- Home

- »

- Free Resources for Small Businesses

- »

- Free Templates

- »

- Free Invoice Templates

- »

- Freelance Invoice Template

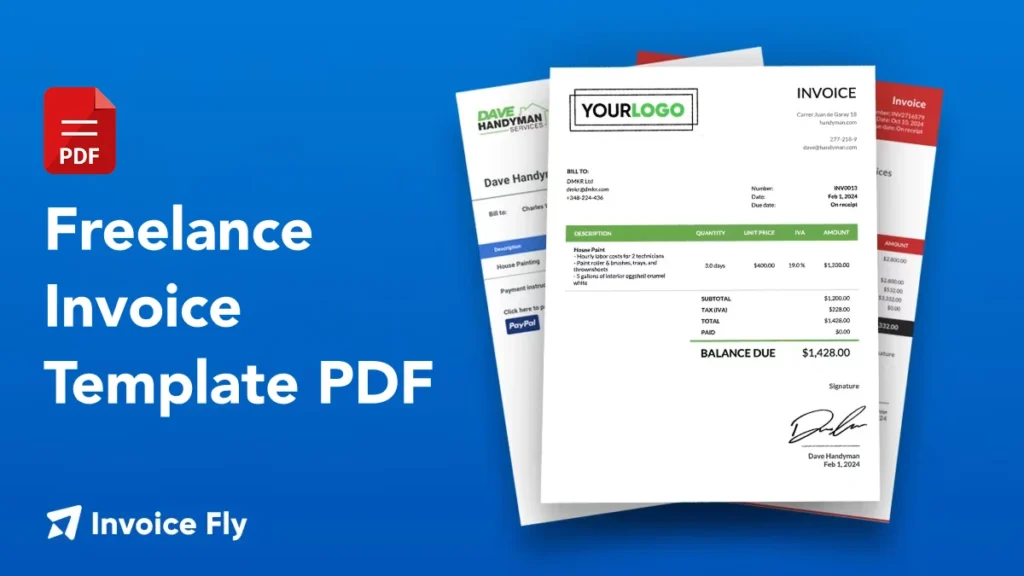

Free Freelance Invoice Template

Bill like a pro with our freelance invoice template. Add your branding, track hours or fixed fees, export to PDF, and get paid faster.

Download a Free Invoice Template for

Google Sheets, Google Docs, Excel, Word & PDF

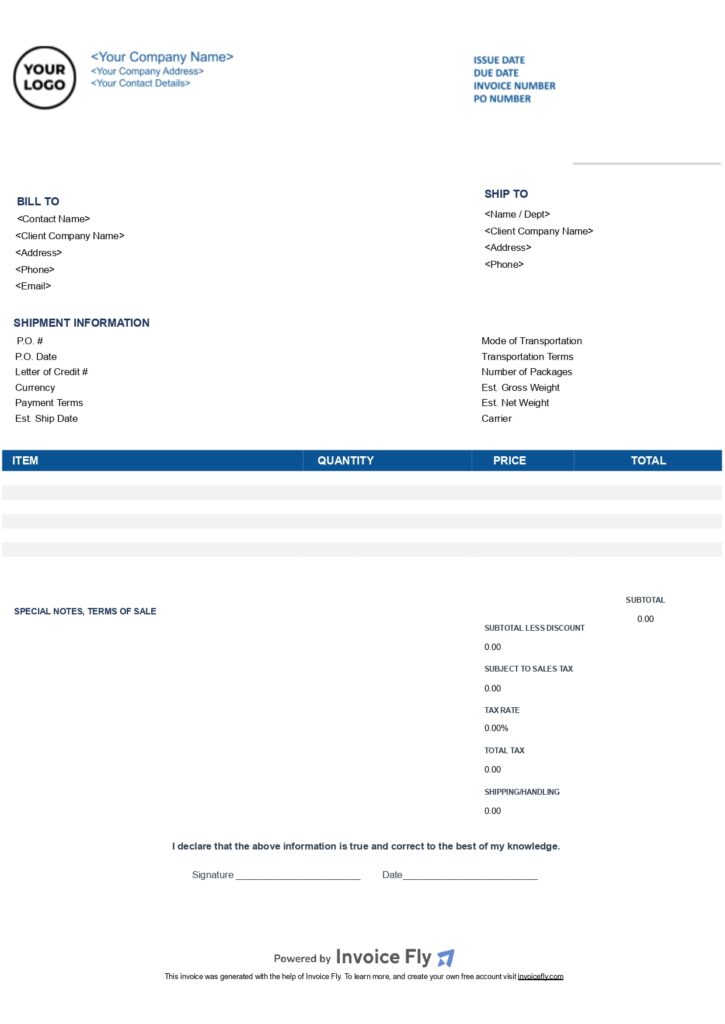

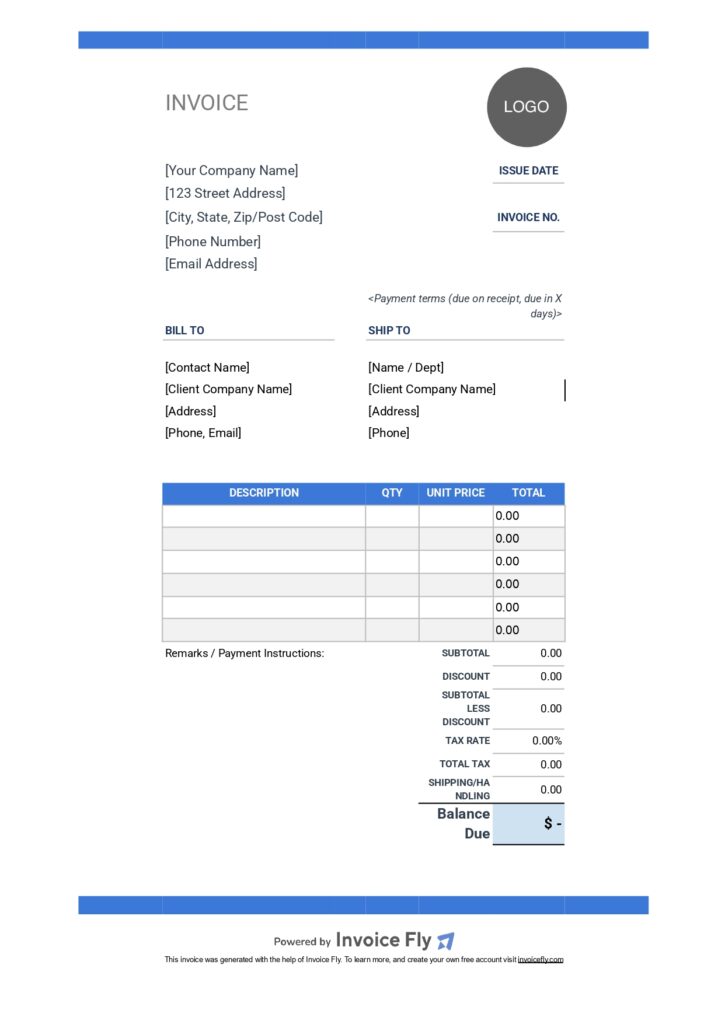

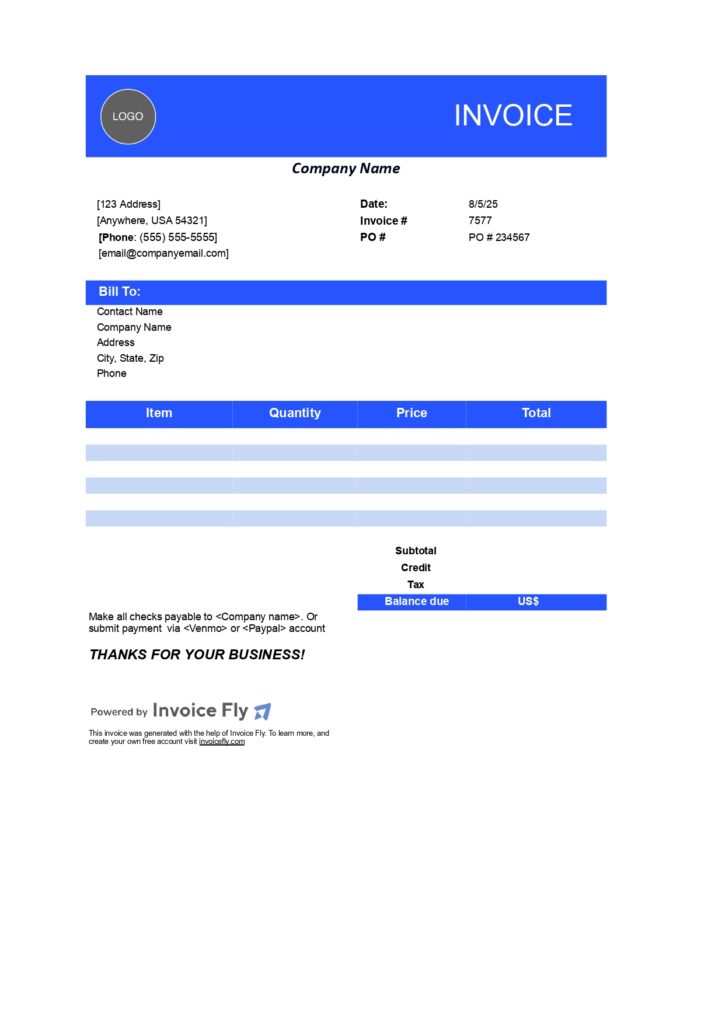

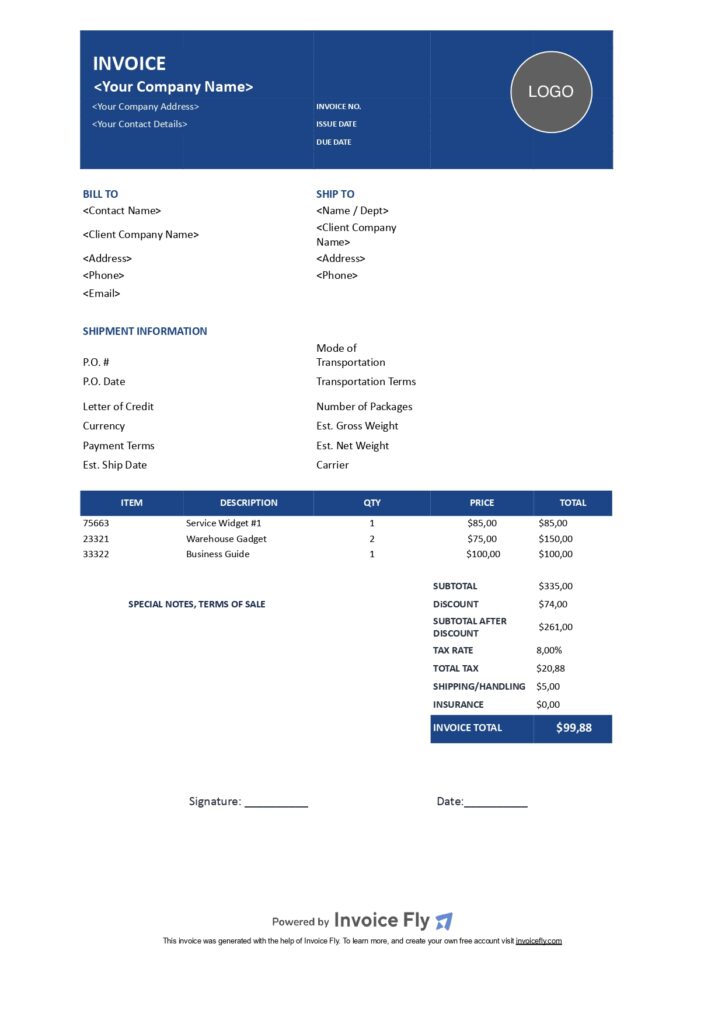

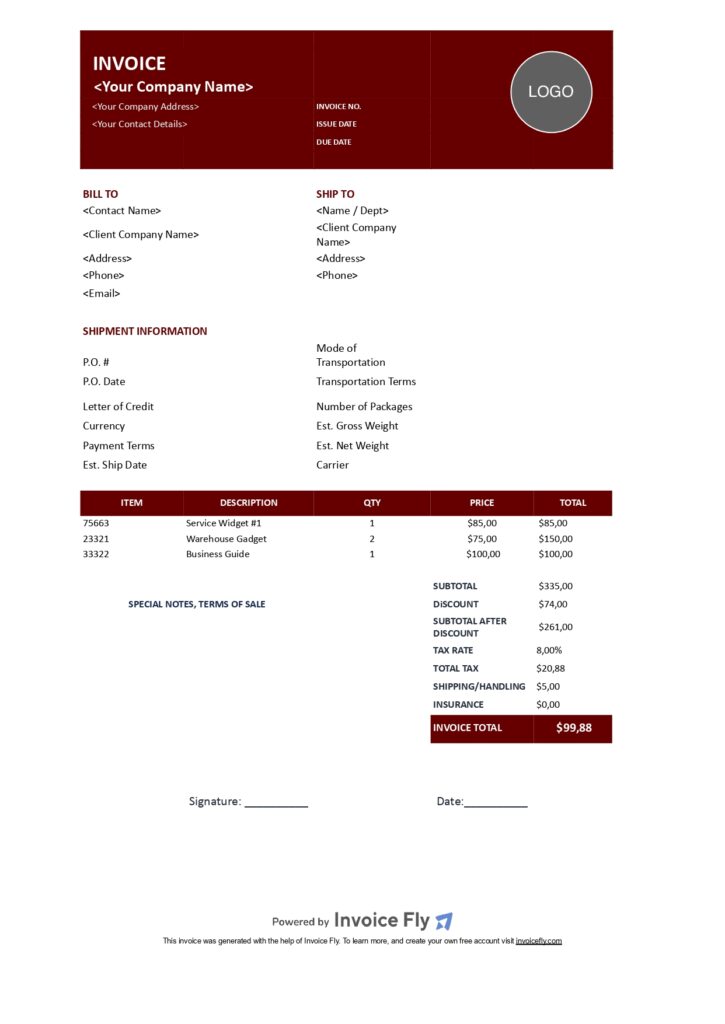

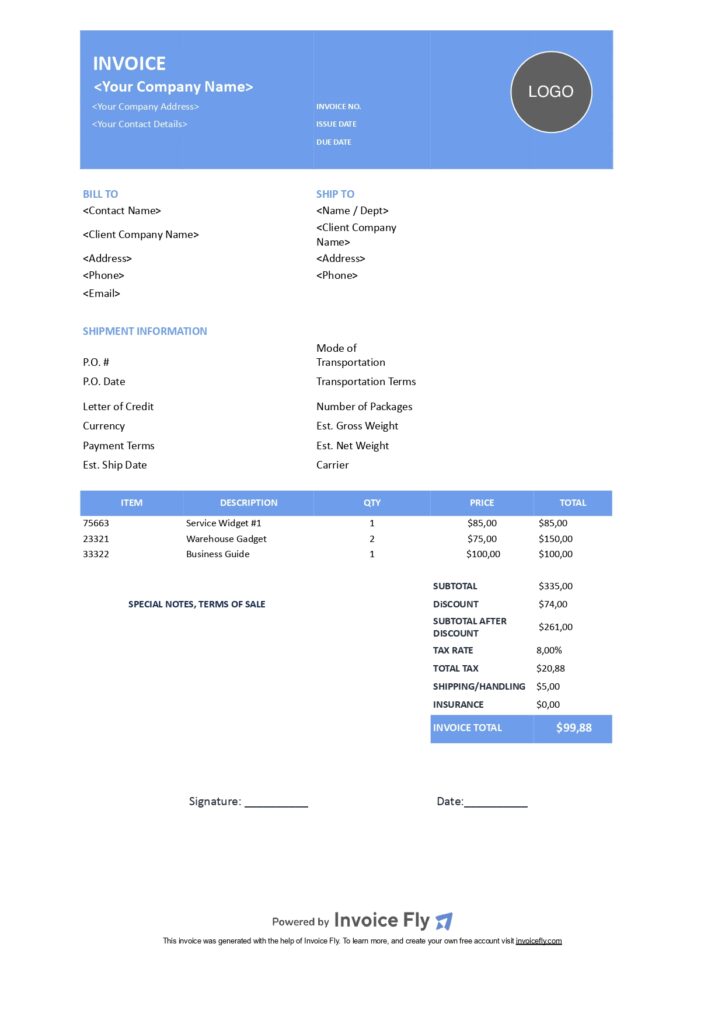

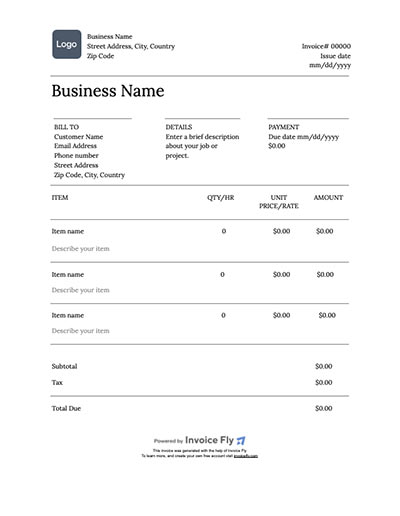

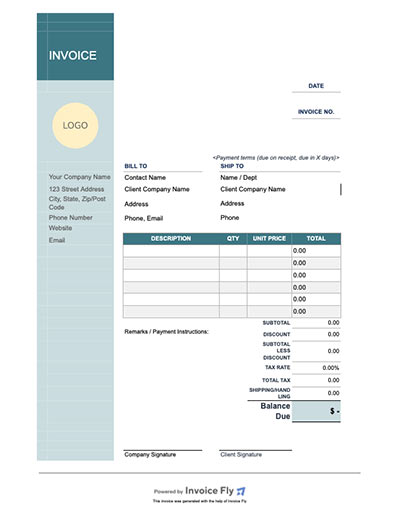

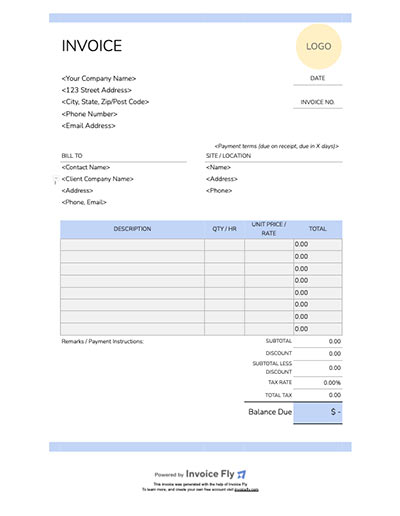

Contractor Free Invoice Template Dark Blue

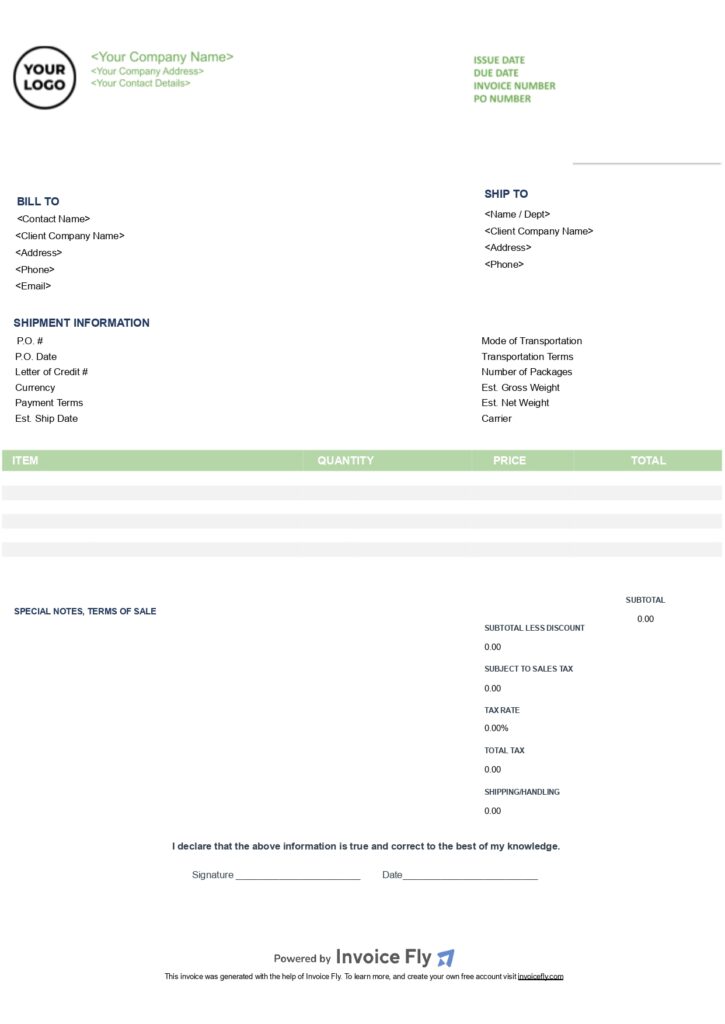

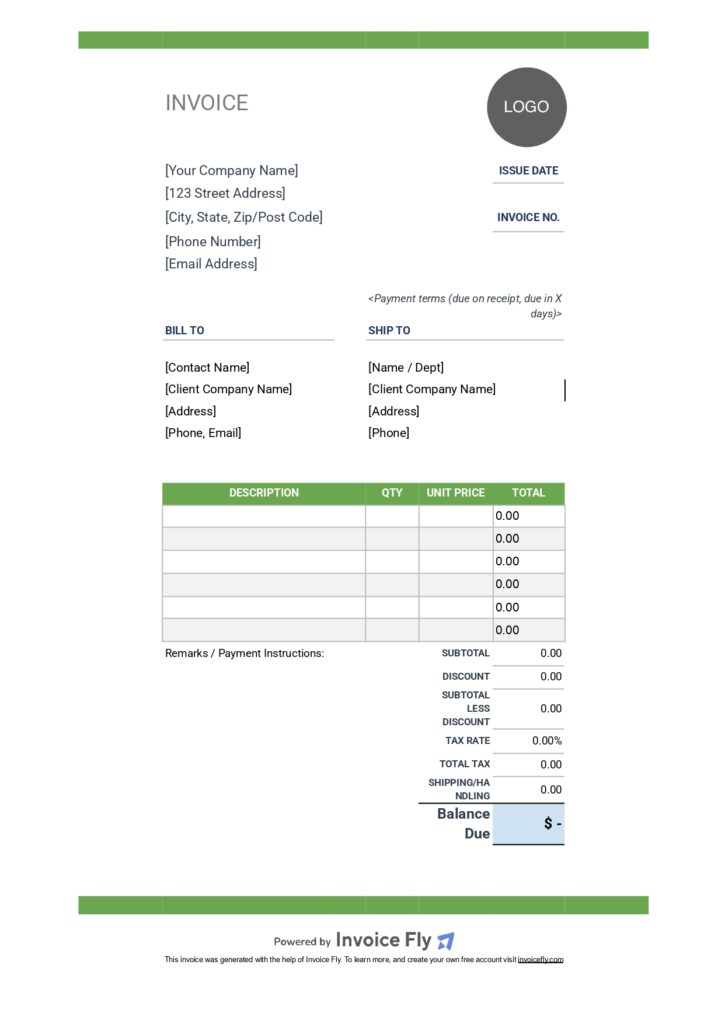

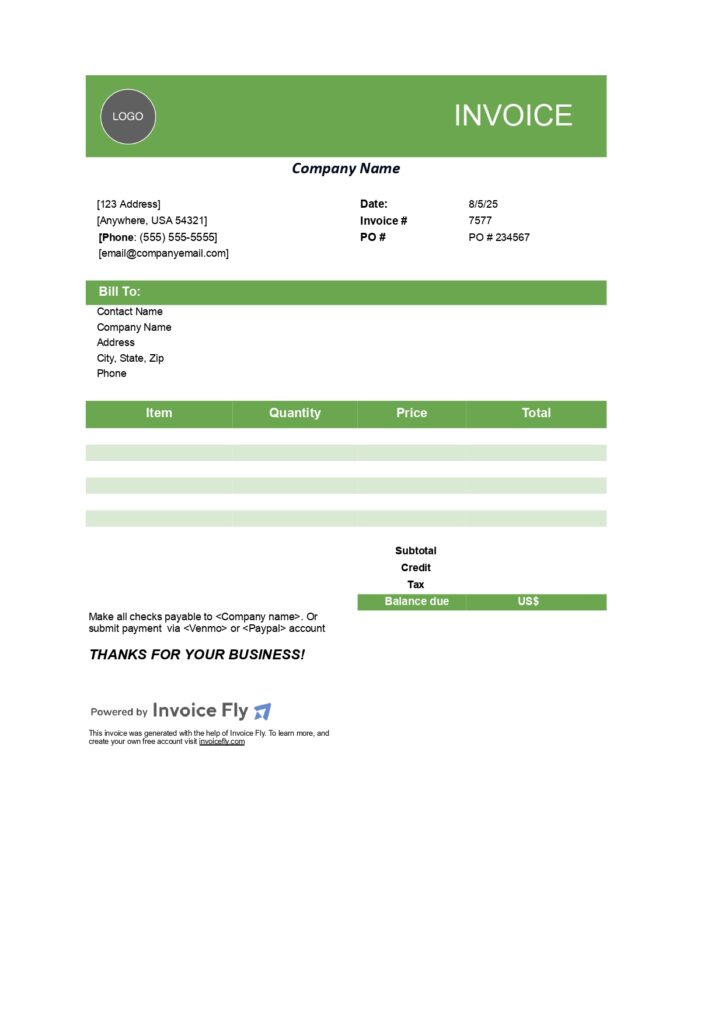

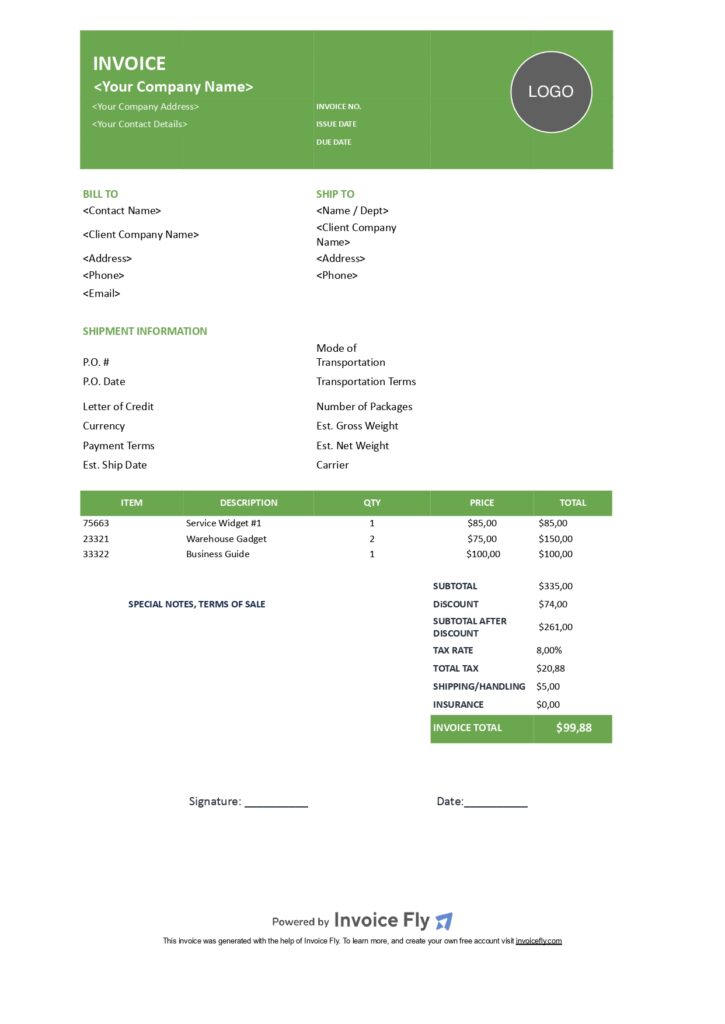

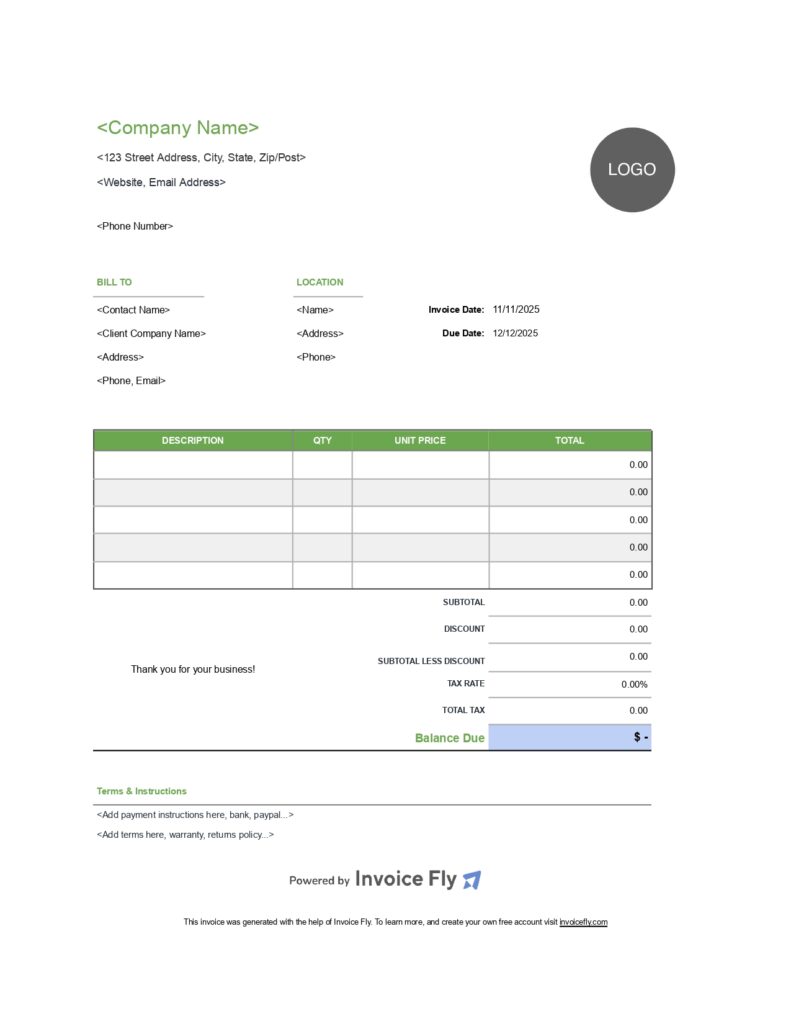

Contractor Free Invoice Template Green

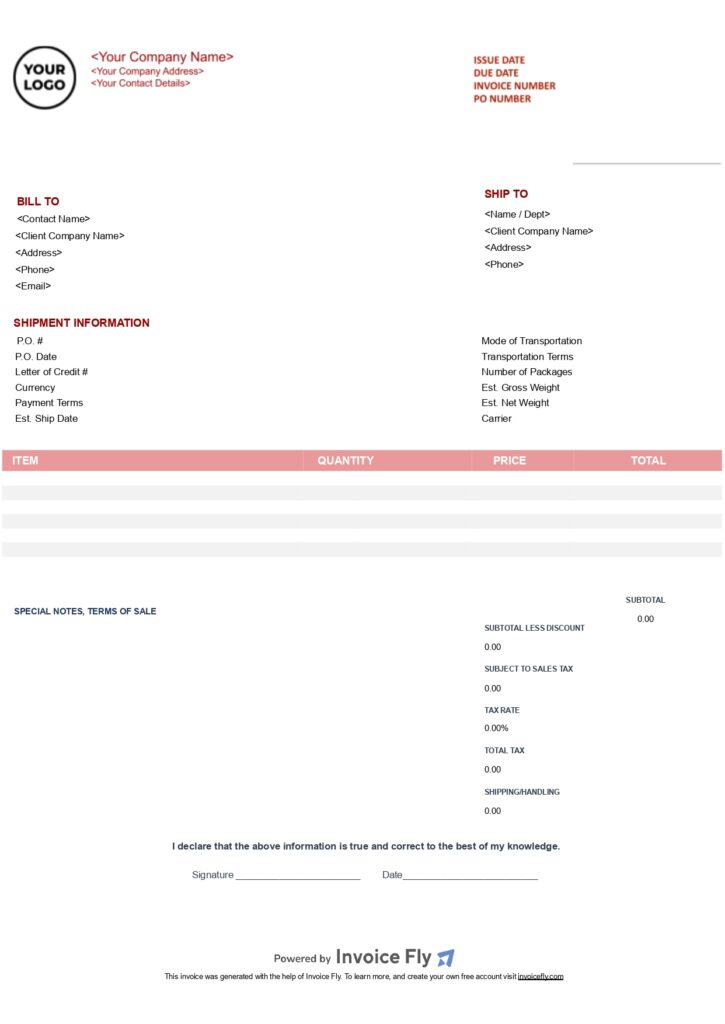

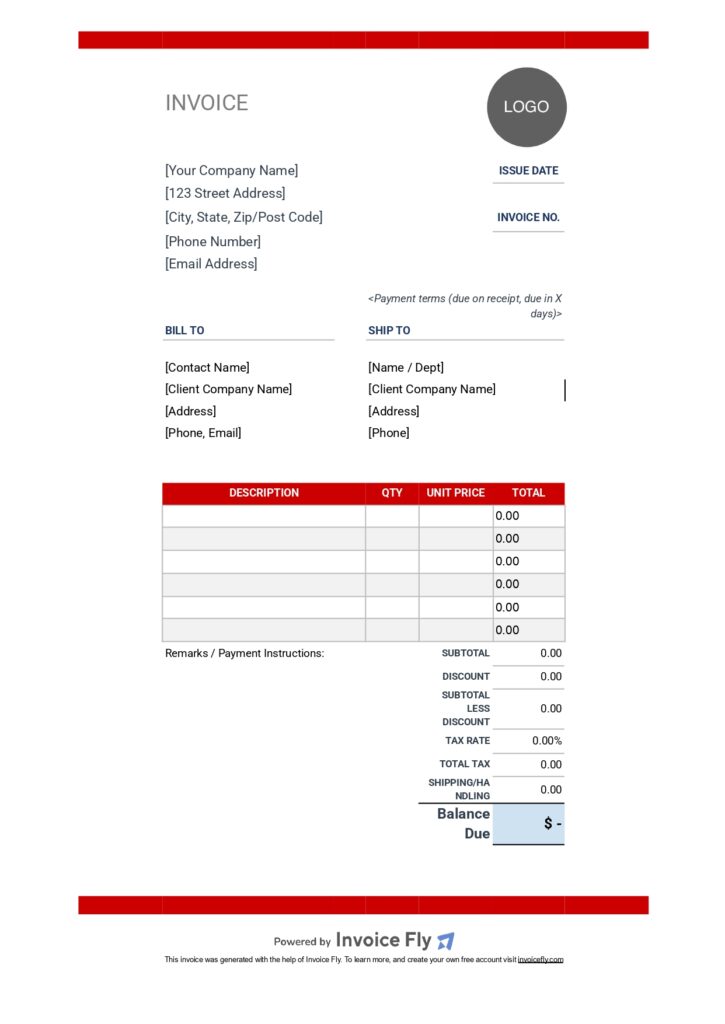

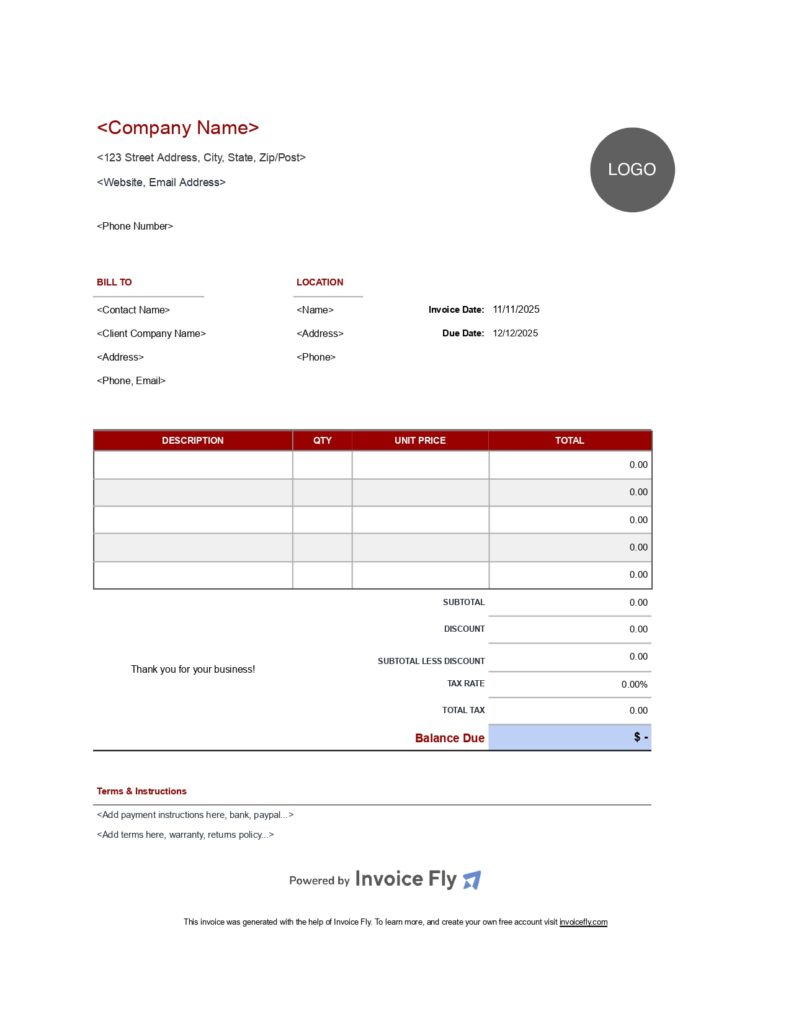

Contractor Free Invoice Template Red

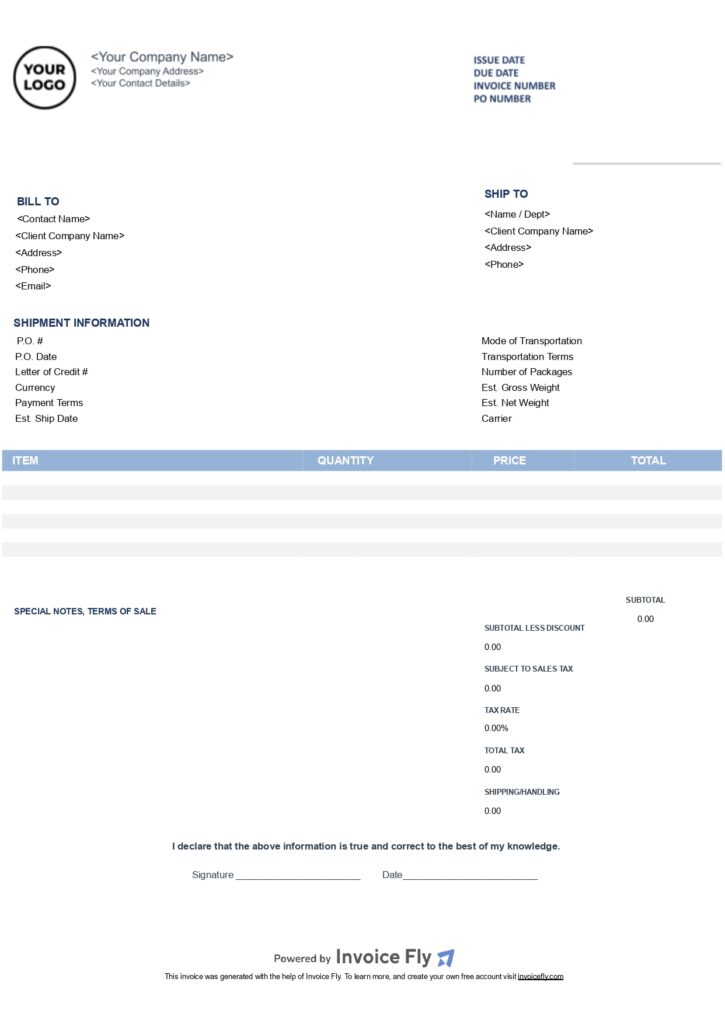

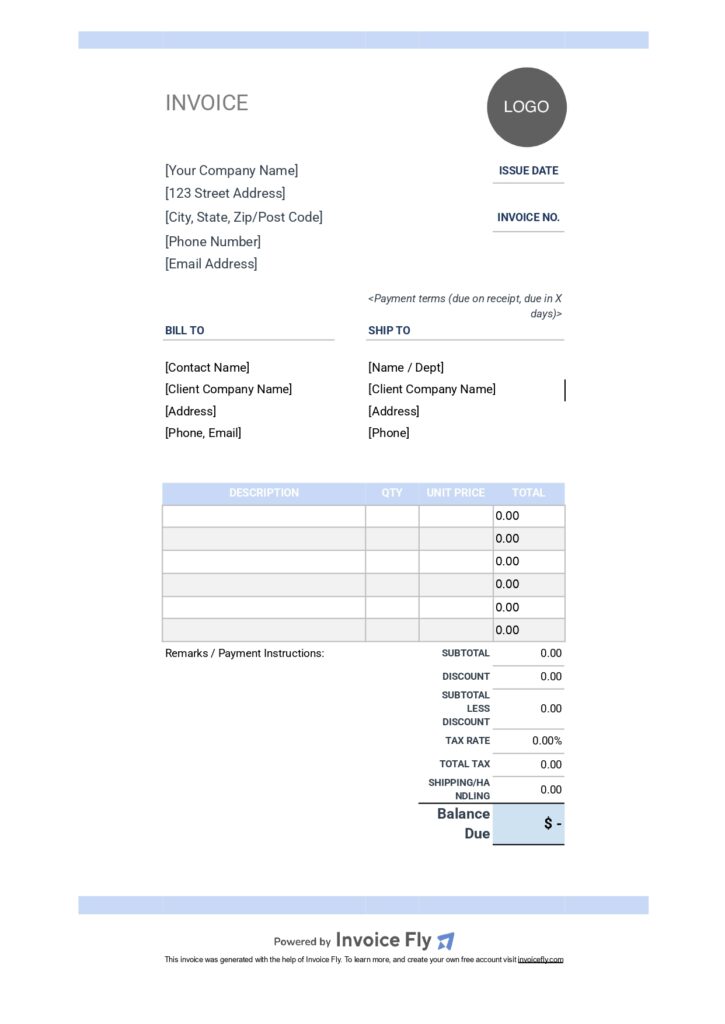

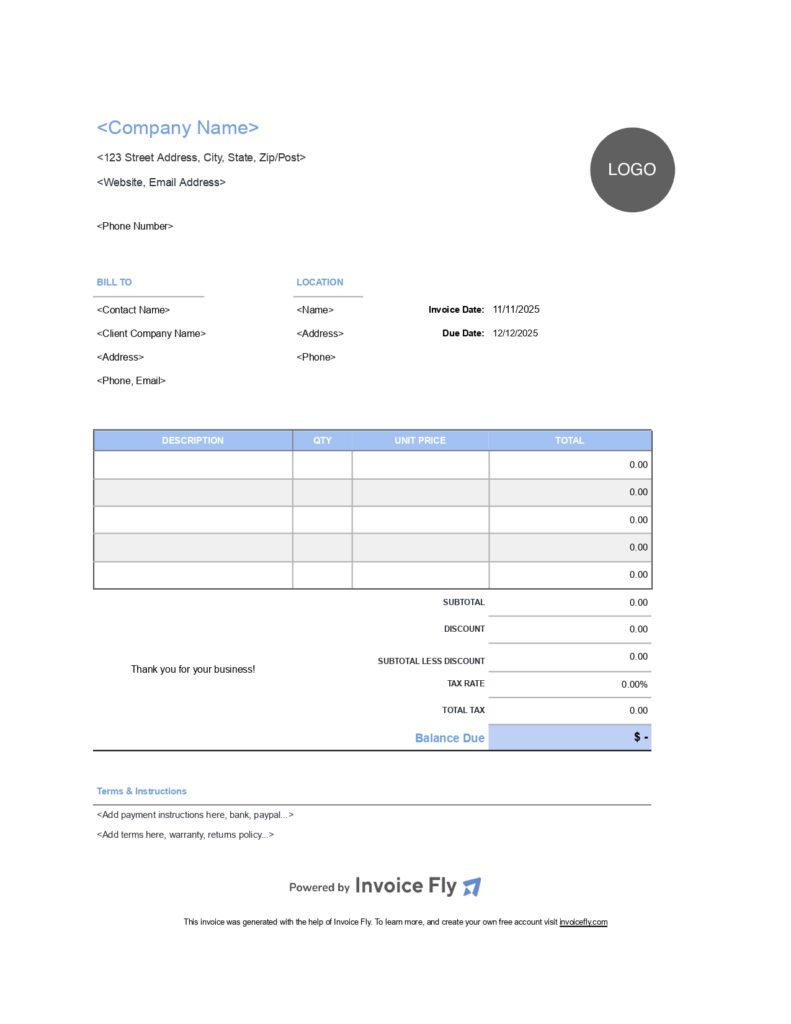

Contractor Invoice Free Template Light Blue

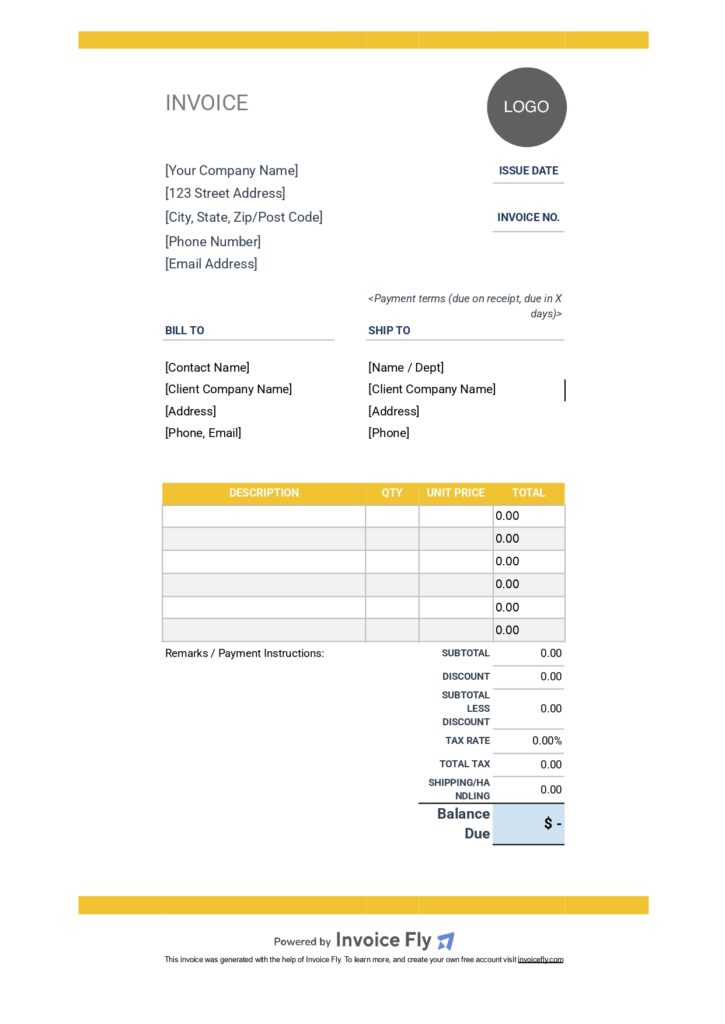

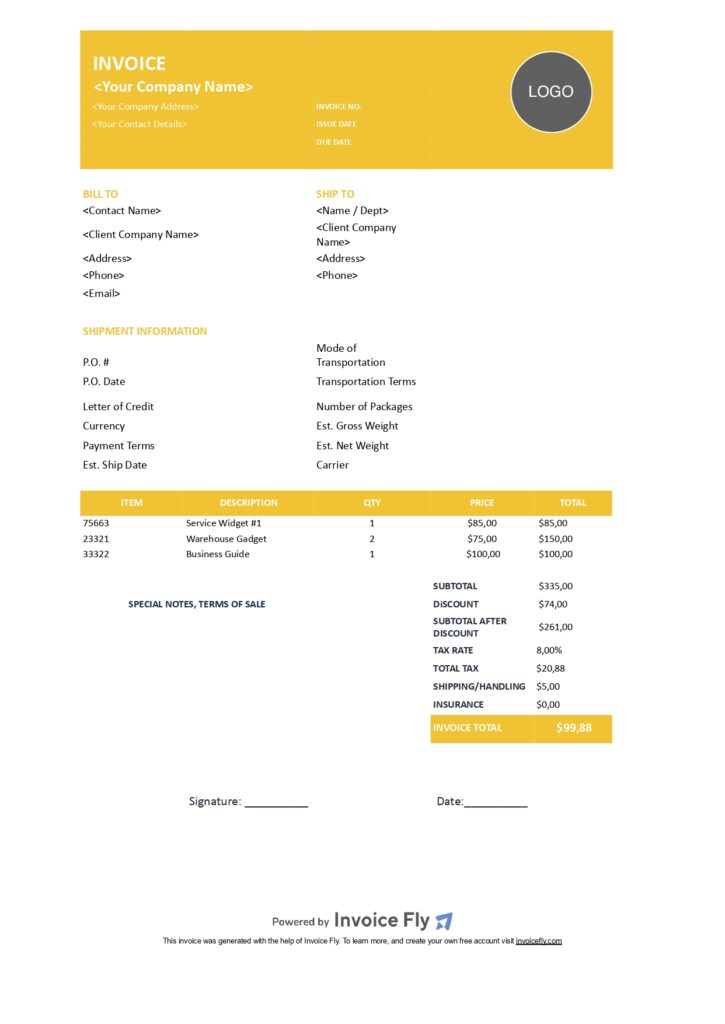

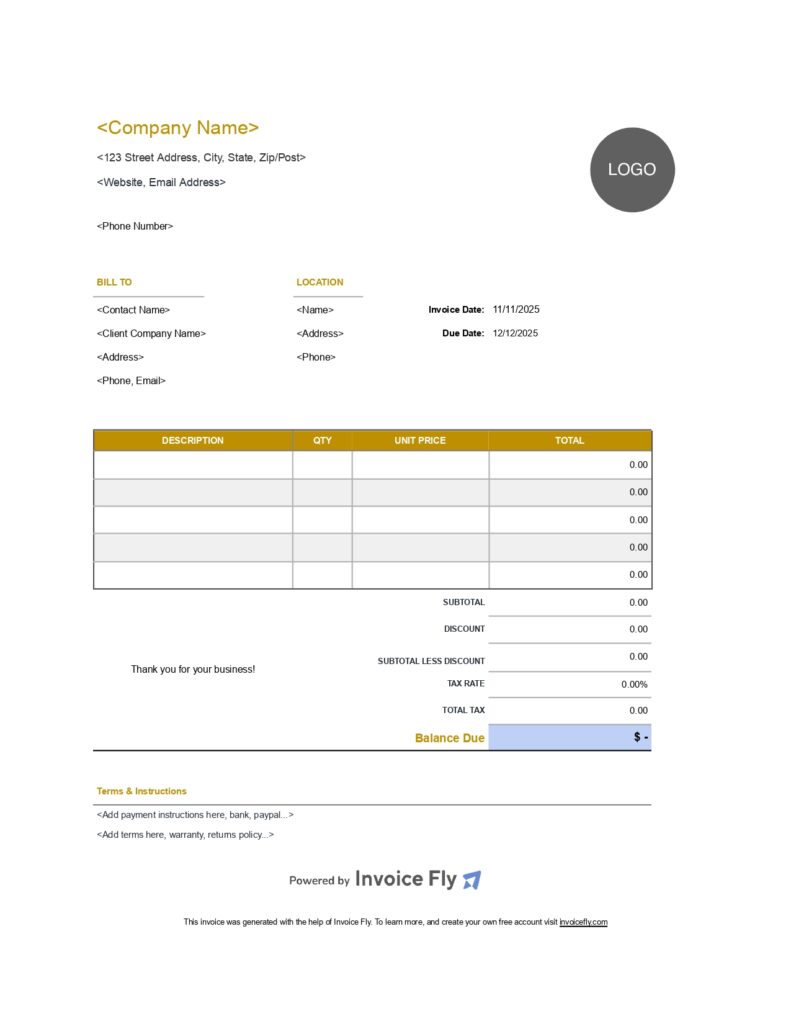

Contractor Free Invoice Template Yellow

Freelancer Free Invoice Template Dark Blue

Freelancer Free Invoice Template Green

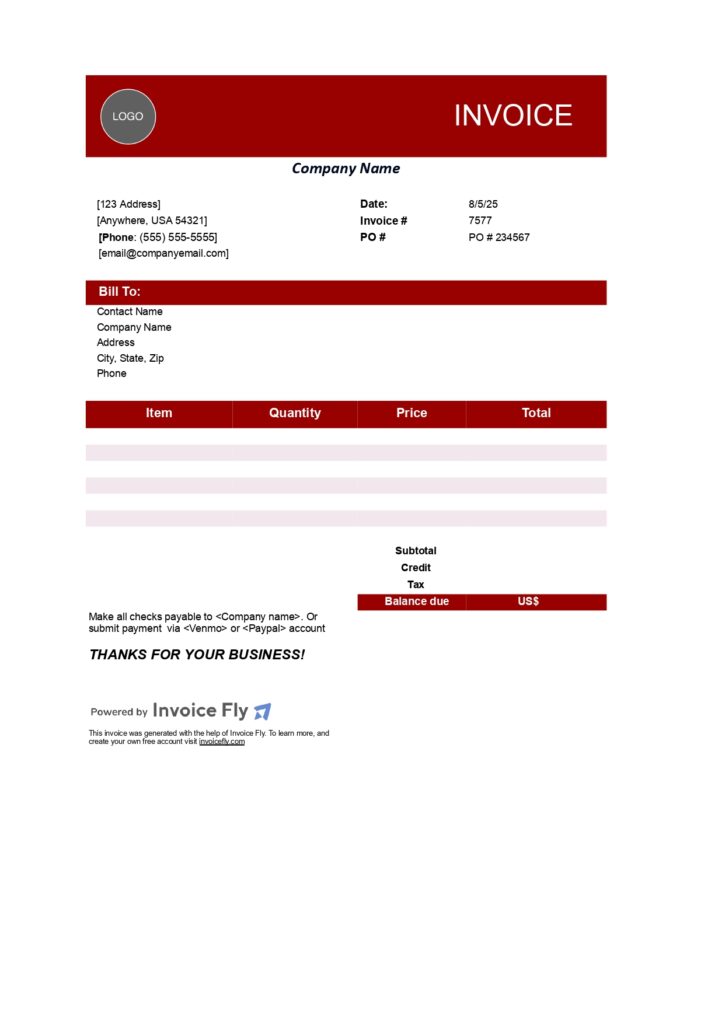

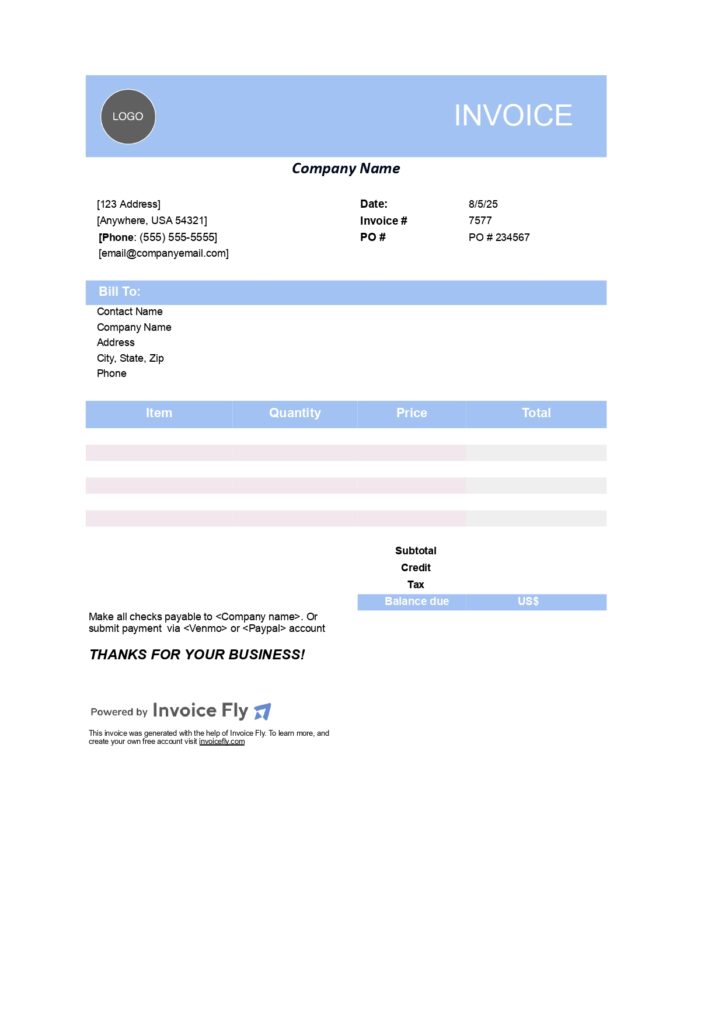

Freelancer Free Invoice Template Red

Freelancer Free Invoice Template Light Blue

Freelancer Free Invoice Template Yellow

Small Business Free Invoice Template Dark Blue

Small Business Free Invoice Template Green

Small Business Free Invoice Template Red

Small Business Free Invoice Template Light Blue

Small Business Free Invoice Template Yellow

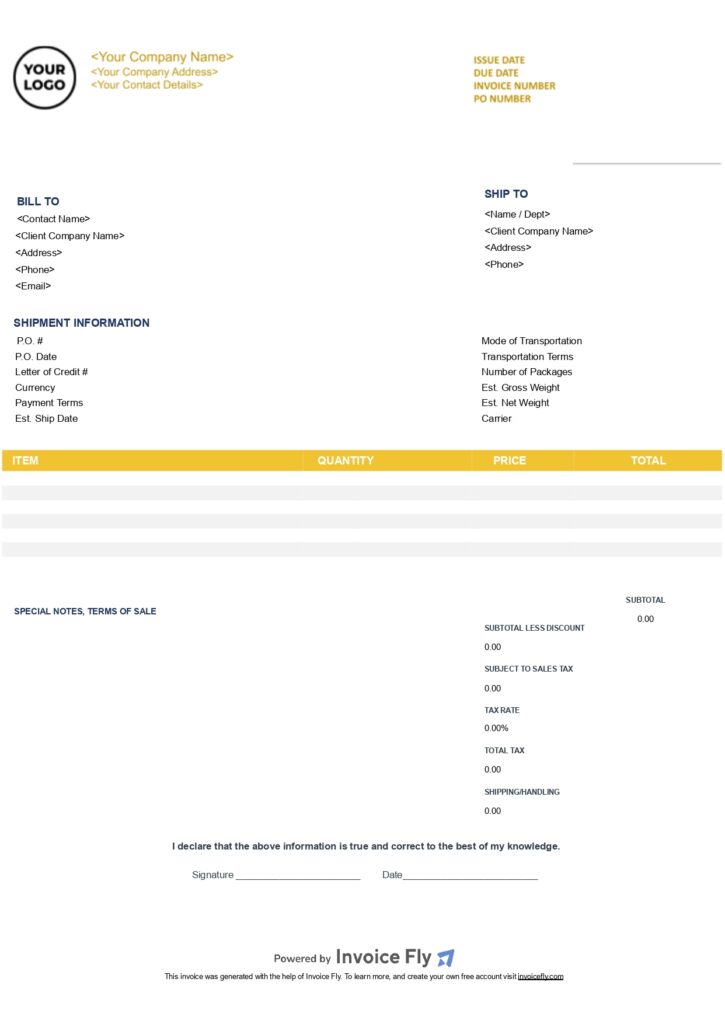

Commercial Free Invoice Template Dark Blue

Commercial Free Invoice Template Green

Commercial Free Invoice Template Red

Commercial Free Invoice Template Light Blue

Commercial Free Invoice Template Yellow

Modern Free Invoice Template Dark Blue

Modern Free Invoice Template Green

Modern Free Invoice Template Red

Modern Free Invoice Template Light Blue

Modern Free Invoice Template Yellow

Download Free Freelance Invoice

Google Docs

Google Sheet

Word

Excel

Why freelancers use this invoice template

Freelancers need flexible billing—hourly, per-project, retainers, or milestones. This invoice template for freelancers keeps things clear for clients and saves you time on every job.

Benefits of using a Freelancer Invoice Template

- Professional look (logo, colors, clean layout)

- Works for hourly and fixed-fee projects

- Clear itemization reduces questions and disputes

- Easy export as a printable invoice (PDF)

- Reusable “master” file for faster billing next time

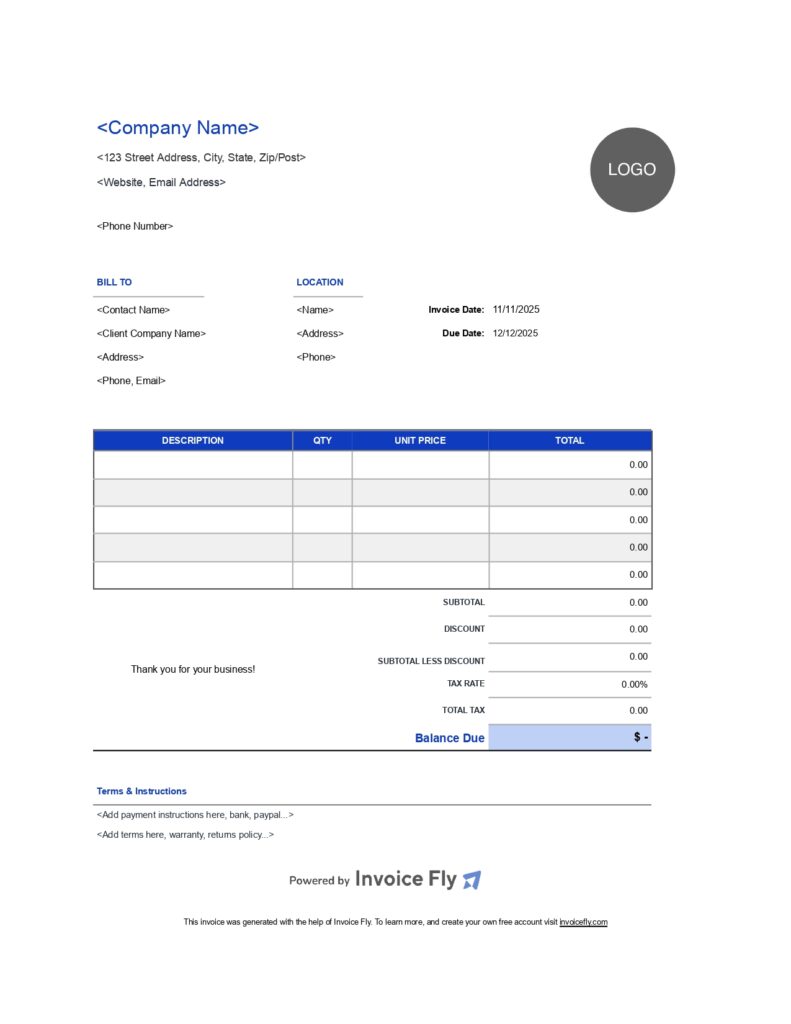

What’s included (fields you can customize)

- Your business info (name, email, phone, website) and client details

- Invoice number, issue date, due date (Net 7/15/30)

- Hourly lines (Hours × Rate) and/or Fixed-fee deliverables

- Subtotal, discounts, expenses/reimbursables, sales tax (if applicable)

- Total due and payment methods (card, ACH, PayPal, check)

- Notes (scope reference, license terms, usage rights)

- Optional: PO/reference, project code, late-fee policy, deposit received

How to use it (fast setup)

- Download the template in Google Docs/Sheets, Word, Excel, or PDF.

- Add your logo and brand colors; save a clean master copy.

- Fill in client info, line items, and tax/discounts.

- Set payment terms and due date; add a friendly note.

- Export to PDF or share a view-only link from Google Drive.

Tip: Keep a separate “Rates & Items” tab (Sheets/Excel) with common services to speed up future invoices.

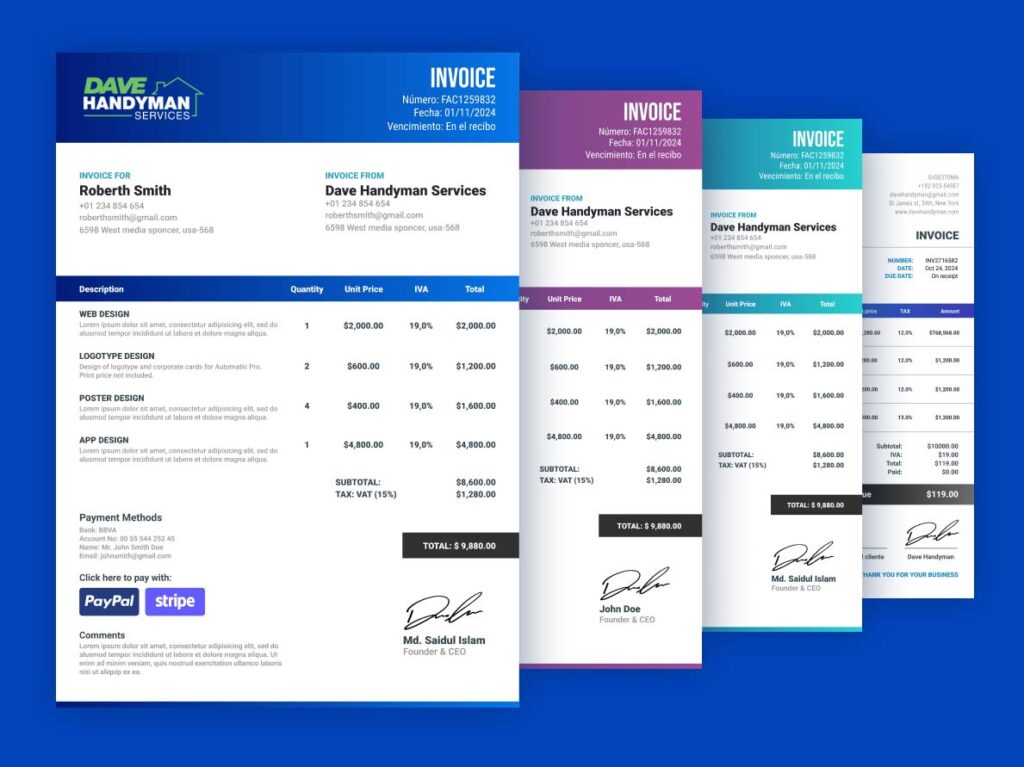

Looking for beautiful & professional

invoice templates?

Try our Premium Invoice Templates for the best results!

- +72 solid & gradient colors

- +6 invoice template lay outs

- Customize invoice structure as needed

- Add company logo & remove background

Freelance Invoice

Template FAQs

- Freelance writer invoice template: per-article, per-word, or hourly editing

- Freelance designer / graphic invoice: concept, rounds, files, licensing

- Developer / consultant: sprint or milestone billing, retainers

- Photographer: shoot fee, post-production, usage/license, travel

- Sole proprietor (sole trader): general services, blank invoice option

Use a clear, itemized layout. Include: your business name, address, email, and phone; the client’s details; a unique invoice number; issue date and due date; line items (description, hours/qty × rate, amount); subtotal, discounts/expenses, taxes (if applicable), and Total Due; payment methods and terms (e.g., Net 15/30); and any notes (license/usage rights, PO, project code). Export as PDF and send, or use InvoiceFly to automate numbering, reminders, and online payments.

Keep it simple and consistent:

- Start from a freelance invoice template and save a branded master copy.

- Use clear line items (what you delivered, hours or flat fees).

- Add due date, late-fee policy, and accepted payment methods.

- Request a deposit (30–50%) for new clients or large projects.

- Number invoices sequentially and store PDFs in client folders for easy bookkeeping.

Same core elements as any business: your details, client details, unique invoice number, dates, itemized services, taxes (if applicable), and total due. If you charge sales tax in your state, show the rate and amount. For international clients, specify currency and any VAT/GST notes. Keep records of every invoice and payment for tax season.

Yes—an invoice documents the work delivered, amount owed, and payment terms. Many clients require one for accounts payable, and you’ll need it for taxes and bookkeeping. Even if you’re paid via platform or retainer, send an invoice for each billing period to keep a clean audit trail.

Only if you accept bank transfers. Include the bank name, routing number, and account number (or IBAN/SWIFT for international). If you’re uncomfortable sharing account details, offer safer options like payment links, card, or ACH via your invoicing software. Never put full debit/credit card numbers on an invoice.

Requirements vary by location and industry, but generally include:

- Seller and buyer details (business name and contact info)

- Unique invoice number and dates (issue and due)

- Clear description of goods/services, quantities/hours, and rates

- Subtotal, applicable taxes, discounts/fees, and Total Due

- Payment terms/methods

If you’re registered for state/local taxes, include the relevant tax number where required. When in doubt, ask your accountant about your state’s rules.

Any legitimate seller or service provider can issue an invoice—there’s no special license for the document itself. The key is accuracy and honesty: invoice only for work performed, use unique numbering, and include your real business details. Misrepresentation or fake invoices can be unlawful.

It’s best practice, and many clients require it. Use your business address; if you work from home and prefer privacy, use a PO box, virtual office, or registered business address. At minimum, include reliable contact info (email and phone) so accounts payable can reach you.

Other Free Resources

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs