What Is a Tax Transcript? How to Get Your IRS Tax Transcripts

Table of Contents

- What Is a Tax Transcript?

- Why Tax Transcripts Are Important

- Types of Tax Transcripts Explained

- How to Get Your Tax Transcript

- What Information Is Included on a Tax Transcript?

- Common Issues and How to Fix Them

- How to Use Tax Transcripts for Financial Aid and Loan Applications

- Conclusion About Tax Transcripts

- FAQs about Tax Transcripts

A tax transcript is an official summary of your tax return information from the Internal Revenue Service (IRS). It’s like a snapshot of what you filed — showing your income, tax payments, and refund details — without all the attachments of a full return. Tax transcripts are free, easy to request, and often required for loan applications, FAFSA, or when you need to verify income with third parties. Whether you’re self-employed, applying for a mortgage, or managing small business bookkeeping, learning how to get your IRS tax transcript online can help you stay organized and compliant.

In this guide, you’ll learn what a tax transcript is, the different types available, how to request them directly from the IRS, and how to use them for financial aid, taxes, or business recordkeeping.

What Is a Tax Transcript?

A tax transcript is a summary document provided by the IRS that shows key information from your tax return. Think of it as a snapshot of your official filing — it includes your adjusted gross income (AGI), filing status, deductions, and tax refund information.

Unlike a full tax return copy, a transcript doesn’t include attachments or schedules. It’s printed on plain paper and delivered electronically or by mail, making it faster and free to obtain.

Tax transcripts typically include:

- Adjusted gross income (AGI)

- Filing status and exemptions

- Taxable income and liability

- Payments and refunds

- Any IRS adjustments made after filing

Learn more directly from the IRS.

Why Tax Transcripts Are Important

Understanding when and why you need tax transcripts helps you prepare for various financial situations.

- Mortgage and Loan Applications: Lenders commonly request IRS tax transcripts to verify your income. Transcripts provide third-party verification that’s more reliable than self-reported income.

- Financial Aid (FAFSA): College students applying for federal financial aid often need tax transcripts to verify family income.

- Business Purposes: Self-employed individuals and contractors frequently need transcripts when applying for business loans. If you’re managing bookkeeping for contractors, you’ll likely request transcripts to verify business income.

- Lost Tax Returns: If you didn’t keep copies of your filed returns, transcripts serve as proof of what you reported. This is helpful for estimated taxes for contractors or tax planning.

- Identity Verification: Some government agencies and financial institutions use tax transcripts to verify your identity and prevent fraud.

For small business owners tracking finances through small business bookkeeping, maintaining access to tax transcripts provides an important backup of your tax history.

Types of Tax Transcripts Explained

| Type of Transcript | What It Includes | Best Used For |

| Tax Return Transcript | Most line items from your original return — including adjusted gross income (AGI), filing status, and dependents. | Commonly required for loan applications, mortgage approvals, and FAFSA financial aid verification. |

| Tax Account Transcript | Basic filing details, payment history, and any IRS adjustments or amended returns. Includes filing date and current account balance. | Tracking IRS updates, verifying payments, and reviewing IRS tax account transcript activity. |

| Record of Account Transcript | Combines both the Tax Return Transcript and Tax Account Transcript into a single, comprehensive record. | When you’re unsure which transcript type to request or need a complete financial record. |

| Wage and Income Transcript | Income reported to the IRS by employers, banks, and other payers (W-2s, 1099s, etc.). | Perfect for contractors calculating self-employment tax or reconciling unfiled income. |

| Verification of Non-Filing Letter | Confirms you didn’t file a tax return for a specific year. Does not show income or tax data. | Often needed for financial aid (FAFSA) or visa applications when no return was filed. |

| Tax Refund Transcript | Summarizes refund status, including payments, overpayments, and issuance dates. | Checking refund history or confirming receipt of prior-year refunds. |

How to Get Your Tax Transcript

The IRS provides several convenient ways to request tax transcripts.

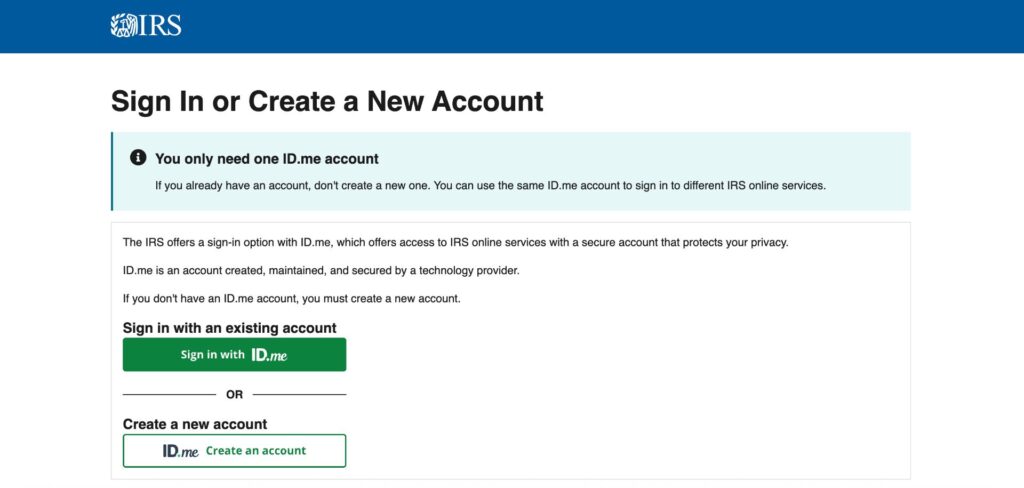

Online (Immediate Access)

The fastest option is through the IRS Get Transcript Online tool:

- Visit IRS.gov → “Get Transcript Online.”

- Log in or create an IRS account.

- Verify your identity.

- Select transcript type and year.

- View, download, or print instantly.

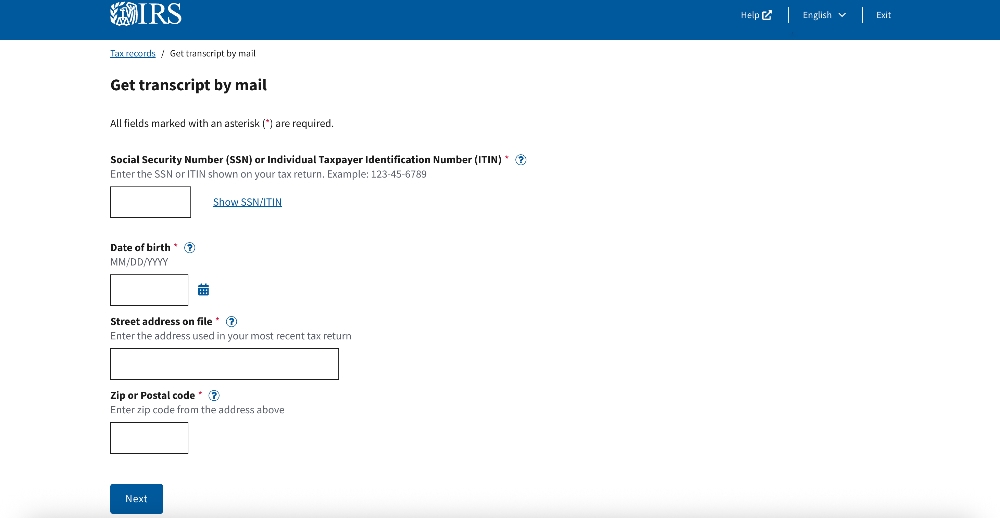

By Mail

- Visit IRS.gov → “Get Transcript by Mail.”

- Enter your SSN, date of birth, and address.

- Choose transcript type and year.

- Delivery takes 5–10 business days.

By Phone

Call 1-800-908-9946 to order. The IRS will mail your transcript to your address of record.

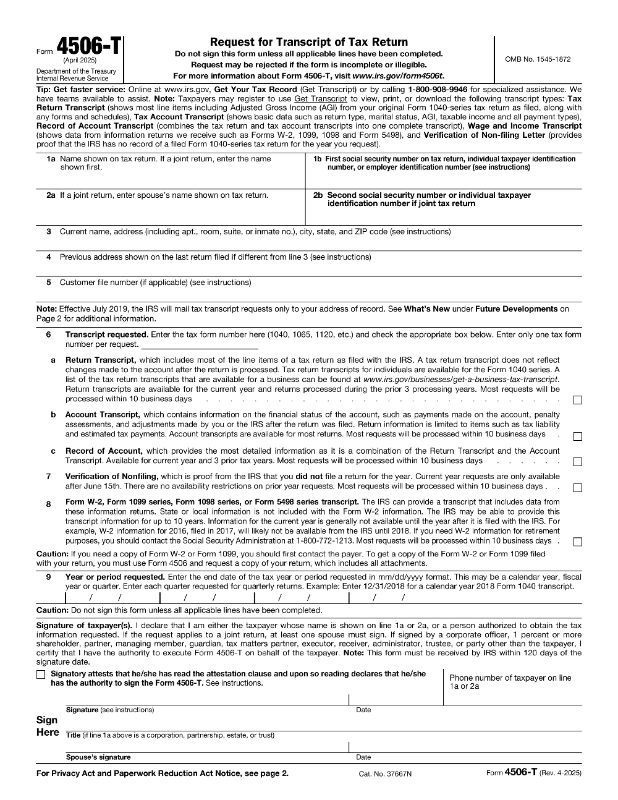

By Fax or Mail (Form 4506-T)

Complete and mail Form 4506-T if you want the IRS to send your transcript directly to a third party (like a lender).

More about transcript options here.

What Information Is Included on a Tax Transcript?

Here’s what you’ll find:

- Personal Information: Name, SSN, address.

- Filing Details: Filing status, return type, and year.

- Income: Total and adjusted gross income.

- Deductions and Credits: Standard or itemized deductions and any tax credits claimed.

- Payments & Refunds: Withholding, estimated payments, and refund details.

- Account Activity: Adjustments, penalties, and interest.

Not included: attachments like Schedule C or Schedule SE. Transcripts also don’t show attachments like W-2s or 1099s.

Common Issues and How to Fix Them

Can’t Verify Identity Online: Try requesting by mail instead.

“No Record of Return” Error: The IRS hasn’t processed your return yet. Wait 2–4 weeks after filing.

Wrong Address: Update your address before ordering to avoid delivery issues.

Missing Income on Wage Transcript: Employers may have filed W-2s or 1099s late. Recheck after a few weeks.

Discrepancies Between Transcript and Records: The IRS might have made adjustments. Cross-check with your tax deductions for contractors to ensure accuracy.Older Tax Years: Online access covers the last 3 years; use Form 4506-T for older ones.

How to Use Tax Transcripts for Financial Aid and Loan Applications

For FAFSA:

Use the IRS Data Retrieval Tool to import transcript data directly. Always confirm the reported income matches your FAFSA entries.

For Mortgage Applications:

Lenders typically need tax return transcripts for the last two years. Self-employed borrowers should ensure business income matches what’s in Schedule C.

For Business Loans:

Lenders may ask for both personal and business tax transcripts. Keep business reports and your IRS tax account transcript aligned for consistency.

Tips:

- Request transcripts at least 2–3 weeks before deadlines.

- Double-check the tax year and transcript type.

- Stay organized using Invoice Fly’s invoicing software and business reports to keep income data accurate.

- Consider hiring a bookkeeper if you manage multiple tax years or filings.

Conclusion About Tax Transcripts

Tax transcripts are essential documents that provide official verification of your tax history. Whether you’re applying for a mortgage, seeking financial aid, or simply need proof of income, knowing how to access these transcripts saves time and hassle.

The IRS makes it easy to obtain transcripts online for free, usually within minutes. Understanding the different types and which one you need ensures you get the right documents the first time.

For self-employed individuals managing quarterly taxes or dealing with multi-state income tax situations, tax transcripts become even more important as proof of your tax situation. Stay organized and don’t hesitate to request transcripts when you need official documentation.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

FAQs about Tax Transcripts

Visit IRS.gov and use the "Get Transcript Online" tool. Create an IRS account and verify your identity using personal information and account numbers. Once verified, you can view and download transcripts immediately. If you can't pass identity verification online, request transcripts by mail, which takes 5-10 business days.

Tax transcripts are completely free when requested through standard methods (online, phone, or mail). However, if you request a full copy of your actual tax return using Form 4506, the IRS charges $43 per return. Most people don't need the full return copy—a free transcript contains sufficient information.

Using the IRS Get Transcript Online tool, transcripts are available immediately—you can view and download them as soon as you complete identity verification. If you request transcripts by mail or phone, delivery takes 5-10 business days. The IRS doesn't email transcripts.

Go to IRS.gov and select "Get Your Tax Record." Choose "Get Transcript Online" and either create an account or log in. After verifying your identity, select the transcript type and tax year. The transcript will display on screen, and you can download it as a PDF.

Generally, no. Tax transcripts can only be requested by the taxpayer, their spouse (if filed jointly), or someone with power of attorney. However, you can use Form 4506-T to authorize the IRS to send your transcript directly to a third party like a lender or school. For business purposes, use your invoicing software to provide income documentation rather than sharing personal tax information.