Working Capital: Definition, Formula, Examples, and Why It Matters

Table of Contents

- What Is Working Capital?

- Understanding Working Capital in Practice

- Working Capital Formula

- Components of Working Capital

- Limitations of Working Capital

- Example of Working Capital

- What Is a Working Capital Loan?

- What Is the Working Capital Cycle?

- How Do You Calculate Working Capital?

- Why Is Working Capital Important?

- Is Negative Working Capital Bad?

- Working Capital vs. Cash Flow: What’s the Difference?

- How Can a Company Improve Its Working Capital?

- Ready to Take Control of Your Working Capital?

- FAQs

Most businesses don’t think about working capital directly, instead they feel it in the business. It shows up when payroll is due before customers have paid, when inventory needs to be reordered but cash is tight, or when sales look strong on paper yet the bank balance keeps falling.

Working capital explains why those situations happen. It reflects how much short-term financial breathing room a business actually has, based on the timing of money coming in and money going out.

This guide will cover:

- What working capital really means in day-to-day business

- How the working capital formula works in practice

- What goes into working capital and what doesn’t

- Why profitable businesses still run into cash problems

- How working capital affects operations, growth, and financial stability

Before we get into the details: how quickly customers pay has a direct impact on working capital. Invoice Fly’s online payments solution lets businesses accept PayPal and Stripe payments directly on invoices, with flexible options like Visa, Mastercard, Apple Pay, Google Pay, and ACH—helping cash move faster and reducing the gap between sending an invoice and getting paid.

What Is Working Capital?

Working capital describes the resources a business has available to cover its short-term obligations. In practical terms, it answers a simple question:

If nothing unexpected happened tomorrow, could this business keep operating without running into cash trouble?

Working capital looks at what a business expects to turn into cash within the next year, such as bank balances, customer payments, and inventory, and compares that to what it owes over the same period, like vendor bills, payroll, and short-term loans. These figures come directly from the balance sheet.

When working capital is positive, a business has room to operate. If it’s tight or negative, even routine expenses can create stress.

Understanding Working Capital in Practice

Working capital matters because most business expenses don’t wait. For example, employees expect to be paid on schedule, vendors have terms, rent, software subscriptions, and utilities come due whether customers have paid their invoices or not.

When incoming cash lags behind outgoing obligations, working capital shrinks. That gap is what forces many businesses to rely on credit cards, short-term borrowing, or delayed payments just to keep things moving.

On the other hand, businesses with healthy working capital can absorb delays, handle seasonal swings, and make decisions without constant cash pressure. They’re not scrambling to cover basic expenses, which makes planning and growth far more manageable.

At its core, working capital is less about accounting theory and more about control. Control over timing, commitments, and cash flow in the normal course of running a business.

Working Capital Formula

The working capital formula itself is straightforward:

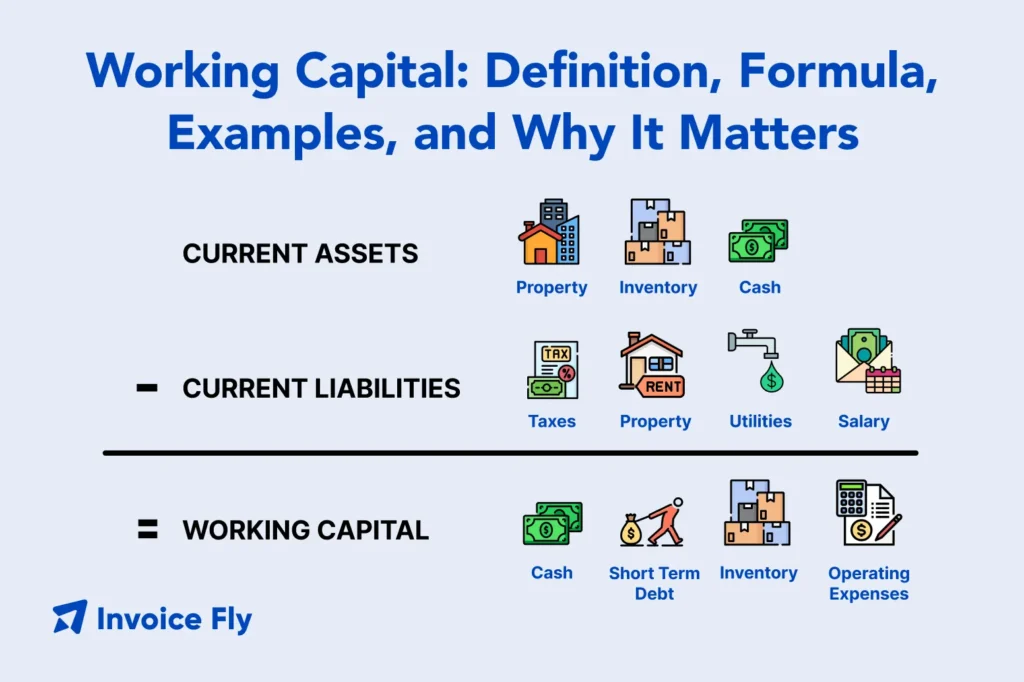

Working Capital = Current Assets − Current Liabilities

This is also called the net working capital equation. It shows how much short-term liquidity remains after covering near-term obligations.

While the formula is simple, the accuracy of the result depends on how well assets and liabilities are classified and recorded. Misplacing even a few items can make working capital look healthier (or riskier) than it actually is.

Components of Working Capital

Current Assets

Current assets are resources expected to be converted into cash within one year. These assets directly support day-to-day operations and liquidity.

Common current assets include:

- Cash and bank balances

- Accounts receivable

- Inventory

- Short-term investments

Because only assets that can realistically be converted into cash in the near term should be included, understanding what qualifies as an asset is essential for ensuring working capital reflects money that will actually be available when it’s needed.

Accounts receivable deserve special attention. Slow-paying customers can inflate asset totals while still causing cash shortages, which is why improving invoice accuracy and payment speed is often the fastest way to strengthen working capital.

Current Liabilities

Current liabilities are obligations due within one year. These represent near-term claims on your company’s cash.

Examples include:

- Accounts payable

- Short-term loans

- Accrued wages

- Taxes payable

Limitations of Working Capital

Working capital is a useful indicator, but it doesn’t tell the whole story.

A business can show positive working capital and still struggle with shrinking margins, inefficient operations, or poor long-term planning. Likewise, a temporary dip in working capital doesn’t always signal trouble if timing issues are understood and managed.

That’s why working capital should be reviewed alongside broader financial data. Using real-time business reports helps business owners spot trends and risks that a single working capital figure can’t reveal on its own.

Example of Working Capital

Imagine a business with:

- $200,000 in current assets

- $135,000 in current liabilities

Working capital equals $65,000. This means the business can cover short-term expenses and still maintain a cushion for unexpected costs.

Examples like this only remain accurate when changes in assets and liabilities are recorded consistently. Reviewing how journal entries track these movements helps ensure working capital figures reflect real activity, not outdated balances.

What Is a Working Capital Loan?

A working capital loan is short-term financing used to cover operating expenses such as payroll, rent, or inventory purchases.

For businesses that need temporary support during growth or seasonal slowdowns, the U.S. Small Business Administration’s Working Capital Pilot Program offers short-term financing designed to cover operating expenses like payroll, rent, and inventory, rather than long-term investments.

While these loans can provide relief, they also create repayment obligations. In many cases, improving billing accuracy and collection speed reduces the need for borrowing.

Pro Tip: Accepting payments through online payments helps businesses collect funds faster without taking on additional debt.

What Is the Working Capital Cycle?

The working capital cycle measures how long it takes to convert inventory and receivables into cash.

A shorter cycle means:

- Faster access to cash

- Less reliance on short-term financing

- Lower operational stress

Improving the working capital cycle often comes down to tightening the gap between finishing the work and receiving invoice payments. Businesses that clearly define payment terms, send invoices immediately, and track outstanding balances are far more likely to shorten that gap and keep cash moving predictably.

How Do You Calculate Working Capital?

To calculate working capital, start with your balance sheet by totaling current assets and subtracting current liabilities.

Where businesses often run into trouble is not the math, but timing—such as recording income before it’s collected or expenses after they’re due. That’s why consistent financial accounting practices matter, especially when working capital is used to make day-to-day decisions.

Planning ahead also matters. Using financial projections allows businesses to anticipate cash gaps before they become operational problems.

Why Is Working Capital Important?

Working capital supports:

- Payroll and day-to-day expenses

- Financial stability during slow periods

- Growth without excessive borrowing

In practice, maintaining adequate working capital means setting aside enough short-term resources to handle routine expenses, unexpected disruptions, and revenue delays without scrambling for emergency funding.

Public-sector finance professionals often recommend defining a clear working capital buffer for this reason, as outlined in guidance on working capital targets for enterprise funds.

Is Negative Working Capital Bad?

Negative working capital isn’t automatically bad—but it can be risky depending on how a business gets paid and how predictable its expenses are. In some industries, collecting cash upfront or turning inventory quickly makes negative working capital manageable.

For many small businesses, however, it signals that cash is leaving faster than it’s coming in, which can create ongoing pressure.

When negative working capital may be manageable:

- Customers pay immediately or upfront

- Inventory turns over quickly

- Vendor payment terms are predictable and flexible

When negative working capital is a warning sign:

- Customer payments are delayed or inconsistent

- Payroll or rent requires using credit or reserves

- Vendor relationships are strained due to late payments

When negative working capital persists under these conditions, it can lead to late payments, payroll stress, and limited flexibility. Identifying cash flow problems early helps prevent timing issues from turning into operational disruptions.

Working Capital vs. Cash Flow: What’s the Difference?

Working capital and cash flow are closely related, but they answer different questions. Understanding the distinction helps explain why a business can look healthy on paper while still feeling cash pressure day to day.

At a high level, working capital shows short-term financial cushion, while cash flow shows how money actually moves through the business.

Working Capital vs. Cash Flow at a Glance

| Aspect | Working Capital | Cash Flow |

| What it measures | Short-term liquidity at a point in time | Movement of money over a period |

| Focus | Ability to cover upcoming obligations | Timing of cash coming in and going out |

| Source | Balance sheet | Cash flow statement |

| Common issue | Cash tied up in receivables or inventory | Delayed or uneven payments |

| Best used for | Assessing short-term financial stability | Managing day-to-day cash needs |

| Can look healthy while problems exist? | Yes | Yes |

A business can have positive working capital but still struggle if cash is slow to arrive. It can also have strong cash inflows during busy periods but weak working capital if short-term obligations pile up just as quickly.

Looking at both together gives a clearer picture of how resilient a business really is, especially when payment timing, expenses, and growth all intersect.

How Can a Company Improve Its Working Capital?

Businesses improve working capital by focusing on timing and visibility—specifically, how quickly money comes in and how clearly expenses are tracked.

Common strategies include:

- Sending invoices promptly so payment timelines start sooner

- Offering flexible payment options to reduce delays

- Reducing unnecessary or poorly timed expenses

- Monitoring margins with a profit margin calculator to ensure revenue supports operating costs

Regularly reviewing business reports also helps identify patterns in income, expenses, and payment behavior that directly affect liquidity and day-to-day decision-making.

Ready to Take Control of Your Working Capital?

Strong working capital gives businesses flexibility, stability, and room to grow. By improving how money moves in and out, tracking financial activity accurately, and reducing delays in getting paid, businesses can operate with far less stress.Invoice Fly helps freelancers and small business owners manage invoices, accept faster payments through online payments, and track financial performance with business reports in one place, making working capital easier to understand and control as your business grows.

FAQs

Working capital itself isn’t repaid, it reflects the short-term resources your business already has. Any loans used to support working capital, however, must be repaid under their terms.

Yes. Cash available for payroll is a current asset, while unpaid wages and accrued payroll expenses are current liabilities.

Long-term assets and long-term debt aren’t included, since working capital only measures short-term liquidity.

Equity represents ownership value in the business, while working capital measures the ability to cover near-term expenses.

Working capital doesn’t show profitability or long-term financial strength, so it should be reviewed alongside other financial metrics.