- Home

- »

- Free Resources for Small Businesses

- »

- Free Templates

- »

- Free Invoice Templates

- »

- Free Auto Repair Invoice Template

Auto Repair Invoice Template (Free Download)

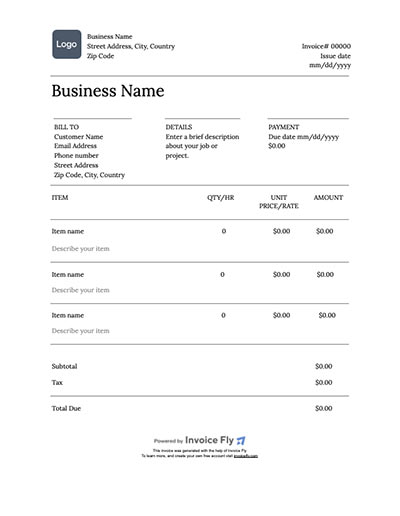

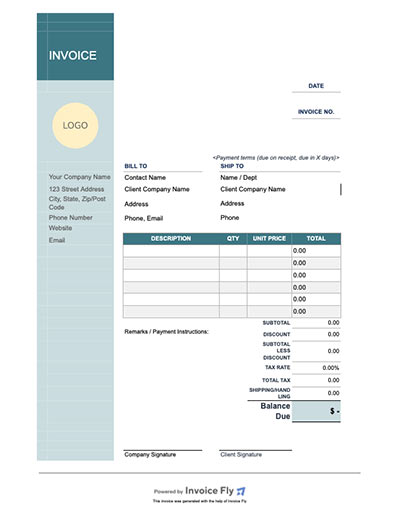

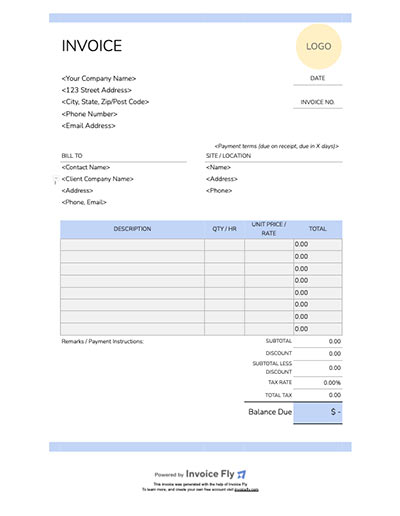

Create professional mechanic invoices in minutes — PDF, Word, Excel, Google Sheets or Google Docs.

Download a Free Invoice Template for

Google Sheets, Google Docs, Excel, Word & PDF

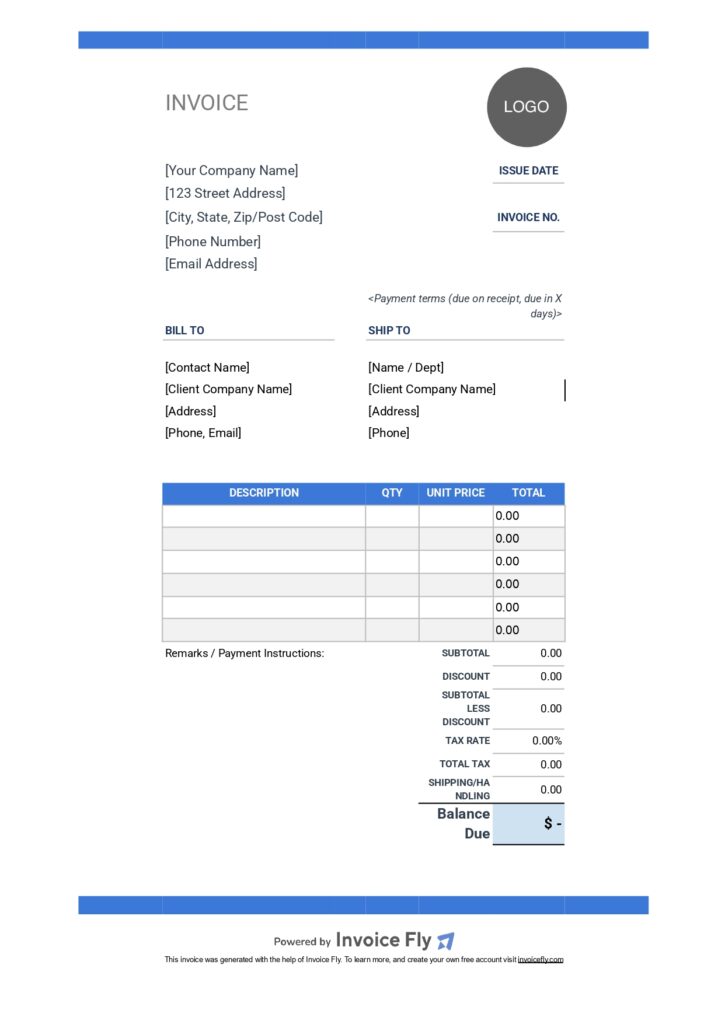

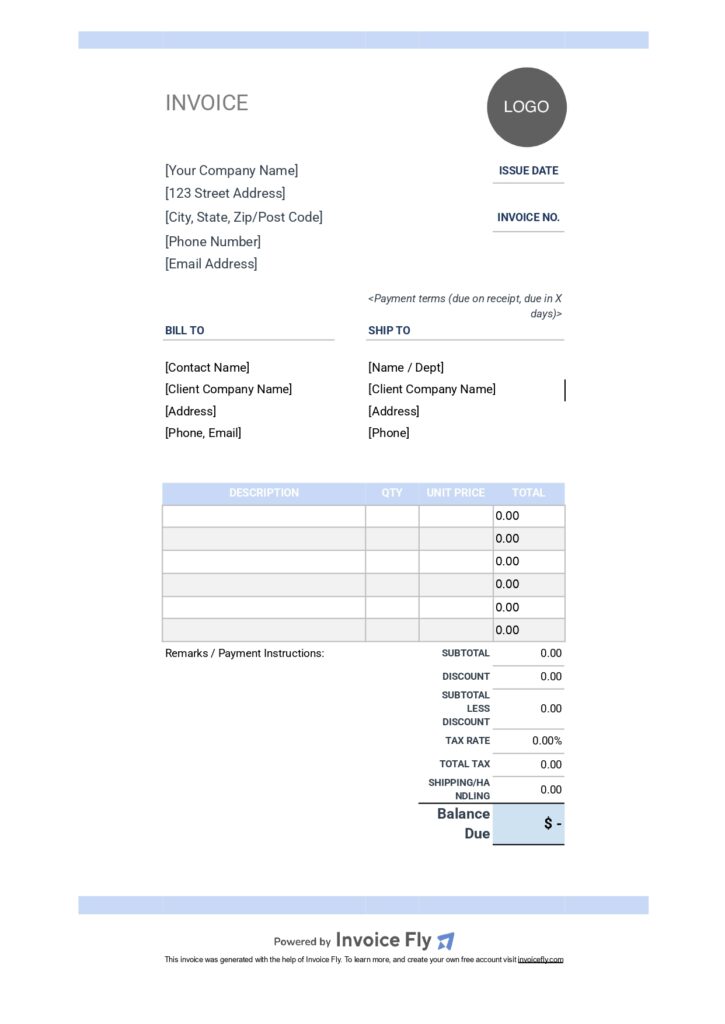

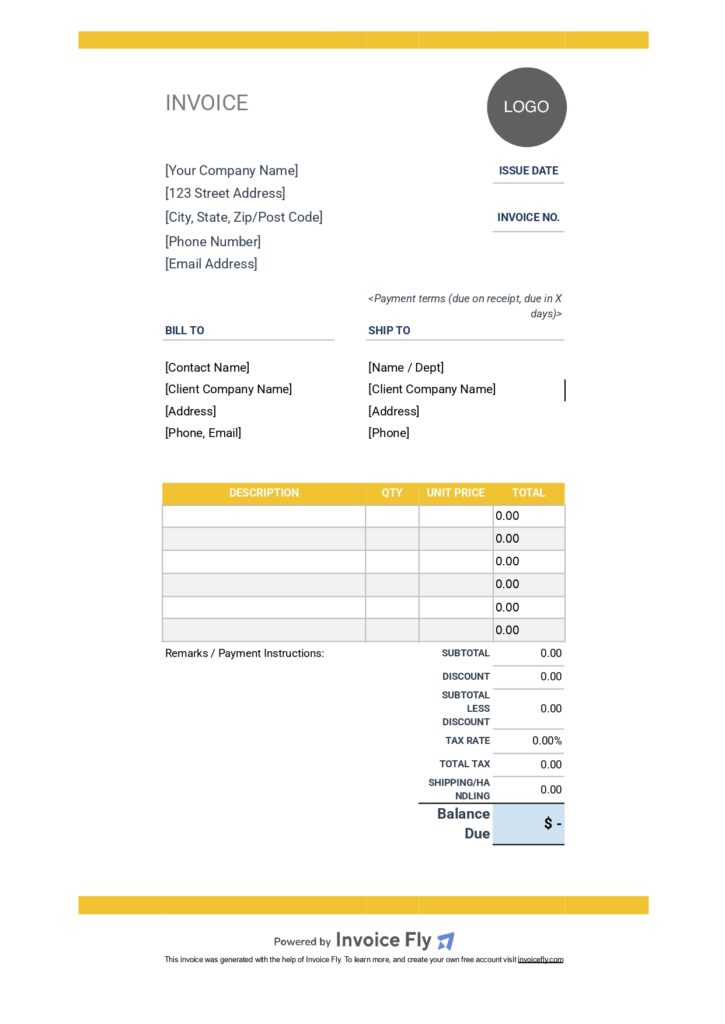

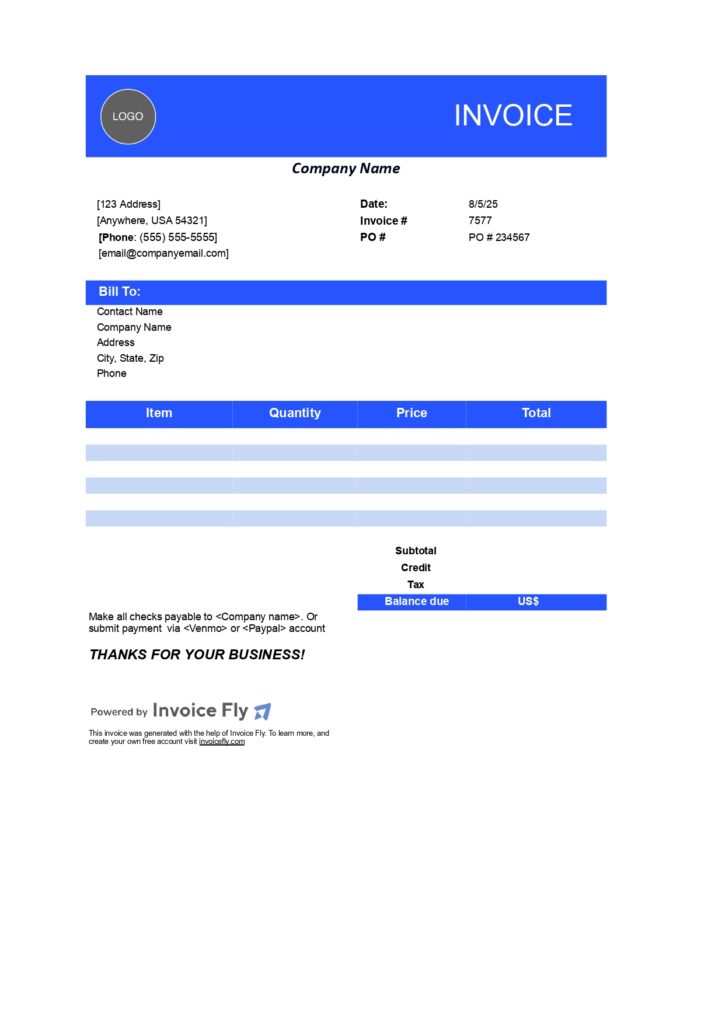

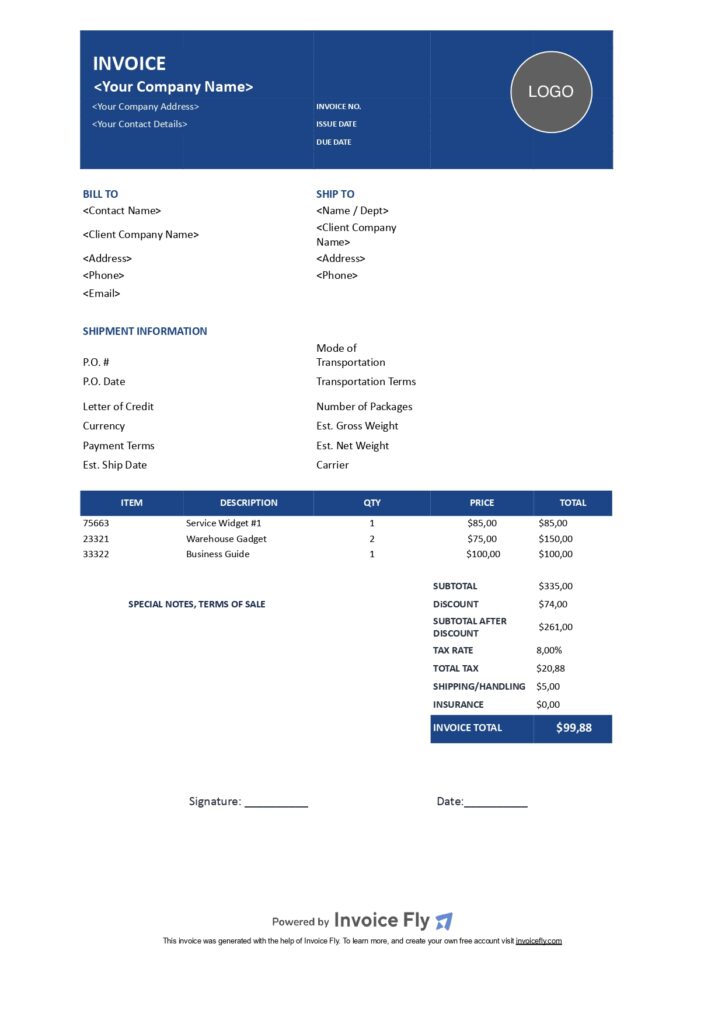

Contractor Free Invoice Template Dark Blue

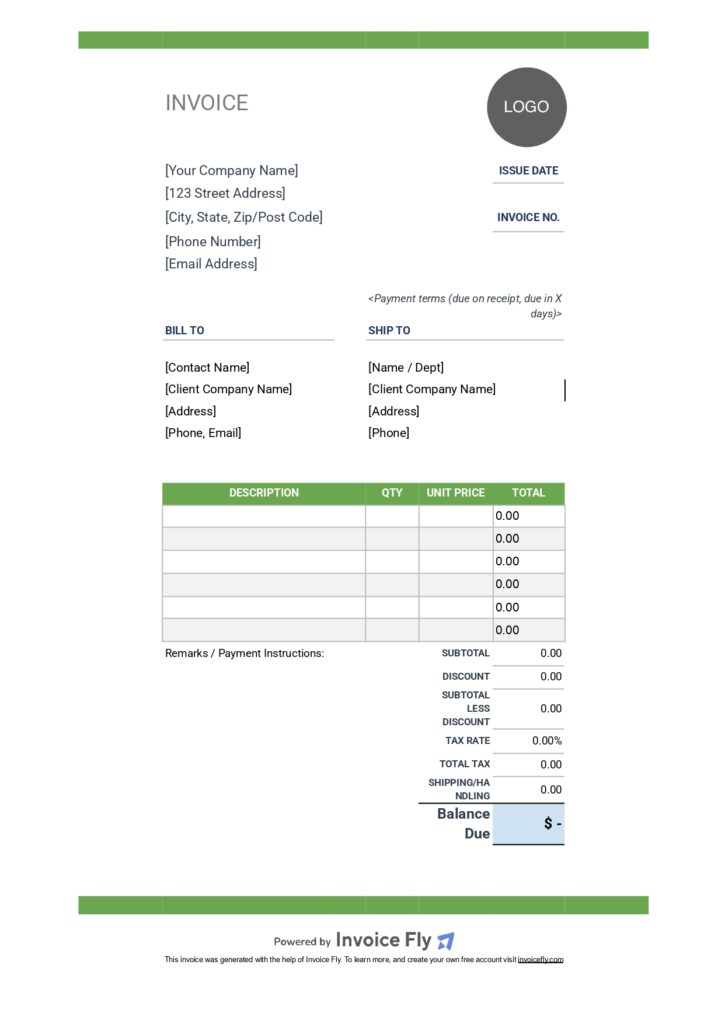

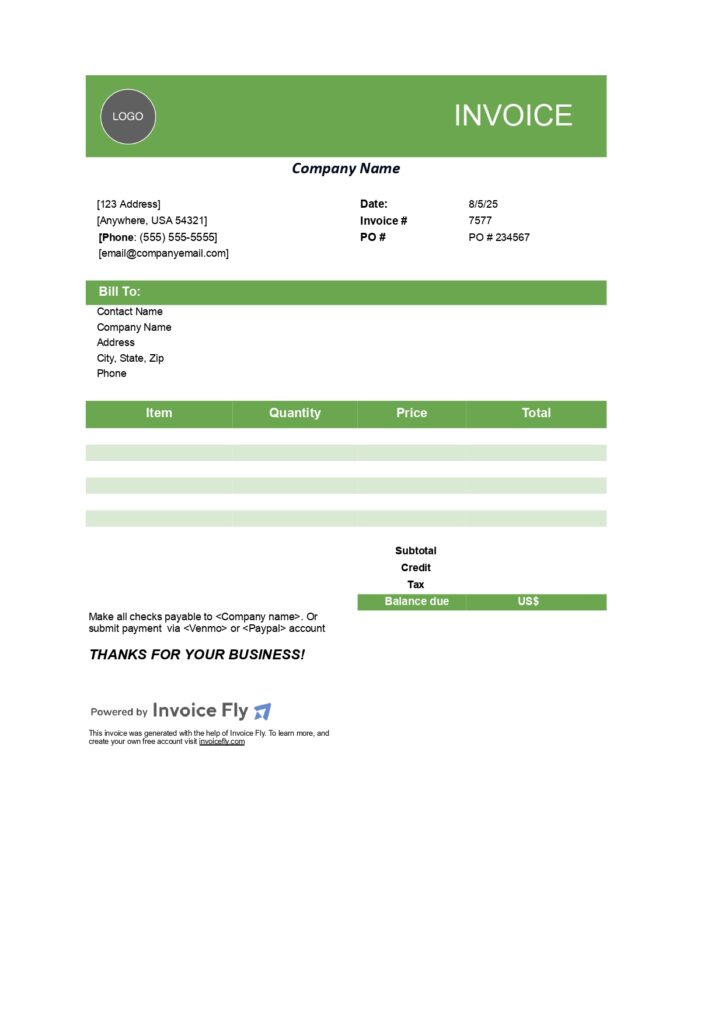

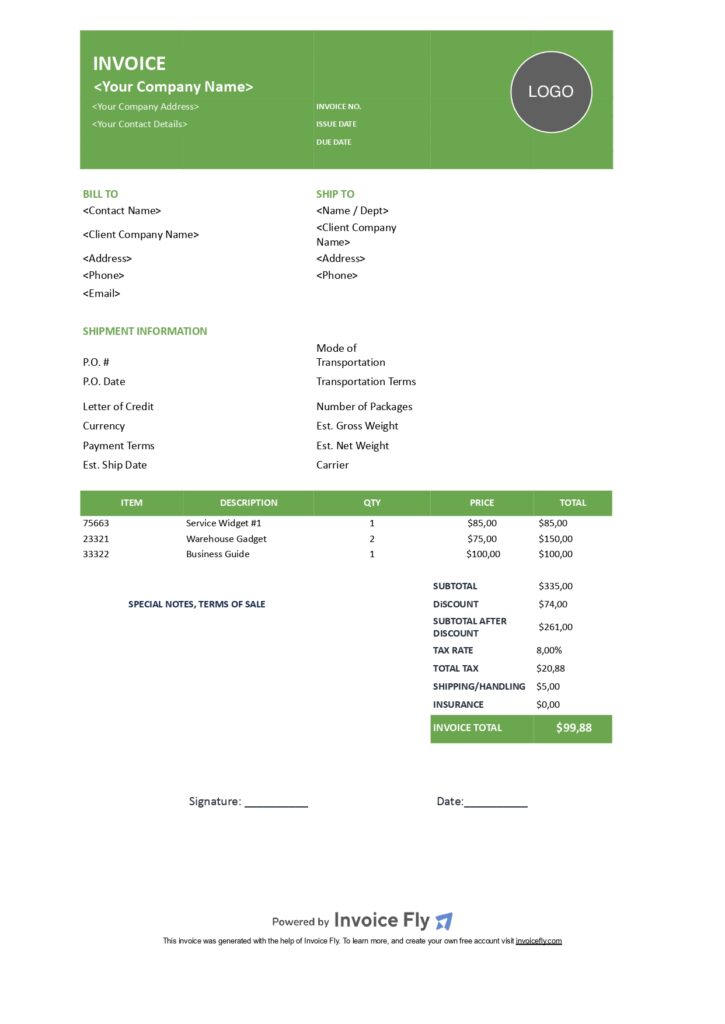

Contractor Free Invoice Template Green

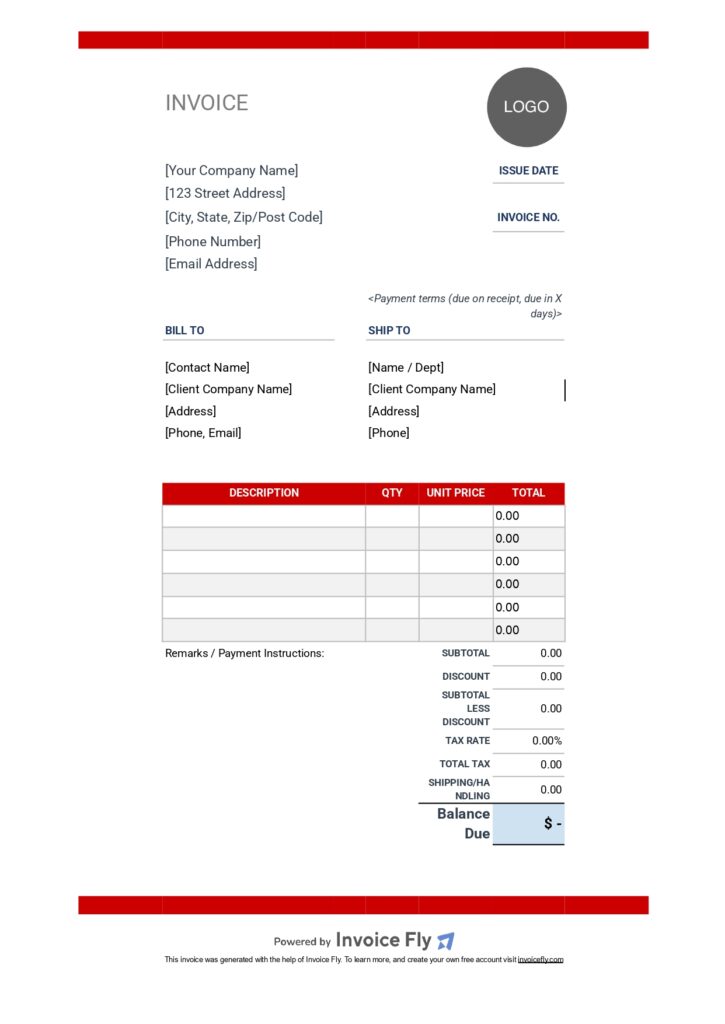

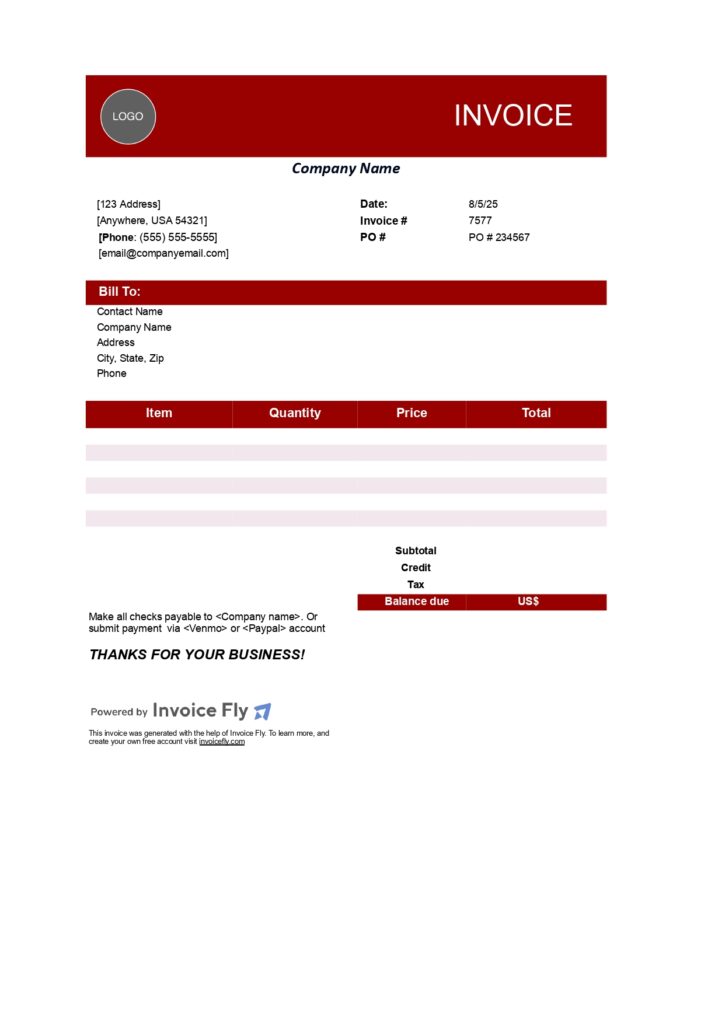

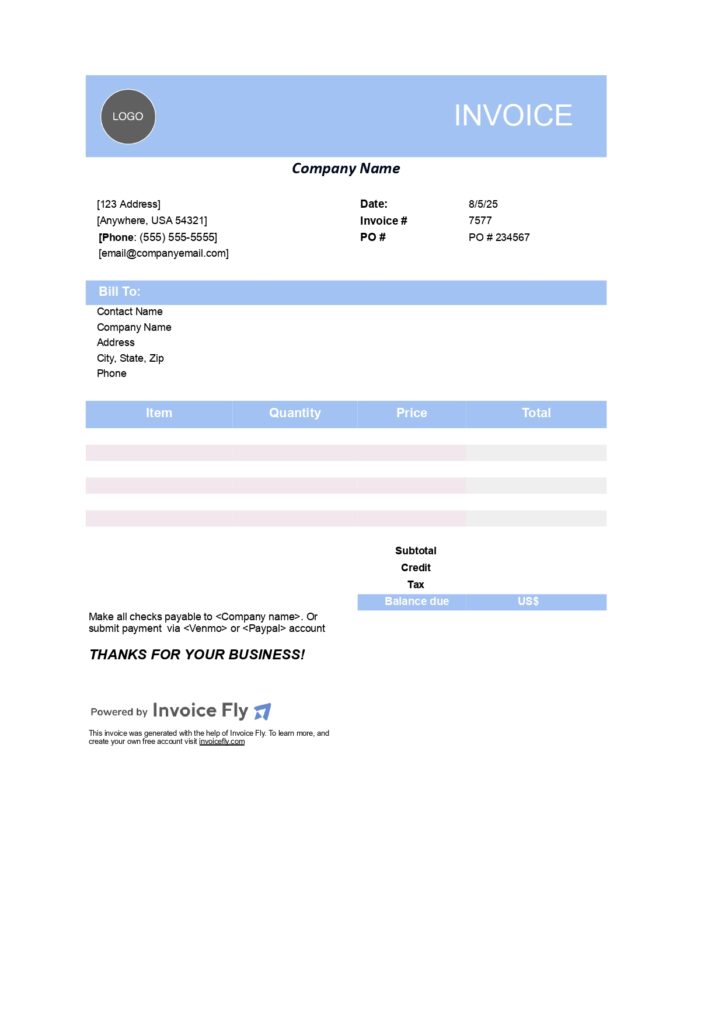

Contractor Free Invoice Template Red

Contractor Invoice Free Template Light Blue

Contractor Free Invoice Template Yellow

Freelancer Free Invoice Template Dark Blue

Freelancer Free Invoice Template Green

Freelancer Free Invoice Template Red

Freelancer Free Invoice Template Light Blue

Freelancer Free Invoice Template Yellow

Small Business Free Invoice Template Dark Blue

Small Business Free Invoice Template Green

Small Business Free Invoice Template Red

Small Business Free Invoice Template Light Blue

Small Business Free Invoice Template Yellow

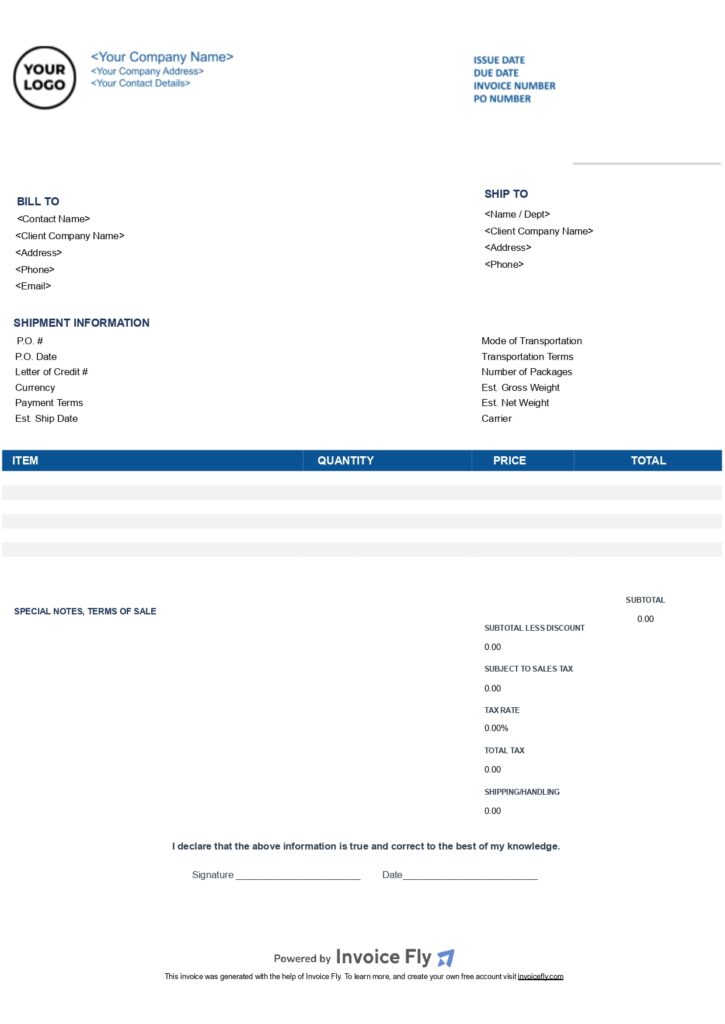

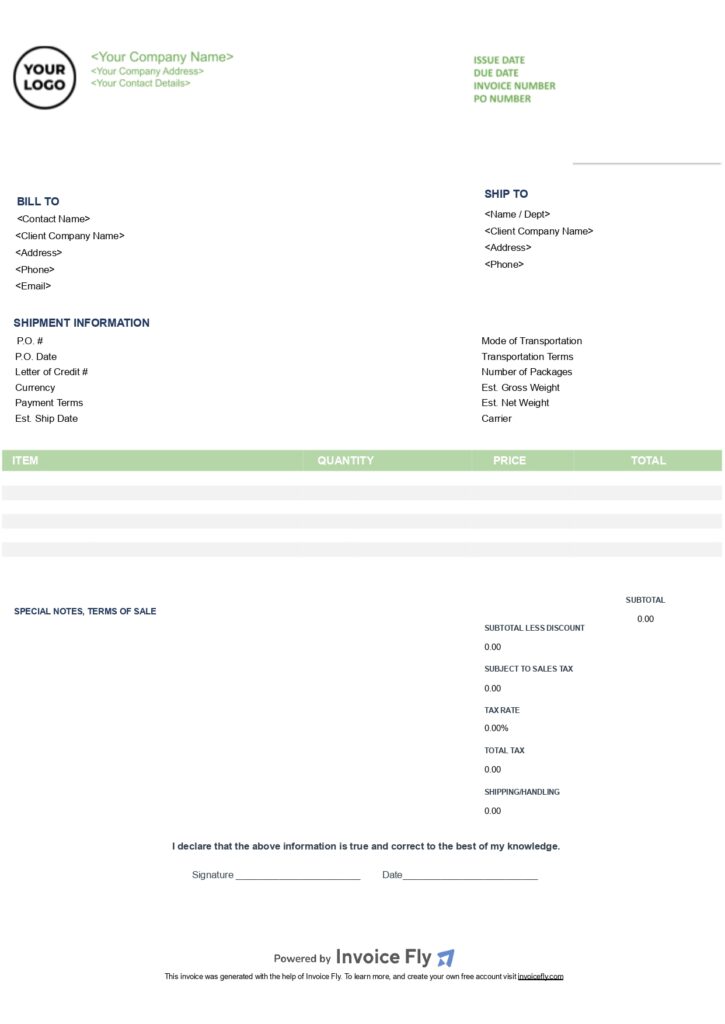

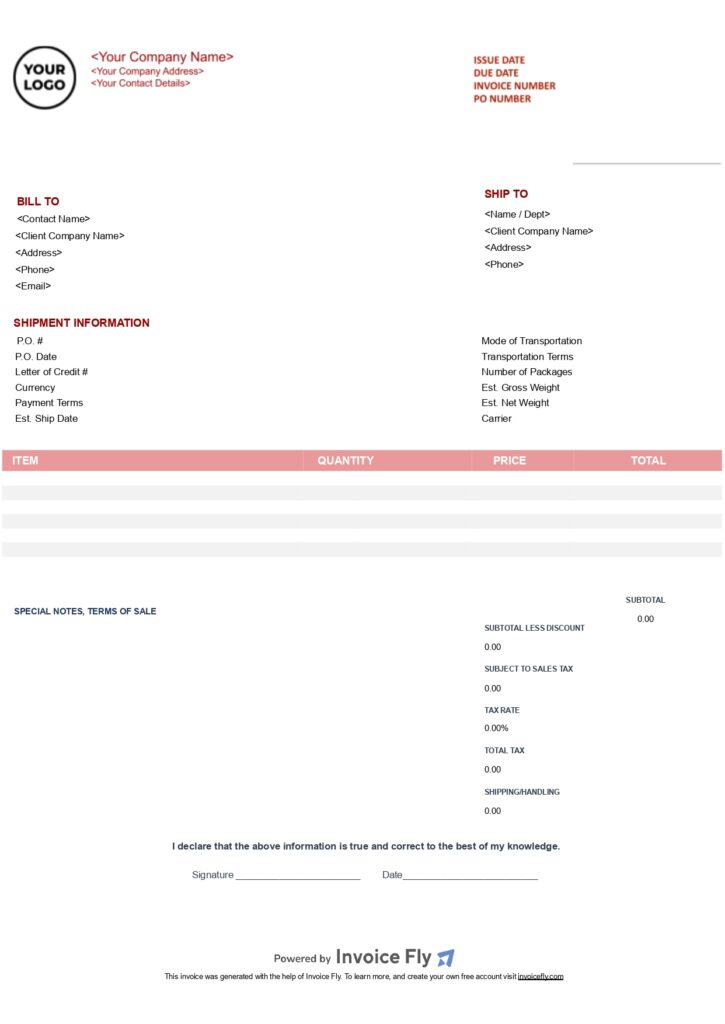

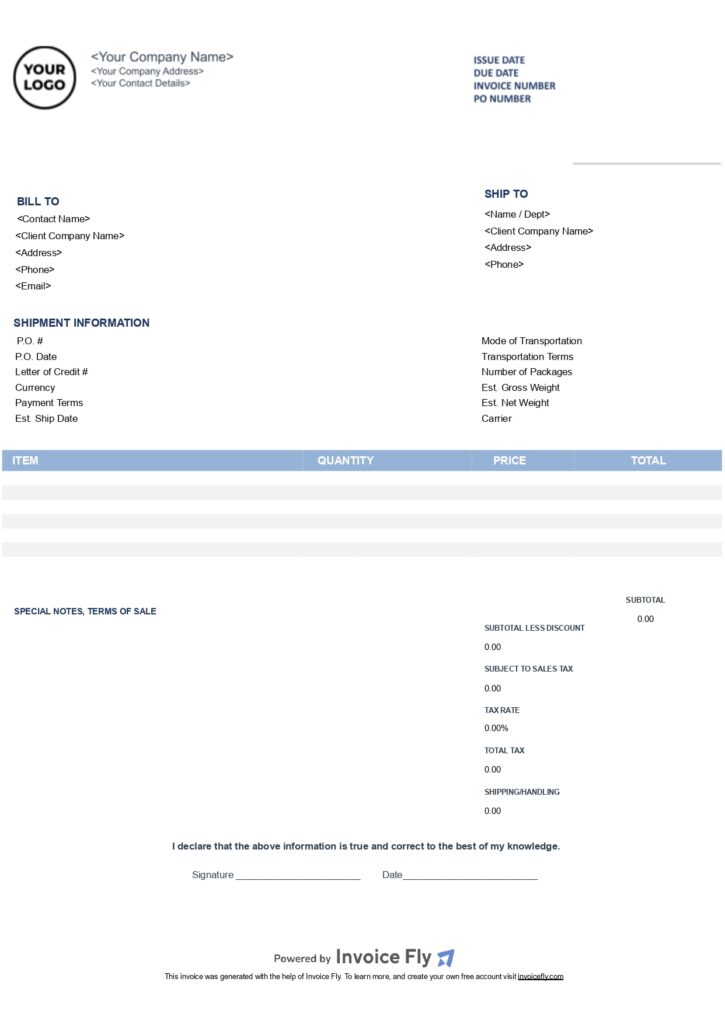

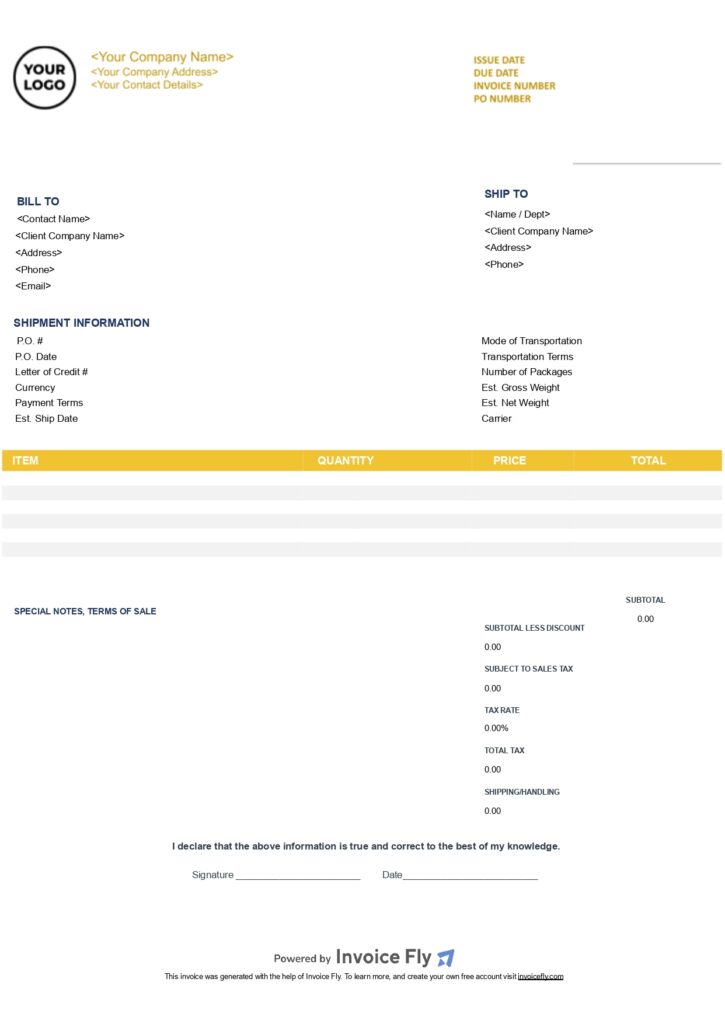

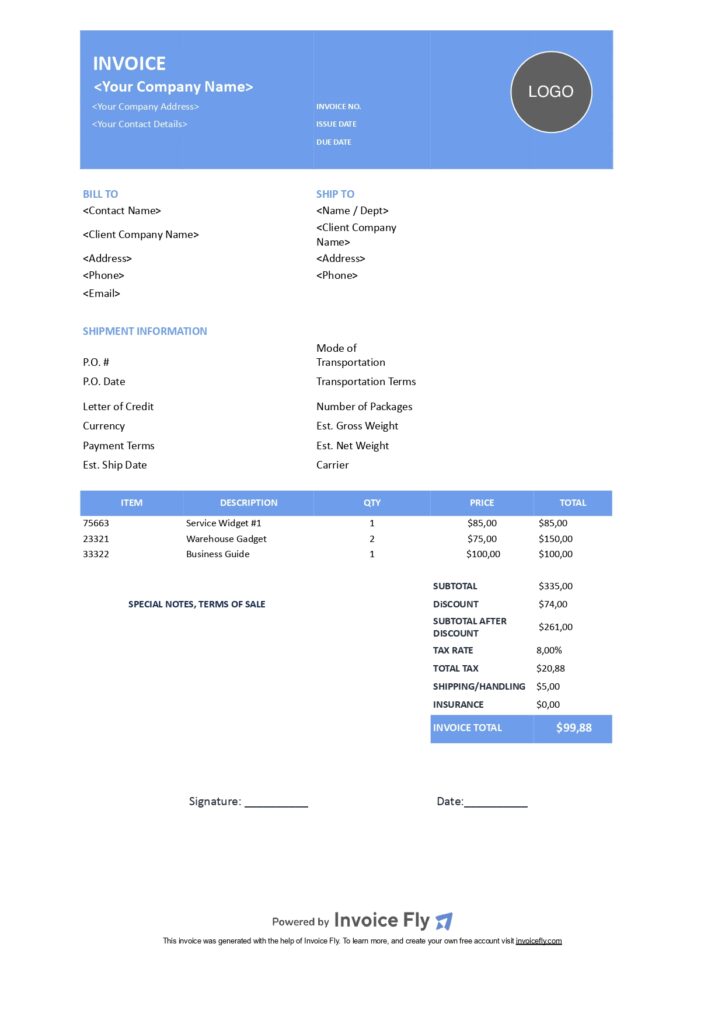

Commercial Free Invoice Template Dark Blue

Commercial Free Invoice Template Green

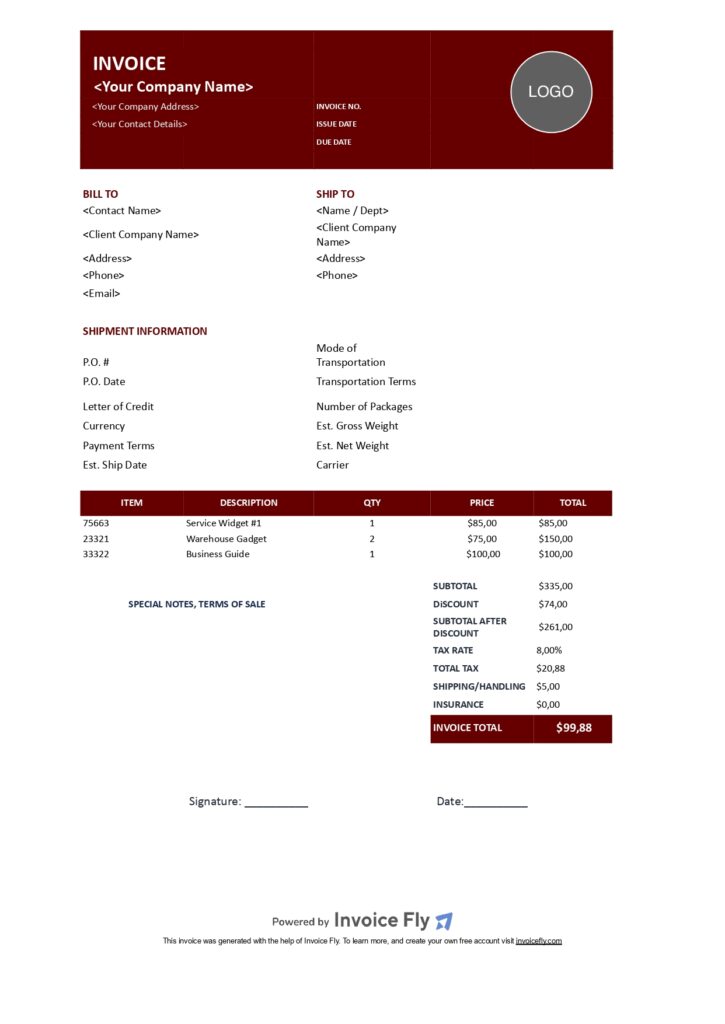

Commercial Free Invoice Template Red

Commercial Free Invoice Template Light Blue

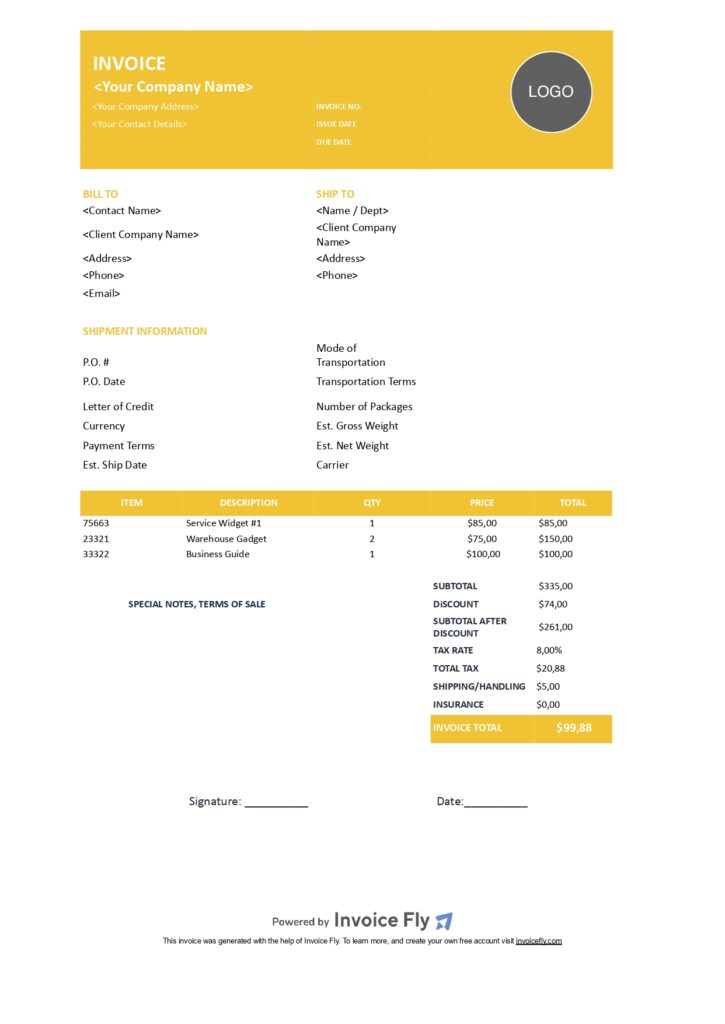

Commercial Free Invoice Template Yellow

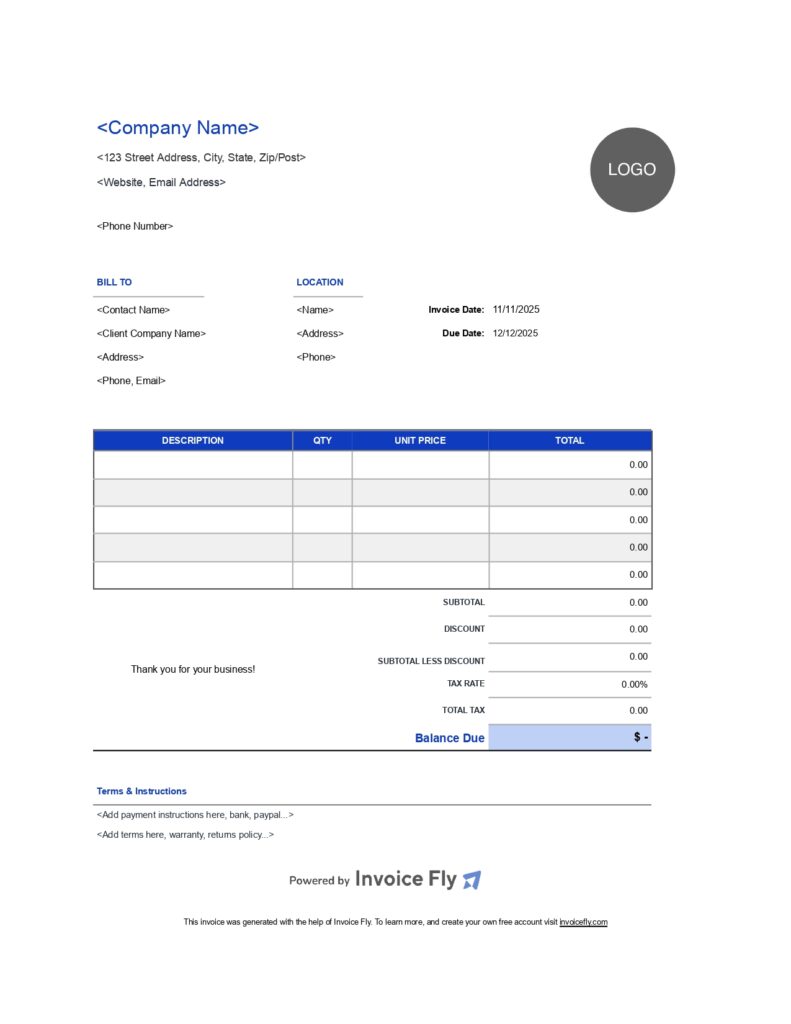

Modern Free Invoice Template Dark Blue

Modern Free Invoice Template Green

Modern Free Invoice Template Red

Modern Free Invoice Template Light Blue

Modern Free Invoice Template Yellow

Free Auto Repair Invoice Templates

Google Docs

Google Sheet

Word

Excel

Problem → Solution

Running an auto shop is hands-on. Paperwork shouldn’t slow you down.

Manually building bills for parts, labor, taxes, and shop supplies leads to errors and late payments.

The fix: our free auto repair invoice templates—pre-formatted for mechanics and auto body shops. Customize fields for parts & labor, add vehicle details, and print or email in one go. Prefer faster billing? Use InvoiceFly’s online invoice generator to save items, track payments, and get paid quicker.

Download Your Free Templates

- PDF: Clean, printable auto repair invoice (fillable fields).

- Microsoft Word / Google Docs: Easy to brand; great for simple edits.

- Microsoft Excel / Google Sheets: Built-in formulas for parts & labor totals.

- Blank Invoice (printable): For quick, handwritten jobs.

What’s Included (and Why It Matters)

- Vehicle & customer info: Owner, VIN, plate, mileage, service advisor.

- Parts & materials: SKU/part #, qty, unit price, line totals.

- Labor entries: Job codes, hours, rates—perfect for diagnostics, brakes, tires, A/C, and more.

- Taxes & shop fees: Sales tax, environmental/disposal fees, shop supplies.

- Totals that make sense: Subtotal, discounts, tax, deposits, balance due.

- Authorization & warranty notes: Sign-off lines and terms to protect your shop.

- Payment methods: Cash, card, bank transfer—plus online payments via InvoiceFly.

Formats: PDF (fillable), Word, Excel, Google Sheets, Google Docs — plus an online invoice generator.

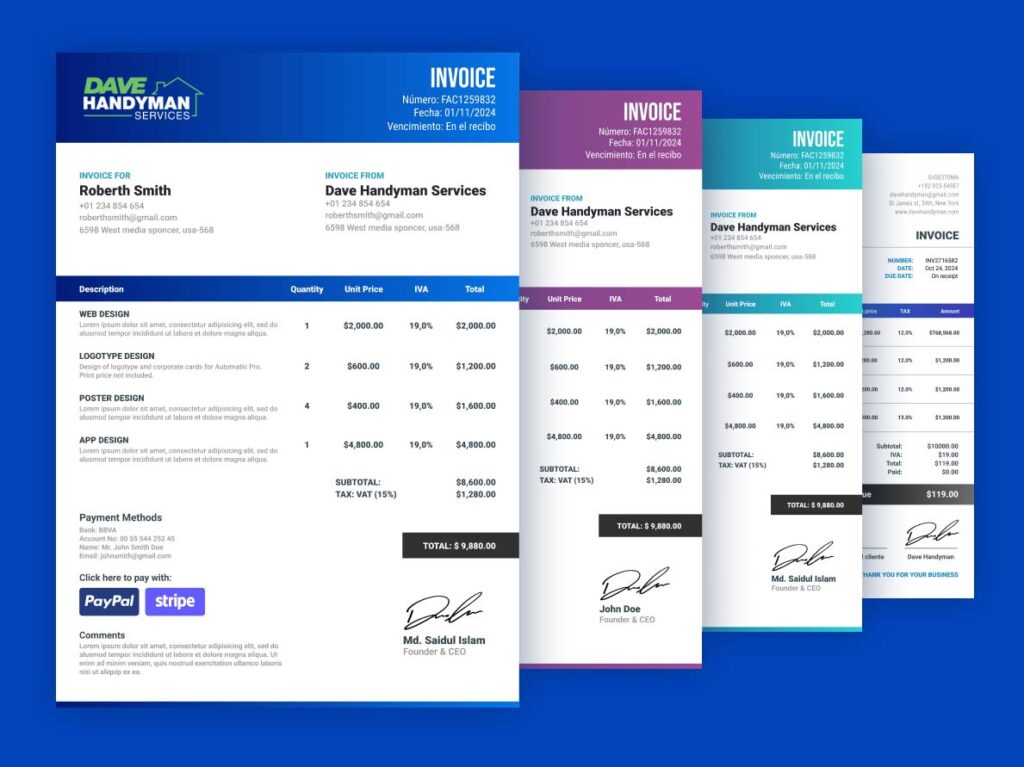

Looking for beautiful & professional

invoice templates?

Try our Premium Invoice Templates for the best results!

- +72 solid & gradient colors

- +6 invoice template lay outs

- Customize invoice structure as needed

- Add company logo & remove background

Auto Repair

Invoice Template FAQs

Start from an auto repair invoice template. Add customer and vehicle details (name, phone, VIN, plate, mileage), your shop info, and a unique invoice/RO number. Itemize labor (job code, hours × rate) and parts (part #, qty, unit price), plus shop supplies, disposal/environmental fees, and sales tax. Show subtotal, deposits, discounts, tax, and Total Due. Include warranty/authorization notes and payment methods, then export to PDF or send online.

Concern, Cause, Correction. Document the customer’s Concern (“A/C not cooling”), the diagnosed Cause (low refrigerant due to leaking condenser), and the Correction (replace condenser, evacuate/recharge, verify performance). Using the 3 C’s keeps invoices clear for customers, insurers, and future warranty claims.

Use a template with separate Labor and Parts sections. Charge labor by your hourly rate or a flat-rate time guide, include diagnostic time if applicable, and list parts with part numbers and warranties. Add shop fees (if used), taxes, and concise terms (for example, Net 15, late-fee policy). Attach estimate/RO references and before-and-after notes or photos for transparency.

Common approach: labor rate × billed hours (or flat-rate guide), parts at retail (with clear markup policy), plus shop supplies (flat fee or capped percentage), disposal/environmental fees, and sales tax where applicable. Provide a written estimate, get pre-authorization, and note any change orders. Always show a final itemized invoice.

Yes. Any legitimate shop or mobile mechanic can issue invoices—no special license for the document itself. Ensure invoices are accurate, sequentially numbered, and include required details (seller/buyer info, description of work, totals, terms). Keep copies for your records and taxes.

A professional automotive invoice includes: shop logo/contact, customer & vehicle details (VIN/plate/mileage), RO/invoice number and dates, 3 C’s write-up, labor lines (hours/rate), parts lines (part #/qty/price), shop fees, taxes, totals, payment info, and warranty/authorization notes. Many shops also include technician IDs and test-drive verification.

Use a blank template in Word/Google Docs or an Excel spreadsheet with formulas. Add your shop info, client/vehicle details, unique invoice number, itemized parts and labor, fees/tax, and Total Due. Save a branded master copy, number invoices sequentially, and export to PDF before sending.

Yes—itemization builds trust, speeds insurance/warranty approvals, and reduces disputes. It also helps customers understand parts vs. labor and supports future service history.

If you paid an independent contractor (not your employee) for services and meet IRS reporting thresholds, you generally issue Form 1099-NEC. Payments made by credit card are typically reported by the processor (1099-K), so you wouldn’t duplicate them. Ask the payee for a Form W-9 to determine their tax status (e.g., individual/sole prop vs. corporation) and confirm requirements with your tax advisor. (This is general information, not tax advice.)

Other Free Resources

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs