- Home

- »

- Free Resources for Small Businesses

- »

- Free Business Calculators

- »

- Sales Tax Calculator

Sales Tax Calculator

Automatically calculate your sales taxes with Invoice Fly’s sales tax calculator.

Managing sales tax can be complex with varying rates across states and local jurisdictions. That’s why Invoice Fly offers an easy-to-use Sales Tax Calculator that helps you quickly figure out either the before-tax price, sales tax rate, or final after-tax price with just two inputs.

Ready to simplify your sales tax process? Add this calculator to your bookmarks for easy access.

Sales Amount

What's your Sales Price?

Tax Rate

Amount of Taxes (%)

Total Summary

Steps to use the online sales tax calculator

Table of Contents

How to use Invoice Fly's sales tax calculator?

- Add the gross amount in which you want to calculate the tax.

- Check our guide below to identify the tax amount that you need to deduct according to your state and conditions.

- Add tax to calculator.

- Check the results.

What is sales tax?

Sales tax is a government-imposed fee added to the price of goods and services at the point of sale.

When you buy something, the seller collects this extra amount from you and later sends it to the appropriate tax authority, such as state or local governments. The rate of sales tax varies depending on where the sale takes place and the type of product or service.

Sales tax helps fund public services like schools, roads, and emergency services. For small businesses, calculating and collecting sales tax correctly is important to stay compliant with tax laws and avoid future penalties.

U.S. sales tax

Unlike many countries, the U.S. does not have a federal sales tax. Instead, sales tax is governed at the state and local levels. Out of the 50 states plus Washington D.C., Puerto Rico, and Guam, only five states do not impose a statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. For the rest, sales tax rates vary widely not only by state but also by cities and counties within states, making compliance challenging.

Sales tax rates can range from 0% to over 16%, depending on the location and type of product or service. For example, Texas exempts prescription medications and food seeds from sales tax, while Vermont adds an extra 10% tax on alcoholic beverages consumed immediately. Such nuances highlight why accurate sales tax calculations are crucial for businesses.

Sales tax rates by state and location / city

| State | State Sales Tax Rate (%) | Max Local/City Sales Tax Rate (%) |

|---|---|---|

| Alabama | 4.00 | 7.00 |

| Alaska | 0.00 | 7.50 |

| Arizona | 5.60 | 5.30 |

| Arkansas | 6.50 | 5.63 |

| California | 7.25 | 3.25 |

| Colorado | 2.90 | 8.31 |

| Connecticut | 6.35 | 1.00 |

| Delaware | 0.00 | 0.00 |

| Florida | 6.00 | 2.50 |

| Georgia | 4.00 | 4.90 |

| Hawaii | 4.00 | 0.50 |

| Idaho | 6.00 | 3.03 |

| Illinois | 6.25 | 7.00 |

| Indiana | 7.00 | 0.00 |

| Iowa | 6.00 | 1.00 |

| Kansas | 6.50 | 4.00 |

| Kentucky | 6.00 | 0.00 |

| Louisiana | 4.45 | 7.00 |

| Maine | 5.50 | 0.00 |

| Maryland | 6.00 | 0.00 |

| Massachusetts | 6.25 | 0.00 |

| Michigan | 6.00 | 0.00 |

| Minnesota | 6.88 | 1.50 |

| Mississippi | 7.00 | 1.00 |

| Missouri | 4.23 | 6.88 |

| Montana | 0.00 | 0.00 |

| Nebraska | 5.50 | 2.00 |

| Nevada | 6.85 | 1.53 |

| New Hampshire | 0.00 | 0.00 |

| New Jersey | 6.63 | 3.00 |

| New Mexico | 5.13 | 3.31 |

| New York | 4.00 | 4.88 |

| North Carolina | 4.75 | 2.75 |

| North Dakota | 5.00 | 2.00 |

| Ohio | 5.75 | 2.25 |

| Oklahoma | 4.50 | 7.00 |

| Oregon | 0.00 | 0.00 |

| Pennsylvania | 6.00 | 2.00 |

| Rhode Island | 7.00 | 0.00 |

| South Carolina | 6.00 | 3.00 |

| South Dakota | 4.50 | 2.00 |

| Tennessee | 7.00 | 2.75 |

| Texas | 6.25 | 2.00 |

| Utah | 4.85 | 5.35 |

| Vermont | 6.00 | 1.00 |

| Virginia | 5.30 | 1.70 |

| Washington | 6.50 | 3.00 |

| West Virginia | 6.00 | 1.00 |

| Wisconsin | 5.00 | 0.50 |

| Wyoming | 4.00 | 2.00 |

| District of Columbia | 6.00 | 0.00 |

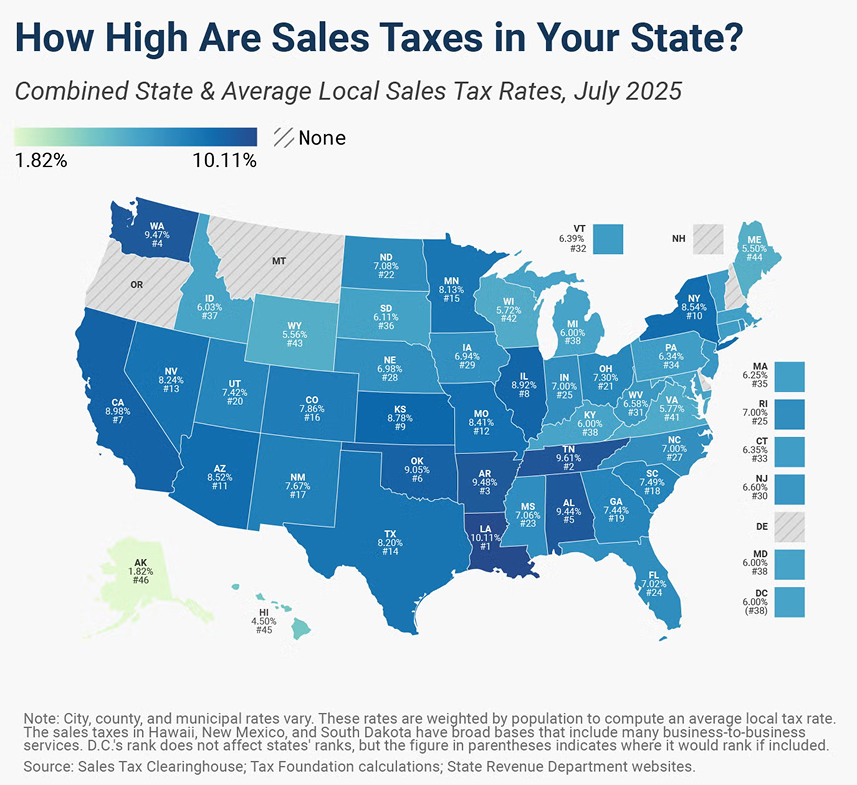

US Sales Tax by State (2025) – By Tax Foundation

U.S. history of sales tax

Sales tax in the United States has a relatively recent history compared to other tax types.

The first state-level sales tax was introduced in 1933 by Mississippi as a way to generate revenue during the Great Depression. The concept quickly spread, and by the 1960s, most states had adopted some form of sales tax.

Unlike many countries that rely heavily on a federal value-added tax (VAT), the U.S. sales tax system remains decentralized, with each state setting its own rules and rates. Over the decades, the sales tax system has grown more complex due to the addition of local and municipal taxes, creating thousands of taxing jurisdictions nationwide. This patchwork has made compliance challenging for businesses, especially with the rise of e-commerce and changing laws around “economic nexus,” which expanded tax collection responsibilities beyond physical presence.

Today, sales tax remains a vital revenue source for states and local governments and continues to evolve in response to modern commerce.

How to deduct sales tax in the U.S.?

In the United States, deducting sales tax on your taxes depends on whether you’re a business owner or an individual taxpayer:

- For Businesses: Businesses generally don’t deduct sales tax they collect from customers because this tax is not revenue — it’s collected on behalf of the government and must be remitted accordingly. However, sales tax paid on business purchases (like supplies, equipment, or services) can often be deducted as a business expense or credited against sales tax owed, depending on your state’s rules. To do this correctly, keep clear records of all sales tax paid on purchases and consult your accountant or tax advisor for your specific state guidelines.

- For Individuals: When filing federal income taxes, taxpayers can choose to deduct either their state and local income taxes or the state and local sales taxes paid during the year, but not both. This is called the “state and local tax (SALT) deduction.” For people in states with no income tax, the sales tax deduction can be especially beneficial. The IRS allows you to use actual receipts for sales tax paid or estimate your deduction using IRS tables based on your income and family size. For large purchases like vehicles or boats, you may be able to add the actual sales tax paid.

Local jurisdiction complexity

One of the biggest challenges businesses face when managing sales tax in the U.S. is the complexity created by local tax jurisdictions.

Many cities, counties, and special districts impose their own additional taxes, leading to a patchwork of overlapping rates within the same geographic area. This means that the total sales tax rate your customer pays can vary significantly—even between neighboring towns or neighborhoods.

For example, a product sold in one city might be subject to a 7% combined tax rate, while just a few miles away, another city could have a rate exceeding 10% due to extra local taxes. This patchwork requires businesses to accurately identify the precise location of the sale to apply the correct tax rate.

For small businesses, freelancers, and blue-collar professionals, navigating this complexity manually can lead to mistakes, undercharging, or overcharging customers—resulting in lost revenue or compliance issues.

Exemptions & special cases

Sales tax rules can get complicated not only because of varying rates but also due to numerous exemptions and special cases that apply in different states and localities. Understanding these exceptions is crucial for small business owners and independent workers.

Common exemptions include necessities such as groceries, prescription medications, and certain medical devices, which many states exclude from sales tax to reduce the financial burden on consumers. Additionally, some services—like professional consulting or certain types of labor—may not be taxable depending on the state.

Special cases also arise with products like alcohol, tobacco, and luxury goods, which often carry higher or additional taxes. For instance, Vermont applies an extra 10% tax on alcoholic beverages consumed immediately, while other states might have different rules for shipping or interstate sales.

For businesses, these exemptions mean that not every sale is subject to the same tax rules. Invoice Fly helps you navigate these complexities by allowing you to apply exemptions where applicable and adjust tax rates based on product or service categories, helping you avoid overcharging or undercharging customers.

Impact on pricing & profit margins

The way sales tax interacts with your pricing strategy can influence how competitive your prices appear. If you don’t clearly communicate that sales tax is extra, customers might perceive your prices as higher than competitors who include tax in their displayed prices.

Additionally, sales tax can indirectly affect your profit margins when managing costs related to exempt purchases or when dealing with tax-inclusive pricing. If you absorb sales tax costs on certain items (for example, if you offer discounts that reduce taxable amounts), it can reduce your profit margin. Carefully track these amounts to maintain your profitability.

With our sales tax calculator, you can automate sales tax calculations, include clear tax breakdowns on your invoices, and easily customize pricing to reflect tax considerations. This transparency helps you maintain healthy profit margins while ensuring customers understand exactly what they’re paying.

Sales tax compliance challenges

Navigating sales tax compliance is one of the most demanding tasks for small businesses & blue-collar pros in 2025. With thousands of tax jurisdictions across the United States, each with its own rates, rules, and filing requirements, staying compliant can quickly become overwhelming. Businesses must not only collect the correct amount of sales tax on every transaction but also file timely reports and remit payments to multiple authorities—sometimes monthly or quarterly.

One of the biggest challenges is tracking changing rates and rules. Sales tax rates can change frequently at both the state and local levels, and some items may become taxable or exempt depending on legislation. Keeping up-to-date manually is time-consuming and prone to errors.

Another difficulty arises with economic nexus laws, which require businesses selling remotely (like online sellers or contractors working across state lines) to collect and remit sales tax in states where they meet certain sales thresholds—even if they have no physical presence there.

RELATED ARTICLE: Multi-State Income: Tax Considerations When Working Across State LinesOnline sales & nexus laws

With the rapid growth of e-commerce and remote work, online sales have introduced new complexities to sales tax collection, especially due to evolving nexus laws. Nexus refers to a business’s connection to a state that requires it to collect and remit sales tax there. Traditionally, nexus was established by having a physical presence like a store or office, but today, many states have expanded these rules.

Thanks to the landmark South Dakota v. Wayfair Supreme Court decision in 2018, states can require businesses to collect sales tax even without a physical presence, based on sales volume or transaction thresholds. This means online sellers, freelancers, and contractors using platforms like Invoice Fly must carefully monitor their sales in each state to determine where they have nexus.

Recent Sales Tax Rate Changes

1. Change in Grocery Sales Taxes

- Mississippi lowers its tax on groceries from 7% to 5%, starting July 1, 2025. Source: Avalara

- Kansas fully eliminates its state sales tax on unprepared foods as of January 1, 2025, though local taxes may still apply.

2. States Adjusting Tax Rates & Rules

- Louisiana increases its state sales tax rate from 4.45% to 5.00%, effective January 1, 2025, and now taxes digital products like e-books and SaaS (with some business-use exemptions).

- Ohio’s Lake County raises its combined sales tax rate to 7.25%, effective July 1, 2025.

3. Economic Nexus Threshold Updates

- Utah removes its 200-transaction nexus rule, now relying solely on a $100,000 sales threshold starting July 1, 2025.

- Alaska abolishes its remote-seller 200-transaction threshold and mandates sales-tax collection via its ARSSTC for vendors exceeding $100,000 annual sales to local jurisdictions.

4. Local & Municipal Rate Adjustments

- Starting July 1, 2025, local sales taxes change in multiple states based on municipal votes or revenue priorities—from parts of Georgia (8–9%) to cities across California, Iowa, Minnesota, Nebraska, New York, Texas, and Washington. Source: Fonoa

Value-Added Tax (VAT)

Value-Added Tax (VAT) is a type of consumption tax applied at each stage of the supply chain—on the value added to goods and services. Unlike U.S. sales tax, which is typically charged only at the final point of sale to consumers, VAT is collected at every step of production and distribution. It’s widely used around the world, especially in Europe, Asia, Africa, and South America.

Here’s how VAT works:

- A manufacturer pays VAT on raw materials.

- A wholesaler pays VAT on finished goods but deducts the VAT paid on inputs.

- The retailer charges VAT to the final customer and again deducts previously paid VAT.

Ultimately, the end consumer bears the full VAT cost, while businesses act as collectors and remitters for the government.

If you’re a freelancer, small business, or contractor working with clients in countries that use VAT, it’s essential to issue VAT-compliant quotes and invoices. Invoices must often include:

- Your business’s VAT ID

- The client’s VAT ID (for B2B transactions)

- Breakdown of taxable amounts and VAT charged

- Local VAT rate (which varies by country)

Invoice Fly makes this process simple with customizable invoice templates that support international tax formats, helping you stay compliant and professional no matter where your clients are based.

VAT vs. Sales Tax: Key Differences

| Feature | VAT | Sales Tax |

|---|---|---|

| Charged At | Every stage of production | Final point of sale only |

| Who Pays It | Collected at each stage | End consumer only |

| Common In | Europe, Asia, Latin America | United States |

| Deductible by Biz? | Yes, input VAT can be deducted | No, not typically |

Goods and Services Tax (GST)

Goods and Services Tax (GST) is a broad-based consumption tax applied to the sale of most goods and services. It’s similar to VAT (Value-Added Tax) and is commonly used in countries like Canada, Australia, India, New Zealand, and Singapore. GST is designed to be a single, unified tax that replaces multiple indirect taxes, making the tax system simpler and more efficient.

GST is collected at each stage of the supply chain, just like VAT, and businesses can typically claim credits for the GST paid on their business purchases (called “input tax credit”). The final consumer ultimately bears the tax, while businesses act as intermediaries.

FAQs about the sales taxes

Sales tax must be collected by businesses that have a “nexus” in the state where the customer is located. A nexus is a legal connection to a state, and it determines whether your business is required to charge sales tax on a transaction.

You should collect sales tax if:

- Your business has a physical presence in a state (like an office, store, warehouse, or employees).

- You meet a state’s economic nexus threshold (typically based on total sales or number of transactions into the state, even without physical presence).

- You sell taxable goods or services in a jurisdiction that charges sales tax.

- You're registered for a sales tax permit in that state.

For example, if you’re a small business owner in Texas who ships goods to customers in California and your sales exceed California’s economic threshold (like $500,000/year), you may be required to collect California sales tax—even if you don't have an office there.

Yes, in many cases, online sellers are required to collect sales tax. Whether or not you need to collect depends on where your customers are located and whether you have a sales tax nexus in that state.

Thanks to the 2018 South Dakota v. Wayfair ruling, physical presence is no longer required for states to enforce sales tax collection. Instead, most states now enforce economic nexus laws, which means that if your online sales into a state exceed a certain dollar amount or number of transactions, you must register and collect sales tax in that state — even if you don’t have a store, office, or warehouse there.

The frequency with which you must file sales tax returns depends on the rules set by each state where you’re registered and how much sales tax you collect. In general, states assign filing frequencies based on your total sales volume or the amount of tax you remit.

Here’s how it usually breaks down:

- Monthly: If your business collects a large amount of sales tax (typically more than $1,000/month in many states).

- Quarterly: For businesses with moderate tax collection, this is a common filing frequency.

- Annually: If your business collects a small amount of sales tax or is just starting out.

Some states will re-evaluate your filing status each year, and they may change your schedule based on your recent activity.

If you forget to collect sales tax when required, your business—not your customer—is still legally responsible for paying it. That means you may have to pay the sales tax out of your own pocket, plus face possible penalties, interest, or audits depending on the state.

Here’s what could happen:

- You owe the tax anyway: States expect you to remit the correct amount whether or not you charged your customer.

- Late fees and interest: Missing collections can result in fines and accumulating interest on the unpaid tax.

- Risk of audit: Repeated mistakes or missing filings may trigger a state sales tax audit.

- Loss of compliance: This could impact your business license or ability to operate legally in that state.

Tip: If you realize you missed collecting tax, it’s best to contact the state’s tax authority and voluntarily disclose the issue. Some states offer reduced penalties if you come forward on your own.

Other Free Calculators

Try Invoice Fly Today

- Send quotes & invoices in seconds

- Collect card & online payments

- Receive instant notifications

- Win more jobs