Gross Receipts Tax Explained: What It Is and How It Works by State

Table of Contents

- What Is a Gross Receipts Tax?

- Gross Receipts Tax vs. Corporate Income Tax

- Gross Receipts Tax vs. Sales Tax

- How Gross Receipts Are Defined (What Counts as Revenue)

- States With Gross Receipts Tax

- Gross Receipts Taxes by State (Full List)

- Gross Receipts Taxes by State (Table)

- How to Calculate Gross Receipts Tax

- How GRT Affects Cash Flow

- Ready to Stay Ahead of Your Business Taxes?

- FAQs

Gross receipts tax is a business tax based on a company’s total revenue, not its profit. Unlike income tax, it applies even when expenses are high or a business operates at a loss.

Several states and cities rely on gross receipts tax instead of, or alongside, income and sales taxes, which makes it especially important for small business owners, contractors, and finance managers to understand how it works.

This guide will cover:

- What GRT is and how it works

- How it differs from income tax and sales tax

- How gross receipts are defined for tax purposes

- Which states and cities impose GRT

- A full text and table breakdown by state

- How businesses calculate, manage, and plan for GRT

What Is a Gross Receipts Tax?

A gross receipts tax (GRT) is a tax imposed on a business’s total gross revenue before any expenses are deducted. Gross receipts generally include all amounts received from selling goods or services, as well as other income streams such as rents, fees, and in some cases interest.

Unlike income tax, gross receipts tax:

- Does not allow deductions for operating expenses

- Applies even if a business is unprofitable

- Is usually assessed at relatively low rates

- Can apply to services as well as goods

States often adopt gross receipts tax because revenue is more predictable and harder to reduce through deductions than income-based taxes. From a business perspective, that predictability for governments can translate into higher effective tax burdens for low-margin operations.

The IRS reinforces this concept by defining gross receipts as total amounts received during the year, before expenses. While IRS guidance applies federally, many states use similar definitions when calculating gross receipts tax.

Gross Receipts Tax vs. Corporate Income Tax

Gross receipts tax and corporate income tax operate on very different principles.

| Feature | Gross Receipts Tax | Corporate Income Tax |

| Tax base | Total revenue | Net income (profit) |

| Expense deductions | Not allowed | Allowed |

| Applies during losses | Yes | No |

| Rate structure | Lower rates | Higher rates |

| Impact on thin margins | Higher | Lower |

Income tax focuses on profitability. GRT focuses on business activity and scale. For businesses with high operating costs (such as contractors and service providers) this distinction matters when estimating overall tax liability.

Gross Receipts Tax vs. Sales Tax

Gross receipts tax is often confused with sales tax, but the two function very differently.

| Feature | Gross Receipts Tax | Sales Tax |

| Who pays | Business | Customer |

| Tax base | Business revenue | Retail sale price |

| Shown on invoice | Usually no | Yes |

| Applies to services | Often | Depends on state |

| Expense deductions | No | Not applicable |

Sales tax is typically collected from customers and remitted to the state. GRT is paid directly by the business and is often built into pricing.

These taxes can coexist, sometimes increasing compliance complexity for businesses operating in multiple jurisdictions.

How Gross Receipts Are Defined (What Counts as Revenue)

What counts as “gross receipts” varies by state, but commonly includes:

- Sales of goods

- Fees for services

- Rental income

- Licensing and usage fees

- Certain reimbursements

A common question business owners ask is whether sales tax collected from customers is included in gross receipts. The answer depends on state law. Some states exclude sales tax collected on behalf of the government, while others include it unless explicitly exempted.

Because definitions differ, businesses should rely on state-specific guidance rather than assuming federal rules apply—especially when managing multi-state income tax obligations.

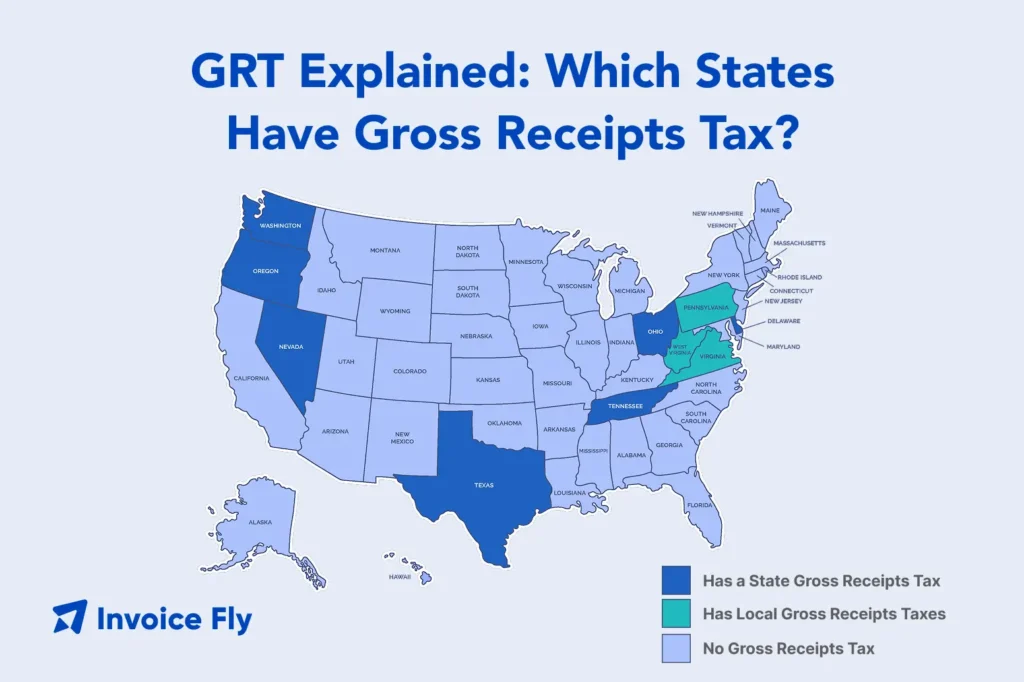

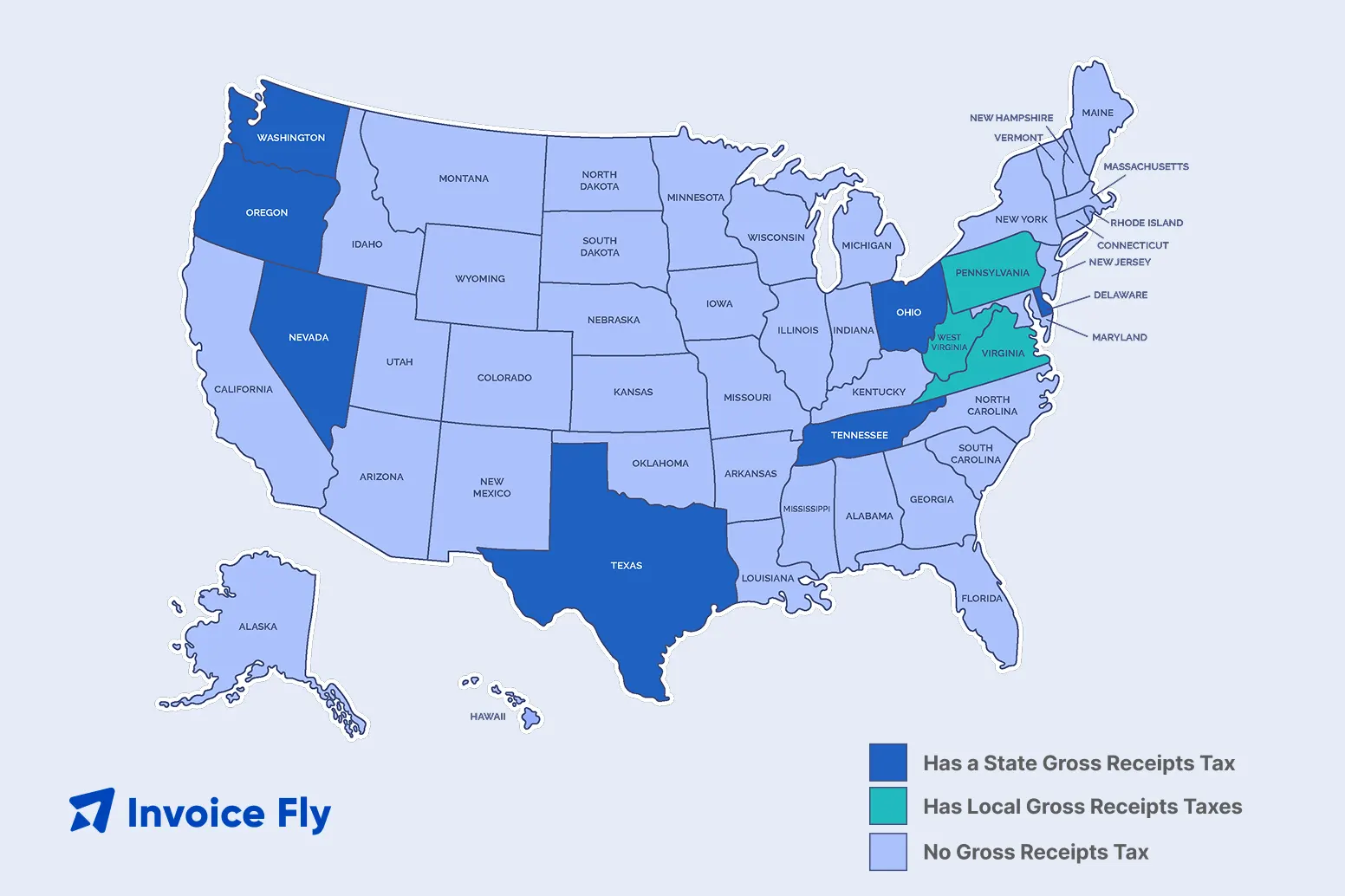

States With Gross Receipts Tax

Only a limited number of states impose a broad statewide gross receipts tax, but several others apply gross-receipts-based taxes under different names or at the local level.

States with notable gross receipts–style taxes include:

Cities such as San Francisco and Los Angeles impose local business taxes based on gross receipts even when the state does not.

Businesses operating across multiple states or cities benefit from keeping revenue organized by jurisdiction. Using Invoice Fly’s invoicing software alongside business reports helps teams track income by client, location, and period, ensuring gross receipts are classified correctly before quarterly filings and estimated tax payments are due.

Gross Receipts Taxes by State (Full List)

Below is a complete text overview of how gross receipts tax applies across all 50 states:

- Alabama: No statewide GRT; limited utility gross receipts taxes apply.

- Alaska: No statewide GRT; some local revenue-based taxes exist.

- Arizona: No GRT; uses Transaction Privilege Tax.

- Arkansas: No GRT.

- California: No statewide GRT; local taxes in San Francisco and Los Angeles.

- Colorado: No GRT.

- Connecticut: No general GRT; limited industry taxes exist.

- Delaware: Statewide gross receipts tax with industry-specific rates.

- Florida: No general GRT; utilities and communications face gross-receipts-style taxes.

- Georgia: No GRT.

- Hawaii: General Excise Tax functions as a gross receipts tax.

- Idaho: No GRT.

- Illinois: No GRT.

- Indiana: No GRT.

- Iowa: No GRT.

- Kansas: No GRT.

- Kentucky: No GRT.

- Louisiana: No statewide GRT; local occupational taxes may apply.

- Maine: No GRT.

- Maryland: No GRT.

- Massachusetts: No GRT; limited revenue-based assessments exist.

- Michigan: No GRT.

- Minnesota: No GRT.

- Mississippi: No GRT.

- Missouri: No GRT.

- Montana: No GRT and no sales tax.

- Nebraska: No GRT.

- Nevada: Commerce Tax applies above revenue thresholds.

- New Hampshire: No traditional GRT; Business Enterprise Tax applies.

- New Jersey: No GRT.

- New Mexico: Statewide GRT applies broadly to goods and services.

- New York: No general GRT; limited industry taxes apply.

- North Carolina: No GRT.

- North Dakota: No GRT.

- Ohio: Commercial Activity Tax applies above revenue thresholds.

- Oklahoma: No GRT.

- Oregon: Corporate Activity Tax applies to gross receipts above a threshold.

- Pennsylvania: No statewide GRT; many local mercantile taxes exist.

- Rhode Island: No GRT.

- South Carolina: No GRT.

- South Dakota: No GRT.

- Tennessee: Business tax based on gross receipts applies.

- Texas: Franchise tax based on revenue.

- Utah: No GRT.

- Vermont: No GRT.

- Virginia: No statewide GRT; local BPOL taxes apply.

- Washington: Business & Occupation tax applies to gross receipts.

- West Virginia: No broad GRT.

- Wisconsin: No GRT.

- Wyoming: No GRT and no income tax.

Gross Receipts Taxes by State (Table)

| State | Gross Receipts Tax? | Notes |

| Alabama | Partial | Utility gross receipts tax |

| Alaska | No | Local revenue taxes only |

| Arizona | No | Transaction Privilege Tax |

| California | Local only | San Francisco, Los Angeles |

| Delaware | Yes | Statewide, no sales tax |

| Hawaii | Yes | General Excise Tax |

| Nevada | Yes | Commerce Tax |

| New Mexico | Yes | Broad application |

| Ohio | Yes | Commercial Activity Tax |

| Oregon | Yes | Corporate Activity Tax |

| Tennessee | Yes | Business tax |

| Texas | Yes | Franchise (margin) tax |

| Washington | Yes | B&O tax |

| Remaining states | No | Income/sales tax only |

How to Calculate Gross Receipts Tax

While rules vary by jurisdiction, the basic steps are consistent:

- Total all gross receipts for the reporting period

- Apply any exemptions or thresholds

- Apply the applicable rate

- File and remit payment

Because expenses do not reduce the tax base, revenue accuracy matters more than expense categorization.

Example: Calculating Gross Receipts Tax

Assume a service business earns $120,000 in gross receipts during a quarter. The state applies a 0.5% GRT rate and does not allow deductions for operating expenses.

- Total gross receipts:

$120,000 - Apply exemptions or thresholds:

None apply in this example - Calculate the tax:

$120,000 × 0.5% = $600 - File and pay:

The business reports $120,000 in gross receipts and remits $600 for the period.

Even if the business had $90,000 in expenses (such as payroll, rent, and materials) the tax owed would still be based on the full $120,000. Because expenses do not reduce the tax base, revenue accuracy matters more than expense categorization when calculating gross receipts tax.

How GRT Affects Cash Flow

Image 4 business-team-calculating-taxes-office

GRT can put pressure on cash flow because the tax is owed on revenue, not profit. Even during slow periods or high-expense months, the obligation remains the same.

Businesses are especially exposed when:

- Revenue is seasonal, but tax payments are due year-round

- Work is billed in milestones, while tax is due before full payment is received

- Customers pay on net-30 or net-60 terms, delaying actual cash inflow

- Margins are thin, leaving little room to absorb taxes tied to gross income

Because expenses do not reduce the tax base, a profitable month and an unprofitable month can trigger similar tax bills if revenue is comparable. This makes cash planning more important than expense tracking when managing gross receipts tax.

To reduce cash flow strain, many businesses:

- Review revenue regularly instead of waiting until filing deadlines

- Forecast tax obligations alongside expected collections

- Set aside a portion of each payment for upcoming tax periods

- Plan around quarterly tax due dates to avoid last-minute shortfalls

With consistent revenue tracking and forward planning, GRT becomes a predictable expense rather than a cash flow shock.

Example: GRT and Timing of Cash

A contractor bills $80,000 for a project milestone in March, with payment due in 45 days. The state applies a 0.4% GRT and requires quarterly filing.

- Gross receipts reported: $80,000

- GRT owed: $320

Even though the contractor doesn’t receive payment until May, the tax is still due based on when the revenue is recognized. If the contractor hasn’t set aside funds, the tax payment must come from existing cash reserves.

This timing gap is why businesses subject to GRT often plan tax payments around expected collections, not just invoicing activity.

Ready to Stay Ahead of Your Business Taxes?

Gross receipts tax changes how businesses think about revenue, pricing, and cash flow. Understanding state-specific rules and keeping accurate records makes compliance far more manageable. Invoice Fly’s invoicing software and reporting tools help businesses maintain clear revenue visibility so tax obligations are easier to anticipate and manage.

FAQs

The full amount a business receives from a customer before expenses.

Businesses operating in states or cities that impose it.

No. Sales tax is paid by customers; gross receipts tax is paid by businesses.

They determine tax liability regardless of profit.

The IRS defines gross receipts as total amounts received during the year before deductions.