How to Calculate Depreciation? Step-by-Step Guide

Table of Contents

- What is depreciation?

- Why is depreciation important for your business?

- Depreciation factors to be aware of

- How to calculate depreciation (depreciation formula)

- Common financial reporting depreciation schedules for financial accounting

- Common tax reporting depreciation schedules (U.S.)

- Depreciation expense vs. accumulated depreciation

- Reporting depreciation on your business tax return

- Internal resources (free tools to keep on hand)

- Final Thoughts

- FAQs about How To Calculate Depreciation

Every business that owns equipment, vehicles, or property needs to account for how those assets lose value over time. This process, known as depreciation, plays a critical role in financial reporting and tax compliance. Learning how to calculate depreciation helps you track the true value of your assets, manage expenses accurately, and prepare for major business decisions like loans or investments.

In this guide, we’ll explain the most common depreciation methods, show step-by-step formulas, and outline how depreciation is reported for both accounting and tax purposes.

Need a payment processing solution for your small business? Try Invoice Fly’s Invoice Maker — It’s free!

What is depreciation?

Depreciation is an accounting method that allocates the cost of a tangible asset over its useful life to reflect its decreasing value through use, wear and tear, and obsolescence. According to Investopedia, this process helps businesses avoid showing massive expenses in a single year when they purchase expensive equipment.

Instead of deducting the entire cost of a $50,000 machine in year one, depreciation spreads the expense over the asset’s expected useful life—perhaps 5 or 10 years. This gives a more accurate picture of profit and matches costs to the revenue those assets help create. Once you understand how to calculate depreciation, you’ll avoid overstating profits in the purchase year.

Key characteristics of depreciable assets:

- Owned by the business (not leased)

- Used for business or income-producing activities

- Determinable useful life longer than one year

- Tangible (physical) assets

Common examples: machinery, vehicles, office equipment, computers, and buildings. Land is not depreciable.

If you’re still setting up your operations, make sure your business plan factors in asset purchases and depreciation. Check out our business plan guide for step-by-step help.

Why is depreciation important for your business?

Understanding how to calculate depreciation affects multiple aspects of your business operations:

Accurate financial reporting

According to CFI, Depreciation follows the matching principle in accounting: expenses are recognized in the same periods as the revenues they help create. This makes your income statement more realistic and dependable for decision-making.

Since depreciation is recorded under accrual accounting rules, it’s worth reviewing how accrual basis accounting works. This method records revenues and expenses when earned or incurred, not when cash changes hands.

Tax implications

Depreciation reduces taxable income each year. For U.S. businesses, methods for how to calculate depreciation for tax often follow IRS rules like MACRS or special provisions such as Section 179 (more on these below). Official IRS resources:

- IRS About Form 4562 (used to claim depreciation/Section 179)

- IRS Publication 946 (How to Depreciate Property)

Asset management

Systematic depreciation tracking helps you plan for equipment replacement and maintenance. By understanding when assets will be fully depreciated, you can budget for upgrades and avoid unexpected equipment failures that disrupt operations.

Loan and investment decisions

Lenders and investors examine depreciation when evaluating your business’s financial health. Accurate depreciation schedules demonstrate professional financial management and help stakeholders understand your true asset values and capital needs. Learn more in our guide to understanding financial projections.

Regulatory requirements

Proper depreciation ensures compliance with Generally Accepted Accounting Principles (GAAP) and IRS regulations. This compliance protects your business from potential penalties and maintains credibility with auditors, lenders, and other stakeholders.

Depreciable assets

Not all business purchases qualify for depreciation. The asset must be used in your business, have a useful life longer than one year, and be subject to wear, decay, or obsolescence. Common depreciable assets include vehicles, machinery, office furniture, computers, and buildings (but not the land they sit on).

Depreciation factors to be aware of

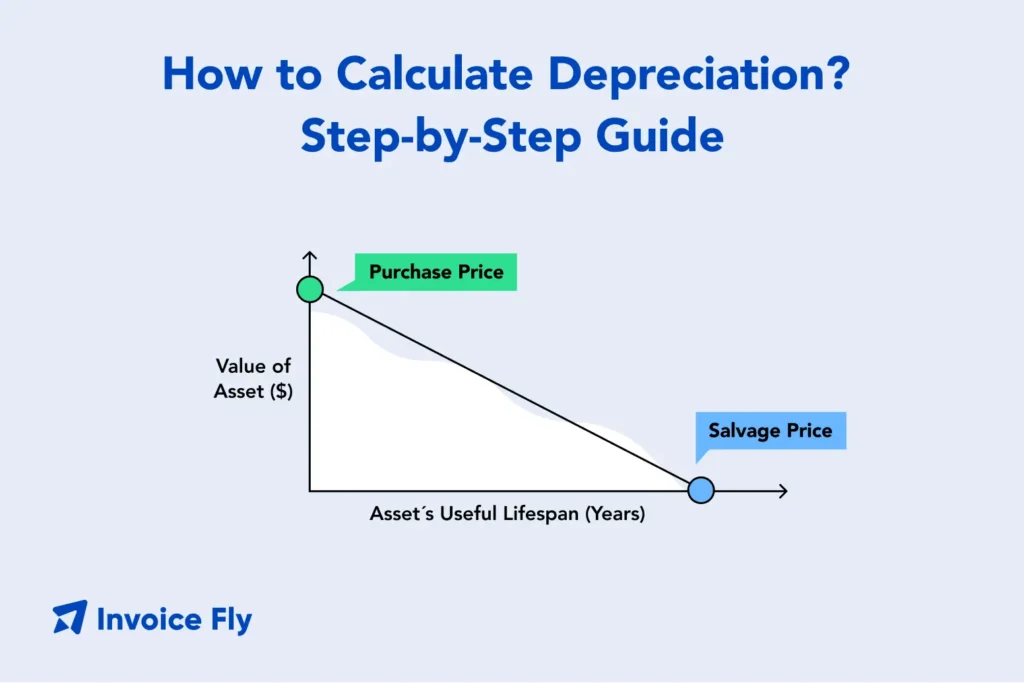

Before you decide how to calculate depreciation, confirm these 4 inputs:

- Useful life

How long you expect to use the asset productively. For taxes, the IRS assigns property classes with set recovery periods (e.g., 5-year, 7-year). For book (financial) accounting, you can estimate based on your operations and industry practice.

- Salvage value

Also called residual value, this is the estimated amount you could receive by selling the asset at the end of its useful life. For many business assets, salvage value is zero, especially for items like computers or specialized equipment that become obsolete. However, vehicles might retain some value even after their useful business life expires.

- Depreciable base

This is the total amount subject to depreciation, calculated as: Depreciable Base = Cost of Asset – Salvage Value

For example, if you purchase equipment for $10,000 with a salvage value of $1,000, your depreciable base is $9,000.

- Depreciation schedules: Calculating depreciation

A depreciation schedule tracks how an asset’s value decreases over time. This schedule typically includes the asset’s original cost, chosen depreciation method, annual depreciation expense, accumulated depreciation, and remaining book value for each year of the asset’s useful life.

How to calculate depreciation (depreciation formula)

For financial accounting, you choose a method (straight-line, double-declining balance, etc.). For tax reporting, the IRS uses MACRS, which assigns assets to specific classes with fixed recovery periods.

| Property Class | Recovery Period | Common Assets |

| 3-Year Property | 3 years | Certain tools, specialized assets with rapid obsolescence |

| 5-Year Property | 5 years | Computers, office equipment, autos, light trucks, machinery |

| 7-Year Property | 7 years | Office furniture, fixtures, equipment not elsewhere classified |

| Residential Rental | 27.5 years | Residential rental real estate |

| Nonresidential | 39 years | Commercial/business real estate |

Reference: IRS Publication 946 and asset class tables.

Source: Embroker

Common financial reporting depreciation schedules for financial accounting

Source: Embroker

Businesses can choose from several methods to calculate depreciation for financial reporting purposes.

Straight-line depreciation method

According to CFI, the straight-line method is the most common and straightforward approach. It spreads the asset’s cost evenly over its useful life.

Formula: Annual Depreciation = (Cost − Salvage Value) ÷ Useful Life

Example: Cost = $50,000, Salvage = $5,000, Life = 5 years

Annual Depreciation = ($50,000 − $5,000) ÷ 5 = $9,000 per year

This is the simplest method, ideal when an asset provides even benefits over time.

Double-declining balance (DDB) method

Accelerated method that records higher depreciation in early years using a declining balance approach.

Formula: Annual Depreciation = 2 × (1 ÷ Useful Life) × Beginning-of-Year Book Value

Using the $50,000 example (5-year life; straight-line rate = 20%; DDB rate = 40%):

- Year 1: $50,000 × 40% = $20,000

- Year 2: $30,000 × 40% = $12,000

- Year 3: $18,000 × 40% = $7,200

Continue until you approach salvage value (book systems often switch to straight-line near the end).

Sum-of-the-years’ digits (SYD) method

Another accelerated method using a diminishing percentage each year.

SYD for 5 years = 1 + 2 + 3 + 4 + 5 = 15

Formula: Annual Depreciation = (Remaining Life ÷ SYD) × Depreciable Base

With $45,000 base (from $50,000 cost − $5,000 salvage):

- Year 1: (5/15) × $45,000 = $15,000

- Year 2: (4/15) × $45,000 = $12,000

- Year 3: (3/15) × $45,000 = $9,000, etc.

Units-of-production depreciation

Usage-based approach tied to output (e.g., machine hours or units produced).

Formula: Depreciation = (Units This Period ÷ Total Expected Units) × Depreciable Base

Great for equipment where wear depends on activity, not years.

Common tax reporting depreciation schedules (U.S.)

Tax depreciation often differs from financial reporting methods, requiring separate calculations and schedules.

[File: macrs-tax-depreciation-schedule.png

ALT: MACRS tax depreciation schedule example for business assets

Caption: Example of a MACRS tax depreciation schedule for small business tax reporting.]

Modified accelerated cost recovery system (MACRS)

MACRS is the primary tax depreciation system in the United States. It assigns assets to specific property classes with predetermined recovery periods and depreciation methods. Block Advisors notes that MACRS generally uses accelerated depreciation methods, allowing businesses to claim larger deductions in early years.

Most business equipment falls into 5-year or 7-year MACRS categories. The system uses specific percentage tables that automatically calculate each year’s depreciation amount based on the asset’s cost and category.

Section 179 depreciation

Section 179 lets you expense (deduct immediately) the cost of qualifying property placed in service during the year, up to annual limits, instead of depreciating over several years. You make the election on Form 4562.

2025 Section 179 limits (per IRS):

| Section 179 Limits (2025) | Amount |

| Maximum deduction | $1,250,000 |

| Phase-out begins after | $3,130,000 |

| SUV cap | $31,300 |

Source: IRS Publication 946 “What’s New for 2025” and Rev. Proc. 2024-40 summaries on IRS-linked updates.

When Section 179 makes sense:

- You want an immediate deduction to lower taxable income this year

- The property qualifies (equipment, certain software, and some building improvements)

- Your business has enough taxable income to absorb the deduction (179 can’t create a tax loss; excess generally carries forward)

Depreciation expense vs. accumulated depreciation

Understanding the difference between these two concepts is crucial for proper financial reporting.

| Aspect | Depreciation Expense | Accumulated Depreciation |

| Definition | The portion of an asset’s cost allocated to a specific accounting period. | The total depreciation recorded against an asset since it was purchased. |

| Formula | Depreciation Expense = (Cost – Salvage Value) ÷ Useful Life (Straight-line method example) | Accumulated Depreciation = Sum of All Depreciation Expenses to Date |

| Financial Statement | Appears on the profit and loss statement (income) statements as an operating expense. | Appears on the balance sheet as a contra-asset account, reducing the asset’s book value. |

| Impact | Reduces net income and taxable income for that year. | Reduces the carrying (book) value of the asset over time. |

| Example | Claiming $5,000 in annual depreciation lowers taxable income by $5,000 that year. | If the asset has been depreciated for three years at $5,000/year, accumulated depreciation would be $15,000. |

| Purpose | Matches expense to revenue in the same period. | Tracks the total decline in value of the asset. |

[File: accumulated-vs-expense-depreciation.png

ALT: Comparison of accumulated depreciation vs. depreciation expense

Caption: Example showing the difference between accumulated depreciation and expense.]

Book Value = Original Cost – Accumulated Depreciation

If you purchased $30,000 equipment three years ago and claimed $5,000 depreciation annually, the accumulated depreciation is $15,000, making the written down value $15,000.

Tip! QuickBooks has a clear overview on recording depreciation entries.

Reporting depreciation on your business tax return

Proper tax reporting requires using IRS Form 4562 (Depreciation and Amortization) to claim depreciation deductions. This form also handles Section 179 deductions and bonus depreciation claims.

Key reporting considerations:

- Use MACRS for most business assets

- Maintain detailed records of purchase dates, costs, and business use percentages

- Consider timing of asset purchases to optimize tax benefits

- Separate financial and tax depreciation records when methods differ

For businesses using accrual basis accounting, depreciation affects both your P&L and balance sheet (and flows into your cash flow statement via non-cash adjustments).

Internal resources (free tools to keep on hand)

- Free Invoice Generator — create professional invoices in minutes

Keep cleaner records that feed into your books (and make tracking assets and expenses easier when you calculate depreciation). - Break-Even Point Calculator — know when new equipment pays for itself

Planning to buy a vehicle or machine you’ll depreciate? Estimate how many jobs or units you need to cover costs (including depreciation) before you profit.

Final Thoughts

Understanding how to calculate depreciation gives small business owners more than just accurate tax filings. It provides a clearer picture of long-term financial health. Depreciation affects your income statement, balance sheet, and even your cash flow, showing the real cost of using assets over time.

When you track depreciation properly, you can plan ahead for equipment replacements, take advantage of tax deductions like MACRS or Section 179, and build financial projections that lenders and investors can trust. Rather than being a technical detail, depreciation becomes a practical tool for smarter decision-making and future growth.

Need a payment processing solution for your small business? Try Invoice Fly’s Invoice Maker — It’s free!

FAQs about How To Calculate Depreciation

The most common formula is the straight-line method: (Cost of Asset - Salvage Value) ÷ Useful Life = Annual Depreciation. For example, a $10,000 machine with a $1,000 salvage value over 5 years would depreciate $1,800 annually [($10,000 - $1,000) ÷ 5 = $1,800].

The straight-line method is the easiest way to calculate depreciation. It spreads the cost of an asset evenly over each year of its useful life, giving you the same expense amount annually. To use it, you only need three numbers: the asset’s purchase price (cost), its estimated salvage value at the end of its life, and the number of years you expect to use it.

Tip: You don’t have to do the math by hand. Use a free straight-line depreciation calculator or Excel’s SLN Function—just plug in cost, salvage value, and useful life to instantly get the annual depreciation expense.

The four main methods are: 1) Straight-line (even distribution), 2) Double-declining balance (accelerated), 3) Sum-of-the-years' digits (accelerated), and 4) Units of production (usage-based). Each method serves different business needs and asset types, with straight-line being most common for financial reporting and MACRS for tax purposes.

Depreciation applies to tangible assets (equipment, vehicles, buildings) while amortization applies to intangible assets (patents, copyrights, goodwill). Both spread costs over time, but depreciation deals with physical assets that wear out, while amortization handles intangible assets with limited useful lives.

Small businesses typically use straight-line depreciation for financial reporting and MACRS for tax purposes. First, identify the asset's cost, useful life, and salvage value. Then apply the appropriate formula based on your reporting needs. Consider Section 179 deductions for immediate write-offs of qualifying equipment purchases up to annual limits.