Bank Reconciliation: Definition, Steps & Examples for Small Businesses

Table of Contents

- What Is a Bank Reconciliation Statement?

- Why Prepare a Bank Reconciliation Statement

- How Often Should You Reconcile Your Bank Account?

- Who Should Oversee Bank Reconciliations?

- Important Terms to Know for Bank Reconciliation

- How to Do a Bank Reconciliation

- Example of a Bank Reconciliation Statement

- Benefits of Bank Reconciliation

- Conclusion

- FAQs About Bank Reconciliation

Bank reconciliation is simply the process of matching your business records with your bank statement to make sure everything lines up. It helps you spot missing payments, bank fees, or recording mistakes before they turn into bigger problems—and keeps your cash balance accurate.

In this guide, we’ll break down what a bank reconciliation is, why it’s important for small businesses, and how to do one step by step using easy, real-world examples.

What Is a Bank Reconciliation Statement?

Think of a bank reconciliation statement as a financial reality check. It’s a report that matches your company’s cash book balance to your bank statement balance. Basically, it ensures that what you think you have in the bank actually matches what the bank says you have.

Your statement shows four key things:

- Your company’s book balance (from your general ledger)

- Your bank balance (from your bank statement)

- Adjustments needed to explain any differences

- The final adjusted cash balance that should match on both sides

This account reconciliation process verifies every transaction recorded in your accounting system appears correctly on your bank statement and vice versa. This catches errors, fraud, and timing differences between when you record transactions and when they actually clear the bank.

Understanding this process keeps your small business bookkeeping accurate and your balance sheet reliable.

Why Prepare a Bank Reconciliation Statement

Regular bank reconciliation provides essential financial controls for your business structure. Here’s why it matters:

Reasons Bank Reconciliation is Important

- Detect Errors: Both you and your bank can make mistakes. Reconciliation catches mathematical errors, duplicate entries, or transposed numbers in your cash book or general ledger. This accuracy matters when preparing your income statement and other financial reports.

- Prevent Fraud: Regular reconciliation identifies unauthorized transactions, forged checks, or suspicious activity. According to Washington State Auditor’s Office guidelines, proper reconciliation procedures are critical fraud prevention controls.

- Track Outstanding Items: Reconciliation identifies outstanding checks (written but not yet cashed) and deposits in transit (recorded but not yet cleared). These timing differences affect your actual available cash and can impact whether you face cash flow problems.

- Maintain Accurate Records: Your financial projections depend on accurate cash balances. Reconciliation ensures reliability across your entire chart of accounts.

- Support Audits: When facing an audit, complete bank reconciliation records demonstrate proper internal controls. This documentation proves invaluable during tax audits or when requesting business credit.

- Manage Cash Flow: Understanding your true cash position helps you make informed decisions about creating invoices and when to send invoices for optimal cash management.

If you run a small contracting business, reconciling your bank account each month could help you catch a $2,500 duplicate payment to a supplier. Without regular bank reconciliation, that money could be lost entirely.

How Often Should You Reconcile Your Bank Account?

Monthly reconciliation is standard for most small businesses. Do it immediately after receiving your bank statements.

However, your frequency depends on transaction volume:

- Monthly: Standard for most small businesses

- Weekly: High-volume businesses or those with significant cash activity

- Daily: Large businesses or those with critical cash management needs

Never let reconciliation go longer than monthly. The longer you wait, the harder it becomes to identify and correct problems. This becomes especially important when preparing quarterly estimated taxes or your annual report.

Who Should Oversee Bank Reconciliations?

This depends on your business size and structure.

Small Businesses: The owner or bookkeeper typically performs reconciliation. If possible, separate duties—have one person reconcile and another review. This is particularly important when managing your small business bank account.

Medium Businesses: An accounting staff member performs reconciliation while a controller or CFO reviews it. Consider using accounts payable automation software to streamline the process.

Best Practice: The person who performs reconciliation shouldn’t be the same person who makes deposits, writes checks, records cash transactions, or processes invoices. This separation of duties prevents fraud. Whether you operate as an LLC or sole proprietorship, clear responsibility assignment matters.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

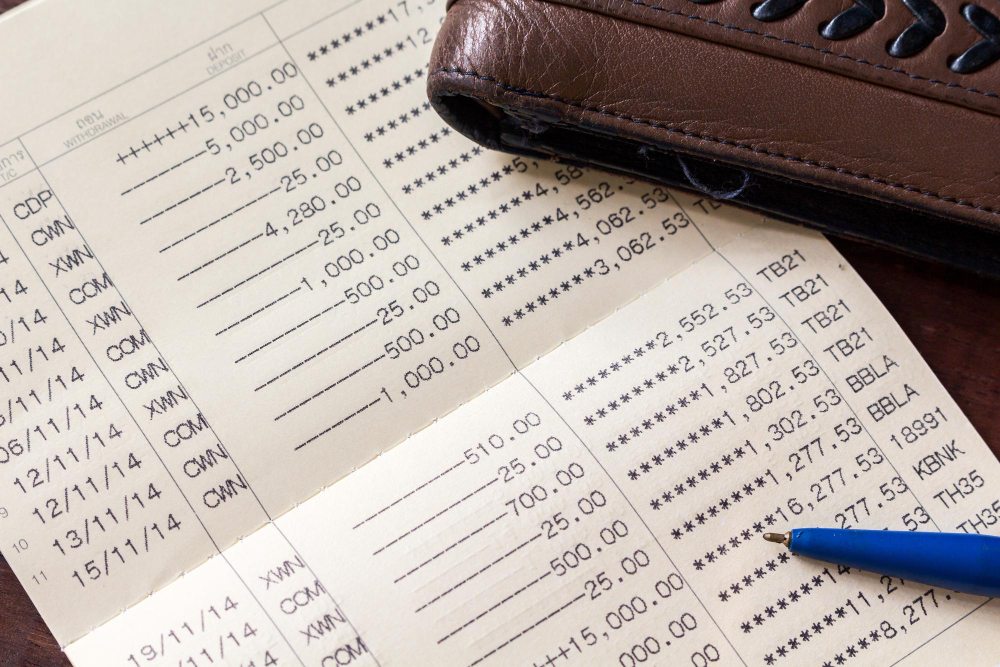

Important Terms to Know for Bank Reconciliation

Bank reconciliation is much easier when you understand the language used in your bank statements and accounting records. Use this table as a quick reference when reviewing your transactions or working with a reconciliation worksheet.

| Simple Definition | Why It Matters | |

| Book Balance | The cash balance shown in your general ledger before reconciliation | Reflects what your business thinks it has based on recorded journal entries |

| Bank Balance | The ending balance shown on your bank statement | Shows what the bank has actually processed |

| Outstanding Check | A check you’ve written and recorded that hasn’t cleared the bank yet | Helps prevent overdrafts, invoicing mistakes, and cash shortages |

| NSF Check | A bounced check due to insufficient funds | Reduces your book balance once identified |

| Deposit in Transit | A deposit you recorded but the bank hasn’t processed yet | Common near statement cutoff dates |

| General Ledger | The master record of all business transactions | Used to track and verify cash activity |

| Adjusted Cash Balance | The final, correct cash amount after reconciliation | Used for accurate financial statements |

| Bank Errors | Mistakes made by the bank, such as incorrect amounts | Must be corrected to keep records accurate |

| Credit Memo | A bank notice of money added to your account | Includes interest earned or incoming transfers |

| Debit Memo | A bank notice of money removed from your account | Includes fees, charges, or loan payments |

| Cleared Transactions | Transactions that appear on your bank statement | Confirmed and fully processed |

| Uncleared Transactions | Transactions recorded in your books but not yet processed by the bank | Cause temporary differences during reconciliation |

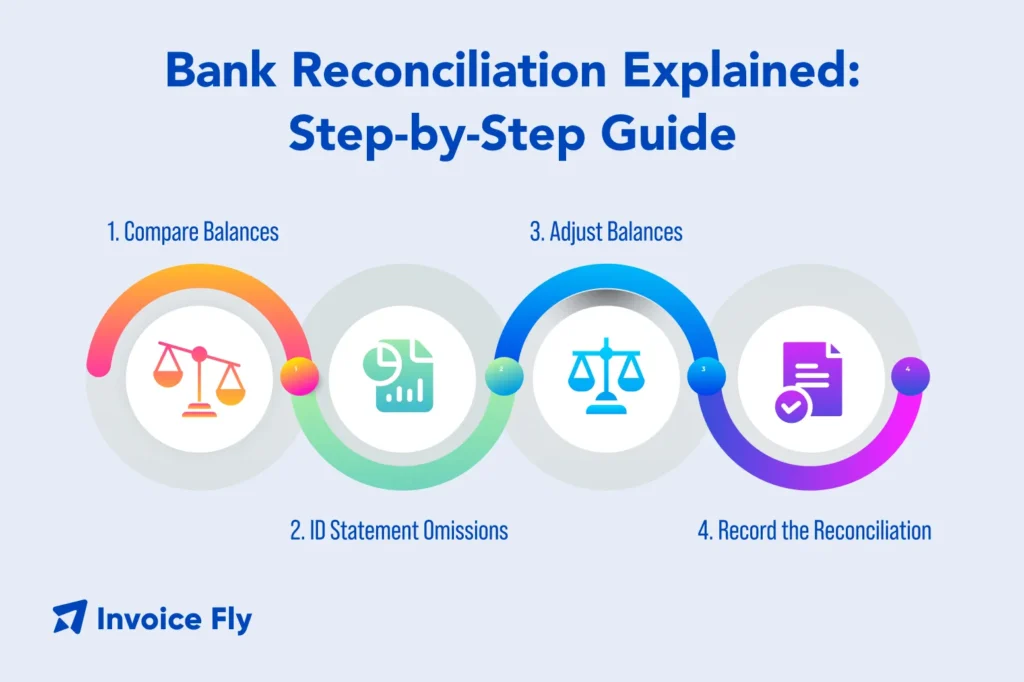

How to Do a Bank Reconciliation

Doing a bank reconciliation works best when you follow a simple, repeatable process. Below are the steps most small businesses use to reconcile their accounts accurately.

Step 1: Gather Your Documents

Collect everything you need:

- Your latest bank statement

- Your general ledger or cash book

- Previous reconciliation statement (if available)

- Records of deposits in transit

- List of outstanding checks

- Bank reconciliation template or software

Many businesses use an Excel template for easy customization.

Step 2: Compare Your Balances and Activity

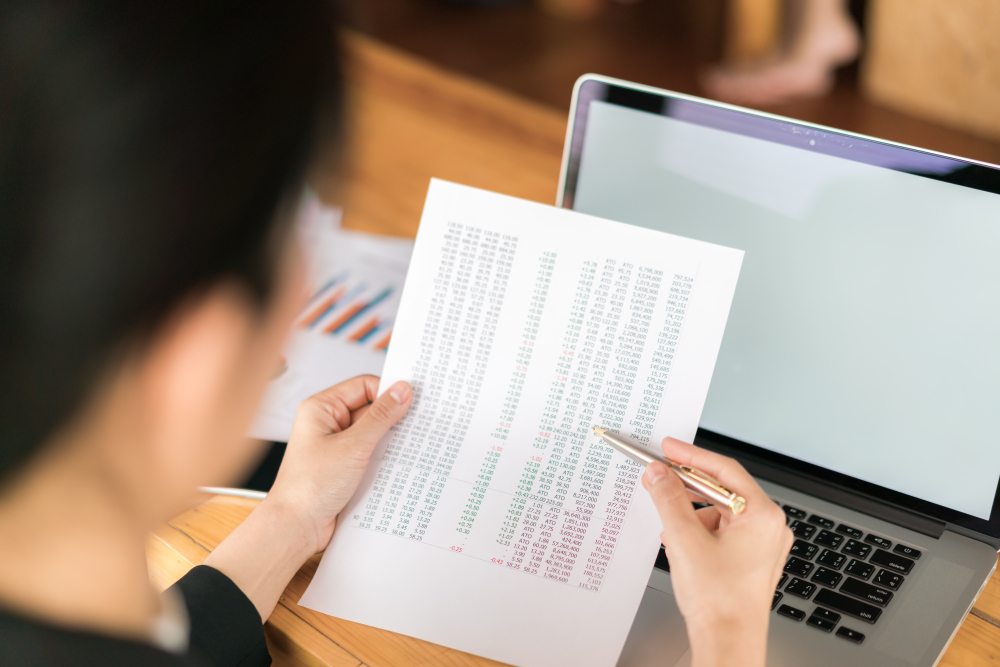

Start with two numbers: book balance from your general ledger and bank balance from your bank statement. These rarely match initially. Compare each transaction on your bank statement to your cash book. Mark items appearing in both records as cleared using proper journal entry accounting procedures.

Step 3: Investigate and Record Outstanding Transactions

Identify items in your books not on the bank statement:

- Outstanding checks

- Deposits in transit

- Pending electronic transfers

- Unprocessed payments

Identify items on the bank statement not in your books:

- Bank service fees

- Interest earned

- Automatic payments

- NSF checks

- Bank errors

- Acquirer reference number transactions

Step 4: Make Adjustments and Reconcile Your Balances

Use this formula approach:

Bank Balance Reconciliation:

- Bank statement ending balance

- Add: Deposits in transit

- Subtract: Outstanding checks

- +/–: Bank errors

- = Adjusted bank balance

Book Balance Reconciliation:

- General ledger cash balance

- Add: Credit memos not recorded (interest, collections)

- Subtract: Debit memos not recorded (fees, NSF checks)

- +/–: Book errors

- = Adjusted book balance

The adjusted bank balance and adjusted book balance must match. This is your true cash balance for financial accounting purposes.

Step 5: Keep Records of Your Changes

Create journal entries for items needing book adjustments. This journalizing process ensures your books stay accurate.

- For bank fees: Debit Bank Service Charge Expense, Credit Cash

- For NSF checks: Debit Accounts Receivable, Credit Cash

- For interest earned: Debit Cash, Credit Interest Income

Document everything. Maintain completed reconciliations in your records for audit purposes. When working with 1099 contractors, accurate cash records become essential for year-end reporting.

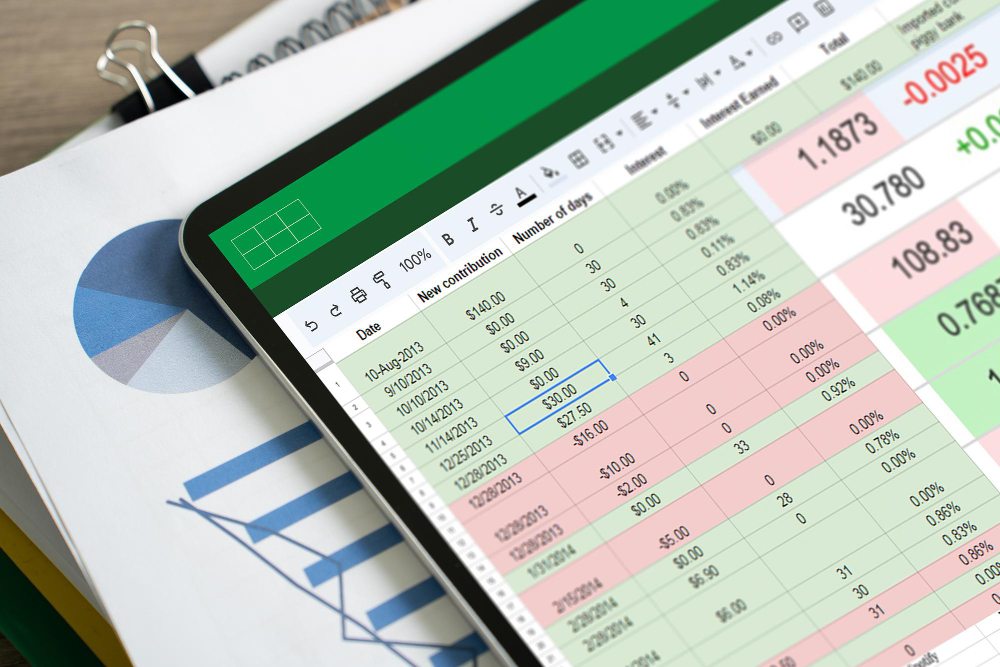

Example of a Bank Reconciliation Statement

Below is a simple example showing how timing differences and banking adjustments affect your final cash balance.

ABC Company

Bank Reconciliation Statement

March 31, 2025

| Item | Bank Balance | Book Balance |

| Starting balance | $15,240 | $16,750 |

| Additions | ||

| Deposit in transit (3/31) | + $3,200 | — |

| Interest earned | — | + $15 |

| Deductions | ||

| Outstanding check #1045 | − $850 | — |

| Outstanding check #1048 | − $1,100 | — |

| Bank service charge | — | − $25 |

| NSF check from customer | — | − $250 |

| Adjusted balance | $16,490 | $16,490 |

✓ Balances Match

Benefits of Bank Reconciliation

Regular reconciliation provides multiple advantages:

Financial Accuracy: Ensures your annual report and financial statements reflect true cash positions, affecting everything from your balance sheet to cash flow calculations.

Early Problem Detection: Identifies issues before they become serious, whether fraud, errors, or cash management problems.

Better Cash Management: Accurate cash balances support better decision-making about expenses, investments, and growth opportunities. Use tools like the ROI calculator alongside reconciliation data.

Tax Preparation: Clean, reconciled records simplify tax filing and support tax transcript requests.

Regulatory Compliance: According to Utah Justice Department guidance, proper reconciliation supports compliance with governmental accounting standards.

Fraud Prevention: Regular reconciliation deters and detects unauthorized activity, especially when multiple people have access to your accounts.

Informed Business Decisions: Accurate cash data supports market research and helps when writing a business plan or seeking financing.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

Conclusion

Bank reconciliation is essential for accurate financial management in any business. Whether you use a template or software, the key is performing this task regularly and systematically.

The process protects your business by catching errors, preventing fraud, and ensuring your financial records accurately reflect your cash position. While it may seem tedious, monthly reconciliation saves time and money by identifying problems early.

For businesses using accrual basis accounting, reconciliation becomes even more critical to distinguish between recorded transactions and actual cash movements. If you manage family employment or complex payroll with Form 940 and Form 941 requirements, consider using bank reconciliation services for professional verification.

Following the steps in this guide helps ensure your financial records remain accurate and audit-ready throughout the year.

FAQs About Bank Reconciliation

The five stages are: gather documents, compare balances, match transactions, identify discrepancies (such as outstanding checks or deposits in transit), and adjust the books until balances match.

Journal entries record items that affect your book balance, such as bank fees, NSF checks, or interest earned. Only book-side adjustments require journal entries.

A bookkeeper or accountant usually performs the reconciliation, while an owner or manager reviews it. In very small businesses, the owner often handles both roles.

Most businesses should reconcile monthly, right after receiving bank statements. High-volume businesses may reconcile weekly or daily.

Yes. All bank and credit card accounts should be reconciled regularly to maintain accurate financial records.