Retainage in Construction: Meaning, Laws, and Best Practices

Table of Contents

- What Is Retainage?

- Retainage Explained

- How Does Retainage Work?

- Retainage Laws Across the US

- Why Is Retainage Important?

- Alternatives to Retainage

- Calculating Retainage

- Four Steps to Reduce Retainage Impact

- How Retainage Affects Cash Flow

- How to Record Retainage in Financial Statements

- Best Practices for Managing Retainage

- Conclusion

- FAQs

Retainage is a common practice in construction where a small portion of each payment—usually 5% to 10%—is held back until the project is fully completed. The idea is simple: it gives project owners peace of mind that the work will be finished properly and according to the contract.

While retainage can help protect quality and reduce risk, it can also slow down payments and put pressure on your cash flow. In this guide, we’ll break down what retainage really means in construction, how it works in real life, and what contractors and business owners should know to handle it without unnecessary stress.

What Is Retainage?

Retainage in construction is money held back from your payments until the project is done. The owner keeps a percentage of what they owe you until all work is finished and meets the contract requirements. The retainage meaning is straightforward: it’s a financial holdback that motivates you to complete your work properly and protects the project owner from defects or incomplete obligations.

What is retainage in simple terms? Think of it as a security deposit in reverse. Instead of you putting money down upfront, the owner keeps a percentage of what they owe you until you’ve proven the work is complete.

How retainage typically works:

- You complete work worth $100,000

- Owner withholds 10% retainage ($10,000)

- You receive $90,000 in the progress payment

- You complete the entire project

- Owner releases the $10,000 retainage after final inspection and approval

The retainage definition in construction contracts usually specifies the percentage withheld (commonly 5-10%), when it’s released (at substantial completion, final completion, or after a warranty period), and any conditions for early release.

Retainage vs. retention: What’s the difference?

Retainage and retention mean the same thing in construction—money withheld from payments until project completion. The terms are used interchangeably, though “retainage” is more common in the United States while “retention” appears more frequently in international contracts.

Retainage Explained

Understanding retainage means looking at it from multiple perspectives because it affects different parties in different ways.

- For project owners: Retainage provides financial leverage to ensure you complete punch list items, fix defects, and fulfill all contract obligations. If you abandon the project or leave work incomplete, the owner uses retainage funds to hire someone else to finish.

- For general contractors: When you’re working as a general contractor, you experience retainage from both sides. The owner withholds retainage from your payments, while you typically withhold the same percentage from your subcontractors.

- For subcontractors: As a subcontractor, you complete your portion of work early in the project but may wait months or even years to receive your retainage. The general contractor holds your retainage until the entire project completes, not just your specific trade work.

- For material suppliers: Suppliers often face retainage on their invoices too, even though they delivered materials months before project completion. This creates significant cash flow challenges for businesses operating on tight margins.

How Does Retainage Work?

The retainage process follows a predictable pattern throughout the construction project lifecycle.

- Contract negotiation: During contract formation, you negotiate the retainage percentage, release conditions, and timing. Standard percentages range from 5-10%, though this varies by project type, size, and risk level.

- Progress billing: As work progresses, you submit progress billing applications (often using AIA billing forms) showing completed work on your invoice. The owner approves the amount, applies the retainage percentage, and pays the net amount. For example, if you bill $50,000 with 10% retainage, you receive $45,000 while $5,000 is withheld.

- Retainage accumulation: Each billing cycle adds to your retainage receivable balance. On a $1 million project with 10% retainage, you’ll have $100,000 withheld by project end—a substantial amount that impacts your working capital.

- Substantial completion: When the project reaches substantial completion (typically 95-98% complete and ready for intended use), many contracts release half the retainage. This provides partial cash flow relief while maintaining incentive to complete remaining work.

- Final completion: After you finish all punch list items and receive final inspection approval, the owner releases the remaining retainage. Some contracts include a waiting period (30-60 days) after final completion before releasing funds.

What Are the Rules of Retainage?

Retainage rules vary significantly by state, project type, and whether the project involves public or private funds.

Federal projects: On federal projects governed by the Miller Act, retainage typically cannot exceed 10% until work reaches satisfactory progress, after which it may be reduced or eliminated.

State laws: Each state regulates retainage differently. Research your state’s specific requirements before signing construction contracts.

Who Should Use Retainage?

Retainage makes sense in certain project scenarios but creates unnecessary burden in others.

When retainage is appropriate:

- Large, complex projects with multiple contractors and long timelines

- High-risk work where quality issues could cause significant problems

- Projects with contractors who have limited track records

- Situations where completing punch list items historically proves difficult

When retainage may be excessive:

- Small projects with established contractors

- Work with minimal complexity or defect risk

- Projects where the contractor’s reputation provides adequate incentive

- Situations where cash flow constraints could cause contractor financial distress

Who Benefits From Retainage & How?

Project owners benefit through financial leverage ensuring project completion, protection against defective work, resources to complete punch lists if contractors fail to return, and reduced risk of contractor abandonment.

The upside for contractors? At least you know what to expect. Retainage is so common that you can plan for it from the start.

Impact of Retainage on Contractors, Subcontractors and Material Suppliers

Retainage creates a domino effect. When the owner holds back your money, you often have to hold back money from your subs—and the delays stack up.

Cash flow strain: When 10% of every payment is withheld, you’re essentially providing interest-free financing to the project owner. On multiple simultaneous projects, this can tie up hundreds of thousands of dollars in withheld funds.

Compounding delays: General contractors often don’t release subcontractor retainage until they receive their own retainage from the owner. This means subs wait even longer than GCs, sometimes extending months past when their work actually finished.

Working capital limitations: Withheld retainage reduces cash available for materials, payroll, equipment, and managing unexpected expenses. This creates particular hardship for smaller contractors operating on tight margins.

Administrative burden: Tracking retainage receivable and retainage payable across multiple projects and billing cycles creates significant accounting complexity for construction companies retainage accounting management.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

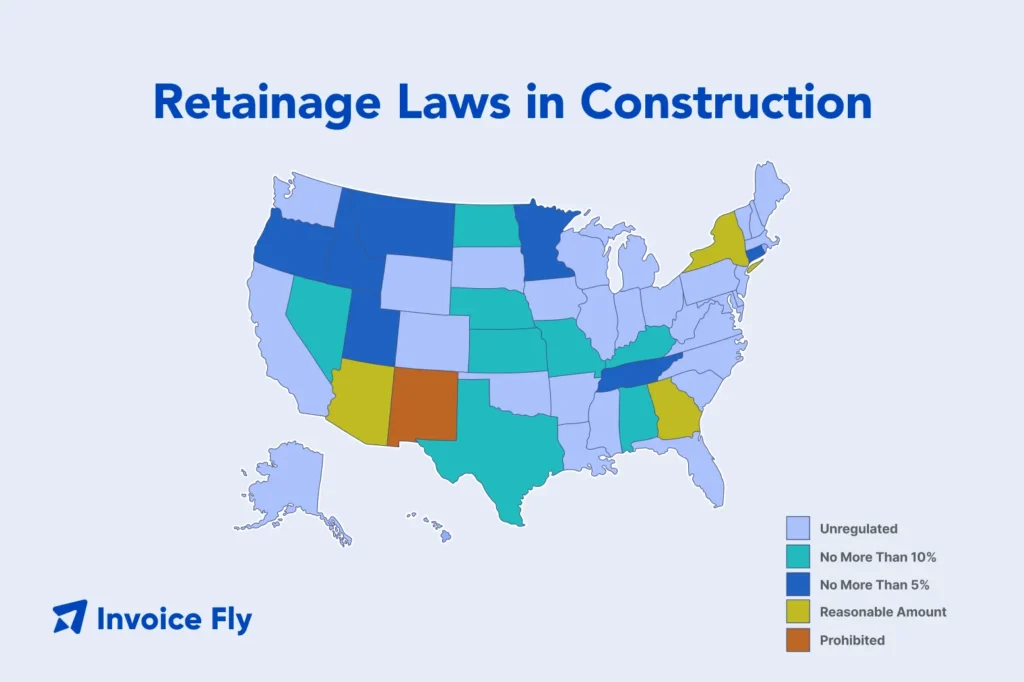

Retainage Laws Across the US

Construction retainage laws by state vary widely in terms of maximum percentages, release timing, and special protections. Laws also differ between public and private projects, and they change regularly as states pass reforms.

Here are a few notable examples of how state retainage laws work:

- California retainage: Starting January 1, 2026, California generally caps retainage at 5% on most private construction projects under SB 61 (Civil Code § 8811). The state also has detailed rules about retainage percentages, timing, and withholding conditions for public projects.

- Colorado retainage law: Colorado HB21-1167 limits retainage to 5% on public projects and also restricts retainage on many private contracts, providing broader protections for contractors.

- Florida retainage law: Florida law allows up to 10% retainage but requires release within specific timeframes after substantial completion.

- Tennessee retainage law: Tennessee law provides protections for subcontractor retainage release and addresses timing requirements.

- New York retainage law: NYS law addresses retainage timing and percentage limits on public contracts.

For a complete breakdown of retainage laws in your state, refer to this comprehensive 50-state retainage law summary. Always verify current regulations before signing contracts, as laws change frequently.

Why Is Retainage Important?

Despite its cash flow challenges, retainage plays a significant role in construction project management and risk mitigation.

History of Retainage

Retainage emerged in the late 19th century during major railroad construction projects. Owners needed ways to ensure contractors completed long-duration projects, especially when contractors operated far from home bases. The practice became standardized throughout the 20th century and now appears in most construction contracts.

Purpose of Retainage

Quality assurance: Retainage creates financial incentive to maintain quality throughout the project. Knowing you won’t receive full payment until final acceptance encourages attention to detail and prompt punch list completion.

Completion guarantee: The withheld funds provide assurance that you’ll return to complete minor items rather than moving to the next job and leaving small tasks unfinished.

Defect protection: If defects appear after your work, retainage funds help cover correction costs without lengthy legal proceedings or payment disputes.

Advantages and Disadvantages of Retainage

Retainage is meant to reduce risk for project owners, but it comes with trade-offs for contractors and subcontractors. The table below outlines the main pros and cons of retainage in construction.

| Advantages of Retainage | Disadvantages of Retainage |

| Protects owners – Covers costs if work is incomplete or defective | Cash flow strain – Delays payment for work already completed |

| Encourages completion – Motivates timely punch list work | Hurts small businesses – Disproportionately affects contractors with tight margins |

| Provides safety net – Funds available if contractor defaults | Penalizes everyone – Reliable contractors face same holdbacks as poor performers |

| Reduces owner risk – Especially helpful with new or unproven contractors | Administrative burden – Adds complexity to billing, tracking, and accounting |

| Creates consistency – Standardized practice across most contracts | No quality guarantee – Doesn’t actually prevent poor workmanship |

Because of these drawbacks, many owners and contractors are exploring alternatives to retainage that reduce risk without tying up cash.

Alternatives to Retainage

Several alternatives to traditional retainage provide owner protection while improving contractor cash flow.

Performance Bond

A performance bond is a surety bond guaranteeing project completion. If you default, the surety company either completes the work or compensates the owner financially. Performance bonds eliminate the need for retainage by transferring completion risk to the surety.

Retainage Bond

A retainage bond or retention bond allows you to receive your full progress payments (no withholding) in exchange for purchasing a bond that guarantees the same protection retainage would provide. You pay the bond premium (typically 1-3% of the retainage amount annually)—similar to other overhead costs—but gain immediate access to working capital.

For example, on a project with $100,000 in retainage, you might pay $2,000-$3,000 in bond premiums but receive the full $100,000 upfront. This trade often makes financial sense if the improved cash flow allows you to take additional profitable work.

Unpaid Retainage

Some contractors negotiate contracts with reduced or eliminated retainage based on their reputation, performance history, or relationship with the owner. While uncommon, this approach works when trust exists and the contractor’s incentive to maintain their reputation outweighs the need for financial holdback.

Calculating Retainage

Retainage calculation is straightforward but must be tracked carefully across multiple billing cycles.

Basic retainage calculation:

- Gross Amount Earned × Retainage Percentage = Amount Withheld

- Gross Amount Earned – Amount Withheld = Net Payment

Example: You complete $75,000 of work this billing period. The contract specifies 10% retainage.

- Retainage: $75,000 × 0.10 = $7,500

- Net payment: $75,000 – $7,500 = $67,500

Cumulative retainage: Track total retainage withheld across all billing periods. If this is your third payment application:

- Previous retainage held: $15,000

- Current period retainage: $7,500

- Total retainage receivable: $22,500

Release calculation: When 50% of retainage releases at substantial completion:

- Total retainage: $22,500

- 50% release: $11,250

- Remaining withheld: $11,250

Four Steps to Reduce Retainage Impact

While you can’t unilaterally eliminate retainage, these strategies reduce its impact:

1. Negotiate lower percentages or progressive reduction: Instead of 10% throughout, negotiate 10% until 50% complete, then 5%, then 0% after 75% completion.

2. Use retainage bonds: Purchase retainage bonds to receive immediate payment in exchange for bond premiums. Compare premium costs to the value of improved cash flow.

3. Build track record for retainage-free contracts: Consistently deliver quality work on time. Use this track record to negotiate reduced or eliminated retainage on future projects.

4. Advocate for legislative reform: Support industry associations working to reform retainage laws in your state. Some states have reduced or eliminated retainage on public projects through legislative action.

How Retainage Affects Cash Flow

Retainage creates three specific cash flow challenges you must plan for and manage.

Delayed Access to Earnings

You complete work today but may not receive full payment for months or years. On a two-year project, retainage withheld in month 3 might not be released until month 26—a 23-month delay between earning and collecting.

Liquidity Strain

Withheld retainage reduces cash available for purchasing materials, meeting payroll, paying subcontractors and suppliers, investing in equipment, and managing unexpected expenses. This creates particular hardship for smaller contractors without significant cash reserves.

Compounding Impact on Large or Long-Term Projects

Multiple concurrent projects each withholding retainage can tie up substantial capital. If you’re running five projects simultaneously, each withholding $50,000, you have $250,000 in retainage receivable—money you’ve earned but can’t access.

Understanding how retainage impacts your cash flow problems helps you plan for the working capital needs of your construction business.

How to Record Retainage in Financial Statements

What is retainage in accounting terms? It’s an accounts receivable that requires special cost accounting treatment—separate from regular receivables.

Recording retainage receivable: When you bill $100,000 with 10% retainage, your journal entry would be:

- Debit: Accounts Receivable – $90,000

- Debit: Retainage Receivable – $10,000

- Credit: Revenue – $100,000

This separates the portion you’ll receive soon (accounts receivable) from the portion withheld until project completion (retainage receivable).

Recording retainage payable: When you withhold retainage from a subcontractor billing $25,000:

- Debit: Subcontractor Costs – $25,000

- Credit: Accounts Payable – $22,500

- Credit: Retainage Payable – $2,500

Balance sheet presentation: On your balance sheet, retainage receivable appears as a current asset (if collection expected within one year) or long-term asset. Retainage payable appears as a current liability or long-term liability based on expected payment timing.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

Best Practices for Managing Retainage

Effective retainage management protects your cash flow while ensuring you receive all withheld amounts when due.

Negotiate Retainage Terms

Don’t accept standard retainage terms without negotiation. Consider requesting:

- Lower retainage percentages (5% instead of 10%)

- Progressive reduction as work progresses

- Early release provisions based on completion milestones

- Elimination of retainage based on your performance record

- Retainage bond options allowing immediate payment

Monitor Aging Retainage Receivables

Create a retainage aging report showing:

- Project name and number

- Total retainage withheld

- Dates withheld

- Expected release conditions and timing

- Age of withheld amounts

Many contractors use time tracking software to monitor not just labor hours, but also track payment milestones and retainage release dates across multiple jobs. This helps you stay on top of what’s owed and when to follow up.

Flag retainage that hasn’t been released within expected timeframes and follow up aggressively on overdue amounts.

Create a Cash Flow Plan

Build retainage delays into your cash flow projections. Don’t budget based on gross revenue—plan for net revenue after retainage. Factor in the timing delay between substantial completion and actual retainage release.

Tools like construction estimating software can help you track retainage across multiple projects and forecast cash flow more accurately.

Maintain a Retainage Reserve

Set aside funds from projects without retainage or during strong cash flow periods to create a buffer that offsets the working capital impact of withheld retainage. This reserve helps you maintain operations during periods when significant retainage is outstanding.

Conclusion

Retainage is a long-standing part of construction contracts, designed to protect owners but often challenging for contractors—especially small businesses and subcontractors that rely on steady cash flow. While it can encourage project completion, it also delays access to earned revenue.

The best way to manage retainage is to plan for it. Understand your state’s retainage laws, calculate the cash-flow impact before signing a contract, and track withheld amounts closely to avoid missed or delayed releases. When possible, explore alternatives like retainage bonds and negotiate terms instead of accepting defaults.

Ultimately, treating retainage as a predictable cost of doing business—not a surprise—puts you in control. As you build a strong track record, use that credibility to negotiate lower retainage rates or eliminate retainage altogether with trusted clients.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

FAQs

Retainage release is when the owner pays out the withheld amount—often partially at substantial completion and the rest at final completion (sometimes after a short waiting period).

Usually, yes—once you finish the work, complete punch-list items, and get final approval. Timing depends on the contract and state rules.

Send a written demand referencing the contract, review your state's retainage and payment laws, and consider a mechanic's lien or legal help if needed.

The owner withholds it from the general contractor, and the general contractor often withholds the same percentage from subs—creating a "holdback" chain down the project.

Often, yes. Under accrual accounting, it may be taxable when it's earned, even if it hasn't been paid yet. Check with a tax professional for your situation.