What Is an Invoice: Everything You Need To Know

Table of Contents

- What’s an invoice?

- Send Invoices in Seconds

- Invoice Types

- Key Elements of an Invoice

- What Does an Invoice Look Like?

- Send Invoices in Seconds

- Invoice vs Bill vs Receipt

- Does an invoice mean I owe money?

- What is invoicing?

- How invoices work

- The benefits of modern invoicing solutions

- Create professional invoices quickly with Invoice Fly

- FAQs about Invoices

- Send Invoices in Seconds

Imagine finishing a job or selling a product and not getting paid. Frustrating, right? That’s where an invoice comes in. An invoice is a document businesses and freelancers send to customers to request payment for goods or services, showing what was provided, how much it costs, and when payment is due. Whether you’re a freelancer, contractor, or small business owner, understanding what an invoice is and how an invoice works is key to staying organized and getting paid on time. In this guide, we’ll explain the defintion of an invoice and how they work.

What’s an invoice?

Businesses exist to make money by selling goods or services. But to keep everything clear and organized, everyone involved needs to agree on how much is owed and when payment is due. While quotes or estimates can give a rough idea of the cost, an invoice is the document that makes the payment official. It’s what helps ensure customers follow through and actually pay for the work you’ve completed.

Whether you’re a solo freelancer or part of a growing company, invoices are a key part of staying financially healthy. They don’t just list a price and a due date. They help you keep track of your income, prepare for taxes, and even understand which products or services are performing well.

So… what exactly is an invoice?

An invoice is a document that clearly shows what you sold, how much it costs, and how and when the customer should pay. It tells the buyer that you’ve completed your part of the agreement and that it’s now their turn to send payment.

Understanding what invoices are becomes easier when you think about how they fit into your overall money management. You’re not only tracking what clients owe you, but also planning when that money will arrive. This helps you manage your cash flow, budget for expenses, and make smarter decisions about your business.

Using proper invoices can benefit your business in many ways, including:

- Keeping track of profits, revenue, and cash flow

- Providing important records for tax season

- Serving as formal proof if a payment issue arises

- Helping you monitor which products or services sell best

- Giving you insight into your business’s overall health

- Supporting future planning, marketing decisions, and growth strategies

In short, invoices help you stay organized, get paid faster, and understand how your business is performing, all without making your billing process complicated.

Send Invoices in Seconds

Set up in 1 minute, send invoices in 2 — it’s that simple with Invoice Fly.

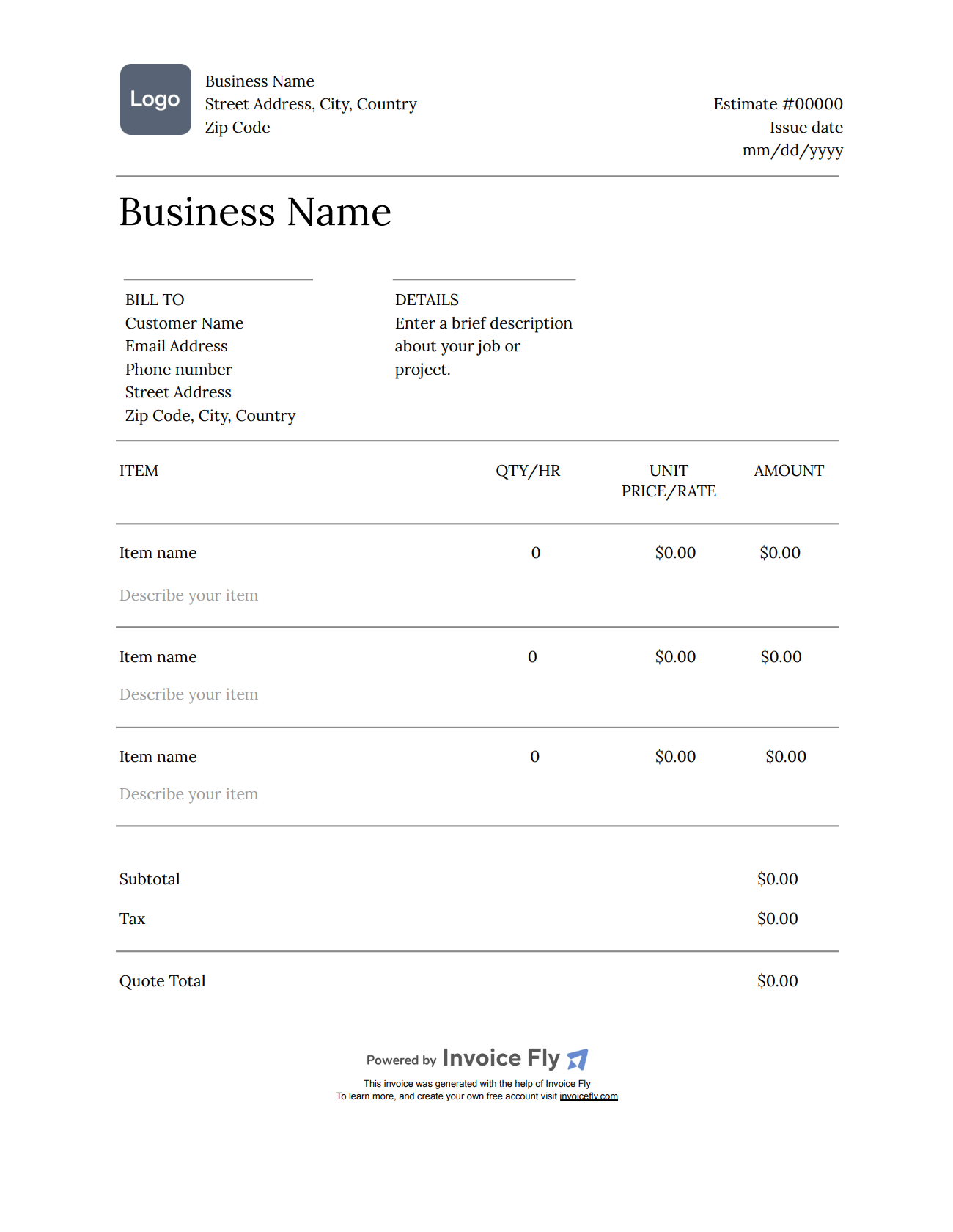

Still unsure? Download one of our free invoice templates. They’ll give you a clear picture of what an invoice is, and you can also customize them to make your own invoices!

RELATED ARTICLE: How To Write An Invoice? Includes Invoice Template & Examples

RELATED ARTICLE: How To Make An Invoice In Google Docs? Invoice Templates for Google Docs

Invoice Types

Common types of invoices include standard, recurring, pro forma, and commercial invoices. Other types, such as credit, debit, interim, and final invoices, are used for specific situations like refunds, additional charges, and project completion.

Types of standard invoices

- Standard Invoice: A general invoice sent to a customer after a product or service has been provided.

- Sales Invoice: A request for payment for a specific product or service delivered.

Project-based invoices

- Pro Forma Invoice: An estimate of a product’s or service’s cost sent before delivery to give the client a clear idea of the price.

- Retainer Invoice: A request for a prepayment for future services.

- Interim Invoice: A partial payment request for large projects with multiple payment milestones.

- Final Invoice: The official payment request for a completed project or service.

- Timesheet Invoice: Used by freelancers or contractors to bill based on the number of hours worked. Check out our time tracker for accurate billing!

Invoices for adjustments and specific transactions

- Credit Invoice: Issued to a customer when a refund or a discount is due, decreasing the amount they owe.

- Debit Invoice: Used to request additional payment from a customer, increasing the amount they owe.

- Mixed Invoice: Combines both credit and debit charges in a single document.

- Commercial Invoice: A customs document required for international sales transactions to list the value of goods.

- Overdue Invoice: An unpaid invoice that has passed its due date. Read how to follow up on unpaid invoices gracefully.

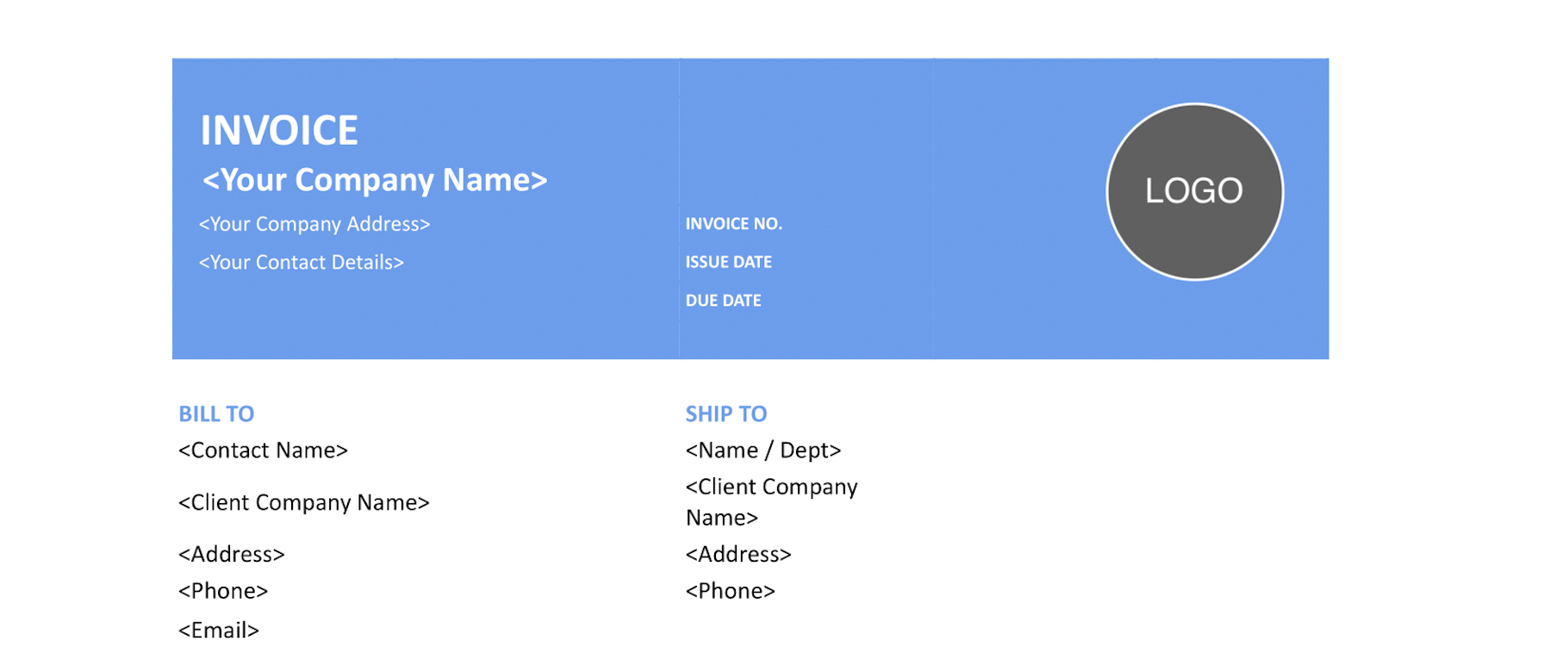

Key Elements of an Invoice

If you’ve ever wondered what is an invoice or what needs to be included on one, this section will walk you through each part in more depth. Every element plays an important role in making sure you get paid correctly and on time.

1. What Is an Invoice Header?

The invoice header is the top section of your document that shows who the invoice is from and who it’s for. It includes:

- Invoice Title: Uses simple titles like “Invoice” or “Tax Invoice.”

- Your Logo (optional): Adds professionalism and helps build brand identity.

- Sender Information: Lists your business name, address, email, phone number, and tax ID.

- Recipient Information: Includes the client’s name, address, and contact details (this is your invoice address).

- Invoice Number: A unique number used for tracking.

- Invoice Date: The day the invoice was created.

Optional invoice details may include:

- Purchase Order (PO) Number: Helps clients match the invoice with a specific order.

- Invoice Type: Such as “Recurring” or “Credit Invoice.”

- Invoice Status: Marked as “Paid,” “Pending,” or “Overdue.”

- Payment Method: States how the client should pay (e.g., credit card, bank transfer).

2. What Is Required on an Invoice for Customer Details?

Include your customer’s name, company name, billing address, and email. Correct details help make sure the invoice goes to the right person and is processed quickly.

3. What Is an Invoice Number?

An invoice number is a unique code that helps you and your client track the document. Use a clear numbering system (like INV-001 or 2026-09) so you can easily find past invoices.

4. What Is an Invoice Date?

The invoice date marks when the invoice was created. It’s used to calculate payment deadlines and track financial records.

RELATED ARTICLE: How Often Should You Send Invoices to Clients?

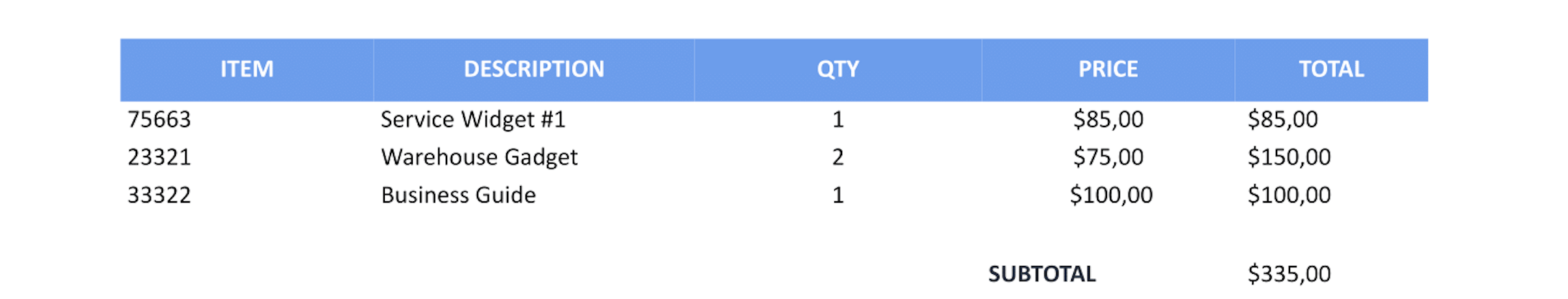

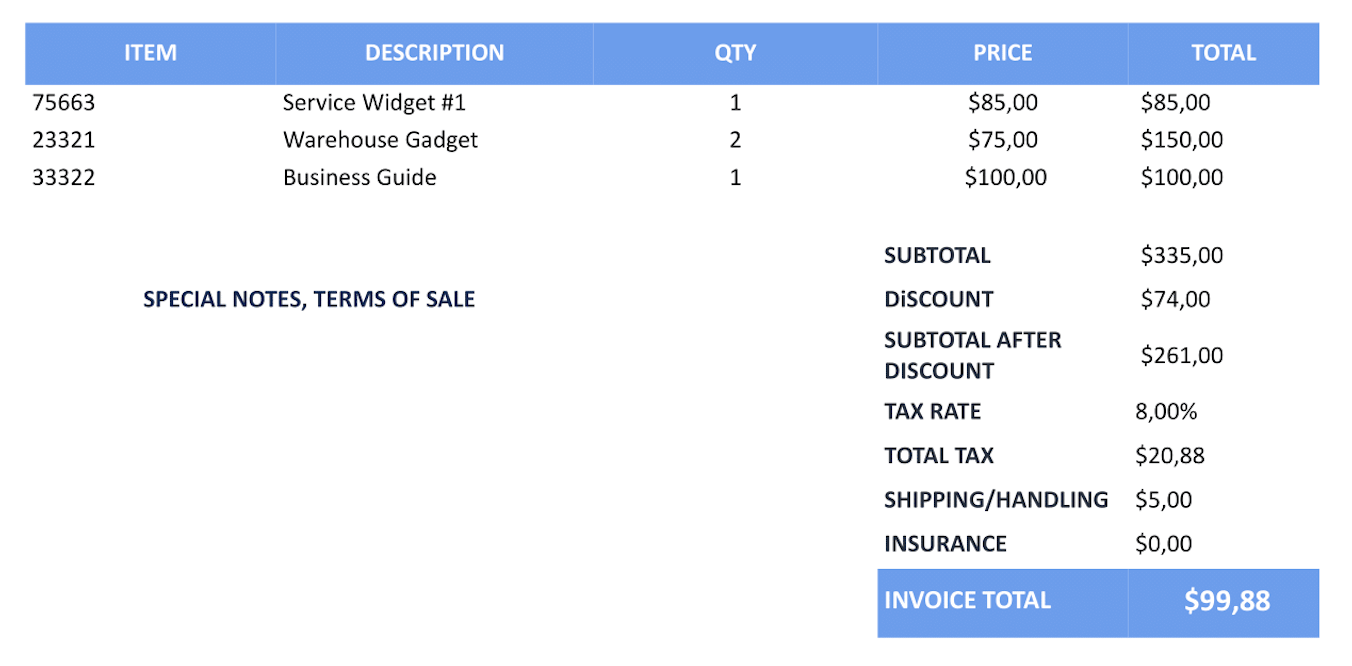

5. What Is on an Itemized Invoice?

An itemized invoice lists the products or services provided, along with prices, quantities, and totals. This makes the payment clear and transparent for both you and your client.

6. What Is an Invoice Payment Method?

Payment terms explain when and how the client should pay. Include your payment deadline, accepted methods (like PayPal or bank transfer), and any late payment fees or early payment discounts.

Invoice Payment: Terms, Methods & Process Explained

7. What Is the Total Amount on an Invoice?

This section shows the final amount due including taxes, fees, and discounts. It’s the most important number on the page and tells the client exactly how much to pay.

For a complete guide on how to create invoices step-by-step, check out our full guide: How To Write an Invoice.

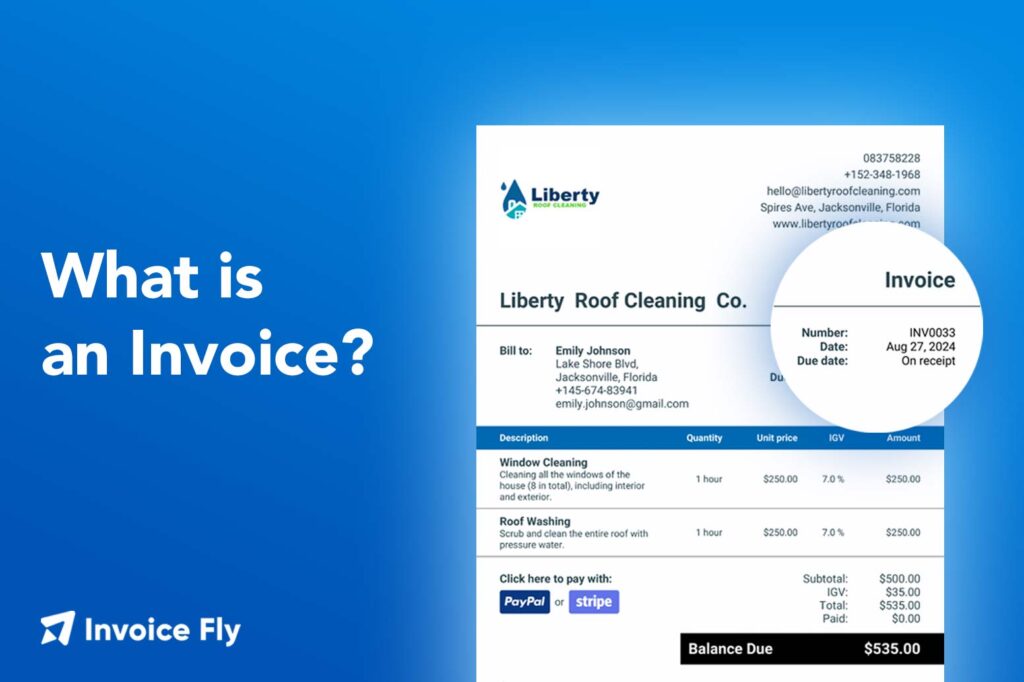

What Does an Invoice Look Like?

If you’ve ever wondered what an invoice looks like, think of it as a clean, organized document that clearly shows what was sold, who it was sold to, and how much is owed. A professional invoice usually fits on one page and follows a simple, easy-to-read layout. They can be digital or paper.

Here’s what a typical invoice usually contains:

- Header: The top section with your business name, logo, and the word “Invoice.”

- Invoice Number and Date: A unique ID and the date it was issued.

- Client Information: The customer’s name, business name, and address.

- Itemized List: A table showing products or services, quantities, unit prices, and totals.

- Subtotal, Taxes, and Discounts: Calculations that lead to the final amount.

- Total Amount Due: The total payment owed, clearly highlighted.

- Payment Details: How and when to pay like your bank info or online payment link.

- Notes or Terms: Any extra information, such as “Thank you for your business” or late payment terms.

Invoices can be printed, emailed as PDFs, or created digitally using invoicing software. No matter the format, the key is to make your invoice clear, professional, and easy for clients to understand.

RELATED ARTICLE: What is a Line Item on an Invoice?

Send Invoices in Seconds

Set up in 1 minute, send invoices in 2 — it’s that simple with Invoice Fly.

Invoice vs Bill vs Receipt

If you’re new to running a business or working for yourself, it’s easy to mix up invoices, bills, and receipts. They may look similar, but each one plays a different role in the payment process.

- Invoice: An invoice is a formal request for payment that you send before you get paid. It usually includes details like the work you completed, how much it costs, your payment terms, and when the payment is due.

- Used when: You expect payment later (net 10, net 30, etc.) – Net 30 vs Net 60.

- Best for: Freelancers, contractors, and businesses that bill clients after delivering work

- Bill: A bill is also a request for payment, but it’s typically used when the customer is expected to pay immediately. Bills are common in everyday settings where you pay on the spot, such as restaurants, salons, or retail shops.

- Used when: Payment is due right now

- Best for: Quick transactions and point-of-sale payments

- Receipt: A receipt is proof that payment has already been made. It confirms what was purchased, how much was paid, and when the payment occurred.

- Used when: Payment has been completed

- Best for: Record-keeping, tax purposes, and resolving disputes

Read more about invoices vs bills and invoices vs receipts.

Does an invoice mean I owe money?

Yes, in most cases where an invoice is received, it means that money is owed. It basically serves as a formal reminder of the amount due for goods or services rendered, specifying the amount, the buyer, and the due date.

Once paid, the sender will note the payment in their records, and if they ever need to refer back to the transaction, the invoice will provide all the key details — one of the great things about invoices!

What is invoicing?

It is the process of creating, sending, and managing an invoice. Some businesses choose to handle this process monthly, others do it weekly, and some on a per-project basis. But regardless of how you do it, the most important thing is to keep on top of your invoices; losing track can only lead to a financial mess.

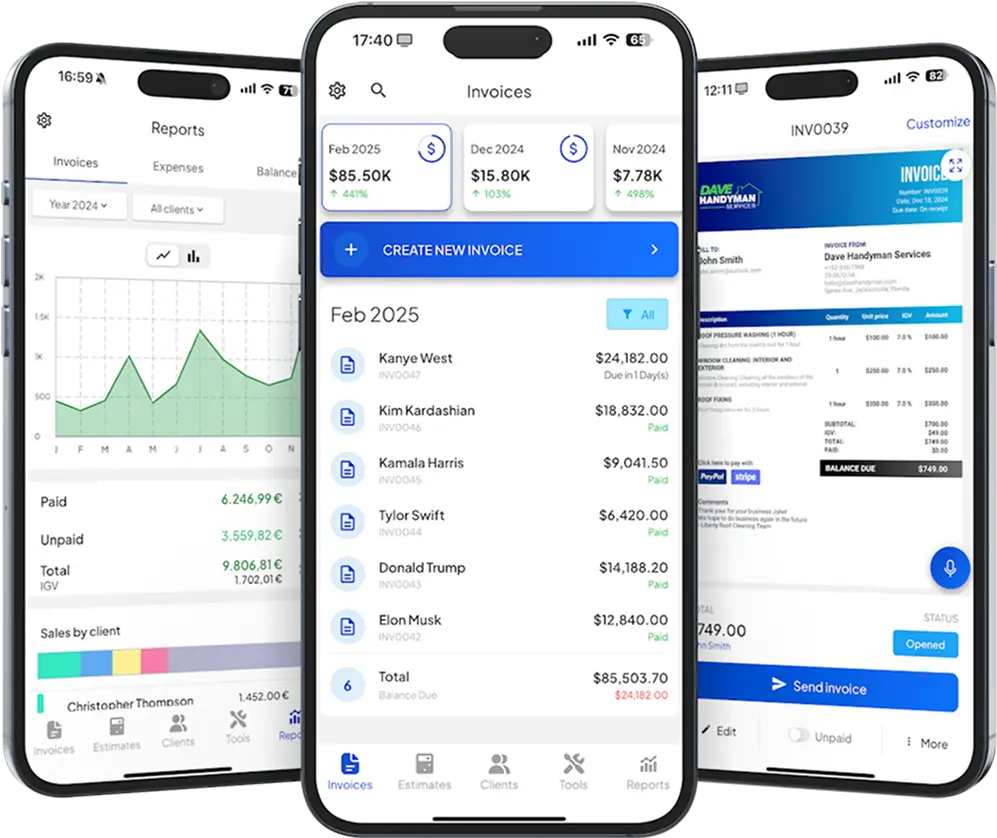

To avoid the headaches, many businesses use modern invoicing solutions, like Invoice Fly, to streamline invoicing, track payments, and store records. Of course, you can still create and send invoices manually. It’s just going to take longer and require greater focus.

How invoices work

Invoicing might seem simple, but it’s one of the most important parts of running a business. When done the right way, it helps you get paid faster, stay organized, and keep your finances stress-free.

Take a quick look at the main steps in the invoicing process:

- Invoice Creation: Make a new invoice that lists your products or services, prices, and payment details.

- Invoice Delivery: Send the invoice to your client, usually by email or through invoicing software.

- Payment Tracking: Keep an eye on which invoices have been paid and which are still open.

- Record-Keeping: Store copies of all invoices as required by the IRS for your financial records and taxes.

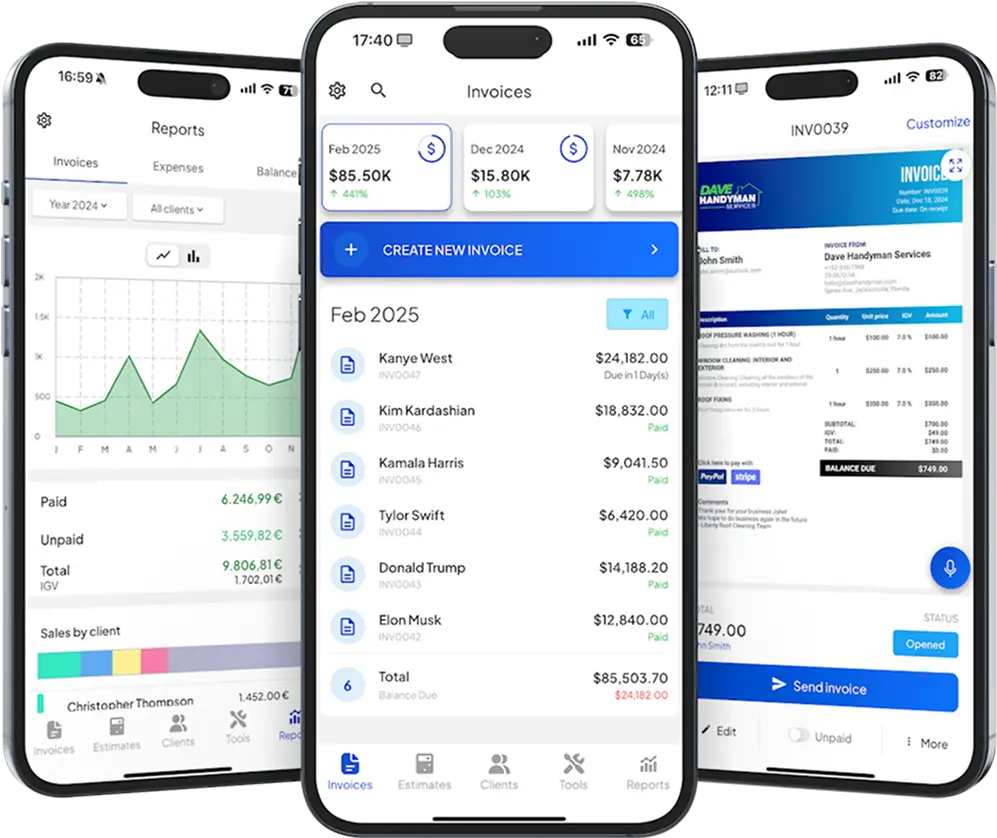

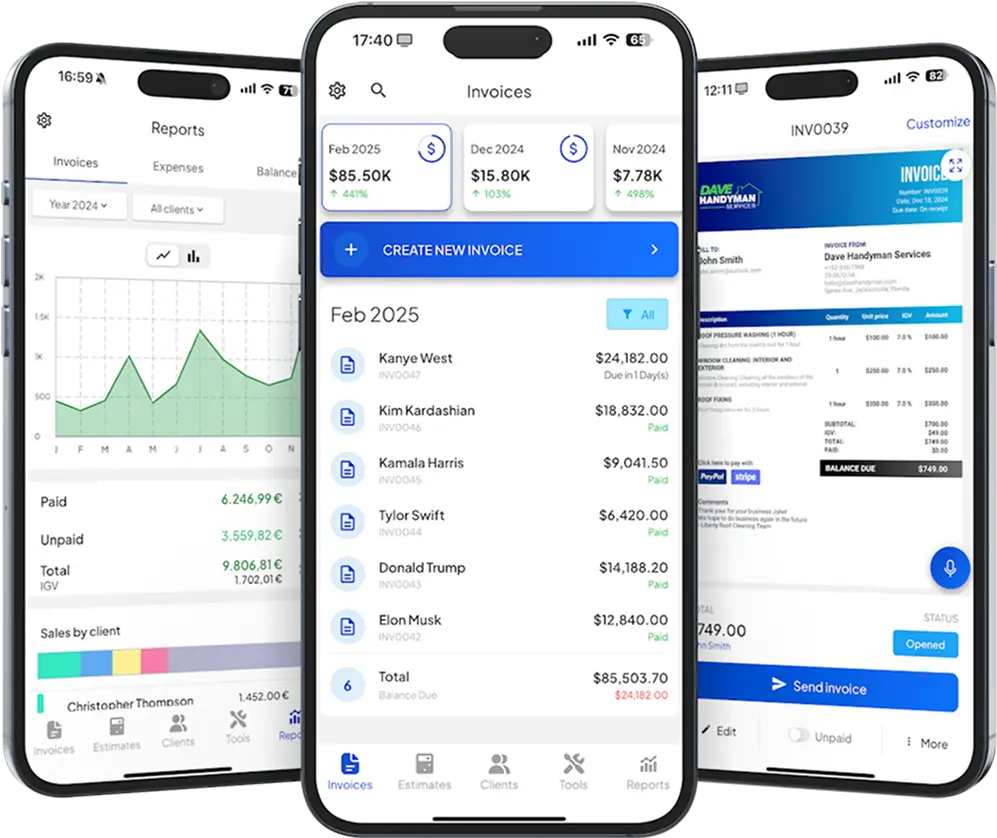

The benefits of modern invoicing solutions

Invoicing Software can completely revolutionize your billing process, freeing up your time, reducing manual errors, and speeding up payment collection.

RELATED ARTICLE: Common Invoicing Mistakes and How to Avoid Them

With features like invoice generators, real-time payment tracking, automated reminders, and secure digital payment options, these tools not only simplify the invoicing process but also improve cash flow management, helping to maintain better financial organization.

Top benefits of using invoicing tools:

- Professional invoice templates

- Time-saving automation

- Error reduction

- Faster payments

- Improved cash flow

- Easy record-keeping

- Increased security

- Simplified reporting

- Complete convenience

Create professional invoices quickly with Invoice Fly

Invoices are the backbone of financial transactions, providing clarity, accountability, and documentation for both buyers and sellers. Yet, when you’re focused on running a successful business, invoicing is often the last thing on your mind.

Ready to streamline your invoicing process?

With Invoice Fly, you can generate invoices in seconds, keeping your cash flow smooth and your records organized.

It’s that easy, download the App now!

FAQs about Invoices

Every invoice must include your business name and contact details, the customer’s information, a unique invoice number, the date, a list of goods or services, the total amount due, and payment terms.

Any business or freelancer that sells products or services and expects payment should issue an invoice. It’s proof of the sale and helps both you and your client keep track of payments for tax and record-keeping.

You can make an invoice using a template, a word processor, or invoicing software. Just fill in your business details, your client’s information, the products or services sold, prices, and payment instructions.

Start with a simple template that includes the basics: your name, the client’s name, what you’re charging for, and the total. Use a free invoice generator or software to make it easier to create, send, and track invoices.

Yes. Always include your bank details or preferred payment method on your invoice so your client knows exactly how to pay you. You can also include online payment for faster processing.

Send Invoices in Seconds

Set up in 1 minute, send invoices in 2 — it’s that simple with Invoice Fly.