Line Item Explained: How It Works on Invoices and in Accounting

Table of Contents

- What Is a Line Item?

- Why Line Items Matter in Invoicing and Accounting

- Anatomy of a Line Item on an Invoice

- How to Create and Organize Line Items on an Invoice

- Common Mistakes When Using Line Items on Invoices

- Line Item Accounting: Tracking Costs and Revenue

- Using Line Items for Budgeting and Forecasting

- Modern Tools for Managing Invoice Line Items

- Line Items in E-commerce and Order Fulfillment

- Line Items in Traditional Warehousing

- Best Practices for Invoice Line Items

- Ready to Create Clear Line Items on Your Invoices?

- Line Item on an Invoice FAQs

A line item is a single, detailed entry on an invoice, budget, or financial document that represents a specific product, service, or expense. Each line item typically includes a description, quantity, unit price, and total amount. For freelancers, contractors, and small business owners, understanding how line items work is essential for accurate billing, clean bookkeeping, and compliant tax reporting.

This guide will cover:

- What a line item is and how it’s defined

- Why line items matter in invoicing and accounting

- How invoice line items are structured

- Line item accounting and profitability tracking

- How line items support budgeting and forecasting

Before we get into the details: if you want a faster way to build clear, professional invoices with properly structured line items, Invoice Fly’s free invoice templates make it easy to list item lines, apply taxes, and calculate totals automatically.

What Is a Line Item?

A line item is one individual row on an invoice, receipt, budget, or financial statement. Each line item represents a single product, service, or expense and shows exactly how that amount contributes to the total.

Instead of billing one lump sum, line items break charges into smaller, understandable parts. This improves clarity for clients and creates cleaner records for accounting.

Line items commonly appear in:

- Invoices and receipts

- Income statements and balance sheets

- Purchase documentation

- Personal and business budgets

Line items are a core concept in financial accounting and are used to track activity at the most detailed level.

Why Line Items Matter in Invoicing and Accounting

Line items matter because they create transparency. Clients can see what they are paying for, and businesses can trace revenue and expenses back to specific services or products.

From an accounting standpoint, line items help:

- Record accurate transactions

- Post entries to a ledger

- Prepare financial reports

- Support audits and compliance

Clear documentation is also required for tax purposes. According to the IRS, businesses must maintain accurate records to report income correctly.

For invoice structure and compliance standards, check out our guide on professional invoice elements.

Pro Tip: Using reliable invoicing software further reduces errors by calculating totals and taxes automatically at the line-item level.

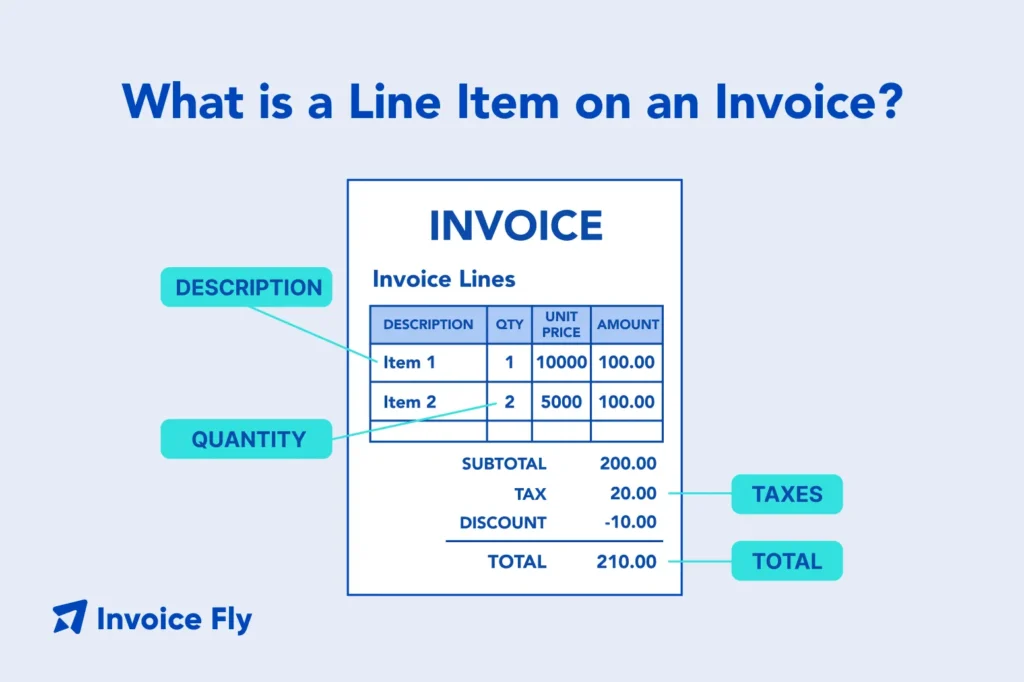

Anatomy of a Line Item on an Invoice

Every invoice line item includes several core components. Understanding each one helps ensure accurate billing.

Item Description and Details

The description explains what the client is being charged for. Clear descriptions reduce disputes and speed up payments.

Strong descriptions often include:

- Product or service name

- Date or project reference

- Scope or specifications

Consistent descriptions also support clean bookkeeping and simplify future reviews.

Quantity and Unit Price

Quantity shows how many units were delivered. Unit price shows the cost per unit. Together, they determine the line total.

This is especially important for:

- Hourly services

- Materials and supplies

- Product sales using a wholesale price model

Accurate quantities and pricing directly affect revenue reporting and profitability.

Discounts, Taxes, and Adjustments

Some line items include discounts, taxes, or credits. Listing these clearly prevents confusion and supports tax reporting.

Detailed item lines also make it easier to process invoice payments and issue a proper receipt of payment.

How to Create and Organize Line Items on an Invoice

Creating effective line items requires consistency and structure.

Best practices include:

- Listing each product or service separately

- Using the same naming format across invoices

- Applying taxes at the correct item level

- Reviewing totals before sending

For service providers, using an estimates app helps predefine item lines before work begins. This ensures invoices match approved estimates.

Once invoices are sent, offering online payments allows clients to pay faster and reduces follow-up work.

Common Mistakes When Using Line Items on Invoices

Small errors in line items can cause delays or accounting issues.

Common mistakes include:

- Vague descriptions

- Combining unrelated charges

- Incorrect quantities or prices

- Missing tax details

These mistakes complicate reporting, especially when calculating percentage of income for taxes. Poor documentation can also increase risk during an audit.

Line Item Accounting: Tracking Costs and Revenue

Line item accounting records income and expenses at a detailed level instead of using summary totals.

This approach supports:

- Better cost control

- More accurate reporting

- Clear audit trails

Line items feed directly into journal entries and are used in both cash and accrual basis accounting.

Line-Item-Level Profitability

Tracking profitability by line item shows which services or products generate the most margin. This helps businesses adjust pricing and control expenses.

Line-item data also supports reviews of assets and liabilities when planning growth.

Comparing Line Item Accounting to Other Methods

Compared to summary accounting, line item accounting provides more insight but requires organization. Most professionals rely on double-entry accounting to manage this level of detail.

To understand how this works day to day, review our guide on what accountants do.

Using Line Items for Budgeting and Forecasting

Line items are just as important in budgeting as they are in invoicing.

Personal and Business Budgets

In a line-item budget, each expense appears as its own entry. This makes it easier to:

- Track spending

- Forecast costs

- Compare planned vs. actual results

Budgets often align with financial statements like the balance sheet.

Modern Tools for Managing Invoice Line Items

Modern accounting tools automate line item management.

They help businesses:

- Reuse item descriptions

- Sync invoices with records

- Reduce manual errors

Automation is especially useful for managing accounts payable automation when reviewing vendor invoices.

Record retention also matters for tax compliance. In most cases, the IRS recommends keeping invoices, receipts, and supporting records for at least three years after filing a return. If you underreport income, that window can extend to six years, and records related to unfiled returns or fraud should be kept indefinitely.

Line Items in E-commerce and Order Fulfillment

In e-commerce, every product a customer orders is treated as a separate line item. Even when multiple products are purchased in a single transaction, each item is listed individually with its own quantity, price, and SKU. This structure allows sellers to track inventory accurately, calculate order totals correctly, and manage fulfillment without confusion.

Line items also create a clear connection between what the customer ordered, what was shipped, and what was billed. This level of detail is essential for scaling online operations, handling returns, and resolving customer disputes efficiently.

Picking, Packing, and Shipping by Line Item

Warehouse teams rely on line items to guide the picking and packing process. Each line item typically corresponds to a specific SKU and quantity, telling staff exactly which products to pull from inventory and how many units to ship.

Line-item-level detail reduces guesswork on the warehouse floor and helps prevent mis-picks, partial shipments, and incorrect deliveries.

This process often ties directly to purchasing and receiving documentation such as a PO number and a goods received note, which confirm that the correct items were ordered, received, and fulfilled.

How Line Items Affect Order Accuracy and Costs

Clear line items play a major role in controlling fulfillment costs. When each product is tracked individually, businesses can more easily identify where errors occur, whether in picking, packing, shipping, or returns.

Accurate line items also make it easier to:

- Track shipping and handling costs by product

- Monitor return rates by item

- Evaluate vendor and supplier performance

- Identify fulfillment inefficiencies

Over time, this visibility helps businesses reduce waste, improve margins, and avoid operational issues that contribute to cash flow problems.

Line Items in Traditional Warehousing

Traditional warehouses rely on line items to manage inventory movement, vendor invoices, and internal transfers between locations. Each line item represents a specific product, quantity, and cost, making it easier to track stock levels, reconcile supplier bills, and document warehouse activity accurately.

In regulated environments, these item-level records are often reviewed against federal procurement and recordkeeping standards.

Guidance outlines the basics such as line-item how individual items should be documented, while FAR rules establish requirements for maintaining detailed records that support traceability and compliance.

Maintaining clear, consistent line items helps warehouses meet regulatory expectations while reducing discrepancies between inventory records, invoices, and financial reports.

Best Practices for Invoice Line Items

To keep line items clear and compliant:

- Use specific descriptions so clients understand exactly what they’re being charged for, reducing questions and payment delays.

- Separate taxable items from non-taxable ones to ensure taxes are calculated correctly and reported accurately.

- Review invoices before sending to catch pricing, quantity, or calculation errors that could slow down payment.

- Store records securely so invoices and supporting documents are easy to find during reconciliations, audits, or tax filing.

Ready to Create Clear Line Items on Your Invoices?

Clear line items make invoicing simpler for everyone involved. When each product or service is listed plainly, clients can quickly see what they’re being charged for, and you spend less time answering follow-up questions or fixing mistakes. It also keeps your records easier to review later, whether you’re checking payments or getting ready for tax time.With Invoice Fly’s free quote generator and invoicing software, you can create professional invoices with accurate item lines, automatic totals, and built-in tax calculations in just a few minutes.

Line Item on an Invoice FAQs

A line item on an invoice is a single entry that lists a specific product or service along with its quantity, price, and total cost.

A line item on a receipt shows each purchased item separately, making it easier to see what was bought and how the total was calculated.

An example of a line item is “Plumbing labor – 2 hours at $90/hour,” which clearly shows what was provided and how the charge was calculated.

Any individual product, service, or expense listed separately on a financial document is considered a line item.

In a financial statement, a line item represents a specific category of revenue, expense, asset, or liability shown as its own entry for clarity and reporting.