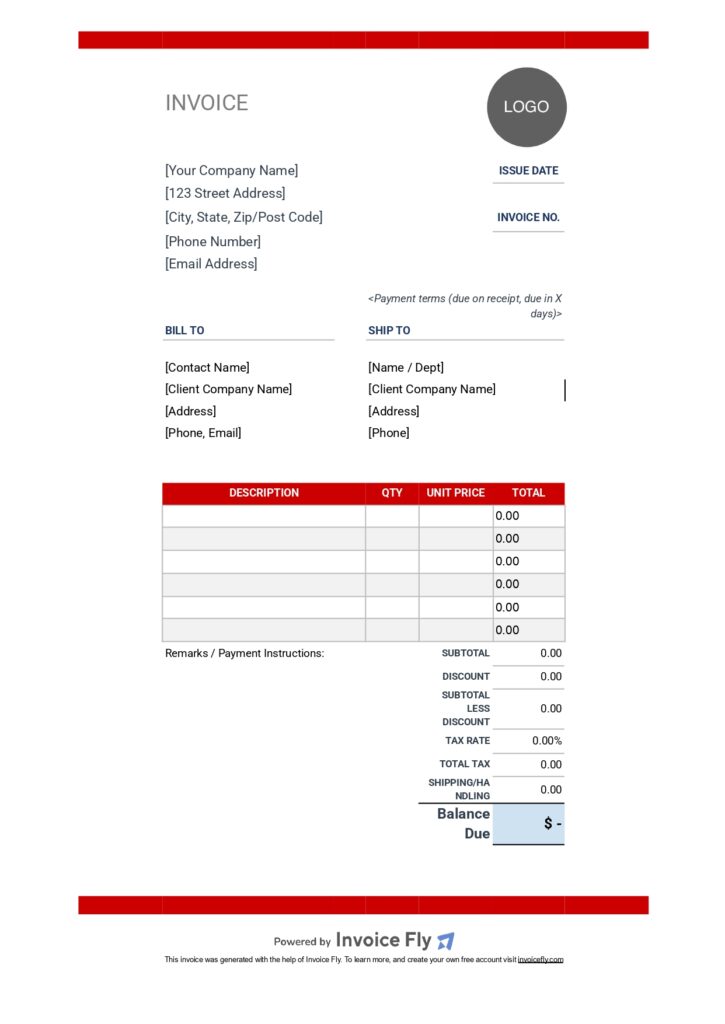

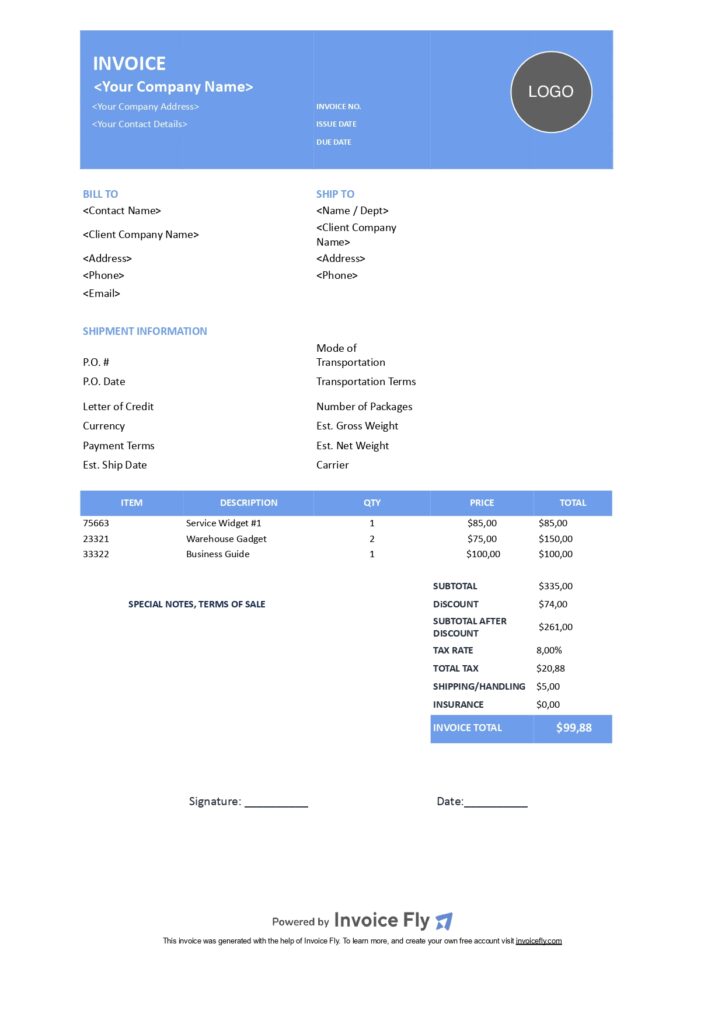

Commercial Free Invoice Template Dark Blue

Commercial Free Invoice Template Green

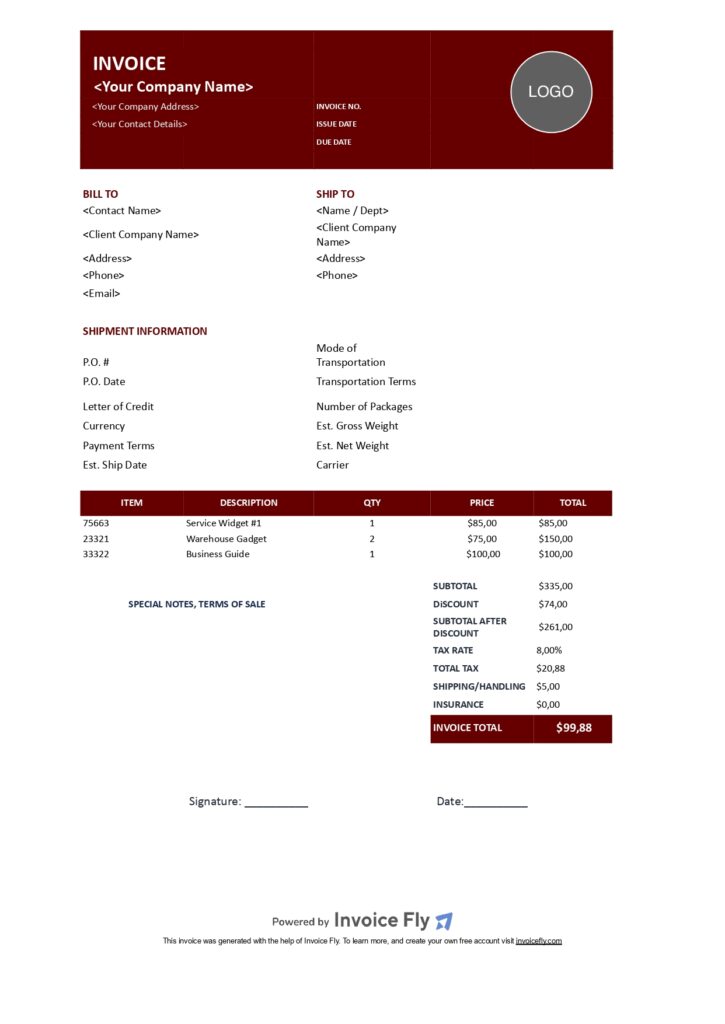

Commercial Free Invoice Template Red

Commercial Free Invoice Template Light Blue

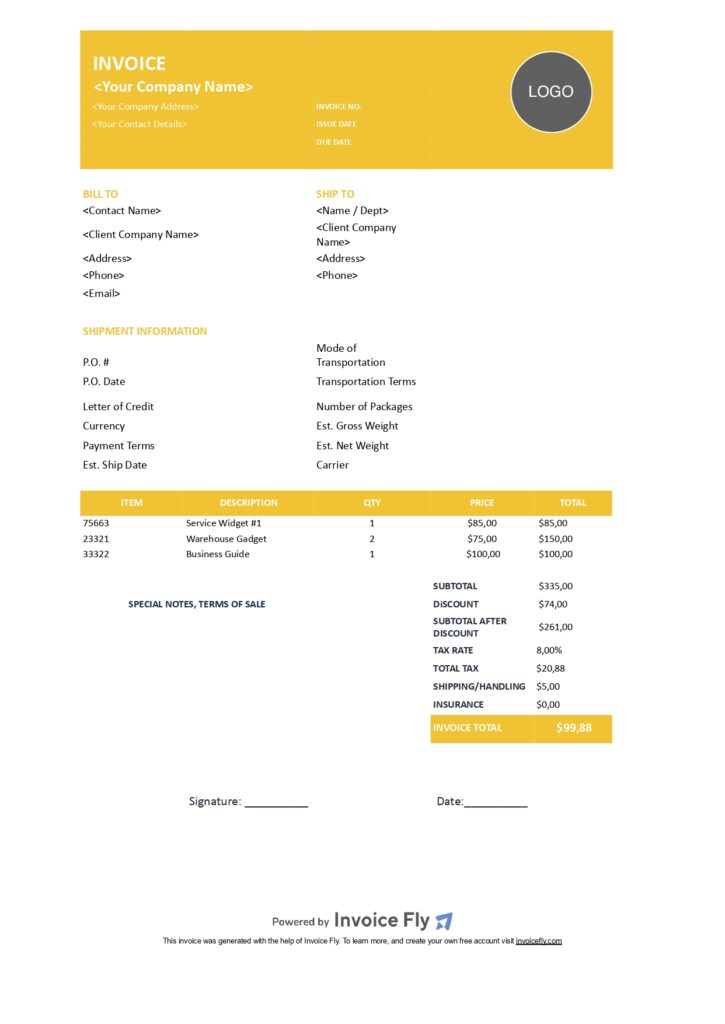

Commercial Free Invoice Template Yellow

Modern Free Invoice Template Dark Blue

Modern Free Invoice Template Green

Modern Free Invoice Template Red

Modern Free Invoice Template Light Blue

Modern Free Invoice Template Yellow

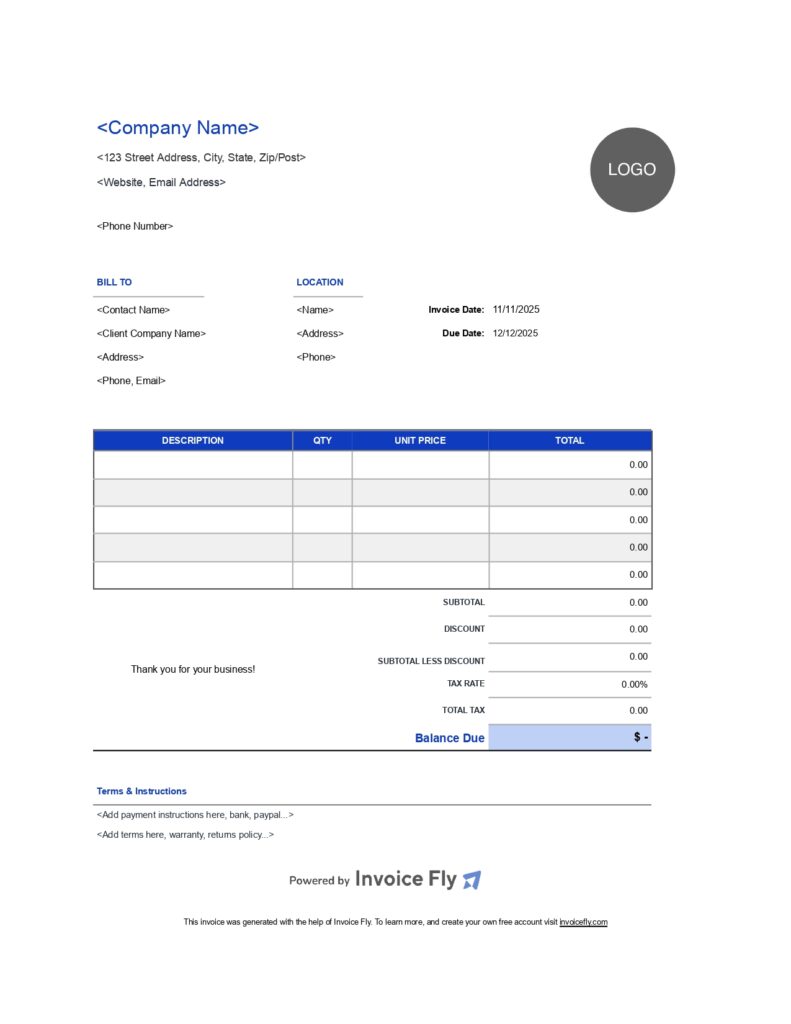

Generic Invoice Templates for all industries

Google Docs Invoice Templates

Google Sheet Invoice Templates

Word Invoice Templates

Excel Invoice Templates

PDF Invoice Templates

Invoice Templates by Trade

Invoice Templates by format

What is an Invoice Template?

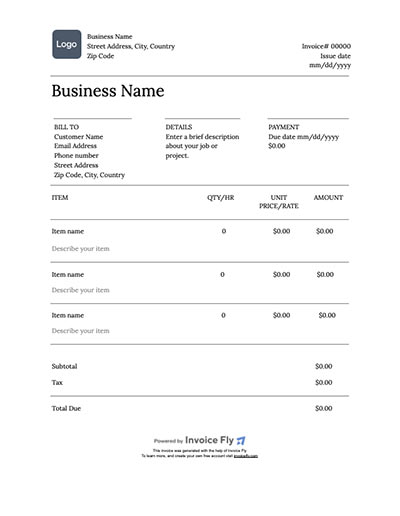

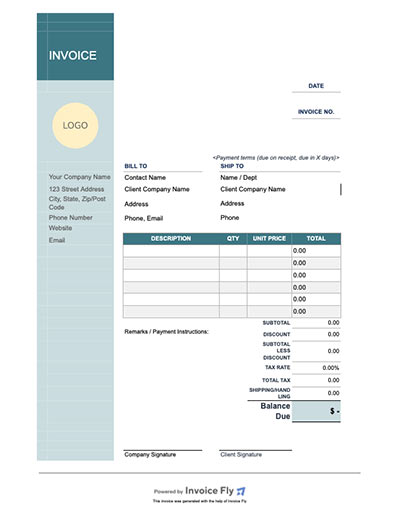

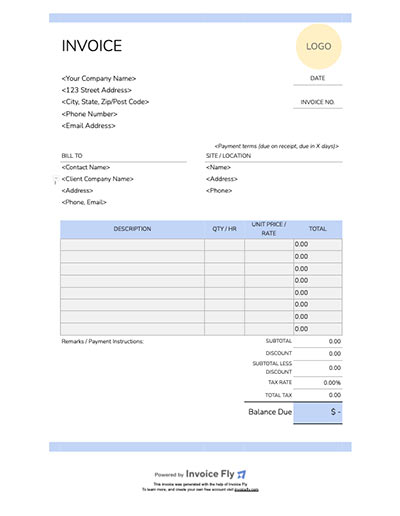

An invoice template is a preformatted document designed to facilitate the creation of invoices, which are essential for billing customers for products or services rendered.

These templates typically include all necessary fields such as the company name, contact details, invoice number, date, item descriptions, quantities, unit prices, total amounts, and payment terms.

Build your brand using Invoice Templates

Boost your business’s professional image and streamline your financial processes with Invoice Fly’s invoice templates.

Offering consistent, branded invoices to your clients and partners not only increases brand visibility but also helps reinforce professionalism.

With Invoice Fly, customizing invoices is simple—use the platform’s intuitive features to personalize color schemes, fonts, and other elements to match your business identity, just like editing in Word or Excel.

Use our intuitive formats: Google Docs, Excel, PDF, Word, and Google Sheets, to customize elements and ensure your invoices reflect your unique style.

You can also leverage automatic calculations similar to Excel, allowing totals and taxes to update in real time as you input details. This eliminates manual errors and speeds up your billing process. Once your invoice is ready, quickly send it via email or print it out for clients.

Save time by storing and reusing templates, updating them as your brand evolves, or adjusting them to suit specific client needs.

With Invoice Fly, tracking invoices and managing your finances becomes a breeze, helping you stay organized and focused on growing your business.

Benefits from using Invoice Fly's Invoice Templates:

Contractors and small business owners benefit from Invoice Fly’s invoice templates in several ways, making invoicing more efficient, professional, and consistent. Here are some key advantages:

1. Time-Saving Automation:

Invoice templates allow users to quickly generate invoices by inputting relevant details without starting from scratch every time.

This saves significant time, especially for busy contractors who manage multiple projects and clients simultaneously.

The templates help eliminate the need for repetitive data entry, allowing business owners to focus on their core work.

2. Professional and Consistent Branding:

Invoice Fly’s templates can be customized to match the business’s branding by adding logos, colors, and specific fonts.

This ensures that all invoices look consistent and professional, which helps strengthen brand visibility and trust with clients.

For contractors, presenting a polished, branded invoice adds credibility and leaves a positive impression.

3. Error-Free Calculations:

With built-in automated calculation features, like those in Excel, Invoice Fly’s templates help contractors avoid common errors in manual calculations.

Whether it’s calculating totals, taxes, or discounts, these features ensure accuracy, reducing the risk of mistakes that could lead to delays in payment or misunderstandings with clients.

4. Efficient Financial Tracking

Using standardized templates allows small business owners to keep better track of payments, outstanding invoices, and overall financial performance.

It streamlines record-keeping and aids in budget management, making it easier to monitor cash flow and follow up on overdue payments promptly.

Other Free Resources

FAQs about Free Invoice Templates

Using an invoice template can help ensure that your invoices are professional, accurate and consistent, which can help you get paid faster and improve your business's reputation.

Yes, all of our templates are free to download and use.

Yes, our templates are fully customizable, so you can add or remove fields, change fonts and colors and more.

Yes, you can send digital invoices using our templates. Simply save it in whatever format you prefer and send it to your client.

Yes, if you have any questions or need help customizing your template, don't hesitate to reach out to our support team at help@labhouse.io.

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs