How to Accept Credit Card Payments As a Contractor?

Table of Contents

- What is payment processing?

- Things to Think About When Choosing a Payment System

- Keep Records Using a Client Management System

- When to Contact Holders of Past-Due Accounts

- Offer Financing to Land More Jobs & Accept More Credit Card Payments

- Final Thoughts About How To Accept Online Payments As A Contractor

- FAQs about How To Accept Credit Card Payments As A Contractor

In today’s construction industry, being able to accept credit card payments is no longer optional—it’s expected. Homeowners and commercial clients alike prefer the convenience and security of paying with a card rather than writing checks or handling cash. For contractors, adopting modern payment solutions like mobile card readers, online gateways, and integrated accounting software makes it easier to get paid quickly, reduce late payments, and keep better financial records.

In this guide, we’ll break down the best ways contractors can start accepting credit card payments, the fees to expect, and how to avoid common pitfalls like chargebacks.

Need a payment processing solution for your contracting business? Try Invoice Fly’s Online Payments — it’s free!

What is payment processing?

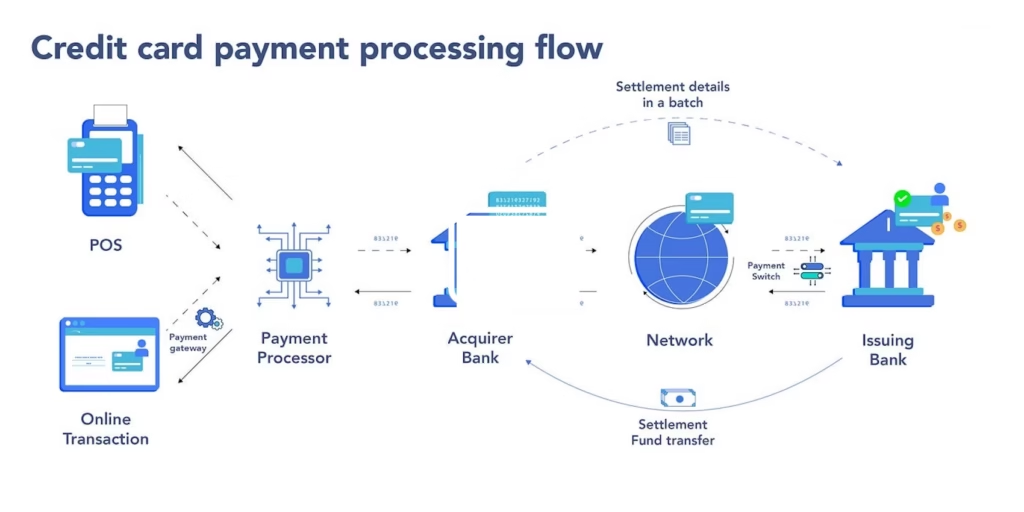

Payment processing is the technology that moves money from a client’s card to your business bank. For contractors, understanding payment processing helps you choose the right solution for your business needs and understand the fees involved.

Three pieces usually work together: a payment gateway (where customers enter their card information), a payment processor (who handles the transaction), and your merchant account (where funds are temporarily held before transfer to your business account).

Types of Payment Processing Systems

| System Type | Good For | Typical Setup | Pros | Cons |

| Traditional Merchant Account | Larger contractors with steady volume | Underwriting, more paperwork | Potentially lower rates at high volume | Slower setup; more complex |

| Payment Service Provider (PSP) (e.g., Stripe, Square, PayPal) | Independent contractors & small firms | Fast, online onboarding | Quick setup; built-in tools | Slightly higher fees |

| All-in-one Contractor Platforms / Integrated Business Solutions | Contractors wanting estimates + invoicing + payments | Platform signup | Unified workflow | Platform fees; features vary |

Source: Edge

Mobile Apps & POS Systems

On-site work makes mobile credit card processing for contractors a no-brainer. According to Stripe, setup is as simple as downloading an app, creating an account, and pairing a reader.

Popular contractor POS systems include:

- Square: Transparent pricing, mobile readers, invoicing.

- Stripe: Flexible APIs, Tap-to-Pay, recurring billing.

- PayPal: Trusted name, online + mobile options.

Practical Ways to Accept Cards

| Use Case | Best Method | Gear Needed | Steps | Notes |

| Job-site deposit/final | Mobile card reader / Tap to Pay | Phone + reader | Enter amount → client taps/swipes | Fastest in person |

| Remote invoice | Online payments for independent contractors | None | Send invoice link → client pays online | Great for retainers |

| Phone authorization | Keyed entry | None | Take details over phone | Higher risk & fees |

| Recurring contracts | Recurring billing | None | Save card on file | Automates cash flow |

Things to Think About When Choosing a Payment System

Selecting the right payment processing solution requires evaluating several factors that directly impact your profitability and customer experience.

Payment Processing Fees

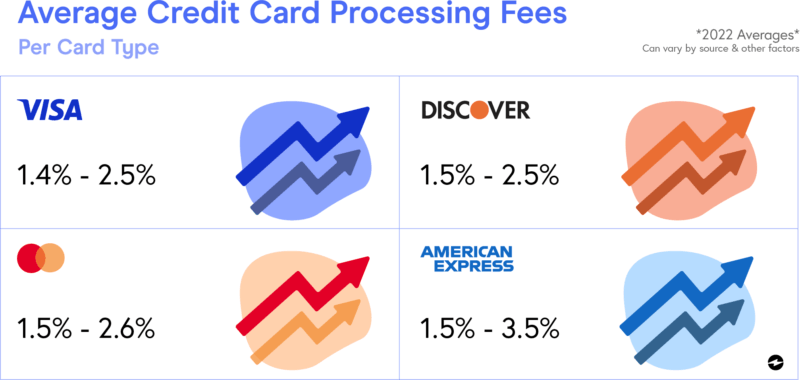

Understanding the fee structure is crucial for maintaining healthy profit margins.

| Provider | Card-Present / In-Person Rate | Online / Card-Not-Present Rate | Notes |

| Square | 2.6% + 15¢ (tap/dip/swipe) | 2.9% + 30¢ (online checkout & invoicing) | Manually keyed or card-on-file = 3.5% + 15¢. ACH bank transfer via invoice = 1% ($1 min, $10 cap) |

| Stripe | Typically 2.7%–2.9% + 30¢ (depends on card type & channel) | 2.9% + 30¢ (standard online U.S. cards) | International cards = +1%, currency conversion = +1% extra |

| PayPal | 2.29% + $0.09 (QR code & PayPal Zettle card-present) | 2.99% + fixed fee (USD = $0.49) for standard credit/debit card & wallets | PayPal Checkout / Guest checkout = 3.49% + fixed fee. “Pay Later” = 4.99% + fixed fee) |

What the fees really mean (and what to watch for):

In-person (card-present) transactions usually cost less because they’re lower risk—think ~2.6% + 15¢ with Square as a common benchmark. By contrast, keyed-in or online payments are riskier and often cost more (e.g., ~2.9% + 30¢ online; ~3.5% + 15¢ when manually keyed). Beyond the headline rate, compare the total cost of ownership:

- Monthly/platform fees (some plans charge a subscription)

- Setup & hardware (readers, terminals, replacements)

- Per-transaction add-ons (AVS/CVV checks, premium fraud tools)

- Chargeback & dispute fees (plus retrieval fees)

- ACH pricing & caps (often ~1% with a dollar cap)

- Cross-border & currency conversion surcharges

- Early termination or contract lock-ins

- Accounting integration or add-on app fees

Small differences add up—run your typical job size and monthly volume through each provider’s calculator to see your real, all-in effective rate.

For more details on how fees impact your bottom line, check out QuickBooks’ guide on credit card processing fees.

Can I pass payment processing fees on to customers?

In most cases yes, but surcharging (adding a fee for credit card use) depends on state law and card network rules. In 2025, it’s prohibited in Connecticut, Maine, and Massachusetts and restricted in several other states.

Rather than adding surcharges, many contractors build processing costs into their overall pricing structure. This approach avoids potential legal issues while maintaining profit margins. You can also offer cash/ACH discounts to customers who pay without credit cards.

Fraud Liability

Not all transactions carry the same level of risk. Card-present payments (where the card is tapped, dipped, or swiped) are generally safer and come with lower fees because the processor can verify the card physically. Keyed-in or online transactions carry higher fraud risk, which is why processors usually charge more for them.

Most providers now include built-in fraud protection tools, such as:

- Address Verification Service (AVS): Confirms billing address matches the card issuer’s records

- CVV Code Checks: Verifies the 3- or 4-digit security code on the card

- Device Identification: Detects unusual logins or devices trying to process payments

- Transaction Monitoring: Flags suspicious activity like duplicate charges or unusually large transactions

Using these features—and choosing a processor with strong fraud detection, like Stripe’s machine learning fraud systems—helps contractors reduce disputes, chargebacks, and financial losses.

Be Aware of Chargebacks

Chargebacks occur when customers dispute transactions through their credit card companies. Common chargeback scenarios for contractors include:

- Customer claims work wasn’t completed to satisfaction

- Billing disputes over project scope changes

- Customer doesn’t recognize the charge on their statement

Chargeback fees typically range from $20 to $100 per incident. Excessive chargebacks can result in higher processing fees or account termination.

For more on this, see our guide to protecting your business from chargebacks.

Respond to Disputes Quickly

When disputes arise, prompt response is critical. Most processors allow only 7-10 days to respond with supporting documentation. Your best defense includes:

- Detailed contracts and change orders

- Signed delivery confirmations

- Email correspondence with customers

- Before/after photos of completed work

- Invoices with clear descriptions

Other Contractor Payment Tips

- Clear Payment Terms: Specify accepted payment methods, due dates, and late fees in your contracts and invoices. This prevents confusion and provides legal protection.

- Professional Invoicing: Use branded invoices with detailed descriptions, payment instructions, and multiple payment options. Professional presentation builds customer confidence.

- Follow-up Procedures: Establish systematic follow-up procedures for overdue payments, starting with friendly reminders and escalating as necessary.

Keep Records Using a Client Management System

Accurate record-keeping is essential for both financial management and tax compliance. Many contractors integrate systems with QuickBooks accounting software, which makes it easier to track payments and expenses.

Benefits of integrated systems:

- Automatic payment tracking and reconciliation

- Customer payment history and preferences

- Integration with accounting software like QuickBooks

- Automated invoice generation and delivery

- Real-time cash flow reporting

Modern contractor management platforms like Joist integrate estimating, invoicing, and payment processing, creating a seamless workflow from initial quote to final payment.

When to Contact Holders of Past-Due Accounts

Even with multiple payment options, some customers may still pay late. Establishing clear procedures for handling overdue accounts protects your cash flow and maintains professional relationships.

Recommended follow-up schedule:

| Day | Action | Message Focus |

| 1–7 | Friendly reminder | “Heads-up—click to pay.” |

| 8–14 | Phone call | Confirm invoice receipt |

| 15–30 | Formal notice | Add late fees |

| 31–60 | Final warning | Collections/legal notice |

| 61–90 | Collections/legal | File or agency |

Tip! For more strategies, read: How to Handle Late Payments from Clients and our guide to payment reminder procedures.

Offer Financing to Land More Jobs & Accept More Credit Card Payments

Offering financing options can help contractors win higher-value projects by making services more affordable for customers. Many contractors partner with financing companies that handle the credit approval and funding process.

| Option | Best For | Pros | Cons |

| Same-as-cash promo | Smaller projects | Easy approvals | Promo ends quickly |

| Long-term plans | Major remodels | Affordable monthly | Higher total cost |

| Equipment financing | HVAC installs | Immediate payout | Varies by partner |

When choosing financing partners, consider approval rates, interest rates offered to customers, and how quickly you receive payment.

Source: eBizCharge

Final Thoughts About How To Accept Online Payments As A Contractor

The ability to accept credit card payments has become essential for contractors who want to remain competitive and maintain healthy cash flow. While processing fees and setup considerations exist, the benefits—faster payments, improved customer satisfaction, and reduced administrative burden—typically outweigh the costs.

Start by evaluating your current payment methods and identifying areas for improvement. Consider factors like transaction volume, average job size, and customer preferences when selecting a payment processor. Remember that the cheapest option isn’t always the best if it lacks features you need or provides poor customer support.

For contractors just starting with credit card acceptance, mobile solutions like Square or Stripe offer simple setup and transparent pricing. As your business grows, consider integrated platforms that combine payment processing with other business management tools.

Understanding standard invoice payment terms and implementing clear policies helps ensure smooth payment processing regardless of which methods you accept.

Ready to streamline your payment processing? Invoice Fly’s Online Payments provides contractors with simple, professional payment solutions that integrate seamlessly with invoicing and client management.

FAQs about How To Accept Credit Card Payments As A Contractor

Yes—clients expect it. Contractors who accept credit card payments typically get paid faster and reduce collections work. According to Federal Reserve data, credit card use, remote transactions, and mobile payments are rising. Contractors who don't accept cards may lose potential customers or experience longer collection times.

The question likely refers to payment processing solutions rather than business credit cards. For payment processing, Square, Stripe, and PayPal are popular choices offering competitive rates (typically 2.9% + $0.30 per transaction) and easy setup. Choose based on your specific needs: mobile payments, online invoicing, or integrated business management.

According to IRS regulations, payment processors issue Form 1099-K to report credit card transactions, not traditional 1099s. You'll receive a 1099-K if you process over $20,000 in payments AND have more than 200 transactions per year (thresholds may vary by state and processor).

Independent contractors and freelancers can accept credit card payments using the same methods as larger contractors: mobile card readers, online payment processors, or invoicing platforms with integrated payments. Popular solutions include Square, PayPal, Stripe, and integrated freelancer platforms that combine invoicing with payment processing.