Gross vs. Net Profit: Formula, Analysis & Examples

Table of Contents

- What is Gross Profit?

- What is Net Profit?

- How to calculate Gross and Net Profit?

- What does Gross Profit tell you?

- What does Net Profit tell you?

- What is a good Gross Profit Margin?

- What is a good Net Profit Margin?

- Key Takeaways Comparison Chart

- Plumbing Business Example

- Final Thoughts

- FAQs about Gross Profit vs. Net Profit

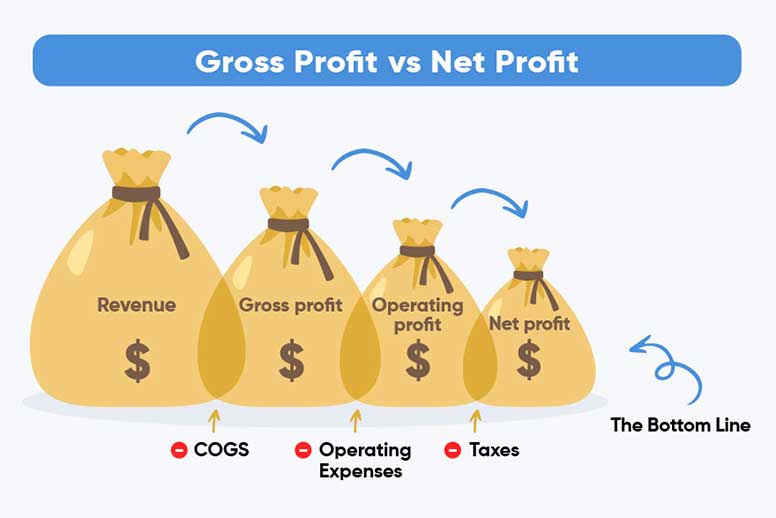

Gross Profit is a financial metric that represents a company’s revenue after deducting the cost of goods sold (COGS). It is a critical measure of profitability, indicating how efficiently a business produces and sells its products or services.

What is Gross Profit?

Gross Profit

Also known as Revenue, it is calculated by subtracting direct costs like materials, labor, and manufacturing from total revenue. This figure highlights the business’s ability to cover its production costs and still generate a profit.

A higher gross profit margin suggests a company is managing production costs well, while a lower margin may indicate inefficiencies.

This business metric plays a vital role in understanding business performance and guiding decisions on pricing, budgeting, and overall financial health.

What is Net Profit?

Net Profit

Total earnings a business retains after deducting all expenses, such as COGS, operating costs, interest, and taxes, from its gross income or revenue.

For contractors like plumbers, landscapers, cleaners, HVAC technicians, and small business owners, net profit represents the true financial health of their business, showing how much they keep after covering labor, materials, overhead, operating costs, interest, taxes, and other expenses.

Maximizing net profit helps them sustain and grow operations while ensuring long-term success.

RELATED ARTICLE: Break-Even Point Formula: Analysis and Examples

How to calculate Gross and Net Profit?

To calculate Gross Profit, use the following formula:

Gross Profit = Revenue – Cost of Goods Sold (COGS)

Where:

- Revenue is the total income from sales.

- Cost of Goods Sold (COGS) includes the direct costs of producing the goods or services sold, such as materials and labor.

To calculate Net Profit, use the following formula:

Net Profit = Revenue – (COGS + Operating Expenses + Interest + Taxes)

Where:

- Revenue is the total income from sales.

- COGS is the Cost of Goods Sold.

- Operating Expenses include costs like rent, utilities, and salaries.

- Interest refers to any interest payments on loans.

- Taxes include any income or business taxes owed.

RELATED ARTICLE: What Is A Ledger Balance? Definition, Formula & Examples

What does Gross Profit tell you?

It shows how efficiently a business is generating profit from its core operations, specifically the production and sale of goods or services.

It measures the difference between Revenue and COGS, highlighting the ability to manage production costs while maintaining sales.

1. Operational Efficiency

A higher gross profit means effectively controlling production or service costs relative to sales.

2. Profitability Before Expenses

It shows profitability before accounting for indirect expenses like administrative, marketing, taxes, and interest.

3. Pricing and Cost Strategy

Gross profit helps evaluate if pricing strategy and production costs are aligned to maintain profitability.

What does Net Profit tell you?

Net Profit provides a comprehensive measure of overall profitability after accounting for all expenses, including operating costs, taxes, interest, and other deductions.

It represents the actual financial gain or loss over a given period and is a key indicator of financial health.

1. True Profitability

Net profit shows how much money remains after all business expenses, giving a clear picture of actual earnings.

2. Financial Sustainability

It helps assess whether the business is financially sustainable by indicating if revenues exceed total costs.

3. Business Efficiency

By highlighting the bottom line, it reflects how efficiently a business manages all aspects of its operations.

What is a good Gross Profit Margin?

It generally depends on the industry, but for most businesses, a margin of 20% to 40% is considered healthy.

For contractors like plumbers, carpenters, HVAC specialists, and landscapers, it tends to fall within the 30% to 50% range.

This margin allows businesses to cover operating costs, reinvest in growth, and ensure profitability after all expenses.

RELATED ARTICLE: Tax Deductions for Small Businesses to Consider in 2025

What is a good Net Profit Margin?

A good Net Profit Margin typically varies by industry, but a general benchmark is around 10% to 20%. For contractors, a margin of 5% to 15% is considered healthy.

Achieving a higher margin indicates effective control of fixed costs and expenses relative to sales.

An above-15% margin suggests strong financial health, enabling reinvestment, resilience to fluctuations, and returns to stakeholders.

RELATED ARTICLES: What is a Pay Stub? Definition & Best Practices

Key Takeaways Comparison Chart

Plumbing Business Example

Here’s a simple example illustrating how a small plumbing business can calculate its revenue for 2024 using gross and net profit margins.

Assumptions:

- Projected Revenue for 2024: $200,000

- Cost of Goods Sold (COGS): $80,000

- Total Operating Expenses (including salaries, rent, utilities, etc.): $70,000

- Interest and Taxes: $10,000

Step 1: Calculate Gross Profit

Formula:

Gross Profit = Revenue – Cost of Goods Sold (COGS)

Calculation: $200,000 – $80,000 = $120,000

Step 2: Calculate Gross Profit Margin

Formula:

Gross Profit Margin = (Gross Profit / Revenue) × 100

Calculation: ($120,000 / $200,000) × 100 = 60%

Step 3: Calculate Net Profit

Formula:

Net Profit = Revenue – COGS – Operating Expenses – Interest – Taxes

Calculation: ($200,000 – $80,000 – $70,000 – $10,000) = $40,000

Step 4: Calculate Net Profit Margin

Formula:

Net Profit Margin = (Net Profit / Revenue) × 100

Calculation: ($40,000 / $200,000) × 100 = 20%

In this example, the plumbing business generates $200,000 in revenue, achieving a 60% gross profit margin and a 20% net profit margin.

This indicates efficient cost management and a healthy bottom line after accounting for all expenses.

Final Thoughts

Running a small home service business in the United States is not easy, especially when you’re just starting.

Knowing how to calculate your gross and net profit margins gives you the clarity to price your services competitively while ensuring all costs are covered.

By tracking these metrics over time, you’ll identify areas where you can improve efficiency—whether it’s reducing material waste, negotiating better rates with suppliers, or adjusting labor allocation.

FAQs about Gross Profit vs. Net Profit

Gross profit and net profit serve different purposes:

- Gross Profit = Revenue – Cost of Goods Sold (COGS). It shows how efficiently you’re producing or sourcing your products.

- Net Profit = Revenue – (All expenses including COGS, operating costs, interest, taxes). It reveals your true bottom‐line earnings.

A healthy net profit margin for most small businesses falls between 10 % and 20 %.

- Service-based contractors (plumbers, landscapers, cleaners) often target 5 %–15 %.

- Retail or e-commerce businesses commonly aim for 10 %–20 %.

Consistently tracking and improving your net profit margin helps ensure sustainable growth and better cash reserves.

Business valuation often uses a multiple of gross profit, especially for asset-light or subscription-based companies.

- Typical range: 1×–3× gross profit, depending on industry stability and growth prospects.

- High-growth or SaaS businesses may command 3×–5× gross profit.

A healthy gross profit margin varies by sector:

- Manufacturing: 25 %–35 %

- Retail/e-commerce: 20 %–40 %

- Service industries: 30 %–50 %

Businesses are taxed on their net profit (taxable income), not gross profit.

- Taxable income = Gross profit – Allowed deductions (operating expenses, depreciation, interest, taxes paid).

- Only profits remaining after legitimate business expenses are subject to corporate or self-employment taxes.

Properly tracking both gross and net profit ensures accurate tax filings and avoids underpayment penalties.