Generally Accepted Accounting Principles (GAAP) Explained

Table of Contents

Generally Accepted Accounting Principles (GAAP) are the standard rules businesses in the United States use to keep their financial records in order. Think of GAAP as a common language for accounting—it helps make sure financial statements are clear, accurate, and easy to compare.

These rules are set by the Financial Accounting Standards Board (FASB) and guide how companies record things like revenue, expenses, assets, and liabilities using accrual accounting.

Understanding GAAP isn’t just about compliance. It helps build trust with investors, supports smarter financial decision-making, and is especially important for growing businesses that need clean, transparent reporting to raise funding or scale with confidence.

In this guide, we’ll take a closer look at how GAAP works, who needs to follow it, and why it matters.

What is GAAP?

GAAP stands for Generally Accepted Accounting Principles. It’s a comprehensive framework of accounting standards, concepts, and conventions that dictate how you prepare and present financial statements in the United States. The GAAP definition encompasses the rules governing how to measure, recognize, present, and disclose financial information across different types of organizations.

When you follow GAAP, you’re using a common language that allows investors, creditors, regulators, and other stakeholders to understand and compare your financial position accurately. These principles ensure that financial reporting is consistent—$100,000 in revenue means the same thing across all GAAP-compliant companies’ financial statements.

What GAAP governs in financial reporting:

- Revenue recognition timing and methods

- Expense matching and allocation

- Asset valuation and depreciation

- Liability measurement and disclosure

- Balance sheet and financial statement presentation

Who GAAP applies to:

Publicly traded companies in the United States must follow GAAP as required by the Securities and Exchange Commission (SEC). Many private companies also follow GAAP because lenders, investors, and stakeholders expect it. Governmental entities and nonprofit organizations use modified versions of GAAP tailored to their specific needs.

History of GAAP

GAAP evolved over decades in response to financial scandals and the need for standardized reporting. The stock market crash of 1929 highlighted the dangers of inconsistent financial reporting. In response, the SEC was created in 1934 and given authority to establish accounting standards. This responsibility moved through several organizations and finally to the Financial Accounting Standards Board (FASB) in 1973, which continues to develop GAAP standards today.

Major accounting scandals like Enron and WorldCom in the early 2000s led to the Sarbanes-Oxley Act, which strengthened GAAP compliance requirements and increased penalties for fraudulent reporting.

Understanding GAAP

In practice, GAAP extends beyond just following rules—it represents a commitment to transparent, honest financial reporting that serves the public interest. GAAP is considered a rules-based system, providing specific, detailed guidance for particular accounting situations. This contrasts with principles-based systems that offer broader concepts and require more professional judgment.

Every line item on your balance sheet, income statement, and cash flow statement reflects GAAP principles. When you prepare GAAP-compliant financial statements, you’re following specific rules about how to classify items, when to recognize revenue and expenses, how to value inventory and fixed assets, and what information to disclose.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

Compliance With GAAP

GAAP compliance means preparing financial statements in accordance with all applicable GAAP standards and principles. It’s not optional for public companies—it’s legally required.

When your financial statements are GAAP compliant, they’ve been prepared following all relevant accounting standards issued by FASB and approved by the Financial Accounting Foundation. This includes proper revenue recognition, expense matching, asset valuation, and comprehensive disclosure of material information.

According to the SEC, all publicly traded companies must file financial statements prepared in accordance with GAAP. This includes annual 10-K reports, quarterly 10-Q reports, and other financial disclosures. Independent auditors must attest that these statements fairly present financial position.

While private companies aren’t legally required to follow GAAP, many do because banks require GAAP financial statements for business loans, investors expect GAAP compliance, and following GAAP builds credibility.

For public companies, GAAP violations can result in SEC enforcement actions, fines, restatement of financial statements, and even criminal charges in fraud cases. For private companies, non-compliance can lead to loan defaults and difficulty raising capital.

GAAP vs. IFRS

While GAAP governs accounting in the United States, International Financial Reporting Standards (IFRS) serve a similar purpose globally. Both frameworks aim to make financial statements accurate and trustworthy. The main difference: GAAP is rules-based with detailed guidance, while IFRS is principles-based with broader concepts requiring more professional judgment.

Some Key Differences Between IFRS and GAAP

| GAAP (U.S.) | IFRS (International) | |

| Revenue recognition | Detailed, industry-specific guidance | Standardized five-step model focused on transfer of control |

| Inventory valuation | Allows LIFO, FIFO, and weighted average | Prohibits LIFO; allows FIFO and weighted average only |

| Financial statement presentation | Requires specific formats and classifications | Allows more flexibility as long as reporting is fair and clear |

| Development and oversight | Issued by FASB under SEC oversight | Issued by the International Accounting Standards Board (IASB) and used in 140+ countries |

Where Are Generally Accepted Accounting Principles (GAAP) Used?

Public companies in the U.S.: All companies whose securities trade on U.S. stock exchanges must prepare financial statements using GAAP.

Private businesses and lenders: Many private companies voluntarily adopt GAAP because banks typically require GAAP financial statements for credit decisions.

Government entities: State and local governments follow GAAP standards developed by the Governmental Accounting Standards Board (GASB). Federal agencies follow standards from the Federal Accounting Standards Advisory Board.

Nonprofit organizations: Generally accepted accounting principles for nonprofits include specific guidance for fund accounting, donor restrictions, and functional expense reporting to maintain transparency with donors and regulatory agencies.

Why Is GAAP Important?

GAAP serves critical functions that benefit the entire financial system.

Financial transparency and trust: GAAP creates transparency by requiring comprehensive disclosure of material information. When financial statements follow GAAP, you can trust they present a complete, honest picture of financial position and performance.

Comparability across companies: Standardized accounting principles let you compare different companies’ financial statements, even across industries. This helps investors make informed decisions about where to allocate capital.

Investor and lender confidence: GAAP compliance signals that your company follows professional standards. This builds confidence, potentially lowering your cost of capital and making it easier to raise funds.

Regulatory accountability: According to Investor.gov, when everyone follows the same rules, regulators can more effectively identify problems and protect the public interest.

What Are Non-GAAP Measures?

Despite GAAP’s comprehensiveness, companies sometimes report additional financial metrics that don’t conform to GAAP standards. Non-GAAP measures are financial metrics calculated using methods that deviate from GAAP requirements. Companies present these alongside GAAP results to provide additional useful information.

Common non-GAAP financial metrics:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- Adjusted earnings excluding one-time charges

- Free cash flow calculations

- Same-store sales for retailers

Companies argue that non-GAAP measures help investors understand ongoing operational performance by excluding unusual items. However, they can mislead if used to present an overly optimistic view. Regulators require companies to reconcile non-GAAP measures to the most comparable GAAP measure and give equal prominence to GAAP results.

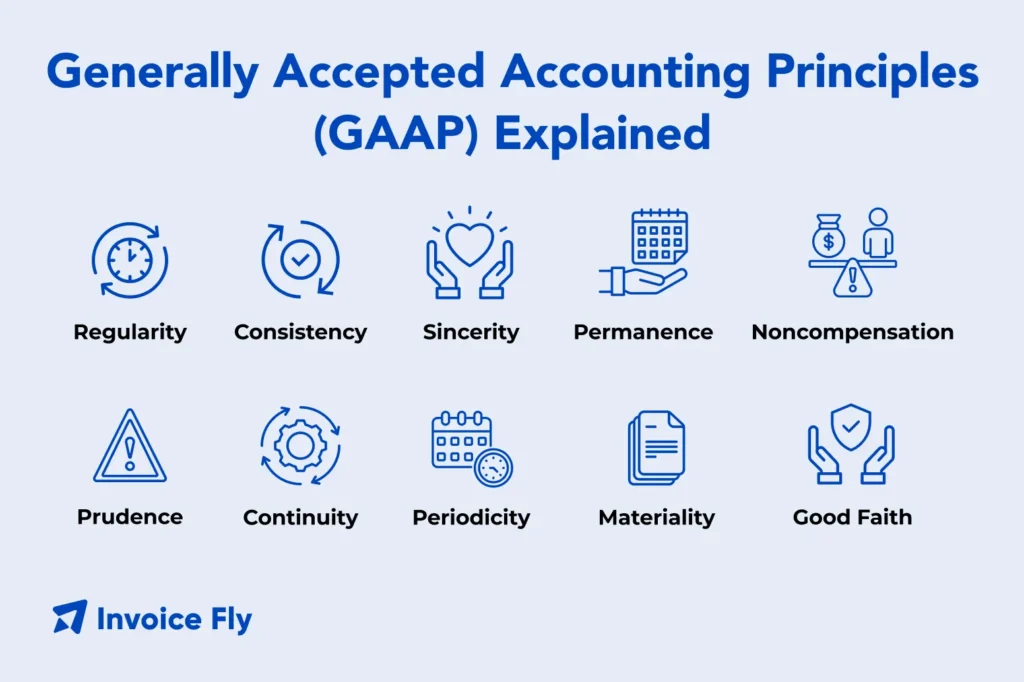

What Are the Basic Principles of Accounting?

GAAP is built on core accounting principles that guide how businesses record and report financial information:

| Accounting Principle | What It Means |

| Principle of Regularity | Follow GAAP rules consistently as standard practice. |

| Principle of Consistency | Use the same accounting method over time. Changes must be explained. |

| Principle of Sincerity (Good Faith) | Report your company’s financial situation honestly and accurately. |

| Principle of Prudence (Conservatism) | Avoid overstating income or assets. Recognize potential losses early. |

| Principle of Continuity (Going Concern) | Assume your business will continue operating, justifying depreciation and cost deferral. |

| Principle of Periodicity | Report financial performance over set time periods for tracking and comparison. |

| Principle of Materiality | Disclose any information that could influence a reasonable person’s decision in your financial projections. |

| Principle of Non-Compensation | Report revenues, expenses, assets, and liabilities separately. |

| Matching Principle | Record expenses in your journal entry in the same period as the revenue they helped generate. |

Who Develops GAAP?

GAAP doesn’t emerge from a single source—several organizations work together to create, maintain, and oversee accounting standards.

Financial Accounting Foundation

The Financial Accounting Foundation provides oversight and funding for FASB and GASB, ensuring these bodies operate independently and in the public interest.

Financial Accounting Standards Board

FASB is the primary organization responsible for developing GAAP standards for private-sector companies. FASB issues Accounting Standards Updates that become part of the GAAP framework.

Governmental Accounting Standards Board

GASB develops GAAP standards specifically for state and local governments, addressing unique governmental accounting needs including fund accounting and budgetary reporting.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

Limitations of GAAP

Despite its importance, GAAP isn’t perfect.

Diverse Types of Companies

GAAP attempts to provide standards applicable across all industries, but this one-size-fits-all approach doesn’t always work well. A manufacturing company and a software company have fundamentally different economics, yet GAAP forces both into similar reporting frameworks.

Timeframe Limitations

GAAP focuses on historical financial results reported in discrete periods. This backward-looking approach doesn’t capture forward-looking information about company strategy or competitive advantages that investors care about.

Global vs. Domestic Accounting Standards

As businesses become increasingly global, having different standards in the U.S. (GAAP) versus the rest of the world (IFRS) creates complications. Companies operating internationally must sometimes prepare financial statements under both frameworks, increasing costs and complexity.

Conclusion

Generally accepted accounting principles provide the foundation for financial reporting in the United States, ensuring consistency, comparability, and transparency across companies. GAAP’s rules-based framework offers detailed guidance that reduces ambiguity but can create complexity. Its core principles—regularity, consistency, conservatism, materiality, and periodicity—guide how you record and present financial information.

Whether you’re managing your company’s small business bookkeeping, preparing for an audit, or evaluating investment opportunities, understanding GAAP helps you make informed decisions based on reliable, comparable financial information.

GAAP FAQs

GAAP (Generally Accepted Accounting Principles) is the standard set of U.S. accounting rules that ensure financial statements are accurate, consistent, and comparable.

Focus on a few core ideas—consistency, conservatism, materiality, periodicity, and matching—and use real-world examples to make them stick.

Common mistakes include mixing personal and business expenses, poor recordkeeping, misclassifying expenses, and recognizing revenue at the wrong time.

Not usually. GAAP is required for public companies, but many small businesses follow it because lenders and investors prefer GAAP-compliant financials.

Canada uses IFRS for publicly accountable enterprises, while private companies can choose IFRS or Accounting Standards for Private Enterprises (ASPE).

The Financial Accounting Standards Board (FASB). publishes official standards, with plain-English guidance also available on Investor.gov.