Withholding Tax Explained: Definition, Examples, and How It Works

Table of Contents

- What Is Withholding Tax?

- How Withholding Tax Works

- Who pays withholding tax?

- What Is the Purpose of Withholding Tax?

- Why Did My Employer Withhold Too Much or Too Little Tax?

- Who Qualifies for Exemption From Withholding?

- The importance of tax withholding

- History of Withholding Taxes

- Types of Withholding Taxes

- How withholding taxes are calculated

- Calculating Your Withholding Tax (2025 Example)

- Withholding tax vs. estimated tax

- How to check your tax withholding

- Conclusion

- FAQs about HVAC Sales

Withholding tax is the amount of income tax an employer or payer deducts from wages, salaries, or other payments and sends directly to the government on behalf of the individual. This ensures taxes are paid incrementally throughout the year, reducing the risk of underpayment.

In this guide, we’ll explain what withholding tax is, how it works, who must pay it, and how to calculate it accurately, so businesses and employees can stay compliant.

What Is Withholding Tax?

Withholding tax is a federal income tax system where your employer or payer automatically deducts a portion of your income before you receive your paycheck and sends it directly to the government. Instead of waiting until April to pay your entire tax bill, you pay incrementally with each paycheck throughout the year.

The withholding tax definition encompasses any prepayment of income taxes collected at the source of income. What is withholding tax in practical terms? It’s the line on your pay stub showing federal income tax withheld, state tax withheld, and sometimes local tax withheld from your gross salary.

What does withholding tax mean for different payment types:

- Wages and salaries from employment

- Bonuses and commissions

- Pension and retirement distributions

- Gambling winnings above certain thresholds

- Unemployment compensation

- Social Security benefits in some cases

The withholding tax meaning extends beyond just employee paychecks. It’s a tax collection system designed to make paying taxes manageable and ensure the government receives tax revenue throughout the year rather than waiting for annual tax returns.

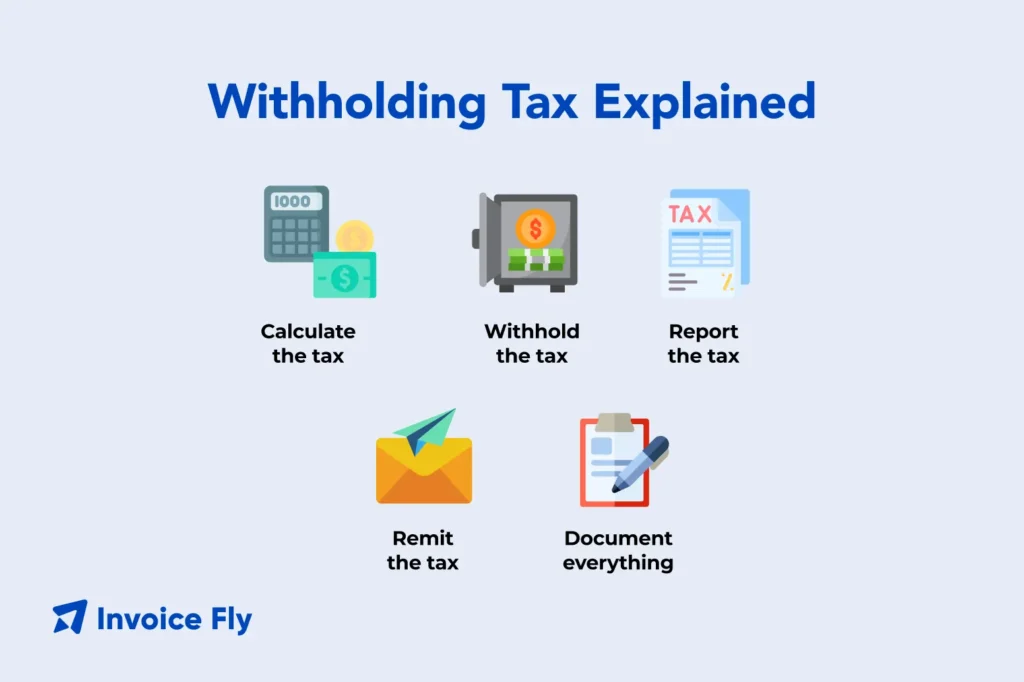

How Withholding Tax Works

The withholding tax system operates as a pay-as-you-go approach to collecting income taxes. Here’s how the process flows from your employer to the government:

Step 1: You provide information

When you start a job, you complete Form W-4 (Employee’s Withholding Certificate). This form tells your employer how much federal income tax to withhold based on your filing status, dependents, and other income factors.

Step 2: Employer calculates and withholds

Your employer uses your W-4 information and IRS tax tables to calculate withholding for each paycheck. They deduct this amount from your gross salary and send it to the IRS on your behalf, typically on a monthly or semi-weekly schedule.

Step 3: Reconciliation at year-end

At the end of the year, you receive Form W-2 showing your total wages and the total federal income tax withheld. When you file your tax return, you calculate your actual tax liability. The federal withholding tax you already paid through withholding gets credited against what you owe.

Step 4: Refund or payment

If more was withheld than you actually owe, you receive a refund. If less was withheld than you owe, you pay the difference when filing your return.

Who pays withholding tax?

Almost everyone who earns income in the United States encounters withholding tax in some form.

W-2 employees:

If you work for an employer who pays you wages or salary, federal withholding is mandatory. Your employer must withhold federal income tax, Social Security tax, and Medicare tax from your paychecks. You don’t have the option to opt out of these withholdings.

Independent contractors and freelancers:

If you’re a 1099 contractor, your clients typically don’t withhold taxes from your payments. Instead, you’re responsible for paying estimated taxes for contractors quarterly to cover your tax liability. However, you can choose to have taxes withheld from certain types of income like pension distributions.

Retirees:

Pension and retirement account distributions can have withholding tax applied. You can request withholding using Form W-4P for pensions or Form W-4R for retirement distributions.

Social Security recipients:

According to the Social Security Administration, you can choose to have federal taxes withheld from your Social Security benefits if they’re taxable. This is optional, not mandatory.

Non-resident aliens:

If you’re not a U.S. citizen or resident but earn income from U.S. sources, you typically face withholding at a flat 30% rate unless a tax treaty between the U.S. and your country provides a different rate.

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

What Is the Purpose of Withholding Tax?

Withholding tax serves several important purposes for both taxpayers and the government.

Ensures consistent tax revenue:

The government needs steady cash flow to fund operations throughout the year. Withholding tax creates a consistent stream of tax revenue rather than having it all arrive in April when people file returns.

Reduces taxpayer burden:

Paying your entire annual tax bill in one lump sum would be financially difficult for most people. Withholding spreads the payment across 26, 52, or however many pay periods you have, making it more manageable.

Improves compliance:

When taxes are automatically withheld before you receive your paycheck, you’re much more likely to pay them. The system prevents situations where people spend their entire paycheck and then can’t afford to pay taxes at year-end.

Minimizes underpayment penalties:

The IRS imposes penalties when you don’t pay enough tax throughout the year. Proper withholding helps you avoid these penalties by ensuring you’re paying as you earn.

Simplifies tax filing:

Because you’ve already paid most or all of your tax liability through withholding, filing your return becomes simpler. You’re reconciling amounts already paid rather than figuring out how to pay a large bill.

Why Did My Employer Withhold Too Much or Too Little Tax?

When you file your tax return and discover you’re getting a large refund or owe a significant amount, it often means your withholding wasn’t properly calibrated. Here’s why that happens:

Outdated W-4 form:

Your withholding is based on the W-4 you filled out when you started your job. Major life changes like marriage, divorce, having a child, buying a house, or starting a side business affect your tax situation but don’t automatically update your withholding. If you haven’t submitted a new W-4 after these changes, your withholding won’t match your actual tax liability.

Multiple jobs:

If you or your spouse work multiple jobs simultaneously, each employer withholds independently based on their own calculation. They don’t know about your other income, which can result in underwithholding because you’re in a higher tax bracket when all income is combined than each employer assumes.

Non-wage income:

W-4 withholding only accounts for wages from that employer. If you have other income like investment earnings, rental income, or self-employment income, your employer can’t withhold for those amounts unless you specifically request additional withholding on your W-4.

Payroll errors:

Occasionally, employers or payroll systems make mistakes in calculating or remitting withholding. Check your pay stubs regularly to ensure the withholding matches what you expect based on your W-4.

Standard deduction changes:

Tax law changes can affect how much you owe. When standard deductions or tax brackets change, your withholding may need adjustment even if your personal circumstances haven’t changed.

Who Qualifies for Exemption From Withholding?

Most employees must have federal income tax withheld from their paychecks, but some people qualify for exemption under specific conditions.

Requirements for exemption:

You can claim exemption only if you had no tax liability last year and expect none this year. Students with very low part-time earnings and some retirees with minimal income typically qualify.

Impo£rtant limitations:

Even if you’re exempt from federal income tax withholding, you’re not exempt from Social Security and Medicare taxes. These continue to be withheld regardless of your income level.

How to claim exemption:

Write “Exempt” in the space below Step 4(c) on Form W-4. You must renew this exemption annually by submitting a new W-4 by February 15 each year.

When exemption doesn’t apply:

You cannot claim exemption if you had tax liability last year or expect to have liability this year, even if the amount is small. Claiming exemption when you don’t qualify can result in penalties and a large tax bill when you file your return.

The importance of tax withholding

Understanding withholding tax matters whether you’re an employee managing your take-home pay or a business owner handling payroll responsibilities.

Accurate financial planning:

Knowing how withholding affects your net pay helps you budget accurately. When you understand why your paycheck is different from your gross salary, you can make better spending and saving decisions.

Avoiding tax surprises:

Proper withholding prevents the unpleasant surprise of owing thousands of dollars when you file your return. It also prevents unnecessary interest-free loans to the government through over-withholding and large refunds.

Compliance for businesses:

Employers who fail to properly withhold and remit taxes face serious penalties. Understanding withholding requirements protects your business from IRS enforcement actions.

Cash flow management:

For contractors and freelancers who don’t have automatic withholding, understanding how the system works helps you calculate quarterly estimated taxes and avoid cash flow problems from unexpected tax bills.

History of Withholding Taxes

The federal withholding tax system became standard during World War II. The Current Tax Payment Act of 1943 established the modern withholding approach, allowing the government to collect tax revenue throughout the year rather than waiting for annual lump-sum payments. Before this, most Americans paid their entire tax bill when filing returns, creating cash flow challenges for both taxpayers and the government. The system has evolved significantly since then, with the most recent major change being the 2020 redesign of Form W-4.

Types of Withholding Taxes

Withholding tax isn’t a single uniform system—different rules apply depending on your residency status and income type.

U.S. Resident Withholding Tax

U.S. citizens and resident aliens face withholding on various income types:

Wage withholding:

Your employer withholds based on your W-4 form and IRS tax tables. The rate varies depending on your income level, filing status, and claimed deductions or credits.

Supplemental wage withholding:

Bonuses, commissions, and other supplemental wages are withheld at a flat 22% federal rate for amounts under $1 million (37% for amounts over $1 million).

Backup withholding:

If you don’t provide your taxpayer identification number to a payer or the IRS notifies the payer that you underreported interest or dividends, the payer must withhold 24% from certain payments like interest, dividends, and independent contractor payments.

Retirement withholding:

Pension and IRA distributions typically have 10% withheld unless you specify a different amount or choose no withholding on Form W-4P or W-4R.

Nonresident Withholding Tax

Nonresident aliens—people who aren’t U.S. citizens or residents—face different withholding rules:

Flat 30% rate:

Most U.S.-source income paid to nonresident aliens is subject to withholding at a flat 30% rate. This includes interest, dividends, rents, and royalties.

Tax treaty rates:

The U.S. has tax treaties with many countries that reduce or eliminate withholding on certain income types. Nonresidents can claim treaty benefits on Form W-8BEN to reduce withholding rates.

Wage withholding:

Nonresident aliens working in the U.S. have wages withheld using similar methods to residents, but with different tax tables and restrictions on filing status.

How withholding taxes are calculated

The calculation of withholding tax involves several factors that determine how much comes out of each paycheck.

Income level:

The federal tax system is progressive, meaning higher income faces higher tax rates. Your employer calculates withholding by estimating your annual income based on the current pay period and applying the appropriate tax brackets.

Filing status:

Whether you’re single, married filing jointly, married filing separately, or head of household significantly affects your withholding calculation. Each status has different standard deductions and tax brackets.

Pay frequency:

How often you’re paid affects the calculation. If you’re paid weekly, your employer multiplies your weekly pay by 52 to estimate annual income. Biweekly paychecks multiply by 26, and so on.

W-4 information:

Your W-4 form provides critical information that adjusts withholding:

- Dependents and tax credits you claim

- Additional income from other jobs

- Deductions you expect to claim

- Extra withholding you request

Get Started with Invoice Fly’s Software

Invoice Fly is a smart, fast, and easy-to-use invoicing software designed for freelancers, contractors, and small business owners. Create and send invoices, track payments, and manage your business — all in one place.

Calculating Your Withholding Tax (2025 Example)

Here’s a simplified example of how federal income tax withholding is calculated.

Example scenario:

You’re single, paid $2,000 biweekly (26 pay periods per year), with no dependents.

Step 1: Calculate annual income

$2,000 × 26 = $52,000 annually

Step 2: Subtract the standard deduction (2025)

$52,000 − $15,750 (2025 single standard deduction) = $36,250 taxable income

Note: This is an estimate of taxable income. Adjusted gross income (AGI) is calculated before subtracting the standard deduction.

Step 3: Apply federal tax brackets (simplified)

- First $11,600 at 10% = $1,160

- Remaining $24,650 at 12% = $2,958

Total estimated annual federal income tax: $4,118

Step 4: Calculate per-paycheck withholding

$4,118 ÷ 26 = $158.38 per paycheck

This example is simplified. Actual withholding calculations can vary based on credits, additional income, pre-tax deductions, and how your Form W-4 is completed—but it shows the basic methodology employers use.

Withholding tax vs. estimated tax

While both withholding tax and estimated tax represent prepayment of income taxes, they work differently and apply to different situations.

| Withholding Tax | Estimated Tax | |

| How it’s paid | Automatically deducted before you receive income | Paid manually by you |

| Who handles payment | Employer or payer sends it to the IRS | You send payments directly to the IRS |

| How it’s calculated | Based on the information you provide on Form W-4 | Based on your expected annual income, deductions, and credits |

| Type of income covered | Primarily wages and salary | Self-employment, freelance, investment, and other non-wage income |

| Payment timing | Each paycheck | Quarterly (four times per year) |

| Ongoing action required | None after submitting your W-4 (unless you update it) | Yes—quarterly calculations and payments are required |

| Risk of penalties | Low if W-4 is accurate | High if payments are late or too low |

When You Might Need Both

If you have a regular job and a side business, you’ll often use both systems. Your employer withholds taxes from your paycheck, while you make quarterly estimated taxes on income from freelancing, consulting, or other self-employment work.

Understanding how to calculate self-employment tax helps you determine your estimated tax obligations.

How They Can Work Together

Instead of making quarterly estimated tax payments, some people choose to increase their W-4 withholding at their day job to cover taxes owed on side income. This approach can simplify cash flow and eliminate the need to track quarterly deadlines—as long as enough tax is withheld overall.

How to check your tax withholding

Regularly reviewing your withholding ensures you’re not significantly over or under-paying throughout the year.

Review your pay stubs:

Each pay stub shows the federal income tax withheld for that period and year-to-date. Compare this to what you expect based on your tax situation. If the amount seems too high or too low, investigate why.

Use the IRS Tax Withholding Estimator:

The IRS withholding estimator is a free online tool that helps you calculate the right withholding amount. You’ll need:

- Your most recent pay stubs

- Most recent tax return

- Estimate of current year income and deductions

The tool tells you whether your current withholding will result in a refund or balance due, and provides recommendations for adjusting your W-4.

Check after major life changes:

According to USA.gov, you should review withholding whenever you experience:

- Marriage or divorce

- Birth or adoption of a child

- Home purchase

- Job changes for you or your spouse

- Changes to income from outside employment

Compare to previous year:

If your situation hasn’t changed significantly, your current year withholding should roughly match last year’s. Large deviations suggest you need to update your W-4.

Adjust as needed:

Submit a new W-4 to your employer anytime you want to change your withholding. Changes typically take effect within one or two pay periods.

Understanding how withholding impacts your finances helps you plan better. Use tools like a net salary calculator to estimate your take-home pay after various withholding scenarios, and review what is net pay to understand the difference between gross and take-home income.

Conclusion

Withholding tax is the backbone of the U.S. income tax collection system, ensuring that taxes are paid throughout the year rather than in one large lump sum. Whether you’re an employee receiving wages, a retiree drawing a pension, or a business owner managing payroll, understanding how withholding works helps you stay compliant and avoid unpleasant tax surprises.

The key to effective withholding management is keeping your Form W-4 current and reviewing your withholding whenever your financial situation changes. Understanding how withholding impacts your overall income—especially when you’re calculating net income as a freelancer—helps you plan more effectively. Too much withholding means giving the government an interest-free loan and waiting for a refund. Too little withholding means facing a large tax bill and potential penalties when you file your return.

For employees, regularly checking your pay stubs and using the IRS withholding estimator ensures your withholding matches your actual tax liability. For business owners handling payroll, proper withholding calculation and remittance protects you from compliance issues and penalties.

By understanding what withholding tax is, how it’s calculated, and when to adjust it, you take control of your tax situation rather than being surprised by refunds or bills at filing time.

FAQs about HVAC Sales

Yes. Federal income tax withholding is required for most employees based on Form W-4. Social Security and Medicare are always withheld.

For most people, yes. Withholding avoids large tax bills and underpayment penalties. Only those who truly qualify for exemption should opt out.

Only if too much was withheld. Any overpayment is refunded when you file your tax return.

They reduce take-home pay. The more withheld, the smaller your paycheck—but the lower your tax bill (or higher refund) later.

If you don't qualify, you may owe back taxes, penalties, and interest. The IRS can also require higher withholding going forward. Review quarterly taxes due dates 2025 to stay compliant if you're making estimated payments instead.