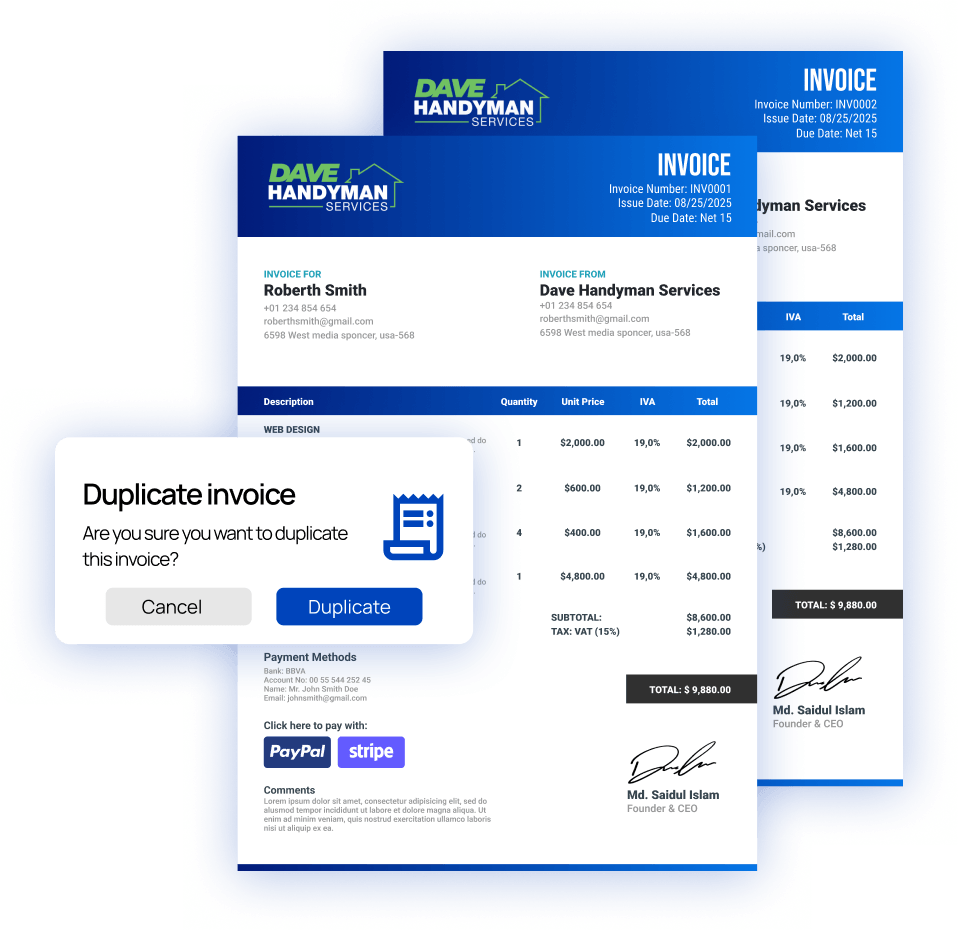

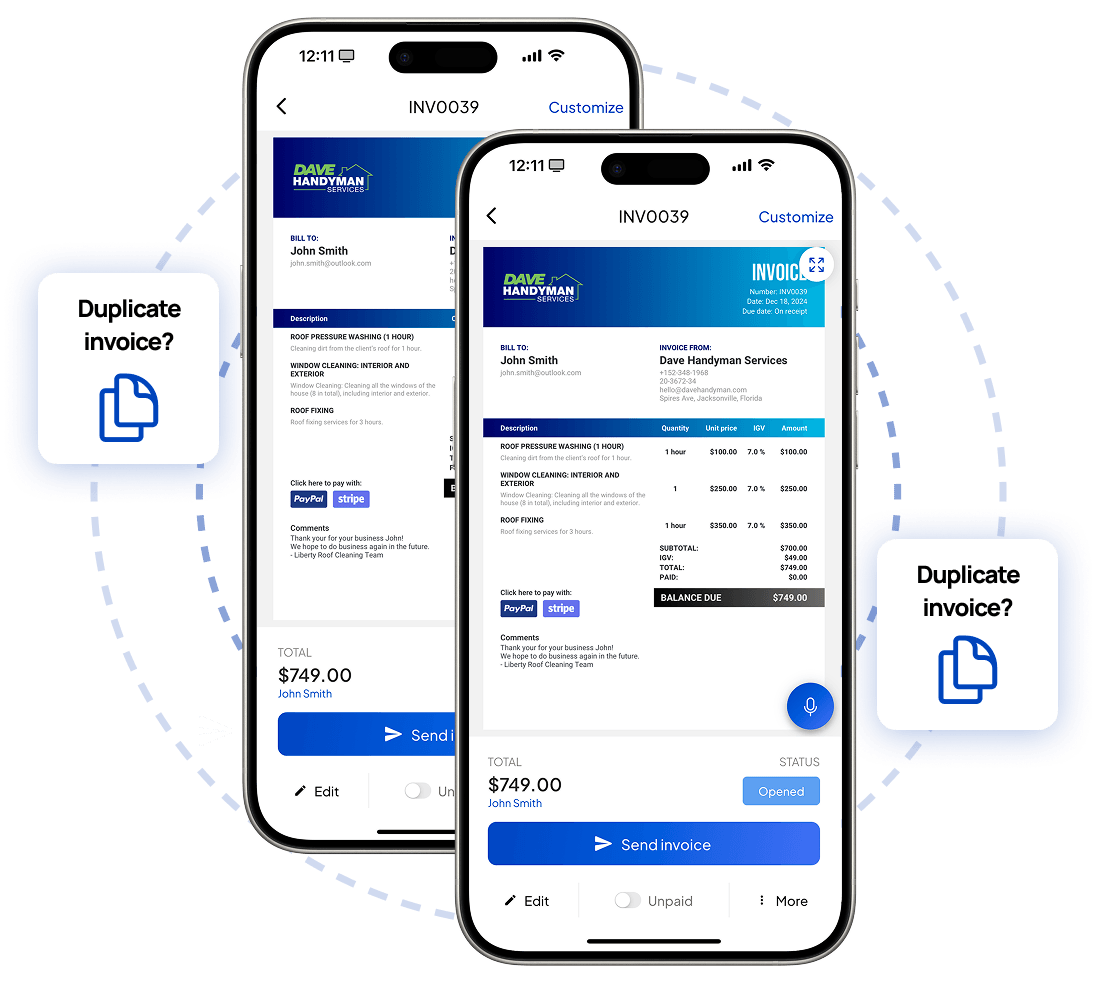

Duplicate your invoices in 1 click with Invoice Fly

Invoice fly allows busy contractors and small businesses to duplicate invoices and estimates for recurrent services, maintenance, scheduled equipment checks & more.

Boost your invoicing process with Invoice Fly by duplicating invoices

Easily duplicate invoices for repetitive jobs, record keeping & legal purposes

Our invoicing app is tailored for small businesses, freelancers, and blue collar workers who need to send fast invoices on the go. Easily duplicate your invoices whether it’s for an ongoing service, routine site visits, monthly retainers, or subscription-style services.

Why do SMEs & blue collar workers duplicate their invoices with Invoice Fly?

How does duplicating invoices with Invoice Fly work?

For Blue Collar Workers & Contractors

Blue collar workers and contractors send duplicated invoices for routine site visits, scheduled equipment checks, and regular deliveries. The best way to do it is by duplicating the invoice format but adjusting the invoice number + service dates.

For Freelancers

Freelancers duplicate their invoices for monthly retainers, weekly design sprints, content creation packages, among other reasons. The best practice is keeping a standard invoice template but always updating the project reference and timeframe.

For Small Businesses

Small businesses send duplicated invoices for subscription-style services such as cleaning, security, landscaping, IT maintenance. The industry standards recommend using automated invoicing software that duplicates invoices on schedule while auto-incrementing invoice numbers.

For Record Keeping

Duplicating invoices makes bookkeeping much easier: For clear tracking of services you can quickly compare one period to another (“Maintenance August vs. September”). For audit trails, sequential invoices show a transparent history of your work and payments. And for faster accounting, accountants prefer consistent, well-structured invoices when reconciling accounts.

For Legal Compliance

Invoices are legally binding financial records. Proper duplication helps you stay compliant for proof of ongoing service. Each invoice documents work performed in a specific period, essential if a client disputes charges. Helps with tax compliance: authorities require unique, sequential invoice numbers. Duplicating invoices as templates ensures consistency while meeting legal rules.

How do SMEs & blue collar workers benefit from duplicated invoices?

Duplicating invoices, when done properly, offers major benefits for freelancers, contractors, and small businesses. It streamlines billing for repetitive services like maintenance or monthly retainers, saves time, and ensures consistent, professional documentation. Each duplicated invoice — with a unique number and updated service period — strengthens record keeping, making it easier to track payments, compare service cycles, and maintain a clear audit trail.

From a legal perspective, this practice also supports tax compliance, provides proof of ongoing work, and protects against disputes or double-billing concerns. In short, duplicating invoices responsibly improves efficiency, transparency, and financial reliability.

3x

invoices sent

every month by creating duplicates in 1 click

4h+

saved every week

by reusing invoices for repetitive jobs

25%+

faster record keeping

& tax submission thanks to duplicating invoices

Do more with the right set of tools

Send professional, polished invoices that make a great impression. Easily customize each one with your branding, payment terms, and itemized details. With built-in online payments and clear layouts, you’ll get paid faster—no chasing, no confusion.

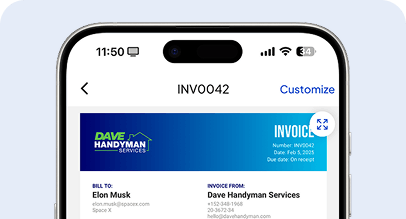

Invoicing Software

Create professional invoices in seconds. Send them to clients, get paid faster, and keep your cash flow moving.

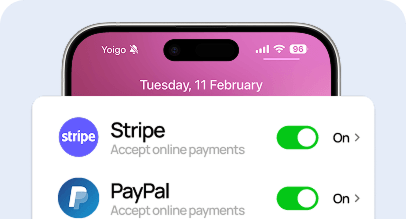

Online Payments

Collect online payments with Credit Card or PayPal, Stripe, Apple Pay, American Express, Visa, MasterCard, and more.

Business Reports

Manage all your client’s details, invoices, estimates and statements from a secure and cloud-based online platform.

Pick the best plan for you.

Get the tools you need to work smarter, stay in control, and grow with confidence.

What does duplicating invoices mean?

Duplicating invoices means creating a copy of an existing invoice to use again, either as a record, a replacement, or a template for future billing. In practice, it’s often used for repetitive services (like monthly maintenance, subscriptions, or retainer work) where the service description stays the same, but details such as the invoice number, billing period, or amounts need updating.

It can also be done for record-keeping (providing copies to clients, accountants, or auditors) or legal purposes (reissuing a lost invoice, creating a corrected version). The key is that a duplicated invoice should never be an exact clone used twice for payment — it must always have a unique invoice number and accurate service details to remain compliant, transparent, and legally valid.

FAQs about duplicate invoices easy

If you identify a duplicate invoice, first verify whether it is a legitimate copy (for record-keeping or client request) or an error. Legitimate duplicates should be clearly marked as “Copy” or “Reissued” and retain the same invoice number. If it’s an accidental duplicate, remove it from your accounting system to avoid double payment or double billing. For recurring services, use invoice templates or automation tools that generate unique invoice numbers to prevent confusion.

Duplicate invoices can lead to serious problems if not handled properly. They may cause double payments, cash flow issues, or disputes with clients. From a compliance standpoint, tax authorities may view duplicate invoices as suspicious, potentially triggering audits or penalties. In worst-case scenarios, repeatedly issuing duplicate invoices without proper labeling can be interpreted as fraudulent activity.

You can detect duplicate invoices by setting up internal checks in your accounting process. Look for red flags such as identical invoice numbers, matching amounts with the same vendor or client, or invoices covering overlapping dates. Many accounting and bookkeeping software solutions include built-in duplicate detection features, which automatically flag potential duplicates before payment is processed.

An invoice becomes illegal if it contains false information (fake services, inflated charges, or altered details), if it is used to double-bill a client, or if it lacks legally required elements (such as unique invoice numbers, correct business information, and accurate service descriptions). Issuing duplicate invoices without proper labeling or intent to deceive is also considered illegal and may be classified as fraud.

- A client misplaces an invoice and requests a copy of the original — marked as “Duplicate” or “Copy.”

- A freelancer reuses the same invoice format for a monthly retainer, updating the date, invoice number, and billing period.

- A contractor resends an invoice to the accounting department because the first copy went to the wrong contact.

- A small business issues a corrected version of an invoice, clearly labeled “Revised Invoice.”

Free Resources

Resources to run your business smoothly and efficiently.

Free Templates

Explore free templates and create estimates, quotes, invoices, bills and receipts.

Free Generators

Generate Estimates, Quotes, Invoices, Bills, Receipts, and Proformas online.

Free Calculators

Use our free calculators: Service Price, Profit Margin, Net Salary, VAT, Break-Even…

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs