Electronic Funds Transfer: How EFT Payments Work for Your Business

Table of Contents

- What Is an Electronic Funds Transfer (EFT)?

- How Does an EFT Work?

- What Types of EFT Payments Exist?

- EFT vs ACH vs Wire Transfers

- Are Electronic Funds Transfers Safe?

- How Long Do EFT Payments Take?

- What Are the Benefits of EFT?

- EFT Payments for International Transfers

- Ready to Simplify How Your Business Gets Paid?

- Electronic Funds Transfer FAQs

Most businesses use electronic funds transfer every day, even if they don’t call it that. Payroll is deposited automatically, customers pay invoices online, and vendors expect bank-to-bank payments instead of checks. These transactions feel routine, but the way they’re processed affects how quickly you get paid, how accurately payments are recorded, and how much time your team spends fixing issues.

Understanding how EFT works helps you make better decisions about payment methods, timelines, and controls, especially as your business grows and payment volume increases.

This guide will cover:

- What electronic funds transfer really means in day-to-day business

- How EFT payments move through the banking system

- Common types of EFT payments businesses rely on

- The difference between EFT, ACH, and wire transfers

- Safety, timing, and practical benefits of using EFT

Before we get into the details: if your business sends invoices or accepts digital payments, Invoice Fly’s invoicing software that supports EFT payments helps you request payments electronically, track when funds arrive, and keep everything organized without extra admin work.

What Is an Electronic Funds Transfer (EFT)?

An electronic funds transfer is simply a way to move money between bank accounts without using cash or paper checks. Instead of mailing a check or visiting a bank branch, the payment is initiated digitally and processed through secure banking systems.

In practice, EFT covers many transactions people already use every day. Direct deposit paychecks, online bill payments, debit card purchases, ATM withdrawals, and bank-to-bank transfers all fall under the EFT umbrella. Most people use EFT regularly without realizing there’s a formal name for it.

For businesses, the value of EFT is consistency. Payments move in predictable ways, records are created automatically, and funds usually arrive faster than with paper-based methods. That reliability is why EFT has become the backbone of modern business payments.

If you want a broader look at how modern businesses get paid, this guide on getting paid as a freelancer or contractor shows how EFT fits into today’s payment landscape.

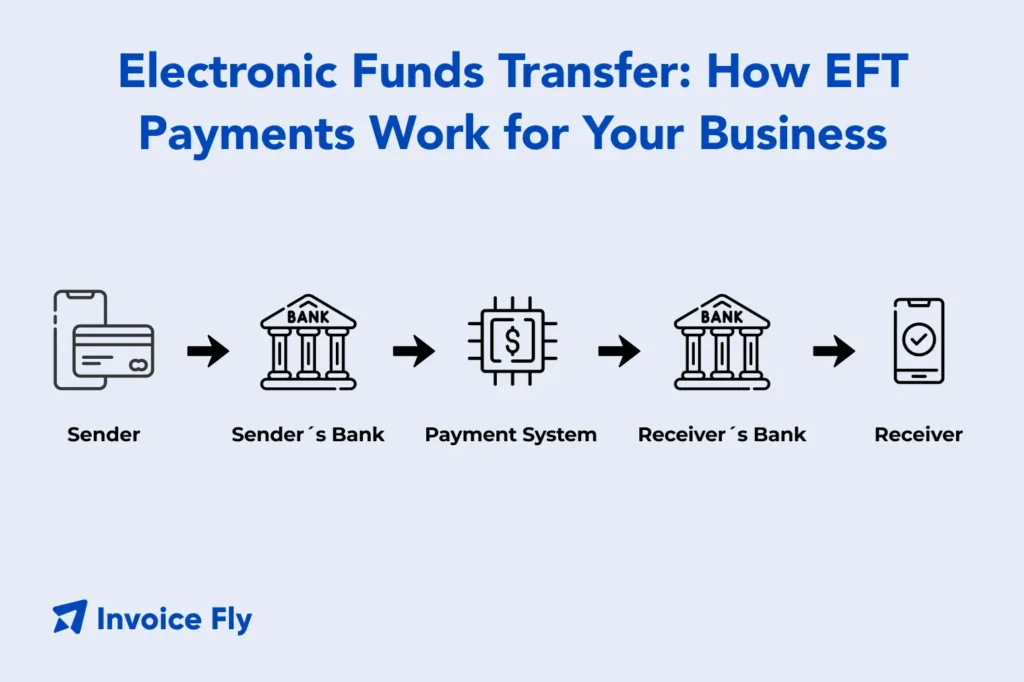

How Does an EFT Work?

While EFT feels instant from the user’s side, there’s a structured process happening in the background.

When a payment is sent, the bank first confirms the account details and checks that funds are available. The instruction is then passed through secure banking networks that coordinate the transfer between financial institutions. Once verified, the funds are removed from one account and added to another.

These systems exist to replace manual processing, which used to involve physical checks, human handling, and long delays. Electronic funds transfer systems were designed to standardize and speed up payments across banks, reducing errors and improving settlement times.

From a business perspective, this matters because timing and accuracy affect everything from payroll to vendor relationships. Keeping clear records and tracking business transactions alongside EFT payments helps ensure nothing slips through the cracks.

What Types of EFT Payments Exist?

EFT isn’t one single payment method. It includes several different types of electronic transfers, each used for specific situations.

Direct Deposit

Direct deposit is one of the most familiar EFTs. Employers use it to pay wages directly into employees’ bank accounts, and government agencies use it for benefits and tax refunds. For businesses, it removes the cost and hassle of printing and distributing checks.

Electronic Checks

Electronic checks work much like traditional checks, but without the paper. The payer authorizes a one-time electronic withdrawal from their checking account, which is processed digitally. This option is often used for vendor payments or recurring expenses.

Phone & Mobile Payments

Mobile banking apps and phone-based payment services allow EFTs to be initiated from anywhere. These are useful for business owners who manage finances on the go or work remotely.

ATM Transactions

ATM withdrawals and deposits are also EFTs. Each transaction sends an electronic instruction to update account balances in real time, allowing immediate access to funds.

Card Payments

Debit card purchases are EFT transactions processed at the point of sale. Funds move electronically from the customer’s bank to the merchant, making this one of the most common EFT uses in everyday commerce.

Online Transfers & Internet Banking

Online bank transfers allow businesses to move money between accounts or pay suppliers electronically. When paired with accepting invoice payments electronically, these transfers help shorten payment cycles and improve cash flow.

EFT vs ACH vs Wire Transfers

EFT is often used interchangeably with ACH or wire transfers, but they aren’t the same thing.

EFT is the broad category that includes all electronic money movements. ACH payments are a specific type of EFT that are processed in batches, which is why they’re commonly used for payroll, subscriptions, and recurring bills.

Invoice Fly’s guide to ACH payment processing explains how these transfers work behind the scenes.

Wire transfers are also EFTs, but they’re handled individually and usually settle faster. Because of that speed, wires often come with higher fees and are typically reserved for large or time-sensitive payments.

Knowing the difference helps businesses choose the right method based on urgency, cost, and volume.

Are Electronic Funds Transfers Safe?

Security is one of the biggest reasons businesses rely on EFT instead of paper checks. Electronic transfers reduce the risk of lost mail, forged signatures, or manual data entry errors.

EFT systems use encryption and authentication to protect sensitive information. In addition, U.S. law provides consumer and business protections. The Electronic Funds Transfer Act limits how much a consumer or business can be held responsible for unauthorized electronic transfers, as long as the issue is reported within the required time frame.

For businesses, combining EFT with routine account monitoring and internal controls adds another layer of protection.

How Long Do EFT Payments Take?

How long an EFT takes depends on the type of transfer being used.

ACH payments usually settle within one to three business days. Debit card and ATM transactions are often processed almost immediately. Wire transfers may settle the same day, while international EFTs can take longer due to additional banks and compliance checks.

Understanding these timelines helps businesses plan payments, manage cash flow, and avoid unnecessary delays.

What Are the Benefits of EFT?

Businesses adopt EFT because it simplifies how money moves.

Electronic transfers are faster than checks, reduce administrative work, and create automatic records that are easy to reconcile. They also make it easier to pay and get paid without relying on physical paperwork.

When combined with strong bookkeeping systems, EFT supports clearer financial reporting and fewer surprises at tax time.

EFT Payments for International Transfers

EFT systems also play an important role in international payments, especially for businesses that work with overseas vendors or clients.

International EFTs typically move through multiple banks and payment networks, which means they can take longer than domestic transfers. Currency conversion, intermediary banks, and additional compliance requirements can all affect processing time. Even so, electronic transfers remain far more efficient and traceable than paper-based methods.

For businesses, understanding these differences helps set realistic expectations around timing and fees. While international EFTs may not settle instantly, they still offer a secure and standardized way to move money across borders, making them a practical option for global payments when speed and reliability both matter.

Ready to Simplify How Your Business Gets Paid?

Electronic funds transfer gives businesses a faster and more dependable way to move money without relying on paper checks or manual processing. Whether you’re paying employees, collecting customer payments, or managing vendors, EFT helps reduce delays, cut down on administrative work, and keep cash moving predictably.Invoice Fly brings invoicing, payment tracking, and online payments for EFT transactions into one system, so you can see what’s been sent, what’s been paid, and what still needs follow-up, making it easier to stay organized and get paid on time without adding complexity.

Electronic Funds Transfer FAQs

EFT is a broad term that includes most electronic bank transfers. If money is moved digitally between bank accounts such as through online banking, direct deposit, or automated payments. It’s generally considered an electronic funds transfer.

The three main types of bank transactions are deposits, withdrawals, and transfers. EFTs fall under transfers and cover many of the electronic ways money moves between accounts today.

A wire transfer is a fast, often same-day type of electronic transfer that usually comes with higher fees. EFT is a broader category that also includes ACH payments, debit card transactions, ATM activity, and online bank transfers.

Limits on electronic transfers vary by bank, account type, and transfer method. Many banks set daily or per-transaction limits, especially for online and automated payments.

Yes. EFTs use secure banking systems and encryption, and federal regulations help protect users if unauthorized transfers occur and are reported in time.